PROSPECTUS

Filed Pursuant

to Rule 424(b)(3)

Registration No.

333-198802

32,082,170

Shares

Global

Digital Solutions, Inc.

COMMON STOCK

This

prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 32,082,170 shares of our common

stock consisting of:

| (i) |

11,022,170 shares of our common stock issued or issuable in connection with our acquisition of North American Custom Specialty Vehicles, LLC; |

| (ii) |

5,634,000 shares of our common stock issued to investors in various private placements; |

| (iii) |

4,250,000 shares of our common stock issued and 4,250,000 share issuable upon the conversion of warrants issued in connection with convertible debt, for services, and for investment banking fees; |

| (iv) |

2,676,000 shares of our common stock issued to certain acquisition, investor relations professionals and consultants for acquisition, investor relations and marketing services; and |

| (v) |

4,250,000 shares of our common stock issued for conversion of debt and debt guarantees. |

All of these shares

of our common stock are being offered for resale by the selling stockholders.

The

prices at which the selling stockholders may sell shares will be determined by the prevailing market price for the shares or in

negotiated transactions. We will not receive any proceeds from the sale of these shares by the selling stockholders.

We

will bear all costs relating to the registration of these shares of our common stock, other than any selling stockholders’

legal or accounting costs or commissions.

Our common stock is quoted on the regulated quotation service of the Over The Counter

Market (“OTCQB”) under the symbol “GDSI”. The last reported sale price of our common stock as reported

by the OTCQB on September 12, 2014, was $0.16 per share.

We

are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to

reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications

of Being an Emerging Growth Company.”

Investing

in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and

uncertainties described under the heading “Risk Factors” beginning on page 6 of this prospectus before making a

decision to purchase our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is October 17, 2014

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not

making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information contained

in this prospectus is current only as of its date. This prospectus will be updated as required

by law.

PROSPECTUS

SUMMARY

The

following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information

that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors”

beginning on page 11 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and our historical financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless the

context provides otherwise, the terms “the Company,” “GDSI,” “we,” “us,” and “our”

refer to Global Digital Solutions, Inc., a New Jersey corporation, and where appropriate, its wholly-owned subsidiaries.

Overview

We

were incorporated in New Jersey as Creative Beauty Supply, Inc. (“Creative”) in August 1995. In March 2004,

Creative acquired Global Digital Solutions, Inc., a Delaware corporation ("Global”). The merger was treated as a recapitalization

of Global, and Creative changed its name to Global Digital Solutions, Inc., Global provided structured cabling design, installation

and maintenance for leading information technology companies, federal, state and local government, major businesses, educational

institutions, and telecommunication companies. Our mission was to target the United States government contract marketplace for

audio and video services. Due to capital constraints our operations team focused mainly in Northern California. On May 1, 2012, we

made the decision to wind down our operations in the telecommunications while concurrently refocusing our efforts in the area

of cyber arms technology and complementary security and technology solutions. We completed the wind down our telecommunications

operations in June 2014. As discussed below, from August 2012 through November 2013 we were actively involved in managing

Airtronic USA, Inc., and in June 2014 we acquired North American Custom Specialty Vehicles, LLC (“NACSV”).

Our

Strategy

| |

● |

Identify,

target, and acquire profitable businesses with proven and established track records of serving Government, Law Enforcement

Agencies, and related Corporate Customers. |

| |

● |

Aggregate

and integrate Product, Service and Technology providers serving this defined customer base. |

| |

● |

Integrate

the significant customer relationships developed from each business to cross sell products and services and expand the GDSI

presence within the Industry. |

| |

● |

Become

a Facilitator in the “Analog to Digital” shift in the Defense and Intelligence Marketplace over the balance of

this decade. |

There

is doubt about our ability to continue as a going concern

Our

independent registered public accounting firm has issued an opinion on our December 31, 2013, financial statements that states

that the financial statements were prepared assuming we will continue as a going concern. As discussed in Note 1 to

the financial statements, we had a net loss of $9,297,253 for the year ended December 31, 2013, and used net cash of $983,345

for operating activities. Additionally, at December 31, 2013, we had an accumulated deficit of $16,858,375. These matters

raise substantial doubt about our ability to continue as a going concern. Our plan in regards to these matters is also

described in Note 1 to our financial statements. The financial statements do not include any adjustments that might

result from the outcome of this uncertainty.

Transactions

with Airtronic USA, Inc.

On

October 22, 2012, we entered into an Agreement of Merger and Plan of Reorganization (“Merger Agreement”) to acquire

70% of Airtronic USA, Inc. (“Airtronic”), a debtor in possession under chapter 11 of the Bankruptcy Code in a case

pending in the US Bankruptcy Court for the Northern District of Illinois, Eastern Division (the “Court”) once Airtronic

successfully reorganized and emerged from bankruptcy (the “Merger”). Contemporaneously, on October 22, 2012, we entered

into a Debtor In Possession Note Purchase Agreement (“Bridge Loans”) with Airtronic in which we agreed to lend them

initially up to $750,000, and which was subsequently modified twice to provide for additional loans totaling $500,000 and $200,000.

From October 2012 through November 2013 we were actively involved in managing and supervising Airtronic’s operations as

we funded their business and planned for its reorganization and successful emergence from bankruptcy. Airtronic’s Plan of

Reorganization which approved their Merger with us, was confirmed by the Court on October 2, 2013 and we intended to close the

Merger with Airtronic by December 2, 2013; however Airtronic refused to close the Merger and the transaction fell through. Subsequently,

in April 2014, Airtronic had a Plan of Reorganization confirmed, and in May 2014 repaid all loans due to the Company under the

Bridge Loans.

Acquisition

of North American Custom Specialty Vehicles, LLC

On June 16, 2014, we and our wholly

owned subsidiary, GDSI Acquisition Corporation, a Delaware corporation (“Buyer”), entered into an Equity Purchase

Agreement (“EPA”) with Brian A. Dekle and John Ramsey (collectively, “Sellers”) and North American Custom

Specialty Vehicles, LLC, an Alabama limited liability company (“NACSV”), pursuant to which Buyer purchased all of

Sellers’ membership interests in NACSV for total consideration of up to $3.6 million (the “Acquisition”) with

(a) $1.2 million payable at closing as follows: (i) a cash payment of $1.0 million and (ii) 645,161 shares of GDSI’s restricted

common stock valued at a discounted price of 80% of the market price of the shares calculated as the average of last reported

selling prices of the Company’s shares of common stock for the five trading days ended two business days prior to the date

of determination (the Discounted Value”), or $0.31 per share, for $200,000 in the aggregate, (b) up to $2.4 million of additional

post-closing contingent consideration payable, at the sellers election, in either in cash or shares of the Company’s common

stock issued at the Discounted Value as certain milestones are met as set forth in the EPA through December 31, 2017, and (c)

a post-closing date purchase price adjustment of $816,373, the excess of the total value of closing date assets of NACSV over

$1.2 million (the “True-Up” payment). NACSV specializes in building mobile command/communications and specialty vehicles

for emergency management, first responders, national security and law enforcement operations.

Increase

in Authorized Share Capital

On

July 7, 2014, we filed a Certificate of Amendment to Certificate of Incorporation to increase the number of our authorized shares

of capital stock from 185,000,000 shares to 485,000,000 shares, divided into two classes: 450,000,000 shares of common stock,

par value $0.001 per share (the “common stock”), and 35,000,000 shares of preferred stock, par value $0.001 per share

(the “Preferred Stock”).

Implications

of Being an Emerging Growth Company

We

qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, as amended,

or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally

to public companies. These provisions include:

| |

● |

Reduced

disclosure about our executive compensation arrangements; |

| |

● |

No

non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; |

| |

● |

Exemption

from the auditor attestation requirement in the assessment of our internal control over financial reporting; and |

| |

● |

Reduced

disclosure of financial information in this prospectus, including two years of audited financial information and two years

of selected financial information. |

We

may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company.

We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of a fiscal

year, if we are deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission, or if we issue

more than $1.0 billion of non-convertible debt over a three-year-period.

The

JOBS Act permits an emerging growth company to take advantage of an extended transition period to comply with new or revised accounting

standards applicable to public companies. We have irrevocably chosen to "opt out" of

the exemption for the delayed adoption of certain accounting standards and, therefore, will be subject to the same new or revised

accounting standards as other public companies that are not emerging growth companies.

Selected

Risk Factors

Our

business is subject to numerous risks, as discussed more fully in the section entitled “Risk Factors” beginning on

page 6 of this prospectus. In particular, the following considerations, among others, may offset our competitive strengths or

have a negative effect on our growth strategy, which could cause a decline in the price of our common stock and result in a loss

of all or a portion of your investment:

| |

● |

There

is doubt about our ability to continue as a going concern. |

| |

● |

We

have a limited operating history, no revenue and may continue to incur losses. |

| |

● |

We

will need additional financing to fully implement our business plan, and we cannot assure you that we will be successful in

obtaining such financing or in continuing our operations. |

Where

You Can Find Us

Our

principal executive office is located at 777 South Flagler Drive, Suite 800 West, West Palm Beach, Florida 33401 and our telephone

number is (561) 515-6163. Our website address is www.gdsi.co. We do not incorporate

the information on or accessible through our website into this prospectus, and you should not consider any information on, or

that can be accessed through, our website a part of this prospectus.

THE

OFFERING

| Common

stock offered by selling stockholders |

|

This

prospectus relates to the sale by certain selling stockholders of 32,082,170 shares of our common stock consisting of: |

| |

|

(i)

11,022,170 shares of our common stock issued or issuable in connection with our acquisition of North American Custom

Specialty Vehicles, LLC; |

| |

|

(ii)

5,634,000 shares of our common stock issued to investors in various private placements; |

| |

|

(iii)

4,250,000 shares of our common stock issued and 4,250,000 share issuable upon the conversion of warrants issued in connection

with convertible debt, for services, and for investment banking fees; |

| |

|

(iv)

2,676,000 shares of our common stock issued to certain acquisition advisors, investor relations professionals and consultants

for acquisition, investor relations and marketing services; and |

| |

|

(v)

4,250,000 shares of our common stock issued for conversion of debt and debt guarantees. |

| |

|

|

| Offering

price |

|

Market

price or privately negotiated prices. |

| |

|

|

| Common

stock outstanding before the offering |

|

103,469,278

shares (1) |

| |

|

|

| Common

stock outstanding after the offering |

|

118,096,287

shares (2) |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of the common stock by the selling stockholders. However, we will receive up to

$1,400,000 from the proceeds from the exercise of the warrants by the selling stockholders if and when those stockholders

exercise their warrants. We expect to use such proceeds, if any, for general working capital purposes. |

| |

|

|

| OTC

Markets (OTCQB) Symbol |

|

GDSI. |

| |

|

|

| Risk

Factors |

|

You

should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth

in the “Risk Factors” section beginning on page 6 of this prospectus before deciding whether or not to invest

in our common stock. |

| (1) |

Represents

the

number

of

shares

of

our

common

stock

outstanding

as

of

September

12,

2014.

Excludes

(i)

4,250,000

shares

of

our

common

stock

issuable

upon

exercise

of

outstanding

warrants,

(ii)

4,500,000

shares

of

our

common

stock

issuable

upon

the

vesting

of

restricted

stock

grants,

(iii)

10,377,009

shares

issuable

in

the

future

for

the

True-Up

payment

and

the

contingent

consideration

in

connection

with

the

acquisition

of

NACSV, (iv)

5,500,000

shares

of

our

common

stock

issuable

upon

exercise

of

options

granted

and

reserved

under

the

2014

Equity

Incentive

Plan

and

(v)

12,000,000

shares

issuable

upon

the

vesting

of

restricted

stock

units

granted

and

reserved

under

the

2014

Equity

Incentive

Plan.

|

| |

|

| (2) |

Includes

(i)

4,250,000

shares

of

our

common

stock

issuable

upon

the

exercise

of

outstanding

warrants,

which

shares

are

offered

for

sale

in

this

prospectus,

and

(ii)

10,377,009

shares

issuable

in

the

future

for

the

True-Up

payment

and

the

contingent

consideration

in

connection

with

the

acquisition

of

NACSV,

which

shares

are

offered

for

sale

in

this

prospectus.

Excludes

(i)

4,500,000

shares

of

our

restricted

common

stock

issuable

upon

the

vesting

of

restricted

stock

grants,

(ii)

5,500,000

shares

of

our

common

stock

issuable

upon

exercise

of

options

granted

and

reserved

under

the

2014

Equity

Incentive

Plan,

and

(iii)

12,000,000

shares

issuable

upon

the

vesting

of

restricted

stock

units

granted

and

reserved

under

the

2014

Equity

Incentive

Plan.

|

SPECIAL

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus contains forward-looking statements that are subject to risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different than the results, performance or achievements expressed or implied

by the forward-looking statements. Such statements include statements regarding our expectations, hopes, beliefs or intentions

regarding the future, including but not limited to statements regarding our market, strategy, competition, development plans (including

acquisitions and expansion), financing, revenues, operations, and compliance with applicable laws. Forward-looking statements

involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement.

Factors that could cause actual results to differ materially from such forward-looking statements include the risks described

in greater detail in the following paragraphs. All forward-looking statements in this document are made as of the date hereof,

based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement.

Market data used throughout this prospectus is based on published third party reports or the good faith estimates of management,

which estimates are based upon their review of internal surveys, independent industry publications and other publicly available

information. Although we believe that such sources are reliable, we do not guarantee the accuracy or completeness of this information,

and we have not independently verified such information.

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below,

together with all of the other information included or referred to in this prospectus, before purchasing shares of our common

stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any

of these risks actually occur, our business, financial condition or results of operations may be materially adversely affected. In

such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Risks

Relating to Our Business

There

is doubt about our ability to continue as a going concern.

Our

independent registered public accounting firm has issued an opinion on our December 31, 2013, financial statements that states

that the financial statements were prepared assuming we will continue as a going concern. As discussed in Note 1 to

the financial statements, we had a net loss of $9,297,253 for the year ended December 31, 2013, and used net cash of $983,345

for operating activities. Additionally, at December 31, 2013, we had an accumulated deficit of $16,858,375. These matters

raise substantial doubt about our ability to continue as a going concern. Our plan in regards to these matters is also

described in Note 1 to our financial statements. The financial statements do not include any adjustments that might

result from the outcome of this uncertainty.

Our

future is dependent on our ability to meet our financing requirements, and complete other identified and unidentified acquisitions.

If we fail for any reason, we might not be able to continue as a going concern.

We

have a limited operating history, limited revenue and may continue to incur losses.

There

can be no assurance that our business will be profitable in the future. We may continue to incur losses and negative cash flows

from operations. This would have a material adverse affect on our financial condition.

We

will need additional financing to fully implement our business plan, and we cannot assure you that we will be successful in obtaining

such financing or in continuing our operations.

We recently acquired North American Custom

Specialty Vehicles, LLC (“NACSV”) a company that NACSV specializes in building mobile command/communications and specialty

vehicles for emergency management, first responders, national security and law enforcement operations. We may acquire complimentary

businesses in the future, but there can be no assurance that we will successfully close a future acquisition, or that additional

public or private financing, including debt or equity financing, will be available as needed, or, if available, on terms favorable

to us to close such an acquisition. Any additional equity financing may be dilutive to our stockholders and holders of such additional

equity securities may have rights, preferences or privileges that are senior to those of our existing common or preferred stock.

Furthermore, debt financing, if available, will require payment of interest and may involve restrictive covenants that could impose

limitations on our operating flexibility. Our failure to successfully obtain additional future funding may jeopardize our ability

to continue our business and operations.

While

part of our strategy is to pursue strategic acquisitions, we may not be able to identify businesses that we can acquire on acceptable

terms, we may not be able to obtain necessary financing or may face risks due to additional indebtedness, and our acquisition

strategy may incur significant costs or expose us to substantial risks inherent in the acquired business’s operations.

Our

strategy of pursuing strategic acquisitions may be negatively impacted by several risks, including the following:

| |

● |

We

may not successfully identify companies that have complementary product lines or technological competencies or that can diversify

our revenue or enhance our ability to implement our business strategy. |

| |

● |

We

may not successfully acquire companies if we fail to obtain financing, or to negotiate the acquisition on acceptable terms, or

for other related reasons. |

| |

● |

We

may incur additional expenses due to acquisition due diligence, including legal, accounting, consulting and other professional

fees and disbursements. Such additional expenses may be material, will likely not be reimbursed and would increase the aggregate

cost of any acquisition. |

| |

● |

Any

acquired business will expose us to the acquired company’s liabilities and to risks inherent to its industry.

We may not be able to ascertain or assess all of the significant risks. |

| |

● |

We

may require additional financing in connection with any future acquisition. Such financing may adversely impact, or

be restricted by, our capital structure. |

| |

● |

Achieving

the anticipated potential benefits of a strategic acquisition will depend in part on the successful integration of the operations,

administrative infrastructures and personnel of the acquired company or companies in a timely and efficient manner.

Some of the challenges involved in such an integration include: |

| |

|

● |

demonstrating

to the customers of the acquired company that the consolidation will not result in adverse changes in quality, customer service

standards or business focus; |

| |

|

● |

preserving

important relationships of the acquired company; |

| |

|

● |

coordinating

sales and marketing efforts to effectively communicate the expanded capabilities of the combined company; and |

| |

|

● |

coordinating

the supply chains. |

Any

integration is expected to be complex, time-consuming and expensive and may harm the newly-consolidated company’s business,

financial condition and results of operations.

New

federal and state laws and regulations may restrict our ability in the future to sell the products that potential acquisition

targets currently sell into the domestic commercial market, which could materially adversely affect our future revenues.

Since

December 2012, there has been an extremely sharp increase in political and public support for new “gun control” laws

and regulations in the United States. Some proposed legislation, including legislation that has been introduced and is under

active consideration in Congress and in state legislatures, would ban and/or restrict the sale of military and law enforcement

firearms, in their current configurations, into the commercial market, either throughout the United States or in particular states.

It is also possible that the President of the United States could issue Executive Orders that would adversely affect our ability

to sell, or customers’ ability to purchase, our products. The political environment for enactment of new “gun

control” measures at the federal, state and local level is evolving rapidly and additional significant change in the domestic

legal and regulatory environment during 2014 is likely.

In

light of the uncertain and evolving political, legal and regulatory environment, it is not clear what measures might be necessary

in order to redesign products to comply with applicable law, nor whether it will even be possible in every instance to do so.

To the extent that redesigns of products are possible, we may need to spend significant amounts of capital in order to effectuate

such redesigns and may incur associated sales, marketing, legal and administrative costs in connection with the introduction of

new models. Furthermore, there is no assurance that customers will accept redesigned product.

A

substantial decline in the domestic commercial market for any of these reasons could have a material adverse effect on the businesses

we acquire.

We

depend upon our senior management and our business may be adversely affected if we cannot retain them.

Our success depends upon our ability to

attract and retain experienced senior management with specialized industry and technical knowledge and/or industry relationships.

On August 12, 2013, Richard J. Sullivan was appointed Chairman and CEO of the Company and David A. Loppert was appointed CFO.

In July 2014, Stephen L. Norris was appointed Vice Chairman and CEO of GDSI International. Mr. Sullivan and Mr. Loppert have significant

experience as CEO and CFO, respectively, of public companies. Mr. Norris is one of five co-founders of the Carlyle

Group, a major merchant bank based in Washington, D. and from 1988-1997, served as Carlyle's President. We might not be able to

find or replace qualified individuals to fill the slots of senior management that we anticipate if their services do not become

available to us or are no longer available to us; accordingly the inability to fill, or the loss of critical members of our anticipated

senior management team could have a material adverse effect on our ability to effectively pursue our business and acquisition

strategy. We do not have key-man life insurance policies covering any of our employees at this time.

If

we are unable to manage future growth, our business may be negatively affected.

We

are continuing to pursue a strategy of rapid growth, and plan to expand significantly our capability and devote substantial resources

to our marketing, sales, administrative, operational, financial and other systems and resources. Such expansion will place significant

demands on our marketing, sales, administrative, operational, financial and management information systems, controls and procedures.

Accordingly, our performance and profitability will depend on the ability of our officers and key employees to:

| |

● |

manage

our business and our subsidiaries as a cohesive enterprise; |

| |

● |

manage

expansion through the timely implementation and maintenance of appropriate administrative, operational, financial and management

information systems, controls and procedures; |

| |

● |

add

internal capacity, facilities and third-party sourcing arrangements as and when needed; |

| |

● |

maintain

service quality controls; and |

| |

● |

attract,

train, retain, motivate and manage effectively our employees. |

There

can be no assurance that we will integrate and manage successfully new systems, controls and procedures for our business, or that

our systems, controls, procedures, facilities and personnel, even if successfully integrated, will be adequate to support our

projected future operations. Any failure to implement and maintain such systems, controls and procedures, add internal capacity,

facilities and third-party sourcing arrangements or attract, train, retain, motivate and manage effectively our employees could

have a material adverse effect on our business, financial condition and results of operations. In addition, we may

incur substantial expenses identifying, investigating and developing appropriate products and services in the small arms business

markets. There can be no assurance that any expenditures incurred in identifying, investigating and developing such products and

services will ever be recouped.

We

will need additional capital to fund ongoing operations, future acquisitions, and to respond to business opportunities, challenges,

acquisitions or unforeseen circumstances. If such capital is not available to us, our business, operating results and

financial condition may be harmed.

At

June 30, 2014, we had $353,087 cash on hand. In August 2014 we received approximately $414,000 for recovery of legal

fees and expenses from Airtronic. We will continue to seek equity financing to provide funding for operations but

there is no assurance that we will be successful in these efforts. If we are not successful in raising additional equity

capital or generate sufficient cash flows to meet our obligations as they come due, we may not be able to complete the acquisition

of Airtronic, and/or fully fund our ambitious growth plans. We may then be required to reduce our overhead expenses by the reduction

of headcount and other available measures.

We

may face strong competition from larger, established companies.

We

likely will face intense competition from other companies that provide the same or similar custom specialty vehicle manufacturing,

virtually all of whom can be expected to have longer operating histories, greater name recognition, larger installed customer

bases and significantly more financial resources, R&D facilities and manufacturing and marketing experience than we have.

There can be no assurance that developments by our potential competitors will not render our existing and future products or services

obsolete. In addition, we expect to face competition from new entrants into the custom specialty vehicle business.

As the demand for products and services grows and new markets are exploited, we expect that competition will become more intense,

as current and future competitors begin to offer an increasing number of diversified products and services. We may not have sufficient

resources to maintain our research and development, marketing, sales and customer support efforts on a competitive basis. Additionally,

we may not be able to make the technological advances necessary to maintain a competitive advantage with respect to our products

and services. Increased competition could result in price reductions, fewer product orders, obsolete technology and reduced operating

margins, any of which could materially and adversely affect our business, financial condition and results of operations.

If

we are unable to keep up with technological developments, our business could be negatively affected.

If

we are successful in acquiring complementary companies in the future, the markets for our anticipated products and services are

expected to be characterized by rapid technological change and be highly competitive with respect to timely innovations. Accordingly,

we believe that our ability to succeed in the sale of our products and services will depend significantly upon the technological

quality of our products and services relative to those of our competitors, and our ability to continue to develop and introduce

new and enhanced products and services at competitive prices and in a timely and cost-effective manner. In order to

develop such new products and services, we will depend upon close relationships with those companies, existing customers and our

ability to continue to develop and introduce new and enhanced products and services at competitive prices and in a timely and

cost-effective manner. There can be no assurance that we will be able to develop and market our new products and services successfully

or respond effectively to technological changes or new product and service offerings of our potential competitors in the arms

business. We may not be able to develop the required technologies, products and services on a cost-effective and timely basis,

and any inability to do so could have a material adverse effect on our business, financial condition and results of operations.

We

may not be able to protect intellectual property that we expect to acquire, which could adversely affect our business.

The

companies that we expect to acquire may rely on patent, trademark, trade secret and copyright protection to protect their technology.

We believe that technological leadership can be achieved through additional factors such as the technological and creative skills

of our personnel, new product developments, frequent product enhancements, name recognition and reliable product maintenance.

Nevertheless, our ability to compete effectively depends in part on our ability to develop and maintain proprietary aspects of

our technology, such as patents. We may not secure future patents; and patents that we may secure may become invalid or may not

provide meaningful protection for our product innovations. In addition, the laws of some foreign countries do not protect intellectual

property rights to the same extent as the United States. Furthermore, there can be no assurance that competitors will not independently

develop similar products, "reverse engineer" our products, or, if patents are issued to us, design around such patents. We

also expect to rely upon a combination of copyright, trademark, trade secret and other intellectual property laws to protect our

proprietary rights by entering into confidentiality agreements with our employees, consultants and vendors, and by controlling

access to and distribution of our technology, documentation and other proprietary information. There can be no assurance, however,

that the steps to be taken by us will not be challenged, invalidated or circumvented, or that the rights granted thereunder will

provide a competitive advantage to us. Any such circumstance could have a material adverse effect on our business, financial condition

and results of operations. While we are not currently engaged in any intellectual property litigation or proceedings,

there can be no assurance that we will not become so involved in the future or that our products do not infringe any intellectual

property or other proprietary right of any third party. Such litigation could result in substantial costs, the diversion of resources

and personnel, and subject us to significant liabilities to third parties, any of which could have a material adverse effect on

our business.

We

may not be able to protect our trade names and domain names.

We may not be able to protect our trade

names and domain names against all infringers, which could decrease the value of our brand name and proprietary rights. We currently

hold the Internet domain names "www.gdsi.co" and “www.nacsvehicles.com” and we use “GDSI”

and “NACS Vehicles” as trade names. Domain names generally are regulated by Internet regulatory bodies and

are subject to change and may be superseded, in some cases, by laws, rules and regulations governing the registration of trade

names and trademarks with the United States Patent and Trademark Office and certain other common law rights. If the domain registrars

are changed, new ones are created or we are deemed to be infringing upon another's trade name or trademark, we could be unable

to prevent third parties from acquiring or using, as the case may be, our domain name, trade names or trademarks, which could

adversely affect our brand name and other proprietary rights.

The

effects of the sequester may adversely impact our business, operating results or financial condition.

The

sequester and its associated cutbacks in the military and support services has resulted in furloughs and delays in processing

and approving of foreign orders that are approved by the United States Department of Defense. This, coupled with continuing changes

in economic conditions, including declining consumer confidence, concerns about inflation or deflation, the threat of a continuing

recession, increases in the rates of default and bankruptcy and extreme volatility in the credit and equity markets, may lead

our customers to cease doing business with us or to reduce or delay that business or their payments to us, and our results of

operations and financial condition could be adversely affected by these actions. These challenging economic conditions

also may result in:

| |

● |

increased

competition for less spending; |

| |

● |

pricing

pressure that may adversely affect revenue; |

| |

● |

difficulty

forecasting, budgeting and planning due to limited visibility into the spending plans of current or prospective customers;

or |

| |

● |

customer

financial difficulty and increased risk of doubtful accounts receivable. |

We

are unable to predict the duration and severity of the sequester and its adverse economic impact on conditions in the U.S. and

other countries.

We

expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult

to predict our future performance.

Our

revenues and operating results could vary significantly from quarter to quarter and year-to-year because of a variety of factors,

many of which are outside of our control. As a result, comparing our operating results on a period-to-period basis

may not be meaningful. In addition to other risk factors discussed in this section, factors that may contribute to

the variability of our quarterly and annual results include:

| |

● |

our

ability to accurately forecast revenues and appropriately plan our expenses; |

| |

● |

the

impact of worldwide economic conditions, including the resulting effect on consumer spending; |

| |

● |

our

ability to maintain an adequate rate of growth; |

| |

● |

our

ability to effectively manage our growth; |

| |

● |

our

ability to attract new customers; |

| |

● |

our

ability to successfully enter new markets and manage our expansion; |

| |

● |

the

effects of increased competition in our business; |

| |

● |

our

ability to keep pace with changes in technology and our competitors; |

| |

● |

our

ability to successfully manage any future acquisitions of businesses, solutions or technologies; |

| |

● |

the

success of our marketing efforts; |

| |

● |

changes

in consumer behavior and any related impact on the advertising industry; |

| |

● |

interruptions

in service and any related impact on our reputation; |

| |

● |

the

attraction and retention of qualified employees and key personnel; |

| |

● |

our

ability to protect our intellectual property; |

| |

● |

costs

associated with defending intellectual property infringement and other claims; |

| |

● |

the

effects of natural or man-made catastrophic events; |

| |

● |

the

effectiveness of our internal controls; and |

| |

● |

changes

in government regulation affecting our business. |

As

a result of these and other factors, the results of any prior quarterly or annual periods should not be relied upon as indications

of our future operating performance, and any unfavorable changes in these or other factors could have a material adverse effect

on our business, financial condition and results of operation.

Growth

may place significant demands on our management and our infrastructure.

We

plan for substantial growth in our business, and this growth would place significant demands on our management and our operational

and financial infrastructure. If our operations grow in size, scope and complexity, we will need to improve and upgrade

our systems and infrastructure to meet customer demand. The expansion of our systems and infrastructure will require us to commit

substantial financial, operational and technical resources in advance of an increase in the volume of business, with no assurance

that the volume of business will increase. Continued growth could also strain our ability to maintain reliable service

levels for our customers and meet their expected delivery schedules, develop and improve our operational, financial and management

controls, enhance our reporting systems and procedures and recruit, train and retain highly skilled personnel.

Managing

our growth will require significant expenditures and allocation of valuable management resources. If we fail to achieve the necessary

level of efficiency in our organization as it grows, our business, operating results and financial condition would be harmed.

Confidentiality

agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information.

In

order to protect our proprietary technology and processes, we will rely in part on confidentiality agreements with our employees,

customers, potential customers, independent contractors and other advisors. These agreements may not effectively prevent

disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential

information. In addition, others may independently discover trade secrets and proprietary information, and in such

cases we could not assert any trade secret rights against such parties. Costly and time-consuming litigation could

be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection

could adversely affect our competitive business position.

We

will continue to incur increased costs as a result of being a public reporting company and our management expects to devote substantial

time to public reporting company compliance programs.

As

a public reporting company, we incur significant legal, insurance, accounting and other expenses that we would not incur as a

non-reporting public company. We expect to invest resources to comply with evolving laws, regulations and standards, and this

investment will result in increased general and administrative expenses and may divert management's time and attention from product

development activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended

by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings

against us and our business may be harmed. We maintain directors' and officers' insurance coverage, which increases our insurance

cost. In the future, it may be more expensive for us to obtain director and officer liability insurance, and we may be required

to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult

for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation

committee, and qualified executive officers.

In

addition, in order to comply with the requirements of being a public reporting company, we may need to undertake various actions,

including implementing new internal controls and procedures and hiring new accounting or internal audit staff. The Sarbanes-Oxley

Act requires that we maintain effective disclosure controls and procedures and internal control over financial reporting. We are

continuing to develop and refine our disclosure controls and other procedures that are designed to ensure that information required

to be disclosed by us in the reports that we file with the Securities and Exchange Commission, is recorded, processed, summarized

and reported within the time periods specified in the Commission's rules and forms, and that information required to be disclosed

in reports under the Exchange Act is accumulated and communicated to our principal executive and financial officers. Any failure

to develop or maintain effective controls could adversely affect the results of periodic management evaluations. In the event

that we are not able to demonstrate compliance with the Sarbanes-Oxley Act, that our internal control over financial reporting

is perceived as inadequate, or that we are unable to produce timely or accurate financial statements, investors may lose confidence

in our operating results and the price of our ordinary shares could decline.

As

discussed below, because we are an emerging growth company, we are exempt from the auditor attestation requirement of Section 404

of the Sarbanes-Oxley Act of 2002, but that does not preclude us from complying with certain of these rules, which require management

to certify financial and other information in our quarterly and annual reports and provide an annual management report on the

effectiveness of our internal control over financial reporting commencing with our second annual report. This assessment will

need to include the disclosure of any material weaknesses in our internal control over financial reporting identified by our management

or our independent registered public accounting firm. We have begun the costly and challenging process of implementing the system

and processing documentation needed to comply with such requirements.

We

may not be able to complete our evaluation, testing and any required remediation in a timely fashion.

Our

independent registered public accounting firm will not be required to formally attest to effectiveness of our internal control

over financial reporting until the later of our second annual report or the first annual report required to be filed with the

Commission following the date we are no longer an "emerging growth company" as defined in the JOBS Act. We cannot assure

you that there will not be material weaknesses or significant deficiencies in our internal controls in the future.

Risks

Related to our Common and Preferred Stock

We

are eligible to be treated as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of

2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common

stock less attractive to investors.

We

are an "emerging growth company", as defined in the JOBS Act. For as long as we continue to be an emerging growth company,

we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are

not emerging growth companies, including (1) not being required to comply with the auditor attestation requirements of Section 404

of the Sarbanes-Oxley, (2) reduced disclosure obligations regarding executive compensation in this Form 10-K and our other

periodic reports, and registration and proxy statements and (3) exemptions from the requirements of holding a

nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

In addition, as an emerging growth company, we are only required to provide two years of audited financial statements. We could

be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier, including

if the market value of our common stock held by non-affiliates exceeds $700.0 million as of any June 30 before that

time (i.e., we become a large accelerated filer) or if we have total annual gross revenue of $1.0 billion or more during

any fiscal year before that time, in which cases we would no longer be an emerging growth company as of the following December 31

or, if we issue more than $1.0 billion in non-convertible debt during any three-year period before that time, we would cease

to be an emerging growth company immediately. Even after we no longer qualify as an emerging growth company, we may still qualify

as a "smaller reporting company" which would allow us to take advantage of many of the same exemptions from disclosure

requirements, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley

Act and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We cannot

predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find

our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price

may be more volatile.

Under

the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards

apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period and, as a result,

we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other

public companies that are not emerging growth companies.

We

may be unable to register for resale all of the shares of common stock sold in private placements, in which case purchasers in

the private placements will need to rely on an exemption from the registration requirements in order to sell such shares.

In

connection with our various private placements, we are obligated to include all such common stock sold in our next “resale”

registration statement with the SEC. Nevertheless, it is possible that the SEC may not permit us to register all of such shares

of common stock for resale. In certain circumstances, the SEC may take the view that the private placements require us to register

the resale of the securities as a primary offering. Investors should be aware of the existence of risks that interpretive positions

taken with respect to Rule 415, or similar rules or regulations including those that may be adopted subsequent to the date

of this report, that could impede the manner in which the common stock may be registered or our ability to register the common

stock for resale at all or the trading in our securities. If we are unable to register some or all of the common stock, or if

shares previously registered are not deemed to be freely tradable, such shares would only be able to be sold pursuant to an exemption

from registration under the Securities Act, such as Rule 144.

We

have not paid dividends in the past and do not expect to pay dividends in the foreseeable future. Any return on investment

may be limited to the value of our common stock.

We

have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment

of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting

us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be

less valuable because a return on your investment will only occur if our stock price appreciates.

There

is currently a limited liquid trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

To

date there has been a nominal liquid trading market for our common stock. We cannot predict how liquid the market for

our common stock might become. Our common stock is quoted for trading on the OTCQB Marketplace (“OTCQB”). As

soon as is practicable, we anticipate applying for listing of our common stock on either the American Stock Exchange, The Nasdaq

Capital Market or other national securities exchange, assuming that we can satisfy the initial listing standards for such exchange. We

currently do not satisfy the initial listing standards, and cannot ensure that we will be able to satisfy such listing standards

or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing

standards of such exchanges, or our common stock is otherwise rejected for listing and remains listed on the OTCQB or suspended

from the OTCQB, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid

and our common stock price may be subject to increased volatility.

Furthermore,

for companies whose securities are traded in the OTCQB, it is more difficult (1) to obtain accurate quotations, (2) to obtain

coverage for significant news events because major wire services generally do not publish press releases about such companies,

and (3) to obtain needed capital.

Our

common stock may be deemed a "penny stock," which would make it more difficult for our investors to sell their shares.

Our

common stock may be subject to the "penny stock" rules adopted under Section 15(g) of the Exchange Act. The

penny stock rules generally apply to companies whose common stock is not listed on The Nasdaq Stock Market or other national securities

exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for

the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for

three or more years). These rules require, among other things, that brokers who trade penny stock to persons other

than "established customers" complete certain documentation, make suitability inquiries of investors and provide investors

with certain information concerning trading in the security, including a risk disclosure document and quote information under

certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny

stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If

we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any,

for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to

dispose of our securities.

Offers

or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If

our stockholders sell substantial amounts of our common stock in the public market, including shares issued in our private placements

upon the effectiveness of the registration statement we expect to file, or upon the expiration of any statutory holding period,

under Rule 144, or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred

to as an "overhang" and in anticipation of which the market price of our common stock could fall. The existence

of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional

financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or

appropriate. The shares of common stock sold in our private placements will be freely tradable upon the earlier of: (i) effectiveness

of a registration statement covering such shares, or (ii) the date on which such shares may be sold without registration pursuant

to Rule 144 (or other applicable exemption) under the Securities Act.

Investor

Relations Activities, Nominal “Float” and Supply and Demand Factors May Affect the Price of our Stock.

We

expect to utilize various techniques such as non-deal road shows and investor relations campaigns in order to create investor

awareness for the Company. These campaigns may include personal, video and telephone conferences with investors and

prospective investors in which our business practices are described. We have and we will continue to provide compensation

to investor relations firms and pay for newsletters, websites, mailings and email campaigns that are produced by third-parties

based upon publicly-available information concerning the Company. We will not be responsible for the content of analyst

reports and other writings and communications by investor relations firms not authored by the Company or from publicly available

information. We do not intend to review or approve the content of such analysts’ reports or other materials based

upon analysts’ own research or methods. Investor relations firms should generally disclose when they are compensated

for their efforts, but whether such disclosure is made or complete is not under our control.

The

SEC and the Financial Industry Regulatory Authority, Inc. (“FINRA”) enforce various statutes and regulations intended

to prevent manipulative or deceptive devices in connection with the purchase or sale of any security and carefully scrutinize

trading patterns and company news and other communications for false or misleading information, particularly in cases where the

hallmarks of “pump and dump” activities may exist, such as rapid share price increases or decreases. The

Company and its shareholders may be subjected to enhanced regulatory scrutiny due to the relatively small number of holders who

own the registered shares of the Company’s common stock publicly available for resale, and the limited trading markets in

which such shares may be offered or sold which have often been associated with improper activities concerning penny-stocks, such

as the OTCQB Marketplace. Until such time as the common stock sold in the private placements are registered and until

such time as the restricted shares of the Company are registered or available for resale under Rule 144, there will continue to

be a large percentage of shares held by a relatively small number of investors, many of whom acquired such shares in privately

negotiated purchase and sale transactions, that will constitute the entire available trading market. The Supreme Court

has stated that manipulative action is a term of art connoting intentional or willful conduct designed to deceive or defraud investors

by controlling or artificially affecting the price of securities. Often times, manipulation is associated by regulators

with forces that upset the supply and demand factors that would normally determine trading prices. The supply of Company common

stock for sale has been and may continue to be limited for an indeterminate amount of time, which could result in higher bids,

asks or sales prices than would otherwise exist. Securities regulators have often cited thinly-traded markets, small

numbers of holders, and awareness campaigns as components of their claims of price manipulation and other violations of law when

combined with manipulative trading, such as wash sales, matched orders or other manipulative trading timed to coincide with false

or touting press releases. There can be no assurance that the Company’s or third-parties’ activities, or

the small number of potential sellers or small percentage of stock in the “float,” or determinations by purchasers

or holders as to when or under what circumstances or at what prices they may be willing to buy or sell stock will not artificially

impact (or would be claimed by regulators to have affected) the normal supply and demand factors that determine the price of the

stock.

We

may apply the proceeds of private placements to uses that ultimately do not improve our operating results or increase the value

of your investment.

We

have used and intend to use the net proceeds from private placements for general working capital purposes. Our management has

and will have broad discretion in how we use these proceeds. These proceeds could be applied in ways that do not ultimately improve

our operating results or otherwise increase the value of the investment in shares of our common stock sold.

Because

our current directors and executive officers are among our largest stockholders, they can exert significant control over our business

and affairs and have actual or potential interests that may depart from those of subscribers in our private placements.

Our

current directors and executive officers beneficially own or control approximately 44% of our issued and outstanding shares of

common stock. Additionally, the holdings of our directors and executive officers may increase in the future upon vesting

or other maturation of exercise rights under any of the restricted stock grants, options or warrants they may hold or in the future

be granted or if they otherwise acquire additional shares of our common stock. The interests of such persons may differ

from the interests of our other stockholders. As a result, in addition to their board seats and offices, such persons

may have significant influence over and may control corporate actions requiring stockholder approval, irrespective of how the

Company's other stockholders may vote, including the following actions:

| |

● |

to

elect or defeat the election of our directors; |

| |

● |

to

amend or prevent amendment of our Certificate of Incorporation or By-laws; |

| |

● |

to

effect or prevent a transaction, sale of assets or other corporate transaction; and |

| |

● |

to

control the outcome of any other matter submitted to our stockholders for vote. |

Such

persons' stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control

of the Company, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock

price.

Exercise

of options and warrants may have a dilutive effect on our common stock.

If

the price per share of our common stock at the time of exercise of any options, or any other convertible securities is in excess

of the various exercise or conversion prices of such convertible securities, exercise or conversion of such convertible securities

would have a dilutive effect on our common stock. As of June 30, 2014, we had outstanding options to acquire 5,500,000 shares

of our common stock at an exercise price of $0.64 per share and warrants to acquire 4,250,000 shares of our common stock at exercise

prices ranging from $0.10 to $1.00. Further, any additional financing that we secure may require the granting of rights, preferences

or privileges senior to those of our common stock and which result in additional dilution of the existing ownership interests

of our common stockholders

Our

certificate of incorporation allows for our board to create new series of preferred stock without further approval by our stockholders,

which could adversely affect the rights of the holders of our common stock.

Our

board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of

directors also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors

could authorize the issuance of a series of preferred stock that would grant to holders a preferred right to our assets upon liquidation,

the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption

of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board of directors could

authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible

into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing

stockholders.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of the common stock by the selling stockholders. However, we will receive up to $1,400,000

from the proceeds from the exercise of the warrants by the selling stockholders if and when those stockholders exercise their

warrants. We expect to use such proceeds, if any, for general working capital purposes.

MARKET

FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

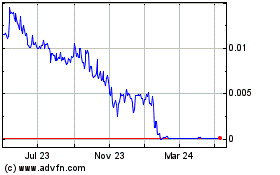

Our

common stock is quoted on the OTCQB Marketplace (“OTCQB”) or pink sheets maintained by the OTC Markets

Group under the symbol “GDSI”. As of September 12, 2014, there were 201 holders of record of our common

stock. The transfer agent for our common stock is Issuer Direct Corporation.

The

following table sets forth the high and low bid prices for our common stock for the periods indicated, as reported by the OTCQB.

The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

| Period | |

High | | |

Low | |

| January 1, 2011 through March 31, 2011 | |

$ | 0.002 | | |

$ | 0.002 | |

| April 1, 2011 through June 30, 2011 | |

$ | 0.002 | | |

$ | 0.002 | |

| July 1, 2011 through September 30, 2011 | |

$ | 0.040 | | |

$ | 0.002 | |

| October 1, 2011 through December 31, 2011 | |

$ | 0.023 | | |

$ | 0.008 | |

| January 1, 2012 through March 31, 2012 | |

$ | 0.31 | | |

$ | 0.055 | |

| April 1, 2012 through June 30, 2012 | |

$ | 0.12 | | |

$ | 0.04 | |

| July 1, 2012 through September 30, 2012 | |

$ | 0.095 | | |

$ | 0.01 | |

| October 1, 2012 through December 31, 2012 | |

$ | 0.17 | | |

$ | 0.02 | |

| January 1, 2013 through March 31, 2013 | |

$ | 0.14 | | |

$ | 0.07 | |

| April 1, 2013 through June 30, 2013 | |

$ | 1.39 | | |

$ | 0.09 | |

| July 1, 2013 through September 30, 2013 | |

$ | 1.11 | | |

$ | 0.70 | |

| October 1, 2013 through December 31, 2013 | |

$ | 0.87 | | |

$ | 0.26 | |

| January 1, 2014 through March 31, 2014 | |

$ | 0.98 | | |

$ | 0.41 | |

| April 1, 2014 through June 30, 2014 | |

$ | 0.80 | | |

$ | 0.27 | |

The

last reported sales price of our common stock on the OTCQB on September 12, 2014 was $0.16 per share.

DIVIDEND

POLICY

We

have not declared nor paid any cash dividend on our common stock, and we currently intend to retain future earnings, if any, to

finance the expansion of our business, and we do not expect to pay any cash dividends in the foreseeable future. The decision

whether to pay cash dividends on our common stock will be made by our board of directors, in their discretion, and will depend

on our financial condition, results of operations, capital requirements and other factors that our board of directors considers

significant.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes appearing

elsewhere in this prospectus. In addition to historical information, this discussion and analysis contains forward-looking statements

that involve risks, uncertainties, and assumptions. Our actual results may differ materially from those anticipated in these forward-looking

statements as a result of certain factors, including but not limited to those set forth under “Risk Factors”. The

various sections of this discussion contain a number of forward-looking statements, all of which are based on our current expectations

and could be affected by the uncertainties and risk factors described throughout this Report as well as other matters over which

we have no control. See “Forward-Looking Statements.” Our actual results may differ materially.

Results

of Continuing Operations

Three

months ended June 30, 2014 and 2013

Revenue

and cost of revenue in the three month period ended June 30, 2014 were $111,405 and $69,346, respectively. Revenue was from fixed-price

and modified fixed-price construction contracts that are recognized using the percentage-of-completion method of revenue recognition.

Cost of revenue include all direct material and labor costs and indirect costs related to contract performance. We had no revenue,

or cost of revenue in the three-month period ended June 30, 2013.

Selling,

general and administrative (“S, G & A”) were $3,834,260 and $1,368,497 in three-month periods ended June 30, 2014

and 2013, respectively. S, G &A was comprised of:

| | |

Three Months Ended

June 30, | | |

Increase/ | | |

% | |

| | |

2014 | | |

2013 | | |

(decrease) | | |

Change | |

| Compensation and benefits | |

$ | 2,620,767 | | |

$ | 907,848 | | |

$ | 1,712,919 | | |

| 188.7 | % |

| Acquisition costs | |

| 754,572 | | |

| - | | |

| 754,572 | | |

| - | |

| Debt issuance costs | |

| 25,000 | | |

| 204,286 | | |

| (179,286 | ) | |

| -87.8 | % |

| Investment banking fees | |

| - | | |

| 71,610 | | |

| (71,610 | ) | |

| -100.0 | % |

| Investor relations and marketing | |

| 84,666 | | |

| 84,933 | | |

| (267 | ) | |

| -0.3 | % |

| Office support and supply | |

| 48,778 | | |

| 1,669 | | |

| 47,108 | | |

| 2821.9 | % |

| Professional and filing fees | |

| 276,092 | | |

| 90,876 | | |

| 185,216 | | |

| 203.8 | % |

| Depreciation and amortization | |

| 12,830 | | |

| - | | |

| 12,830 | | |

| - | |

| Other | |

| 11,555 | | |

| 7,275 | | |

| 4,281 | | |

| 58.8 | % |

| | |

$ | 3,834,260 | | |

$ | 1,368,497 | | |

$ | 2,465,763 | | |

| 180.2 | % |

Compensation

and benefits increased by $1,712,919, or 188.7% % to $2,620,767 in 2014 compared to $907,848 in 2013. In the three-month period

ended June 30, 2014 compensation and benefits comprised:

| | |

2014 | | |

2013 | |

| Fair value expense of stock option grants | |

$ | 1,759,998 | | |

$ | - | |

| Fair value expense of restricted stock grants | |

| 743,613 | | |

| 841,848 | |

| Officer salaries | |

| 96,000 | | |

| 66,000 | |

| Payroll | |

| 21,156 | | |

| - | |

| | |

$ | 2,620,767 | | |

$ | 907,848 | |

Major

changes in compensation and benefits include:

| |

● |

Options

with a fair market value of $3,520,000 were granted in 2014 and $1,759,998 was expensed in the quarter. |

| |

● |

We

have granted restricted stock to officers and advisors which vest ratably through June 2016 and $743,613 was expensed in 2014

compared to $841,848 in 2013. |

Acquisition

costs were related to the NACSV acquisition in 2014 and comprised non-cash compensation of (i) $664,000 of costs to advisors paid

in shares of our common stock, and (ii) $65,572 in stock discount expense for payments to the sellers of NACSV in our common stock

at a price which resulted in a $0.02 discount to fair value, and $25,000 paid in cash for due diligence services.

Debt

issuance costs decreased by $(179,286), or (87.8)%. In connection with the issuance of notes payable and convertible

notes payable in prior years, we issued a warrant to a consultant which vested over one year. In three-month period ended June

30, 2014 we expensed $25,000 for amortization of the warrant. In three-month period ended June 30, 2013, $204,286 was

for amortization of warrants issued related to the loans, including to the consultant and to the noteholder.

We

had no investment banking fees in 2014. In 2013 we paid placement fees of $71,610 in connection with private placements.

Investor

relations and marketing expense include $79,170 in 2014 and $80,033 paid to consultants for services in shares of our common stock

or compensation through the issuance of a warrant which is being amortized over the term of the consulting agreement.

Office

supply and support expenses increased by $47,108 or 2,821.9% to $48,778 in 2014 compared to $1,669 in 2013. In the