Haz Holdings Announces Completion of Merger

March 19 2007 - 4:15PM

Business Wire

Haz Holdings, Inc. (OTC:HAZH) (�Haz Holdings� or the �Company�),

announced the closing of the merger, effective March 15, 2007,

between Haz Holdings Inc., a Texas corporation, f/k/a Oncology Med,

Inc., and Haz Holdings, Inc., a Delaware corporation (the

�Merger�), that, as a result of the Merger is now the wholly-owned

and operating subsidiary of the Company. The Company originally

announced the merger agreement on February 5, 2007. The Company�s

primary business is the ownership and management of hotel

properties. The Company wholly-owns three family friendly mid-range

business hotels operating under the brand names �Hotel Marquis

& Suites� and �Marquis Inn & Suites� (www.hazhotels.com).

Its existing hotels consist of the 174-room Hotel Marquis and

Suites Intercontinental Airport hotel in Houston, Texas, the

203-room Hotel Marquis Airport in San Antonio, Texas, and the

Marquis Inn & Suites, a 30-room economy hotel with 70

recreational vehicle units in Edmonton, Alberta, Canada. Haz

Holdings� five year business plan is to increase its ownership

portfolio by acquiring 100-300 rooms hotel properties, while

concurrently franchising additional hotels under its brand names.

Near term strategy is to acquire properties at below replacement

value and leverage its holdings toward further expansion. Haz

Holdings recently announced agreements with Air France, American

Airlines, China Airlines and Continental Airlines to provide

accommodations to stranded air travelers departing from George Bush

Intercontinental Airport in Houston, Texas and San Antonio

International Airport in San Antonio, Texas. The Company�s

portfolio includes wholly-owned subsidiaries: Mortgage and

Financial Institute, LLC (www.mfibanking.com), a mortgage brokerage

company specializing in commercial and residential lending in

Washington and Alaska; Nationwide Hotel Management, LLC, a hotel

management company; KB Realty Group International LLC, a commercial

and residential real estate sales company; Evergreen Sound

Construction, LLC, a commercial and residential development

company; and DoTravelDeals (www.dotraveldeals.com), a global travel

booking engine. Karim Bhanji, CEO of Haz Holdings: �Now that the

merger is complete, the Company can continue to focus on our goal

of acquiring up to 75 corporate-owned properties and franchising

our corporate hotel brand to 155 properties throughout North

America over the next 5 years. We also look forward to the exposure

this will bring as we seek to expand the Company�s other

subsidiaries.� About Haz Holdings, Inc. Haz Holdings owns and

manages three mid-scale, full-service hotels in the United States

and Canada, under the brand names �Hotel Marquis & Suites� and

�Marquis Inn & Suites.� More information about Haz Holdings,

Inc. can be found at http://www.hazholdings.com. NOTE: This press

release may contain ``forward-looking statements.'' In some cases,

you can identify forward-looking statements by terminology such as

``may,'' ``will,'' ``should,'' ``could,'' ``expects,'' ``plans,''

``intends,'' ``anticipates,'' ``believes,'' ``estimates,''

``predicts,'' ``potential,'' ``continue'' or the negative of such

terms and other comparable terminology. These forward-looking

statements include, without limitation, statements about our market

opportunity, our strategies, competition, expected activities and

expenditures as we pursue our business plan, and the adequacy of

our available cash resources. Although we believe that the

expectations reflected in any forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Actual results may differ materially

from the predictions discussed in these forward-looking statements.

Changes in the circumstances upon which we base our predictions

and/or forward-looking statements could materially affect our

actual results. Additional factors that could materially affect

these forward-looking statements and/or predictions include, among

other things: (1) the company�s ability to manage its current

merger transaction; (2) the company's limited operating history;

(3) the company's ability to pay down existing debt; (4) the

company's ability to secure necessary financing for its property

acquisitions; (5) potential litigation by shareholders and/or

former or current advisors against the company; (6) the company's

ability to comply with federal, state and local government

regulations and/or unforeseen changes in federal or and government

regulations; and (7) the risks inherent in the investigation and

consummation of the acquisition of a new business opportunity or

other factors over which we have little or no control.

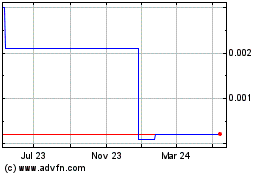

Haz (CE) (USOTC:HAZH)

Historical Stock Chart

From Jan 2025 to Feb 2025

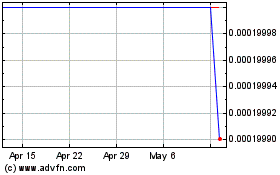

Haz (CE) (USOTC:HAZH)

Historical Stock Chart

From Feb 2024 to Feb 2025