Credit Agricole Targets 2022 Net Profit of More Than EUR5 Billion -- Update

June 06 2019 - 3:57AM

Dow Jones News

--Credit Agricole's new mid-term plan forecasts net profit

growth above 3% a year, to more than 5 billion euros in 2022

--Bank to simplify capital structure as part of the plan

--Lender targeting more retail customers in France and Italy,

more small and medium businesses

By Pietro Lombardi

Credit Agricole SA (ACA.FR) is targeting net profit of more than

5 billion euros ($5.63 billion) in 2022, the bank said Thursday as

it presented its new mid-term plan, which also includes measures to

simplify the group's capital structure.

The new plan, which sees net profit growing by more than 3% a

year, comes after France's second largest listed bank by assets

achieved its targets for this year ahead of schedule. Meanwhile,

French peers BNP Paribas SA (BNP.FR) and Societe Generale SA

(GLE.FR) have in recent months cut some of their 2020 targets after

weak trading revenue hit their investment bank arms.

Credit Agricole's expected net profit in 2022 compares with net

profit of EUR4.4 billion in 2018. The French bank sees its return

on tangible equity--a key measure of profitability--above 11%, down

from the 12.7% it reported last year.

"The economic scenario is based on interest rates remaining

low," it said.

The bank aims to attract more retail customers in France and

Italy and more small and medium businesses.

The lender also targets a cost-income ratio below 60% and a core

tier 1--a key measure of capital strength for lenders--of 11%,

compared with 11.5% as of December.

The new targets failed to boost the stock, which traded 1.3%

lower at 0708 GMT.

The plan doesn't have many details yet, Citi said, adding that

it expected a muted market reaction.

"We expect the market to focus on the details on capital...as

well as divisional trends," it said.

The group said the three key elements of the plan are growth in

all its markets, revenue synergies between its entities and

investment in technology. It pledged to invest EUR15 billion in

technological transformation over the duration of the plan.

Credit Agricole will also push forward with the simplification

of its capital structure by partially unwinding the switch

guarantee granted by the regional banks of the group to Credit

Agricole SA. This will have a positive impact on earnings per

share, it said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

June 06, 2019 03:42 ET (07:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

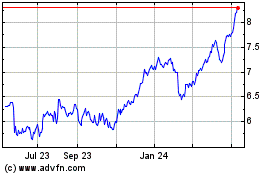

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jun 2024 to Jul 2024

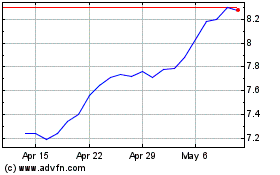

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024