0001393540false0.0011740000000119219215815369203050.0010.00110000001250000100000010000005000000186450199375324378532441329916543150014768705000000500003454358637180000025500060000290000.050.80381896648151131857710.0010.0010.001165431000000012500000000000000.350.189803920.15December 2, 202100032500000000.000.000.0000000013935402022-01-012022-03-310001393540us-gaap:InvestorMember2022-03-080001393540us-gaap:ComputerEquipmentMember2022-03-010001393540us-gaap:InvestorMember2022-03-010001393540us-gaap:InvestorMember2022-02-202022-03-010001393540us-gaap:ComputerEquipmentMember2022-02-010001393540us-gaap:ComputerEquipmentMember2022-01-202022-02-010001393540igen:SeriesAPreferredSharesMember2022-02-280001393540igen:SeriesAPreferredSharesMember2022-01-202022-02-280001393540igen:SeriesAPreferredSharesMember2022-02-180001393540igen:SeriesAPreferredSharesMember2022-01-202022-02-180001393540igen:SeriesAPreferredSharesMember2022-01-202022-02-030001393540igen:EquityLinePurchaseAgreementMember2022-01-202022-02-030001393540igen:DirectorsMember2022-01-012022-01-270001393540igen:EquityLinePurchaseAgreementMember2022-01-240001393540us-gaap:ComputerEquipmentMember2022-01-012022-01-240001393540igen:EquityLinePurchaseAgreementMember2022-01-012022-01-240001393540igen:FederalAndStateMember2021-01-012021-12-310001393540igen:ReconciliationOfIncomeTaxesMember2021-01-012021-12-310001393540igen:ReconciliationOfIncomeTaxesMember2020-01-012020-12-310001393540us-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2021-01-012021-03-310001393540us-gaap:SalesRevenueNetMemberus-gaap:CreditConcentrationRiskMember2021-01-012021-03-310001393540us-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2022-01-012022-03-310001393540us-gaap:SalesRevenueNetMemberus-gaap:CreditConcentrationRiskMember2022-01-012022-03-310001393540us-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2020-01-012020-12-310001393540us-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2021-01-012021-12-310001393540us-gaap:SalesRevenueNetMemberus-gaap:CreditConcentrationRiskMember2020-01-012020-12-310001393540us-gaap:SalesRevenueNetMemberus-gaap:CreditConcentrationRiskMember2021-01-012021-12-310001393540igen:StockOptionPlanMember2021-01-012021-12-310001393540igen:StockOptionPlanMember2021-12-310001393540igen:StockOptionPlanMember2021-01-012021-03-310001393540igen:StockOptionPlanMember2022-01-012022-03-310001393540igen:OptionsThreeMember2022-01-012022-03-310001393540igen:OptionsTwoMember2022-01-012022-03-310001393540igen:OptionsThreeMember2021-01-012021-12-310001393540igen:OptionsOneMember2022-01-012022-03-310001393540igen:OptionsThreeMember2021-12-310001393540igen:OptionsThreeMember2022-03-310001393540igen:OptionsTwoMember2021-01-012021-12-310001393540igen:OptionsTwoMember2022-03-310001393540igen:OptionsTwoMember2021-12-310001393540igen:OptionsOneMember2022-03-310001393540igen:OptionsOneMember2021-01-012021-12-310001393540igen:OptionsOneMember2021-12-310001393540us-gaap:StockOptionMember2022-03-310001393540us-gaap:StockOptionMember2022-01-012022-03-310001393540us-gaap:StockOptionMember2020-12-310001393540us-gaap:StockOptionMember2021-12-310001393540us-gaap:StockOptionMember2020-01-012020-12-310001393540us-gaap:StockOptionMember2021-01-012021-12-310001393540us-gaap:StockOptionMember2019-12-3100013935402020-08-012020-08-2100013935402020-08-210001393540igen:WarrantsAt000Member2022-01-012022-03-310001393540igen:WarrantsAt003Member2022-01-012022-03-310001393540igen:WarrantsAt020Member2021-01-012021-12-310001393540igen:WarrantsAt015Member2021-01-012021-12-310001393540igen:WarrantsAt000Member2021-01-012021-12-310001393540igen:WarrantsAt003Member2021-01-012021-12-310001393540igen:WarrantsAt000Member2022-03-310001393540igen:WarrantsAt020Member2021-12-310001393540igen:WarrantsAt003Member2022-03-310001393540igen:WarrantsAt015Member2021-12-310001393540igen:WarrantsAt000Member2021-12-310001393540igen:WarrantsAt003Member2021-12-310001393540igen:WarrantsMember2022-03-310001393540igen:WarrantsMember2022-01-012022-03-310001393540igen:WarrantsMember2021-01-012021-12-310001393540igen:WarrantsMember2020-01-012020-12-310001393540igen:WarrantsMember2019-12-310001393540igen:WarrantsMember2020-12-310001393540igen:WarrantsMember2021-12-310001393540igen:SeriesAPreferredStockPurchaseAgreementsMemberus-gaap:InvestorMember2021-12-310001393540igen:SeriesAPreferredStockPurchaseAgreementsMemberus-gaap:InvestorMember2022-03-310001393540igen:SeriesBSuperVotingPreferredStockMember2020-02-012020-02-100001393540igen:CommonStockSharesMember2021-01-012021-03-310001393540igen:CommonStockSharesMember2022-01-012022-03-310001393540igen:RightsAndPrivilegesOfTheSeriesAPreferredStockMember2021-01-012021-12-310001393540igen:SeriesBSuperVotingPreferredStockMember2021-01-012021-03-310001393540igen:SeriesBSuperVotingPreferredStockMember2021-02-012021-02-100001393540igen:RightsAndPrivilegesOfTheSeriesAPreferredStockMember2022-01-012022-03-310001393540igen:CommonStockSharesMember2020-01-012020-12-310001393540us-gaap:SeriesAPreferredStockMember2020-01-012020-12-310001393540igen:EquityPurchaseAgreementsMember2020-01-012020-12-310001393540igen:MarchTwoFourTwentyTwentyTwoMember2022-01-012022-03-310001393540igen:FebruaryTwoTwentyTwentyTwoMember2022-01-012022-03-310001393540us-gaap:SeriesAPreferredStockMember2021-01-012021-03-310001393540us-gaap:SeriesAPreferredStockMember2022-03-310001393540igen:SeriesBSuperVotingPreferredStockMember2022-03-310001393540igen:SeptemberThirteenTwentyTwentyOneMember2021-01-012021-12-310001393540igen:DecemberTwentySevenTwentyTwentyOneMember2021-01-012021-12-310001393540igen:AugustElevenTwentyTwentyOneMember2021-01-012021-12-310001393540igen:SeriesAPreferredStockPurchaseAgreementsMemberus-gaap:InvestorMember2022-01-012022-03-310001393540igen:JuneSeventeenTwentyTwentyOneMember2021-01-012021-12-310001393540igen:AprilThirtyTwentyTwentyOneMember2021-01-012021-12-310001393540igen:AprilFiveTwentyTwentyOneMember2021-01-012021-12-310001393540igen:MarchOneTwentyTwentyOneMember2021-01-012021-12-310001393540igen:FebruaryOneTwentyTwentyOneMember2021-01-012021-12-310001393540igen:CommonStockSharesMember2021-01-012021-12-310001393540igen:HolderMemberigen:SeriesAConvertiblePreferredStockMember2022-01-012022-03-310001393540igen:SeriesAPreferredStockPurchaseAgreementsMemberus-gaap:InvestorMember2021-01-012021-12-310001393540igen:SeriesBSuperVotingPreferredStockMember2020-01-012020-12-310001393540igen:SeriesBSuperVotingPreferredStockMember2021-01-012021-12-310001393540igen:SeriesBSuperVotingPreferredStockMember2020-02-100001393540us-gaap:SeriesAPreferredStockMember2021-12-310001393540igen:HolderMemberigen:SeriesAConvertiblePreferredStockMember2020-01-012020-12-310001393540igen:HolderMemberigen:SeriesAConvertiblePreferredStockMember2021-01-012021-12-310001393540igen:SeriesBSuperVotingPreferredStockMember2021-02-100001393540igen:VPAndGeneralManagerMember2021-01-012021-12-310001393540igen:VPAndGeneralManagerMember2020-01-012020-12-310001393540igen:VPAndGeneralManagerMember2021-01-012021-03-310001393540igen:VPAndGeneralManagerMember2022-01-012022-03-310001393540igen:VPAndGeneralManagerMember2021-12-310001393540igen:VPAndGeneralManagerMember2022-03-310001393540igen:VendorsMember2020-01-012020-12-310001393540igen:VendorsMember2020-12-310001393540srt:OfficerMember2022-01-012022-03-310001393540srt:DirectorMember2020-12-310001393540igen:VendorsMember2022-01-012022-03-310001393540igen:VendorsMember2021-01-012021-03-310001393540igen:VendorsMember2022-03-310001393540igen:VendorsMember2021-12-310001393540srt:DirectorMember2021-12-310001393540srt:DirectorMember2022-03-310001393540srt:OfficerMember2020-01-012020-12-310001393540srt:OfficerMember2021-01-012021-12-310001393540srt:OfficerMember2021-01-012021-03-310001393540srt:MaximumMemberigen:WarrantsMember2021-01-012021-12-310001393540srt:MaximumMemberigen:WarrantsMember2020-01-012020-12-310001393540srt:MinimumMemberigen:WarrantsMember2021-01-012021-12-310001393540srt:MaximumMemberigen:WarrantsMember2022-01-012022-03-310001393540srt:MinimumMemberigen:WarrantsMember2020-01-012020-12-310001393540srt:MinimumMemberigen:WarrantsMember2022-01-012022-03-310001393540igen:ConvertibleNotesMember2021-12-310001393540igen:AdjustmentMember2019-05-170001393540igen:CommonStockPurchaseWarrantAgreementMember2019-05-012019-05-170001393540igen:PromissoryNoteMember2020-12-012020-12-130001393540igen:PromissoryNoteMember2020-07-012020-07-100001393540igen:PromissoryNoteMember2020-09-300001393540igen:ConvertibleNotesMember2021-01-012021-12-310001393540igen:SecuritiesPurchaseAgreementMemberigen:HolderMember2019-05-170001393540igen:CommonStockPurchaseWarrantAgreementMember2019-05-170001393540us-gaap:ComputerEquipmentMember2020-06-190001393540us-gaap:ComputerEquipmentMember2020-07-100001393540us-gaap:ComputerEquipmentMember2021-12-310001393540us-gaap:ComputerEquipmentMember2019-10-010001393540us-gaap:ComputerEquipmentMember2020-11-012020-11-020001393540us-gaap:ComputerEquipmentMember2020-11-020001393540igen:PromissoryNoteMember2019-09-300001393540igen:CrownBridgePartnersLLCMemberigen:ConvertiblePromissoryNoteMember2021-12-130001393540igen:PromissoryNoteMember2020-06-190001393540igen:PPPLoanMember2021-12-310001393540igen:PromissoryNoteMember2019-06-300001393540igen:PromissoryNoteMember2020-11-012020-11-020001393540igen:PromissoryNoteMember2020-07-100001393540igen:SBALoansMember2021-12-310001393540igen:PromissoryNoteOneMember2020-07-012020-07-100001393540igen:PromissoryNoteMember2020-06-012020-06-190001393540igen:PPPLoanMember2020-04-282020-05-040001393540igen:CrownBridgePartnersLLCMemberigen:ConvertiblePromissoryNoteMember2019-04-012019-06-300001393540igen:CrownBridgePartnersLLCMemberigen:ConvertiblePromissoryNoteMember2021-12-012021-12-130001393540igen:SBALoansMember2020-07-012020-07-070001393540igen:CrownBridgePartnersLLCMemberigen:ConvertiblePromissoryNoteMember2019-05-012019-05-170001393540igen:PPPLoanMember2020-05-0400013935402020-05-0400013935402020-07-070001393540igen:PromissoryNoteMember2020-11-020001393540igen:SBALoansMember2020-07-070001393540igen:CrownBridgePartnersLLCMemberigen:ConvertiblePromissoryNoteMember2019-05-170001393540us-gaap:ConvertibleNotesPayableMember2022-03-310001393540us-gaap:ConvertibleNotesPayableMember2021-12-310001393540us-gaap:NotesPayableToBanksMember2022-03-310001393540us-gaap:NotesPayableToBanksMember2021-12-310001393540igen:ContractAssetBalanceMember2021-12-310001393540igen:ContractAssetBalanceMember2020-12-310001393540igen:ContractAssetBalanceMember2022-03-310001393540igen:DeferredRevenuesOutstandingMember2021-01-012021-12-310001393540igen:DeferredRevenuesOutstandingMember2022-01-012022-03-310001393540srt:MinimumMember2022-01-012022-03-310001393540srt:MaximumMember2022-01-012022-03-310001393540us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-03-310001393540us-gaap:OfficeEquipmentMember2022-01-012022-03-310001393540us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-01-012021-12-310001393540us-gaap:ComputerEquipmentMember2022-01-012022-03-310001393540us-gaap:OfficeEquipmentMember2021-01-012021-12-310001393540us-gaap:ComputerEquipmentMember2021-01-012021-12-310001393540us-gaap:RetainedEarningsMember2022-03-310001393540us-gaap:AdditionalPaidInCapitalMember2022-03-310001393540us-gaap:CommonStockMember2022-03-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2022-03-310001393540igen:SeriesBPreferredStocksMember2022-03-310001393540us-gaap:RetainedEarningsMember2022-01-012022-03-310001393540us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001393540us-gaap:CommonStockMember2022-01-012022-03-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2022-01-012022-03-310001393540us-gaap:RetainedEarningsMember2021-12-310001393540us-gaap:AdditionalPaidInCapitalMember2021-12-310001393540us-gaap:CommonStockMember2021-12-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2021-12-310001393540igen:SeriesBPreferredStocksMember2021-12-310001393540us-gaap:RetainedEarningsMember2021-01-012021-12-310001393540us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001393540us-gaap:CommonStockMember2021-01-012021-12-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2021-01-012021-12-310001393540igen:SeriesBPreferredStocksMember2021-01-012021-12-310001393540igen:SubscriptionReceivableMember2021-03-3100013935402021-03-310001393540us-gaap:RetainedEarningsMember2021-03-310001393540us-gaap:AdditionalPaidInCapitalMember2021-03-310001393540us-gaap:CommonStockMember2021-03-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2021-03-310001393540igen:SeriesBPreferredStocksMember2021-03-310001393540igen:SubscriptionReceivableMember2021-01-012021-03-310001393540us-gaap:RetainedEarningsMember2021-01-012021-03-310001393540us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001393540us-gaap:CommonStockMember2021-01-012021-03-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2021-01-012021-03-310001393540igen:SeriesBPreferredStocksMember2021-01-012021-03-310001393540us-gaap:RetainedEarningsMember2020-12-310001393540us-gaap:AdditionalPaidInCapitalMember2020-12-310001393540us-gaap:CommonStockMember2020-12-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2020-12-310001393540igen:SeriesBPreferredStocksMember2020-12-310001393540us-gaap:RetainedEarningsMember2020-01-012020-12-310001393540us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001393540us-gaap:CommonStockMember2020-01-012020-12-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2020-01-012020-12-310001393540igen:SeriesBPreferredStocksMember2020-01-012020-12-310001393540us-gaap:RetainedEarningsMember2019-12-310001393540us-gaap:AdditionalPaidInCapitalMember2019-12-3100013935402019-12-310001393540us-gaap:CommonStockMember2019-12-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2019-12-310001393540igen:SeriesBPreferredStocksMember2019-12-310001393540us-gaap:RetainedEarningsMember2019-01-012019-12-310001393540us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-3100013935402019-01-012019-12-310001393540us-gaap:CommonStockMember2019-01-012019-12-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2019-01-012019-12-310001393540igen:SeriesBPreferredStocksMember2019-01-012019-12-310001393540us-gaap:RetainedEarningsMember2018-12-310001393540us-gaap:AdditionalPaidInCapitalMember2018-12-3100013935402018-12-310001393540us-gaap:CommonStockMember2018-12-310001393540igen:RedeemableConvertiblePreferredStocksSeriesAMember2018-12-310001393540igen:SeriesBPreferredStocksMember2018-12-3100013935402021-01-012021-03-3100013935402020-01-012020-12-3100013935402021-01-012021-12-310001393540us-gaap:SeriesBPreferredStockMember2022-03-310001393540us-gaap:SeriesBPreferredStockMember2021-12-310001393540us-gaap:SeriesBPreferredStockMember2020-12-310001393540igen:RedeemableConvertiblePreferredStockSeriesaMember2020-12-310001393540igen:RedeemableConvertiblePreferredStockSeriesaMember2022-03-310001393540igen:RedeemableConvertiblePreferredStockSeriesaMember2021-12-3100013935402020-12-3100013935402022-03-3100013935402021-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:sqftigen:integer

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IGEN Networks Corp. |

(Exact name of registrant as specified in its charter) |

Nevada | | 7363 | | 20-5879021 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

31772 Casino Drive, Suite C., Lake Elsinore, CA 92530

(855-912-5378)

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Neil G. Chan

c/o Registered Agents, Inc.

401 Ryland St, Suite 200-A

Reno, NV 89502

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Robert J. Burnett

Witherspoon Brajcich McPhee, PLLC

601 West Main Street, Ste. 714

Spokane, WA 99201-0677

Phone: (509) 455-9077

Fax: (509) 624-6441

Approximate date of commencement of proposed sale to the public: From time-to-time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delay or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☐ | Smaller reporting company | ☒ |

(Do not check if a smaller reporting company) | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided in Section 7(a)(2)(B) of the Securities Act. ☐

The information in this Prospectus is not complete and may be changed. We may not sell these securities until after the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities, in any state where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED ____________

PRELIMINARY PROSPECTUS

IGEN NETWORKS CORP.

Up to 200,000,000 Shares of Common Stock

This Prospectus relates to the offer and sale from time-to-time of up to 200,000,000 shares of Common Stock, par value $0.001, of IGEN Networks Corp, a Nevada corporation, by Jefferson Street Capital, LLC, a New Jersey limited liability company (the “Selling Stockholder”). We are registering the resale of the above shares of Common Stock issuable under an equity line in the amount of $5,000,000 established by the Equity Financing Agreement, dated as of April 3, 2022 (the “Equity Line”), between us and the Selling Stockholder, as more fully described in this Prospectus. The resale of such shares by the Selling Stockholder pursuant to this Prospectus is referred to as the “Offering.” The Offering consists of 200,000,000 shares being registered issuable pursuant to the Equity Line.

Our common stock is currently quoted on the OTC Market Group, Inc.’s Pink Current Information tier under the symbol “IGEN”. As reported by OTC Markets, the most recent reported trading price of our Common Stock was $.0041 per share on May 31, 2022.

We are not selling any securities under this Prospectus and will not receive any proceeds from the sale of shares of Common Stock by the Selling Stockholder. We will, however, receive proceeds from sale of our Common Stock under the Equity Line to the Selling Stockholder.

The Equity Financing Agreement with the Selling Stockholder provides that the Selling Stockholder is committed to purchase up to $5,000,000 (“Maximum Commitment Amount”) of our Common Stock over the course of its term. The term of the Equity Financing Agreement commenced on April 3, 2022 and will end on the earlier of (i) the date on which the Selling Stockholder has purchased Common Stock from us pursuant to the Equity Financing Agreement equal to the Maximum Commitment Amount, (ii) April 3, 2025, or (iii) written notice of termination by us.

We may draw on the Equity Line from time-to-time, as and when we determine appropriate in accordance with the terms and conditions of the Equity Financing Agreement. The securities included in this Prospectus represent the Common Stock issuable to the Selling Stockholder under the Equity Line.

The Selling Stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”). The Selling Stockholder may sell the shares of Common Stock described in this Prospectus in a number of different ways and at varying prices. We will pay the expenses incurred in registering the shares of Common Stock, including legal and accounting fees. See “Plan of Distribution” for more information about how the Selling Stockholder may sell the shares of Common Stock being offered pursuant to this Prospectus.

Investing in our Common Stock is speculative and involves substantial risks. You should carefully consider the matters discussed under “Risk Factors” beginning on page 8 of this Prospectus before making any decision to invest in our Common Stock.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

As used in this Prospectus, unless otherwise indicated, “we”, “us”, “our”, and the “Company” refer to IGEN Networks Corp.

This Prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”). It omits some of the information contained in the registration statement and reference is made to the registration statement for further information with regard to us and the securities being offered by the Selling Stockholder. You should rely only on the information provided in this Prospectus or to which we have referred you. We have not authorized anyone to provide you with information different from that contained in this Prospectus. This Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this Prospectus. This Prospectus does not constitute an offer to sell, or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. The Selling Stockholder may offer to sell and seek offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted.

Neither the delivery of this Prospectus nor any sale made in connection with this Prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this Prospectus, or that the information contained by reference to this Prospectus is correct as of any time after its date. The information in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of common stock. The rules of the SEC may require us to update this Prospectus in the future.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States must inform themselves about, and observe any restrictions relating to, the Offering of securities and the distribution of this Prospectus outside the United States.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included and incorporated by reference in this Prospectus constitute “forward-looking statements.” Words such as “may,” “will,” “should,” “anticipate,” “estimate,” “expect,” “projects,” “intends,” “plans,” “believes” and words and terms of similar substance used in connection with any discussion of future operating or financial performance, identify forward-looking statements. Forward-looking statements represent management’s present judgment regarding future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks include, but are not limited to, risks and uncertainties relating to our current cash position and our need to raise additional capital in order to be able to continue to fund our operations; our ability to retain our managerial personnel and to attract additional personnel; competition; our ability to obtain new projects, and any and other factors, including the risk factors identified in the documents we have filed, or will file, with the Securities and Exchange Commission. Please also see the discussion of risks and uncertainties under the caption “Risk Factors,” beginning on page 7 of this Prospectus.

In light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this Prospectus or in any document incorporated herein by reference, might not occur. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the respective dates of this Prospectus, or the date of the document incorporated by reference in this Prospectus. We expressly disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by federal securities laws.

You should rely only on information contained or incorporated by reference in this Prospectus that we have authorized to be delivered to you in connection with this Offering. We have not authorized anyone to provide you with information that is different. The information contained or incorporated by reference in this Prospectus is accurate only as of the respective dates thereof, regardless of the time of delivery of this Prospectus or of any sale of our securities offered hereby. It is important for you to read and consider all information contained in this Prospectus, including the documents incorporated by reference therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the captions “Where You Can Find More Information.”

PROSPECTUS SUMMARY

This summary highlights information contained throughout this Prospectus and is qualified in its entirety to the more detailed information and financial statements included elsewhere herein. Because this is only a summary, it is not complete and does not contain all the information that may be important to you. Before making an investment decision, you should read carefully this entire Prospectus, including, but not limited to, the information under the caption “Risk Factors,” and our financial statements and related notes.

Our Business

IGEN Networks Corp. (“IGEN”, the “Company”, “we”, “our”) was incorporated in the State of Nevada on November 14, 2006, under the name of Nurse Solutions Inc. On September 19, 2008, the Company changed its name to Sync2 Entertainment Corporation and traded under the symbol SYTO. On September 15, 2008, the Company became a reporting issuer in British Columbia, Canada. On May 26, 2009, the Company changed its name to IGEN Networks Corp. On March 25, 2015, the Company was listed on the Canadian Securities Exchange (CSE) under the trading symbol IGN and the Company became a reporting Venture Issuer in British Columbia and Ontario, Canada.

The Company’s principal business is the development and marketing of software services for the automotive and fleet management industry. The Company works with Wireless Carriers and distribution partners to provide direct and secure access to information on vehicle assets and driver behavior. The software services are based on AWS Cloud infrastructure created to provide valuable information to its customers over the wireless network and accessible from internet connected devices. The software services are marketed through automotive dealers, financial institutions, and government channels as distinct commercial and consumer brands that include Nimbo Tracking, CU Trak, Medallion GPS and most recently “FamilyShield” sold direct to consumers through Amazon.com.

Notable highlights of the year ended December 31, 2021 include the following Company achievements:

i) | IGEN secures GSA Multiple Award Schedule Contract with State and Federal Governments |

| |

ii) | IGEN Networks and T-Mobile for Business launches Co-branded Medallion GPS for Light Commercial Fleets |

| |

iii) | IGEN launches industry’s first consumer brand “FamilyShield” to protect young drivers through Amazon.com |

| |

iv) | IGEN receives patent acceptance for its Digital Telematics Signature (DTC) patent for greater accuracy in measuring driver performance |

| |

v) | IGEN launched Medallion GPS for Light - Commercial Fleets with County Executives of America |

| |

vi) | Nimbo Tracking appoints Peak Performance Team (PPT) and DOWC as distributors for nationwide launch of its products and services across 50 States covering 2400 dealership franchises |

The Company’s head office is located at 31772 Casino Drive Suite C, Lake Elsinore CA 92530, United States

Direct line is 855-912-5378

The Company currently owns the DTS patent for normalization of driver behavior data for consistent and accurate measurement of driver performance regardless of asset-type or data source. The Company acquired the DTC patent, via a patent ownership agreement, on March 16, 2020. The Company has secured trademarks and distribution licenses through increased ownership of privately held technology companies.

The Company is not aware of any government approval or regulations, other than those governing the normal course of business, which will affect its own business. However, the Company is invested in and foresees future investment in, or possible joint ventures with, companies for which local, regional or national regulatory approvals, particularly those pertaining to wireless networks or GPS-based applications, may apply.

The Company is not aware of any significant costs or effects of compliance with environmental laws.

Equity Financing Agreement with Jefferson Street Capital, LLC

On April 3, 2022, we executed an Equity Financing Agreement with Jefferson Street Capital, LLC (“Jefferson Steet Capital” or the “Selling Stockholder”), which was finalized and effected on April 3, 2022 (the “Equity Line”). Under the Equity Line, we have the right to sell to Jefferson Street Capital up to $5,000,000 of shares of our Common Stock for a period of up to three (3) years, commencing on the execution date of the agreement. Under the Equity Line, the Selling Stockholder is committed to purchase, on an unconditional basis, shares of our common stock (“Put Shares”).

The Equity Financing Agreement provides that that we have the right, but not the obligation, to deliver to Jefferson Street Capital from time-to-time, a “put notice” stating the number of shares and purchase price of Common shares we intend to sell to Jefferson Street Partners. The purchase price of the shares will be 88% of the lesser of the (i) “market price,” defined as the lowest traded price for any trading day during the 15 consecutive trading days immediately preceding delivery of the put notice. The 15 consecutive trading days preceding the receipt of the put notice is referred to as the pricing period. Each put notice shall be (i) in a minimum amount not less than $10,000 and (ii) a maximum amount up to the lesser of (a) $200,000 or (b) 200% of the average daily trading dollar volume during the pricing period. The put amount is defined as the average trading volume of our common stock during the 15 consecutive trading days immediately preceding delivery of the respective put notice (the “pricing period”), multiplied by the lowest traded price of the of our shares during the pricing period. We may not deliver a new put notice until ten trading days after the clearing of the prior put notice.

As a term of the Equity Financing Agreement, we entered into a Registration Rights Agreement with Jefferson Street Capital, whereby we agreed to register for resale by Jefferson Street Capital the shares of Common Stock purchased pursuant to the Equity Financing Agreement. Accordingly, we filed a registration statement with the SEC on Form S-1, of which this Prospectus is a part, and which covers the resale of shares to be issued under the Registration Rights Agreement.

The Offering

Securities offered by the Selling Stockholder | | Up to 200,000,000 shares of Common Stock. |

| | |

Common Stock outstanding before Offering | | 1,549,420,305 |

| | |

Common Stock outstanding after Offering | | 1,749,420,305 shares, assuming the issuance of the entire additional 200,000,000 shares pursuant to the Equity Financing Agreement. |

| | |

Use of Proceeds | | We will not receive any proceeds from the sale of Common Stock by the Selling Stockholder. However, we will receive proceeds from the sale of shares to Jefferson Street Capital pursuant to our exercise of a put right granted to us in the Equity Financing Agreement. Any such proceeds will be used for general corporate and business operations purposes and film production and distribution activities. |

| | |

Risk Factors | | An investment in our securities involves a high degree of risk and could result in a loss of your entire investment. Further, the issuance to, or sale by, the Selling Stockholder of a significant amount of shares being registered in connection with this Prospectus at any given time, could cause the market price of our common stock to decline and to be highly volatile. We do not have the right to control the timing and amount of any sales of such shares by the Selling Stockholder. Prior to making an investment decision, you should carefully consider all of the information in this Prospectus and, in particular, you should evaluate the risk factors set forth under the caption “Risk Factors” beginning on page 7. |

| | |

OTC Markets trading symbol | | IGEN |

| | |

Placement Agent | | Moody Capital Solutions Inc., acted as the placement agent for the Company with respect to the Equity Financing Agreement. Moody Capital Solutions Inc., will receive a finder’s fee of three percent (3%) of the gross proceeds received by Company pursuant to the Equity Line. |

Selling Stockholder

The Selling Stockholder, Jefferson Street Capital, LLC, a New Jersey limited liability company, is committed to purchase, on an unconditional basis, shares of our Common Stock (“Put Shares”) at an aggregate price of up to $5,000,000 over the term of the Equity Financing Agreement. Based on the trading price of our Common Stock as of April 19, 2022, we estimate Jefferson Street Capital would purchase an aggregate of 833,000,000 shares of Common Stock under the Equity Financing Agreement if the entire $5,000,000 amount had been drawn. The Offering consists of 200,000,000 Put Shares issuable pursuant to the Equity Line; such shares would represent approximately 11% of our outstanding Common Stock as of April 19, 2022, resulting in significant ownership dilution to our existing Common stockholders. This Prospectus relates to the future sale of these shares, from time-to-time, by Jefferson Street Capital.

Plan of distribution

The Selling Stockholder, including any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of its securities covered hereby that were acquired under the Equity Line. Sales may be made on the OTC Markets Pink Current Information tier or any other stock exchange, market or trading facility on which the securities are traded, or in private transactions. These sales may be at the prevailing market price or related to the then current market price, fixed prices or negotiated prices. See “The Offering - Plan of Distribution.”

RISK FACTORS

An investment in IGEN common stock is speculative, involves significant risks and should not be made by anyone who cannot afford to lose his or her entire investment. Before you invest in our common stock, you should be aware that our business faces numerous financial and market risks, including those described below, as well as general economic and business risks. You should consider carefully the following risks and uncertainties, together with all other information contained in this Prospectus, before deciding to invest in our common stock. The risks and uncertainties identified below are not the only risks and uncertainties we face. If any of the following events or risks should occur, our business, operating results and financial condition would likely suffer materially and you could lose part or all of your investment.

Risks Relating to Our Business

Our auditors have expressed a going concern modification to their audit report.

Our independent auditors include a modification in their report to our financial statements, expressing that certain matters regarding the Company raise substantial doubt as to our ability to continue as a going concern. Note 1 to the December 31, 2021 and 2020 consolidated financial statements, states that the Company has recurring losses from operations and has a negative operating cash flow since inception that raise substantial doubt about our ability to continue as a going concern. Management anticipates that the Company can attain profitable status and improve liquidity through continued business development and additional debt or equity investment in the Company. There can be no assurance that necessary debt or equity financing will be available, or will be available, on terms acceptable to the Company, in which case we may be unable to meet our obligations. If we are unable to obtain adequate financing or achieve profitability, there will be substantial doubt about our ability to continue as a going concern in the future.

If we continue to have an ineffective system of internal controls over financial reporting, we may not be able to accurately report our financial results, which could have a material adverse effect on our share price.

Effective internal controls are necessary for us to provide accurate financial reports. Section 404 of the Sarbanes-Oxley Act of 2002 and related SEC rules require, among other things, management to assess annually the effectiveness of our internal control over financial reporting. For the year ended December 31, 2021, we identified material weaknesses in our internal controls over financial reporting: namely (1) a material weakness related to the discovery of an error in a prior period financial statements related to revenue recognition, and (2) a material weakness related to the proper valuation of derivative instruments and share-based compensation amounts using the appropriate valuation models to determine reasonable estimates of fair value. If our controls fail, or management and/or our independent auditors conclude in their reports that our internal control over financial reporting was not effective, investors could lose confidence in our reported financial information, which could negatively affect the value of our shares. Also, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Because we do not have an audit committee, stockholders will have to rely on our directors, one of whom is not independent, to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. These functions are performed by the board of directors as a whole. One member of the board of directors is not an independent director. Accordingly, there is a potential conflict in that board members may also be engaged in management and participate in decisions concerning management, compensation and audit issues, which may affect management performance.

If sufficient demand for our services does not materialize, our business would be materially affected, which could result in the loss of your entire investment.

Demand for our services depends on many factors, including:

| ● | the number of customers we can attract and retain over time; |

| ● | the economy in general and, in periods of rapidly declining economic conditions, customers may defer services, such as ours, to pay their own debts to remain solvent; |

| ● | the competitive environment in the software services markets may force us to reduce prices below desired pricing level or increase promotional spending; and |

| ● | the ability to anticipate changes in user preferences and to meet customers’ needs in a timely, cost-effective manner. |

All these factors could result in immediate and longer-term declines in demand for our offered services, which could adversely affect our sales, cash flows and overall financial condition. As a result, an investor could lose his or her entire investment.

Our future success depends on our ability to develop services, products and projects and to sell them to distribution channels. The inability to establish distribution channels, may severely limit our growth prospects.

Our business success is completely dependent on our ability to successfully develop services, products and projects and secure viable distribution channels. Revenues derived therefrom will represent vital funds necessary for our continued operations. The loss or damage of any of our business relationships and/or revenues derived therefrom, will result in the inability to market our services, products and projects.

It is possible that our projects may infringe on other patented, trademarked or copyrighted concepts. Litigation arising out of infringement or other commercial disputes could cause us to incur expenses and impair our competitive advantage.

We cannot be certain that our products or projects will not infringe upon existing patents, trademarks, copyrights or other intellectual property rights held by third parties. Because we may rely on third parties to help develop some of our projects, we cannot ensure that litigation will not arise from disputes involving these third parties. We may incur substantial expenses in defending against prospective claims, regardless of their merit. Successful claims against us may result in substantial monetary liability, significantly impact our results of operations in one or more quarters, or materially disrupt the conduct of our business. Our success depends in part on our ability to obtain and enforce intellectual property protection for our products and projects, to preserve our trade secrets and to operate without infringing the proprietary rights of third parties.

The validity and breadth of claims covered in our copyrights and trademarks that we intend to file involve complex legal and factual questions and, therefore, may be highly uncertain. No assurances can be given that any future copyright, trademark or other applications:

| ● | will be issued; |

| ● | that the scope of any future intellectual property protection will exclude competitors or provide competitive advantages to the Company; |

| ● | that any copyrights or trademarks will be held valid if subsequently challenged; |

| ● | that others will not claim rights in, or ownership of, the potential copyrights or trademarks or other proprietary rights held by us; or |

| ● | that our intellectual property will not infringe, or be alleged to infringe, on the proprietary rights of others. |

Furthermore, there can be no assurance that others have not developed or will not develop similar intellectual properties. Also, whether or not additional intellectual property protection is issued to the Company, others may hold or receive protection covering intellectual properties that were subsequently developed by the Company. No assurance can be given that others will not, or have not, independently developed or otherwise acquired substantially equivalent intellectual property.

Dependence on general economic conditions.

The success of our Company depends, to a large extent, on certain economic factors that are beyond our control. Factors such as general economic conditions, levels of unemployment, interest rates, tax rates at all levels of government and other factors beyond our control may have an adverse effect on our ability to sell our services and to collect sums due and owing to us.

We are dependent upon our directors, officer and consultants, the loss of any of whom would negatively affect our business.

We are dependent upon the experience and efforts of our directors, officers and consultants to operate our business. We also expect to depend upon service provider such as actors, editors, writers and camera crews. If any director or officer leaves or is otherwise unable to perform their duties, or should any consultant cease their activities for any reason before qualified replacements could be found, there could be material adverse effects on our business and prospects. We have not entered into employment or non-competition agreements with any individuals, and do not maintain key-man life insurance. Our future success will depend on our ability to attract and retain qualified personnel. Unless and until additional employees are hired, our attempt to manage our business and projects and meet our obligations with a limited staff could have material adverse consequences, including, without limitation, a possible failure to meet a contractual or SEC deadline or other business-related obligation.

We may not be able to manage future growth effectively, which could adversely affect our operations and financial performance.

The ability to manage and operate our business as we execute our business plan will require effective planning. If we should experience significant rapid growth in the future, it could strain management and internal resources that would adversely affect financial performance. We anticipate that future growth could place a serious strain on personnel, management systems, infrastructure and other resources. Our ability to manage future growth effectively will require attracting, training, motivating, retaining and managing new employees and continuing to update and improve operational, financial and management controls and procedures. If we do not manage growth effectively, our operations could be adversely affected resulting in slower growth and a failure to achieve or sustain profitability.

We have had a history of losses and may incur future losses, which may prevent us from attaining profitability.

We have a history of operating losses since inception and, as of December 31, 2021 and March 31, 2022 we had a accumulated deficit of $19,076,522 and $19,358,959 respectively. We may incur future operating losses and these losses could be substantial and impact our ability to attain profitability. In the immediate future, we do not expect to significantly increase expenditures for product development, general and administrative expenses, and sales and marketing expenses without additional funding. However, if we cannot generate sufficient future revenues, we will not achieve or sustain profitability or positive operating cash flows. Even if we achieve profitability and positive operating cash flows, we may not be able to sustain or increase profitability or positive operating cash flows on a quarterly or annual basis.

We anticipate needing additional financing to accomplish our business plan.

At May 31, 2022 we had cash on hand of $ 75,000. Management estimates that we will require approximately an additional $900,000 during the next 12 months to fully implement our current business plan. We anticipate that at least a portion of these funds will be realized from the Equity Line. However, there is no assurance that we will be able to secure all necessary financing, or that any additional financing available will be available on terms acceptable to us, or at all. Shares issued under the Equity Line and any additional offerings of Common Stock will dilute the holdings of our then-current stockholders. If we borrow funds, we would likely be obligated to make periodic interest or other debt service payments and be subject to additional restrictive covenants. If alternative sources of financing are required, but are insufficient or unavailable, we will be required to modify our growth and operating plans in accordance with the extent of available funding. Presently, we do not intend to obtain any debt financing from a lending institution. If necessary, our board of directors or other stockholders may agree to loan funds to the Company, although there are no formal agreements to do so. Failure to secure additional capital, if needed, could force us to curtail our growth strategy, reduce or delay capital expenditures and downsize operations, which would have a material negative effect on our financial condition.

Our agreement with Jefferson Street Capital may limit the amount we may draw pursuant to an individual put notice under the Equity Line.

Under the Equity Line with Jefferson Street Capital, we have the ability to put shares of Common Stock for purchase up to the maximum aggregate amount of $5,000,000. However, the Equity Financing Agreement contains certain limitations on the amount we can draw pursuant to any single put notice. Because of the pricing formula in the agreement, we may be limited in the maximum amount of a put notice during a pricing period when our shares are trading at a lower price with low volume. Thus, there is no assurance that we will be able to draw sufficient funds during a certain pricing period that would satisfy current cash needs. In this event, we may have to rely on the availability of alternative funding. If such funding is not readily available, we would likely encounter financial difficulties that could threaten our ongoing business endeavors and financial conditions.

We could become involved in claims or litigations that may result in adverse outcomes.

From time-to-time we may be involved in a variety of claims or litigations. Such proceeding may initially be viewed as immaterial, but could prove to be material. Litigations are expensive and inherently unpredictable and excessive verdicts do occur. Given the inherent uncertainties in litigation, even when we can reasonably estimate the amount of possible loss or range of loss and reasonably estimable loss contingencies, the actual outcome may change in the future due to new developments or changes in approach. In addition, such claims or litigations could involve significant expense and diversion of management’s attention and resources from other matters.

Being a public company involves increased administrative costs, including compliance with SEC reporting requirements, which could result in lower net income and make it more difficult for us to attract and retain key personnel.

As a public company subject to the reporting requirements of the Exchange Act, we incur significant legal, accounting and other expenses. The Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the SEC, require changes in corporate governance practices of public companies. We believe these new rules and regulations increase legal and financial compliance costs and make some activities more time consuming. For example, in connection with being a public company, we may have to create new board committees, implement additional internal controls and disclose controls and procedures, adopt an insider trading policy and incur costs relating to preparing and distributing periodic public reports. These rules and regulations could also make it more difficult to attract and retain qualified executive officers and members of our board of directors, particularly to serve on our audit committee.

Management must invest significant time and energy to stay current with public company responsibilities, which limits the time they can apply to other tasks associated with operations. It is possible that the additional burden and expense of operating as a public company could hinder our ability to achieve and maintain profitability, which would cause our business to fail and investors to lose all their money invested in our stock.

We estimate that being a public company will cost us more than $100,000 annually. This is in addition to all other costs of doing business. It is important that we maintain adequate cash flow, not only to operate our business, but also to pay the cost of remaining public. If we fail to pay public company costs as incurred, we could become delinquent in our reporting obligations and our shares may no longer remain qualified for quotation on a public market. Further, investors may lose confidence in the reliability of our financial statements causing our stock price to decline.

Provisions in our charter documents and under Nevada law could make an acquisition of our Company more difficult, limit attempts by our stockholders to replace or remove our current board of directors and limit the market price of our common stock.

Provisions in our amended and restated Articles of Incorporation and may have the effect of delaying or preventing a change of control or changes in our management. Our amended and restated Articles of Incorporation include provisions that:

● | permit our board of directors to establish the number of directors and fill any vacancies and newly created directorships; |

● | require super-majority voting to amend some provisions in our amended and restated Articles of Incorporation and amended and restated bylaws; |

● | authorize the issuance of “blank check” preferred stock that our board of directors could use to implement a stockholder rights plan or issue preferred shares with super voting rights that will effectively reduce or eliminate the rights of shareholders of our common stock to amend our Articles of Incorporation or remove a director; |

● | provide that only the Chairperson of our board of directors, our Chief Executive Officer, or a majority of our board of directors will be authorized to call a special meeting of stockholders. |

In addition, Section 78.411 et seq. of the Nevada Revised Statutes provides that a Nevada corporation which has not opted out of coverage by this section in the prescribed manner may not engage in any combination with an interested stockholder for a period of two years following the date that the stockholder became an interested stockholder unless prior to that time the board of directors of the corporation approved either the combination or the transaction which resulted in the stockholder becoming an interested stockholder. The Company has not opted out of this provision, which reduces the options of the Company being acquired without the consent of the board of directors.

Risks Relating to Our Industry

If we are not successful in the continued development, timely manufacture, and introduction of new products or product categories, demand for our products could decrease to the extent that lost sales and profits from declining segments or product categories are not entirely offset.

We expect that a significant portion of our future revenue will continue to be derived from sales of newly introduced products. This is particularly important to replace sales and profits lost in declining segments or product categories. The market for our products is characterized by rapidly changing technology, evolving industry standards and changes in customer needs. If we fail to introduce new products, or to modify or improve our existing products, in response to changes in technology, industry standards or customer needs, our products could rapidly become less competitive or obsolete. We must continue to make significant investments in research and development in order to continue to develop new products, enhance existing products and achieve market acceptance for such products. However, there can be no assurance that development stage products will be successfully completed or, if developed, will achieve significant customer acceptance.

If we are unable to successfully develop and introduce competitive new products, and enhance our existing products, our future results of operations would be adversely affected. Our pursuit of necessary technology may require substantial time and expense. We may need to license new technologies to respond to technological change. These licenses may not be available to us on terms that we can accept or may materially change the gross profits that we are able to obtain on our products. We may not succeed in adapting our products to new technologies as they emerge. Development and manufacturing schedules for technology products are difficult to predict, and there can be no assurance that we will achieve timely initial customer shipments of new products. The timely availability of these products in volume and their acceptance by customers are important to our future success. Any future challenges related to new products, whether due to product development delays, manufacturing delays, lack of market acceptance, delays in regulatory approval, or otherwise, could have a material adverse effect on our results of operations.

If we are unable to compete effectively with existing or new competitors, our resulting loss of competitive position could result in price reductions, fewer customer orders, reduced margins and loss of market share.

The Company was impacted by the pandemic from supply chain delays and lack of availability of franchise vehicles within the automotive industry. The markets for our products are highly competitive, and we expect competition to increase in the future. Some of our competitors have significantly greater financial, technical and marketing resources than we do. These competitors may be able to respond more rapidly to new or emerging technologies or changes in customer requirements. They may also be able to devote greater resources to the development, promotion and sale of their products or secure better product positioning with retailers. Increased competition could result in price reductions, fewer customer orders, reduced margins and loss of market share. Our failure to compete successfully against current or future competitors could seriously harm our business, financial condition and results of operations.

The consumer automotive segment, which represents almost all of our revenue, may decline in 2022. The demand for personal navigation devices (PNDs) has been and continues to be reduced by replacement technologies becoming available on mobile devices and factory-installed systems in new autos, as well as by market saturation.

This market is highly competitive, as competing new technologies emerge. GPS/navigation technologies have been incorporated into competing devices such as mobile handsets, tablets, and new automobiles through factory-installed systems. Many companies are now offering tracking software for these mobile devices.

We have a number of competitors in our market segment, and some of them are well capitalized and they continue to develop competitive products.

There are a number of companies offering automobile tracking products that may compete with our products. While we continuously strive to improve our product line and offer new and improved technology, some of our competitors are more well capitalized than we are and can produce competing produces on a larger scale and for a more competitive price.

Risks Relating to this Offering and Ownership of Our Common Stock

Our Common Stock is traded on the OTC Markets Pink Current Information Tier under the symbol “IGEN”, but there is no assurance that an active market for the shares will be maintained.

Although our shares are currently quoted and traded on the OTC Markets Pink Current Information tier, we cannot assure our stockholders that a continuous and active trading market will be sustained. In the even an active trading market is not maintained, it would be difficult, if not impossible, for stockholders to liquidate their shares. Also, the trading price for our shares may be highly volatile and subject to significant fluctuations due to variations in quarterly operating results and other business and economic factors. These price fluctuations may adversely affect the liquidity of our shares, as well as the price that holders may realize for their shares upon any future sale.

Stockholders of IGEN Common Stock should be aware that the public market may be volatile and subject to severe swings in price.

We believe that the trading market for our shares on the OTC Markets Pink Current Information Tier is volatile and subject to numerous factors, many beyond our control. Some factors that may influence the price of our shares are:

| ● | Our ability to find viable companies in which to invest; |

| ● | Our ability to successfully manage companies in which we invest; |

| ● | Our ability to successfully raise capital; |

| ● | Our ability to successfully expand and leverage the distribution channels of our portfolio companies; |

| ● | Our ability to develop new distribution partnerships and channels; |

| ● | Expected tax rates and foreign exchange rates |

| ● | The continuing uncertain economic conditions; |

| ● | Price and product competition; |

| ● | Changing product mixes; |

| ● | The loss of any significant customers; |

| ● | Higher than expected product, service or operating costs; |

| ● | Inability to leverage intellectual property rights; and |

| ● | Delayed product or service introductions. |

Additionally, the stock market may experience extreme price and volume fluctuations, which, without a direct relationship to our operating performance, may affect the market price of our shares. In the past, following periods of extreme volatility in the market price of a company’s securities, a securities class action litigation has often been instituted. A securities class action suit against us could result in substantial costs and divert our management’s time and attention, which would otherwise be used to benefit our business.

Issuing a large number of shares of Common Stock could significantly dilute our existing stockholders and negatively impact the market price of our shares.

The Equity Financing Agreement (Equity Line) with Jefferson Street Capital (the Selling Stockholder) provides that Jefferson Street Capital is committed to purchase, on an unconditional basis, shares of our Common Stock (“Put Shares”) at an aggregate price of up to $5,000,000 over the three-year term of the agreement. Upon delivery of a put notice, the purchase price of the Put Shares shall equal 88% of the lesser of the (i) “market price,” defined as the lowest traded price for any trading day during the 15 trading days immediately preceding the respective Put Date. The Company may not deliver a new put notice until ten trading days after the clearing of the prior put notice. As a result, if we sell shares of Common Stock under the Equity Line, we will be issuing Common Stock at a discount below market prices, which could cause the market price of our Common Stock to decline and, if such issuances are significant in number, the amount of the decline in our market price could also be significant.

In general, we are unlikely to sell shares of Common Stock under the Equity Line at a time when the additional dilution to stockholders would be substantial, unless we are unable to obtain capital to meet our financial obligations from other sources on better terms at such time. However, if we do, the dilution that could result from such issuances could have a material adverse impact on existing stockholders and could cause the price of our Common Stock to fall rapidly based on the amount of such dilution.

The Selling Stockholder may sell a large number of shares, resulting in a substantial decrease to the value of shares held by existing stockholders.

Pursuant to the Equity Financing Agreement, we are prohibited from delivering a put notice to the Selling Stockholder to the extent that the issuance of shares causes the Selling Stockholder to beneficially own more than 4.99% of our then-outstanding shares of Common Stock. However, these restrictions do not prevent the Selling Stockholder from selling shares of Common Stock received in connection with the Equity Line and then receiving additional shares of Common Stock in connection with a subsequent issuance. In this way, the Selling Stockholder could sell more than 4.99% of the outstanding shares of Common Stock in a relatively short time frame while never holding more than 4.99% at any one time. As a result, our existing stockholders and new investors could experience substantial diminution in the value of their shares. Additionally, we do not have the right to control the timing and amount of any sales by the Selling Stockholder of shares issued under the Equity Line.

Trading in our shares could be restricted because of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws.

Trading and transfer of our Common Stock may be restricted under certain securities laws promulgated by various states and foreign jurisdictions, commonly referred to as Blue Sky laws. Individual state Blue Sky laws could make it difficult or impossible to sell our common stock in those states. Many states require that an issuer’s securities be registered in their state, or appropriately exempted from registration, before the securities can trade in that state. We have no immediate plans to register our securities in any state. Absent compliance with such laws, our Common Stock may not be traded in such jurisdictions. Whether stockholders may trade their shares in a particular state is subject to various rules and regulations of that state.

We do not expect to pay dividends in the foreseeable future, which could make our stock less attractive to potential investors.

We have not declared any dividends since inception of the Company. Any future payment of cash dividends will be at the discretion of our Board of Directors after considering many factors, including operating results, financial condition and capital requirements. We plan to retain any future earnings and other cash resources for operation and business development and do not intend to declare or pay any cash dividends in the foreseeable future. Corporations that pay dividends may be viewed as a better investment than corporations that do not.

Trading in our common stock is subject to certain “penny stock” regulation, which could have a negative effect on the price of our shares in the marketplace.

Trading the Company’s common stock is subject to certain provisions, commonly referred to as “penny stock” rules, promulgated under the Exchange Act. A penny stock is generally defined as any non-exchange listed equity security that has a market price less than $5.00 per share, subject to certain exceptions. These rules require additional disclosure by broker-dealers in connection with any trades involving a penny stock. The rules also impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors, generally institutions. These sales practice requirements include a broker-dealer to:

| ● | Make a special written suitability determination for a purchaser of penny stocks; |

| ● | receive the purchaser’s prior written consent to execute the trade; and |

| ● | deliver to a prospective purchaser of a penny stock, prior to the first transaction, a risk disclosure document relating to the penny stock market. |

Consequently, penny stock rules may restrict the ability of broker-dealers to trade and/or maintain a market in our Common Stock, which could affect the ability of stockholders to sell their shares. These requirements may be considered cumbersome by broker-dealers and could impact their willingness to trade or make a market in our Common Stock, which could severely limit the market price and liquidity of our shares. Also, many prospective investors may not want to get involved with these additional administrative requirements, which could have a material adverse effect on the price and trading of our shares.

Future sales or the potential sale of a substantial number of shares of our common stock could cause our market value to decline.

As of the date of this Prospectus, we have 1,549,420,305 shares of Common Stock outstanding. Of these outstanding shares, approximately 69,355,435 shares are considered restricted securities and may be sold only pursuant to a registration statement, or the availability of an appropriate exemption from registration, such as Rule 144. Additionally, up to a total of 200,000,000 Put Shares that are the subject of this Prospectus can be purchased by the Selling Stockholder under the Equity Line, with such shares being freely tradable without restriction upon issuance and be immediately sold into the market. Sales of a substantial number of these restricted shares and Put Shares in the public markets, or the perception that these sales may occur, could cause the market price of our Common Stock to decline and materially impair our ability to raise capital through the sale of additional equity securities.

In the event we issue additional Common Stock in the future, current stockholders could suffer immediate and significant dilution, which could have a negative effect on the value of their shares.

We are authorized to issue 1,890,000,000 shares of Common Stock, of which 340,155,242 shares are unissued. Also, an additional total of 200,000,000 Put Shares may be issued pursuant the Equity Line to which this Prospectus relates. Our Board of Directors (the “Board”) has broad discretion for future issuances of Common Stock, which may be issued for cash, property, services rendered or to be rendered, or for several other reasons. We could also issue shares to make it more difficult, or to discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest, or otherwise. For example, if in the due exercise of its fiduciary obligations the Board determines that a takeover proposal was not in the Company’s best interests, unissued shares could be issued by the board without stockholder approval. This might prevent, or render more difficult or costly, completion of an expected takeover transaction.

Other than the Put Shares issuable pursuant to the Equity Line, we do not presently contemplate additional issuances of significant amounts of Common Stock in the immediate future, except to raise addition capital. We presently do not have an agreement or understanding to sell additional shares. Our Board has authority, without action or vote of our stockholders, to issue all or part of the authorized but unissued shares. Any future issuance of shares will dilute the percentage ownership of existing stockholders and likely dilute the book value of the Common Stock, which could cause the price of our shares to decline and investors in our shares to lose all or a portion of their investment.

USE OF PROCEEDS

We will not receive any proceeds from the resale of shares offered by the Selling Stockholder hereby. Proceeds from sales of offered shares will be paid to Selling Stockholder. We have agreed to bear expenses relating to the registration of the Put Shares for the Selling Stockholder that are the subject of this Prospectus. The Selling Stockholder will be obligated to pay all underwriting discounts, selling commissions and expenses incurred by it for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Stockholder in connection with the sale of shares.

We will receive proceeds from the sale of shares to Jefferson Street Capital pursuant to our exercise of the put right granted to us by the Equity Line. Any such proceeds will be used for general corporate purposes, which may include (i) acquisition of projects, (ii) refinancing or repayment of indebtedness, (iii) capital expenditures and working capital, and (iv) investing in equipment and property development.

CAPITALIZATION

The following table sets forth our actual capitalization at March 31, 2022 and December 31, 2021. This table should be read in conjunction with the financial statements and the notes thereto included elsewhere in this Prospectus.

Redeemable convertible preferred stock - Series A: | | | | | | |

Authorized – 1,250,000 shares with $0.001 par value, 199,375 shares and 199,375 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively, net of discount of $71,967 and $101,317, respectively, aggregate liquidation preference of $202,721 and $203,463 as of March 31, 2022 and December 31, 2021, respectively | | | 112,384 | | | | 84,022 | |

| | | | | | | | |

Stockholders’ Deficit | | | | | | | | |

Series B preferred stock: Authorized – 5,000,000 shares with $0.001 par value issued and outstanding – 5,000,000 shares, as of March 31, 2022 and December 31, 2021, respectively | | | 5,000 | | | | 5,000 | |

Common stock: Authorized - 1,740,000,000 shares with $0.001 par value issued and outstanding – 1,536,920,305 and 1,476,869,532 shares, as of March 31, 2022 and December 31, 2021, respectively | | | 1,536,921 | | | | 1,476,870 | |

| | | | | | | | |

Additional paid-in capital | | | 17,022,651 | | | | 16,900,962 | |

Accumulated Deficit | | | (19,358,959 | ) | | | (19,076,522 | ) |

Total Stockholders’ Deficit | | | (794,387 | ) | | | (693,690 | ) |

Total Liabilities and Stockholders’ Deficit | | $ | 835,970 | | | $ | 761,826 | |

DILUTION

We are not immediately selling any of the shares of our Common Stock in this Offering. All shares sold in this Offering will be issued to the Selling Stockholder pursuant to the terms of the Equity Financing Agreement. If all of the shares in this Prospectus are issued, we will have an additional 200,000,000 shares of Common Stock issued and outstanding in addition to a total of shares outstanding 1,549,420,305 as of May 31, 2022. The Company may sell shares to Jefferson Street Capital at a price equal to 88% of the lesser of the (i) market price when the purchase price is calculated per the Agreement. Each put notice shall be (i) in a minimum amount not less than $10,000, and (ii) a maximum amount up to the lesser of (a) $200,000, or (b) 200% of the Average Daily Trading Value. To the extent that the shares are sold at a discount of 12% to the fair market value, the use of the Equity Line could result in the dilution of the value of the outstanding common shares or in the depression of the stock price.

MARKET FOR OUR COMMON STOCK

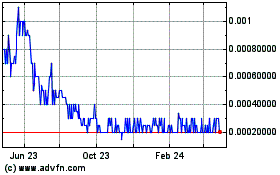

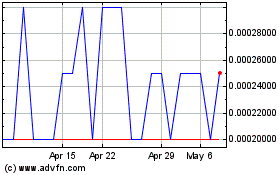

Our Common Stock is presently quoted on the OTC Markets Pink Current Information tier under the trading symbol “IGEN”, The most recent reported trade by OTC Markets was on May 31, 2022 at a price of $0.0041 per share.

Set forth in the table below are the quarterly high and low prices of our common stock as obtained from OTC Markets for the past two fiscal years ended December 31, 2021 and 2020.

| | High | | | Low | |

| | | | | | |

Fiscal year ended December 31, 2021 | | | | | | |

First Quarter | | $ | .0219 | | | | .0061 | |

Second Quarter | | $ | .0109 | | | | .0075 | |

Third Quarter | | $ | .0095 | | | | .0055 | |

Fourth Quarter | | $ | .0125 | | | | .0038 | |

| | | | | | | | |

Fiscal year ended December 31, 2020 | | | | | | | | |

First Quarter | | $ | .0175 | | | | .0013 | |

Second Quarter | | $ | .0084 | | | | 0.0008 | |

Third Quarter | | $ | .013 | | | | .0074 | |

Fourth Quarter | | $ | .0078 | | | | .0048 | |

As of April 19, 2022, there were approximately 147 stockholders of record of our Common Stock, which does not consider those stockholders whose certificates are held in the name of broker-dealers or other nominee accounts.

The ability of individual stockholders to trade their shares in a particular state may be subject to various rules and regulations of that state. Many states require that an issuer’s securities be registered in their state or appropriately exempted from registration before the securities are permitted to trade in that state. Presently, we have no plans to register our securities in any state.

Penny Stock Rule

It is unlikely that our securities will be listed on any national or regional exchange or The NASDAQ Stock Market in the foreseeable future. Therefore, our shares will be subject to the provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the “penny stock” rule. Section 15(g) sets forth certain requirements for broker-dealer transactions in penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act.

The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that any equity security is a penny stock unless that security is:

| ● | Registered and traded on a national securities exchange meeting specified criteria set by the SEC; |

| ● | authorized for quotation on the NASDAQ Stock Market; |

| ● | issued by a registered investment company; |

| ● | excluded from the definition based on price (at least $5.00 per share) or the issuer’s net tangible assets; or |

| ● | exempted from the definition by the SEC. |

Broker-dealers who sell penny stocks to persons other than established customers and accredited investors, are subject to additional sales practice requirements. An accredited investor is generally defined as a person with assets more than $1,000,000, excluding their principal residence, or annual income exceeding $200,000, or $300,000 together with their spouse.