UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2024

| Innovative Food Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

| Florida | 000-09376 | 20-1167761 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| 9696 Bonita Beach Rd, Suite 208 Bonita Springs, Florida | 34135 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (239) 596-0204

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: None

On December 20, 2024, Golden Organics, Inc. (“Golden”), a subsidiary of Innovative Food Holdings, Inc. (the “Company”), entered into an asset purchase agreement (the “APA”) with LoCo Food Distribution LLC, a Colorado limited liability company (the “Seller”), and Elizabeth G. Mozer and Benjamin Mozer (each an “Owner,” collectively, the “Owners” and together with Seller, collectively, the “Seller Parties”).

Pursuant to the APA, Golden has agreed to (i) purchase substantially all of the properties, business, and assets of the Seller used and/or useful in the operation of the Seller’s business of sourcing and wholesaling food products (the “Business”) and (ii) assume certain liabilities and obligations of the Seller (such transaction, the “Transaction”) for an aggregate purchase price of $304,268.85 (the “Purchase Price”), which price is payable to the Seller’s lenders for all outstanding and unpaid indebtedness of the Seller as of the closing of the Transaction. In addition, as an adjustment to the Purchase Price, if earned, Golden will pay the Seller $53,430 (the “Earnout Amount”) if, in the twelve-month period, the Business achieves certain revenue and adjusted EBITDA targets.

The APA contains customary representations and warranties, as well as five-year non-competition and non-solicitation covenants of the Seller Parties and indemnification of Golden by the Seller Parties. In connection with the APA, Ms. Mozer entered into a consulting services agreement with Golden to provide consulting services for a period of twelve (12) months with the option to extend on a month-to-month basis with respect to the transitioning of the relationships and knowledge concerning the Business, which agreement also contains a two-year non-solicitation provision.

The Transaction was closed the same day on December 20, 2024.

On January 7, 2025, the Company issued a press release announcing the entry of the APA. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INNOVATIVE FOOD HOLDINGS, INC.

|

|

| |

|

|

|

|

Dated: January 7, 2025

|

|

|

|

| |

By:

|

/s/ Robert William Bennett

|

|

| |

|

Robert William Bennett

|

|

| |

|

Chief Executive Officer

|

|

false

0000312257

true

0000312257

2024-12-20

2024-12-20

Exhibit 99.1

FOR IMMEDIATE RELEASE

INNOVATIVE FOOD HOLDINGS, INC. ANNOUNCES ACQUISITION OF THE ASSETS OF LOCO FOOD DISTRIBUTION LLC, A COLORADO-BASED DISTRIBUTOR OF LOCALLY PRODUCED PRODUCTS

BONITA SPRINGS, FL. (January 7, 2025) – Innovative Food Holdings, Inc. (OTCQB: IVFH) (“IVFH” or the “Company”), a national seller of gourmet specialty foods to professional chefs, is pleased to announce the opportunistic acquisition of 100% of the assets of LoCo Food Distribution LLC, based in Fort Collins, CO (“LoCo Foods”), via the Company’s subsidiary, Golden Organics, Inc. (“Golden Organics”), for total consideration of $357,699, consisting of an upfront cash payment of $304,269 and a one-year earnout payment of $53,430, based on hitting revenue and adjusted EBITDA targets. It is also anticipated that the Company will make an initial investment into working capital of approximately $375,000.

LoCo Foods was founded by Elizabeth Mozer in 2011 with a dream and a minivan. Personally committed to eating locally and sustainably, Elizabeth and her husband Ben struggled to find the local products they wished to feed to their family and sell to the customers of their other business, a local movie theater, The Lyric. So after years of scouring the greater Rocky Mountain Region to source these products, they started LoCo Foods in the basement of their Fort Collins, CO home. Their goal was to help local Colorado food brands find a thriving market for their goods, and enabling the community to have a fresher, healthier food system, made by people they know and trust. Now more than a decade later, LoCo Foods’ sales have reached approximately $4.7 million over the trailing twelve months, and it serves more than 200 customers up and down the front range of the Rocky Mountains, including retailers, hotels, hospitals, schools, and restaurants.

The purchase includes approximately $187,000 of net PP&E, mainly consisting of six refrigerated delivery trucks, warehouse racking, two large coolers, and other warehouse equipment. All long-term debt was extinguished as a closing condition. The business operates out of a 9,000 square foot leased warehouse in Fort Collins, CO. This lease expires in March 2025, at which point LoCo Foods will be moved and consolidated with the operations of the Golden Organics business in Denver. This relocation is expected to result in two immediate large buckets of savings: 1) the lease and lease-related expenses will cease, and 2) logistics expenses will significantly decrease. 80% of LoCo Foods’ customers are in Denver, which is a 120 mile round trip from the current warehouse, incurring significant expenses in fuel, driver labor, other auto-related costs. Before factoring in the cost savings outlined above, LoCo has generated positive EBITDA over the trailing twelve months (unaudited). After removal of these expected savings, the implied purchase price represents an expected EBITDA multiple much lower than the Company’s previously stated target of 3-5 times. The Company expects the acquisition will be accretive to EPS in 2025, despite moving and transitional costs expected to be incurred in the first half of 2025.

For additional context, LoCo Foods’ growth has been entirely financed with debt. This fact, coupled with the impact of COVID and other issues common in small, fast-growing businesses, led to a worsening working capital situation. Despite maintaining positive adjusted EBITDA, interest expense, principal repayments, and asset replacement costs were prioritized over timely vendor payments and inventory purchases. This transaction therefore allows the original mission of LoCo Foods to continue forward, enables vendors to receive payment and continue their growth, and represents an attractive opportunity to IVFH stockholders. Since closing the transaction on December 20th, 2024, all past due payables have now been brought current, and inventory investments are being made to support future growth.

LoCo Foods brings a significant incremental customer base and sourcing capabilities to IVFH. Its 200+ Rocky Mountain customers are primarily retailers, with the Denver divisions of three large national retail chains making up approximately 56% of overall revenue. The remainder consists of regional grocers, hotels, hospitals, schools, and restaurants. LoCo Foods also brings more than 500 incremental local Colorado items to IVFH’s catalog, with the largest supplier making up 14% of revenue. LoCo Foods’ incremental customer base, sourcing capabilities, and large catalog expansion all increase the long-term profitable growth opportunities for IVFH.

Post integration, the cross-selling opportunities to both Golden Organics and LoCo Foods customers are significant, as there is minimal overlap. Another opportunity is to sell Golden Organics’ catalog to LoCo Foods’ supplier base of Denver-area food manufacturers. The Company will also consolidate delivery routes, improving delivery economics and return on assets. IVFH expects synergies from back office consolidation, implementing a single ERP system, and integrating a single warehouse management system. The Company also intends to expand LoCo Foods’ growth opportunities by providing access to the other sales channels under the IVFH umbrella. These opportunities should further improve the deal’s economics and will be a key focus post-closing.

LoCo Foods’ business will be managed by the President of Golden Organics business, Taeshaud Jackson, along with a key employee from LoCo Foods, Sam Novotny. The Company has also signed a consulting agreement with Elizabeth Mozer. The Company will continue to use the LoCo Foods brand name given the strong reputation it has garnered with its vendors and customers over the years.

Chief Executive Officer of IVFH, Bill Bennett, stated, “We’re very enthusiastic about this acquisition, as it helps us launch new categories, enter new markets, and access new customers, with simple immediate cost savings opportunities to better leverage the Golden Organics assets we recently purchased. This transaction is consistent with our previous commentary about our acquisition search criteria and far exceeds our rate of return requirements before including the upside from synergies. We believe the financial terms of this transaction are attractive with only factoring in the near term, committed relocation of the business, and before including any cost/revenue synergies or other long-term strategic implications. Not only do we look forward to Elizabeth and Sam’s assistance with the move and integration, we are sincerely excited for the long-term contributions they will bring to the business given their intricate knowledge, deep local network, and proven expertise relating to LoCo Foods and all of its stakeholders. Given the opportunistic purchase price and structure of this deal, as well as the know-how of the team we are onboarding, this is an exciting additional opportunity for IVFH in the Denver market.”

Steptoe & Johnson PLLC acted as legal counsel to IVFH on the transaction. IVFH expects to incur transaction-related costs of approximately $30,000, most of which was incurred during the fourth quarter of 2024. Further details can be found in IVFH’s Current Report on Form 8-K to be filed with the Securities and Exchange Commission.

About Innovative Food Holdings, Inc.

At IVFH, we help make meals special. We provide access to foods that are hard to find, have a compelling story, or are on the forefront of food trends. Our gourmet foods marketplace connects the world’s best artisan food makers with top professional chefs nationwide. We curate the assortment, experience, and tech enabled tools that help our professional chefs create unforgettable experiences for their guests. Additional information is available at www.ivfh.com.

Forward-Looking Statements

This release contains certain forward-looking statements and information relating to the Company that are based on the current beliefs of the Company’s management, as well as assumptions made by, and information currently available to, the Company. Such statements reflect the current views of the Company with respect to future events and are subject to certain assumptions, including those described in this release. Should one or more of these underlying assumptions prove incorrect, actual results may vary materially from those described herein as “should,” “could,” “will,” “anticipate,” “believe,” “intend,” “plan,” “might,” “potentially” “targeting” or “expect.” Additional factors that could also cause actual results to differ materially relate to international crises, environmental and economic issues and other risk factors described in the Company’s public filings. The Company does not intend to update these forward-looking statements. The content of the websites referenced above are not incorporated herein.

Investor and Media contact:

Gary Schubert

Chief Financial Officer

Innovative Food Holdings, Inc.

investorrelations@ivfh.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

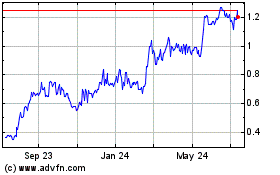

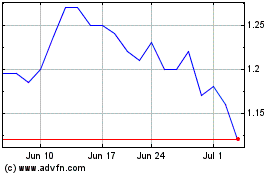

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Feb 2024 to Feb 2025