Current Report Filing (8-k)

September 29 2022 - 12:28PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM

8-K

________________

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September

23, 2022

_______________________________

FORZA

INNOVATIONS INC.

(Exact

name of registrant as specified in its charter)

_______________________________

| Wyoming |

000-56131 |

30-0852686 |

| (State

or Other Jurisdiction |

(Commission |

(I.R.S.

Employer |

| of

Incorporation) |

File

Number) |

Identification

No.) |

30

Forzani Way NW

Calgary,

Alberta T3Z

1L5

Tel:

(702) 205-7064

(Address

and telephone number of principal executive offices)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

☐

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| |

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On September 23, 2022, Forza Innovations Inc. (the “Company”),

closed a Securities Purchase Agreement (the “Purchase Agreement”) with Mast Hill Fund, L.P., a Delaware limited partnership

(“Mast Hill”), dated as of September 19, 2022, pursuant to which the Company issued Mast Hill a convertible promissory note

in the principal amount of $290,000 (the “Note”), a five-year warrant to purchase up to 100,000,000 shares of common stock

at a price of $0.003 per share (the “First Warrant”) and a warrant to purchase up to 100,000,000 shares of common stock at

a price of $0.003 per share (the “Second Warrant”), which warrants are only exercisable upon an “Event of Default”

as defined in the Note.

Pursuant to the Purchase Agreement, Mast Hill purchased the Note, such

principal and the interest thereon convertible into shares of the Company’s common stock at the option of Mast Hill. The Company

intends to use a majority of the net proceeds ($250,780) to help fund the growth of its wholly-owned subsidiary Sustainable Origins Inc.

The Note contains an original issue discount amount of $29,000 and legal fees payable to Mast Hill’s legal counsel of $5,000.

The maturity date of the Note is September 19, 2023 (the “Maturity

Date”). The Note shall bear interest at a rate of 12% per annum, which interest may be paid by the Company to Mast Hill in shares

of common stock, but shall not be payable until the Note becomes payable, whether at the Maturity Date or upon acceleration or by prepayment,

as described in the Note. Mast Hill has the option to convert all or any amount of the principal face amount of the Note.

The conversion

price for the Note shall be equal to the Conversion Price (subject to equitable adjustments for stock splits, stock dividends or rights

offerings by the Company relating to the Company’s securities or the securities of any subsidiary of the Company, combinations,

recapitalization, reclassifications, extraordinary distributions and similar events). The “Conversion Price” shall equal

$0.0015. Notwithstanding the foregoing, Mast Hill shall be restricted from effecting a conversion if such conversion, along with other

shares of the Company’s common stock beneficially owned by Mast Hill and its affiliates, exceeds 4.99% of the outstanding shares

of the Company’s common stock.

The foregoing

descriptions of the Purchase Agreement, the Note, the First Warrant and the Second warrant do not purport to be complete and are qualified

in their entirety by reference to the full text of such documents, copies of which are attached hereto as Exhibits 10.1, 10.2, 10.3 and

10.4 and are incorporated herein by reference.

Item

2.03 Creation of Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement by a Registrant

The disclosure

under Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 2.03 by reference.

Item

3.02 Unregistered Sales of Equity Securities

The disclosure

under Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 3.02 by reference.

Item

9.01 Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FORZA

INNOVATIONS INC. |

| |

|

|

| Date:

September 29, 2022 |

By: |

/s/ Johnny

Forzani |

| |

|

Johnny

Forzani, President & C.E.O. |

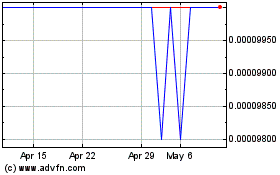

Forza Innovations (CE) (USOTC:FORZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

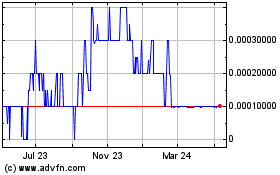

Forza Innovations (CE) (USOTC:FORZ)

Historical Stock Chart

From Feb 2024 to Feb 2025