false

0001006830

0001006830

2023-08-10

2023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

August 10, 2023

(Date of report/date of earliest event reported)

CONSUMERS BANCORP, INC.

(Exact name of registrant as specified in its charter)

| Ohio |

033-79130 |

34-1771400 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

614 East Lincoln Way

P.O. Box 256

Minerva, Ohio 44657

(Address of principal executive offices) (Zip Code)

(330) 868-7701

(Registrant’s telephone number, including area code)

N/A

(Former name or former address if changed since the last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 10, 2023, Consumers Bancorp, Inc. issued a press release reporting its results for the fourth fiscal quarter and twelve-month periods ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

d. Exhibits

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Consumers Bancorp, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: August 10, 2023

|

By:

|

/s/ Ralph J. Lober

|

|

|

|

|

Ralph J. Lober, II President and Chief

|

|

|

|

|

Executive Officer

|

|

Exhibit 99.1

Consumers Bancorp, Inc. Reports:

| |

●

|

Net income was $2.7 million for the three-month period and $10.7 million for the twelve-month period ended June 30, 2023.

|

| |

●

|

A return on average equity of 20.27% and on return on average assets of 1.05% for the 2023 fiscal year.

|

| |

●

|

Total loans increased by $98.5 million, or 16.1%, for the twelve-month period ended June 30, 2023, and non-performing loans to total loans remained low at 0.01% at June 30, 2023.

|

| |

●

|

Total deposits increased by $66.0 million, or 7.4%, for the twelve-month period ended June 30, 2023.

|

Minerva, Ohio — August 10, 2023 (OTCQX: CBKM) Consumers Bancorp, Inc. (Consumers) today reported net income of $2.7 million for the fourth quarter of fiscal year 2023, a decrease of $86 thousand, or 3.1%, from the same period last year. Earnings per share for the fourth quarter of fiscal year 2023 were $0.87 compared to $0.91 for the same period last year.

Net income was $10.7 million, or $3.45 per share, for the twelve months ended June 30, 2023 compared to $11.2 million, or $3.68 per share, for the twelve months ended June 30, 2022. The return on average equity was 20.27% and the return on average assets was 1.05% for the twelve-month period ended June 30, 2023.

“The quarter and annual results reported today were achieved in a volatile banking environment and during a period of unprecedented market rate increases. Increasing pretax core earnings, net of Paycheck Protection Program (PPP) interest and fee income, by 18.3% in this environment is an accomplishment. Total loan balances increased by $98.5 million in the 12 months ending June 30, 2023, contributing to a 29.8% increase in interest income (net of the $2.6 million PPP interest and fees earned in fiscal year 2022) in fiscal year 2023. The FOMC Federal Funds target rate increases slowed economic activity and loan production. Loans originated for the portfolio totaled $234.6 million in fiscal year 2023, a 15% decrease from fiscal year 2022 originations, however, slower runoff and higher rates on new originations and existing variable rate loans offset the decrease in new loan production. While new loan rates and portfolio yields continue to increase, a sustained increase in competition for deposits that accelerated in the third fiscal quarter of 2023 is negatively impacting the bank’s margin,” said Ralph J. Lober II, President & Chief Executive Officer. “We believe the increase in the cost of funds will slow in the first half of fiscal year 2024 and the margin will begin to improve during fiscal year 2024. Increasing $66.0 million in the 12-month period ended June 30, 2023, total deposit and customer repurchase agreements have remained consistent through the third and fourth fiscal quarters of 2023 as the industry absorbed the fall-out from the March 2023 banking crisis, and the uninsured deposit ratio, excluding collateralized public fund deposits, has decreased to approximately 18% as of June 30, 2023,” he continued.

Quarterly Operating Results Overview

Net income was $2.7 million, or $0.87 per share, for the three months ended June 30, 2023, compared to $2.8 million, or $0.91 per share, for the same period in 2022.

Net interest income was $8.3 million for both of the three-month periods ended June 30, 2023 and 2022. The net interest margin was 3.20% for the quarter ended June 30, 2023, 3.27% for the quarter ended March 31, 2023, and 3.51% for the quarter ended June 30, 2022. The yield on average interest-earning assets was 4.37% for the quarter ended June 30, 2023, compared with 3.67% for the same prior year period. The cost of funds increased to 1.65% for the quarter ended June 30, 2023, from 0.23% for the same prior year period. The yield on interest-earning assets as well as the cost of funds have been impacted by the rapid increase in current market interest rates.

The provision for loan losses was $60 thousand for the three-month period ended June 30, 2023, compared with $190 thousand for the same period last year. Net charge-offs of $159 thousand were recorded for the three-month period ended June 30, 2023.

Other income increased by $164 thousand, or 14.6%, for the three-month period ended June 30, 2023, compared to the same prior year period primarily due to service charges on deposit accounts increasing by $49 thousand, or 13.1%, and debit card interchange income increasing by $28 thousand, or 5.1%.

Other expenses increased by $346 thousand, or 5.9%, for the three-month period ended June 30, 2023, compared to the same prior year period. Increases in salaries, employee benefits, and FDIC insurance assessments contributed to the increase in other expenses for the three-month period ended June 30, 2023.

Year-to-Date Operating Results Overview

Net income decreased to $10.7 million, or $3.45 per share, for the twelve months ended June 30, 2023, compared to $11.2 million, or $3.68 per share, for the twelve months ended June 30, 2022.

Net interest income for the twelve months ended June 30, 2023 increased by $969 thousand compared to the same period last year, with interest income increasing by $6.8 million and interest expense increasing by $5.8 million. The net interest margin was 3.37% for the 2023 fiscal year and 3.60% for the 2022 fiscal year. Consumers’ yield on average interest-earning assets was 4.09% for the current fiscal year period compared with 3.75% for the prior fiscal year period. Consumers’ cost of funds increased to 1.03% for the current fiscal year from 0.22% for the prior fiscal year. Interest income and the net interest margin for the 2022 fiscal year were positively impacted by the recognition of $2.6 million of interest and fees on PPP loans that were forgiven during that period. Interest income in the 2023 fiscal year increased and more than offset the loss of PPP income primarily as a result of a $51.1 million, or 5.6%, increase in average interest-earning assets from the 2022 fiscal year and because of the increase in current market interest rates.

The provision for loan losses expense was $855 thousand for the twelve-month period ended June 30, 2023, compared with $735 thousand for the same prior year period. Net charge-offs of $291 thousand and $46 thousand were recorded for the twelve-month periods ended June 30, 2023 and 2022, respectively.

Other income increased by $12 thousand, or 0.3%, for the twelve-month period ended June 30, 2023, compared to the same prior year period. Service charges on deposit accounts increased by $138 thousand, or 9.5%, and debit card interchange income increased by $112 thousand, or 5.4%, for the twelve-month period ended June 30, 2023, compared to the same prior year period. These increases were partially offset by gains on mortgage banking activity decreasing by $287 thousand, or 45.4%, from the same prior year period due to the increase in mortgage rates.

Other expenses increased by $1.5 million, or 6.3%, for the twelve-month period ended June 30, 2023, compared to the same prior year period. Salaries and benefits increased by $760 thousand, or 5.7%, for the twelve-month period ended June 30, 2023, compared to the same prior year period primarily due to merit and cost of living increases and lower deferred loan costs. These increases were partially offset by lower salary continuation plan expense because of an increase in the discount rate and lower incentive expenses.

Balance Sheet and Asset Quality Overview

Assets as of June 30, 2023 totaled $1.06 billion, an increase of $82.7 million, or 8.5%, from June 30, 2022. From June 30, 2022, total loans increased by $98.5 million, or 16.1%, and total deposits increased by $66.0 million, or 7.4%.

Total available-for-sale securities decreased by $16.7 million to $279.6 million as of June 30, 2023, from $296.3 million as of June 30, 2022. The decline in the available-for-sale securities portfolio from June 30, 2022, was from a $6.0 million net reduction in the portfolio from sales and principal paydowns not being reinvested into the portfolio and due to a $9.9 million increase in the net unrealized mark to market loss. Total shareholders’ equity increased to $55.5 million as of June 30, 2023, from $54.0 million as of June 30, 2022, because of net income of $10.7 million for the 2023 fiscal year which was partially offset by an increase of $7.9 million in the accumulated other comprehensive loss from the mark-to-market of available-for-sale securities and from cash dividends paid of $2.1 million. The total accumulated other comprehensive loss was $30.0 million as of June 30, 2023. Available-for-sale securities and shareholders’ equity were impacted by rapidly rising interest rates during 2022 and 2023 causing the accumulated other comprehensive loss to increase as available-for-sale securities are marked to fair market value. As market interest rates rise, the fair value of fixed-rate securities decline with a corresponding net of tax decline recorded in the accumulated other comprehensive loss portion of equity. This unrealized loss in securities is temporary and is adjusted monthly for additional market interest rate fluctuations, principal paydowns, calls, and maturities. Consumers has significant sources of liquidity and therefore does not expect to have to sell securities to fund growth.

Non-performing loans were $104 thousand as of June 30, 2023 and $440 thousand as of June 30, 2022. The allowance for loan and lease losses (ALLL) as a percent of total loans at June 30, 2023 was 1.09% compared with an ALLL to loans ratio of 1.17% at June 30, 2022.

Consumers provides a complete range of banking and other investment services to businesses and clients through its twenty-one full-service locations and one loan production office in Carroll, Columbiana, Jefferson, Mahoning, Stark, and Summit counties in Ohio. Its market includes these counties as well as the sixteen contiguous counties in northeast Ohio, western Pennsylvania, and northern West Virginia. Information about Consumers National Bank can be accessed on the internet at https://www.consumers.bank.

Forward-Looking Information

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). The words “may,” “continue,” “estimate,” “intend,” “plan,” “seek,” “will,” “believe,” “project,” “expect,” “anticipate” and similar expressions are intended to identify forward-looking statements. These forward-looking statements cover, among other things, anticipated future revenue and expenses and future plans, objectives and strategies of Consumers. These statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those anticipated at the date of this press release. Risks and uncertainties that could adversely affect Consumers include, but are not limited to, the following: regional and national economic conditions becoming less favorable than expected, resulting in, among other things, high unemployment rates; rapid fluctuations in market interest rates could result in changes in fair market valuations and net interest income, pricing and liquidity pressures may result; a deterioration in credit quality of assets and the underlying value of collateral could prove to be less valuable than otherwise assumed or debtors being unable to meet their obligations; material unforeseen changes in the financial condition or results of Consumers National Bank’s (Consumers’ wholly-owned bank subsidiary) customers; legal proceedings, including those that may be instituted against Consumers, its board of directors, its executive officers and others; competitive pressures on product pricing and services; the economic impact from the oil and gas activity in the region could be less than expected or the timeline for development could be longer than anticipated; and the nature, extent, and timing of government and regulatory actions. While the list of factors presented here are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. The forward-looking statements included in this press release speak only as of the date made and Consumers does not undertake a duty to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Contact: Ralph J. Lober, President and Chief Executive Officer 1-330-868-7701 extension 1135.

|

Consumers Bancorp, Inc.

Consolidated Financial Highlights

|

|

(Dollars in thousands, except per share data)

|

|

Three Month Periods Ended

|

|

|

Twelve Month Periods Ended

|

|

|

Consolidated Statements of Income

|

|

June 30,

2023

|

|

|

June 30,

2022

|

|

|

June 30,

2023

|

|

|

June 30,

2022

|

|

|

Total interest income

|

|

$ |

11,318 |

|

|

$ |

8,690 |

|

|

$ |

40,939 |

|

|

$ |

34,160 |

|

|

Total interest expense

|

|

|

3,004 |

|

|

|

377 |

|

|

|

7,224 |

|

|

|

1,414 |

|

|

Net interest income

|

|

|

8,314 |

|

|

|

8,313 |

|

|

|

33,715 |

|

|

|

32,746 |

|

|

Provision for loan losses

|

|

|

60 |

|

|

|

190 |

|

|

|

855 |

|

|

|

735 |

|

|

Other income

|

|

|

1,285 |

|

|

|

1,121 |

|

|

|

4,747 |

|

|

|

4,735 |

|

|

Other expenses

|

|

|

6,243 |

|

|

|

5,897 |

|

|

|

24,685 |

|

|

|

23,215 |

|

|

Income before income taxes

|

|

|

3,296 |

|

|

|

3,347 |

|

|

|

12,922 |

|

|

|

13,531 |

|

|

Income tax expense

|

|

|

602 |

|

|

|

567 |

|

|

|

2,248 |

|

|

|

2,339 |

|

|

Net income

|

|

$ |

2,694 |

|

|

$ |

2,780 |

|

|

$ |

10,674 |

|

|

$ |

11,192 |

|

|

Basic and diluted earnings per share

|

|

$ |

0.87 |

|

|

$ |

0.91 |

|

|

$ |

3.45 |

|

|

$ |

3.68 |

|

|

Consolidated Statements of Financial Condition

|

|

June 30,

2023

|

|

|

June 30,

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

11,755 |

|

|

$ |

20,952 |

|

|

Certificates of deposit in other financial institutions

|

|

|

2,501 |

|

|

|

3,781 |

|

|

Securities, available-for-sale

|

|

|

279,605 |

|

|

|

296,347 |

|

|

Securities, held-to-maturity

|

|

|

6,970 |

|

|

|

7,874 |

|

|

Equity securities, at fair value

|

|

|

386 |

|

|

|

400 |

|

|

Federal bank and other restricted stocks, at cost

|

|

|

2,168 |

|

|

|

2,525 |

|

|

Loans held for sale

|

|

|

764 |

|

|

|

1,165 |

|

|

Total loans

|

|

|

710,362 |

|

|

|

611,843 |

|

|

Less: allowance for loan losses

|

|

|

7,724 |

|

|

|

7,160 |

|

|

Net loans

|

|

|

702,638 |

|

|

|

604,683 |

|

|

Other assets

|

|

|

53,237 |

|

|

|

39,586 |

|

|

Total assets

|

|

$ |

1,060,024 |

|

|

$ |

977,313 |

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

$ |

952,533 |

|

|

$ |

886,562 |

|

|

Other interest-bearing liabilities

|

|

|

35,143 |

|

|

|

29,551 |

|

|

Other liabilities

|

|

|

16,864 |

|

|

|

7,230 |

|

|

Total liabilities

|

|

|

1,004,540 |

|

|

|

923,343 |

|

|

Shareholders’ equity

|

|

|

55,484 |

|

|

|

53,970 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

1,060,024 |

|

|

$ |

977,313 |

|

| |

|

At or For the Twelve Months Ended

|

|

|

|

|

June 30, 2023

|

|

|

June 30, 2022

|

|

| Performance Ratios: |

|

|

|

|

|

|

|

|

|

Return on Average Assets

|

|

|

1.05 |

% |

|

|

1.17 |

% |

|

Return on Average Equity

|

|

|

20.27 |

|

|

|

16.43 |

|

|

Average Equity to Average Assets

|

|

|

5.16 |

|

|

|

7.10 |

|

|

Net Interest Margin (Fully Tax Equivalent)

|

|

|

3.37 |

|

|

|

3.60 |

|

| |

|

|

|

|

|

|

|

|

|

Market Data:

|

|

|

|

|

|

|

|

|

|

Book Value to Common Share

|

|

$ |

17.92 |

|

|

$ |

17.66 |

|

|

Dividends Paid per Common Share (YTD)

|

|

$ |

0.68 |

|

|

$ |

0.64 |

|

|

Period End Common Shares

|

|

|

3,096,100 |

|

|

|

3,056,674 |

|

| |

|

|

|

|

|

|

|

|

|

Asset Quality:

|

|

|

|

|

|

|

|

|

|

Net Charge-offs to Total Loans

|

|

|

0.04 |

% |

|

|

0.01 |

% |

|

Non-performing Assets to Total Assets

|

|

|

0.03 |

|

|

|

0.05 |

|

|

ALLL to Total Loans

|

|

|

1.09 |

|

|

|

1.17 |

|

v3.23.2

Document And Entity Information

|

Aug. 10, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CONSUMERS BANCORP, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 10, 2023

|

| Entity, Incorporation, State or Country Code |

OH

|

| Entity, File Number |

033-79130

|

| Entity, Tax Identification Number |

34-1771400

|

| Entity, Address, Address Line One |

614 East Lincoln Way

|

| Entity, Address, Address Line Two |

P.O. Box 256

|

| Entity, Address, City or Town |

Minerva

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

44657

|

| City Area Code |

330

|

| Local Phone Number |

868-7701

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001006830

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

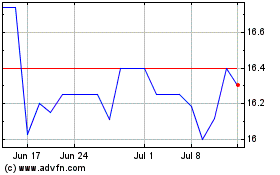

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From Apr 2024 to May 2024

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From May 2023 to May 2024