Walmart to Sell British Unit Asda to U.K. Rival Sainsbury -- Update

April 30 2018 - 3:47AM

Dow Jones News

By Saabira Chaudhuri

LONDON -- Walmart Inc. on Monday said it would sell its British

arm Asda Group Ltd. to rival J Sainsbury PLC, a deal that values

the chain at about $7.3 billion ($10.1 billion) and, if successful,

would create the U.K.'s largest grocer.

Walmart will hold a 42% stake in the combined company and get

almost GBP3 billion in cash. The Bentonville, Ark. company will

have voting rights up to 29.9%.

If cleared by antitrust regulators, the move would clear the

path for a new grocery behemoth that would help both companies

better compete against a resurgent Tesco PLC, Amazon.com Inc. --

which has been pushing further into online groceries -- and

increasingly popular discounters Aldi and Lidl.

For Walmart the move is part of a broader shift to form joint

ventures in competitive markets and focus investments in areas

executives think will provide growth. It is also in talks to sell

its controlling stake in its Brazilian operations and in advanced

discussions to buy a majority stake in Flipkart Group, a homegrown

startup that has become India's largest e-commerce company.

Stiff competition and large numbers of online shoppers means the

U.K. grocery market is billed by many retail executives as the

world's toughest. In response, the U.K.'s market leaders have been

moving to bulk up with Tesco last month acquiring Booker Group PLC,

the country's largest food wholesaler, for GBP3.7 billion, becoming

the U.K.'s largest food business.

Sainsburys, whose shares rose about 20% in early trading Monday,

said the combined company would have total sales of around GBP51

billion and more than 2,800 stores. It also said the new business

would lower prices by about 10% on "many" everyday products.

Despite this, the proposed deal will likely draw major antitrust

scrutiny amid worries that consolidation could give the combined

entity greater power to maintain or raise prices for food. Analysts

on Monday cited the deal's high regulatory risk noting that it will

be a lengthy process.

Sainsbury buying Asda "would represent a remarkable step-up in

U.K. industry consolidation, if cleared," said Jefferies analyst

James Grzinic, adding that the two companies "are willing to accept

very punishing conditions to secure an approval."

The combined company would have a value of about GBP12 billion,

according to Bernstein analysts, while its grocery market share

would be 27% according to Kantar.

It is expected to add at least GBP500 million to earnings before

interest, taxes, depreciation and amortization as the companies

benefit from bulk buying and the opening of Argos businesses in

Asda stores. Sainsbury bought Argos owner Home Retail Group in 2016

for GBP1.4 billion.

The companies plan to keep both the Sainsbury and Asda brands,

which have different market positions, the latter being more

upmarket. It will be led by Sainsbury's chairman and chief

executive, while Asda's CEO will join the board of the combined

business. Two Walmart executives will also join the board.

Sainsbury said it doesn't expect to close any of its stores or any

Asda stores as a result of the deal.

For the year to March 10, Sainsbury reported profit fell 18% to

GBP309 million weighed down by one-time costs although underlying

pretax profit climbed 1.4%. Revenue including fuel but excluding

value-added-tax climbed to GBP28.46 billion from GBP26.22

billion.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 30, 2018 03:32 ET (07:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

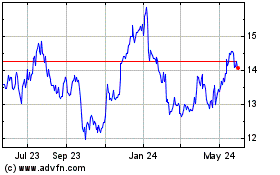

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jun 2024 to Jul 2024

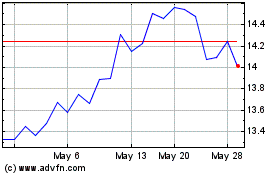

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jul 2023 to Jul 2024