Current Report Filing (8-k)

January 27 2021 - 6:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 27, 2021

Date of Report (Date of earliest event reported)

|

flooidCX Corp.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

0-55965

|

|

35-2511643

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

1282A Cornwall Road

Oakville, Ontario, Canada

|

|

L6J 7W5

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(855) 535-6643

Registrant’s telephone number, including area code

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None.

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 3.03 Material Modification to Rights of Security Holders.

Following approval by our stockholders on December 11, 2020, a reverse stock split of all issued and outstanding shares of our common stock, at a ratio of 1-for-85, pursuant to Nevada Revised Statutes (“NRS”) 78.2055 is being announced in FINRA’s Daily List on January 27, 2021 for a market effective date of January 28, 2021 (the “Effective Time”).

The terms of the reverse stock split are such that every 85 shares of the Company’s issued and outstanding common stock will automatically be combined into one issued and outstanding share of common stock, without any change in par value per share. As a result of the reverse stock split, proportionate adjustments will be made to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all then outstanding stock options and warrants, which will result in a proportional decrease in the number of shares of the Company’s common stock reserved for issuance upon exercise or vesting of such stock options and warrants, and a proportional increase in the exercise price of all such stock options and warrants. In addition, the number of shares reserved for issuance under the Company’s equity compensation plans immediately prior to the Effective Time will be reduced proportionately.

No fractional shares will be issued in connection with the reverse stock split. Stockholders will be issued one whole share of common stock in exchange for any fractional interest that such stockholder would have otherwise received as a result of the reverse stock split. The reverse stock split will affect all stockholders proportionately and will not affect any stockholder’s percentage ownership of the Company’s common stock, except to the extent that the reverse stock split results in any stockholder owning an additional share.

The Company’s common stock will begin trading on a split-adjusted basis commencing upon market opening on January 27, 2021. The new CUSIP number for the Company’s common stock following the reverse stock split is 33974L205. A “D” will be placed on the ticker symbol for 20 business days. After 20 business days, the symbol will then change back to FLCX.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

flooidCX Corp.

|

/s/ Richard Hue

|

|

|

Richard Hue

Chief Executive Officer

January 27, 2021

|

|

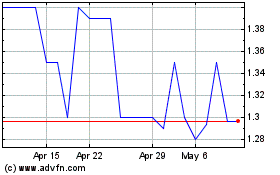

flooidCX (CE) (USOTC:FLCX)

Historical Stock Chart

From Nov 2024 to Dec 2024

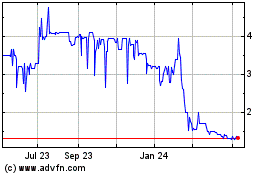

flooidCX (CE) (USOTC:FLCX)

Historical Stock Chart

From Dec 2023 to Dec 2024