UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2015

Commission File Number: 001-35132

BOX SHIPS INC.

(Name of Registrant)

15 Karamanli Ave., GR 166 73, Voula,

Greece

(Address of principal

executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form

20-F x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Special Meeting of Shareholders

Box Ships Inc. (the

“Company”) has announced that a special meeting of shareholders will be held on January 27, 2016 (the “Special

Meeting”). In that regard, attached hereto as Exhibits 99.1, 99.2 and 99.3 are copies of (i) the Notice of Special Meeting,

(ii) Proxy Statement, and (iii) Form of Proxy Card, respectively.

The Company’s

Annual Report on Form 20-F (the “Annual Report”), which contains the Company’s audited financial statements for

the year ended December 31, 2014, as well as copies of the Proxy Statement and form of Proxy Card for the Special Meeting, are

being posted on the Company’s website at http://www.box-ships.com/agm-materials.php. Please note that the form of Proxy Card

on the website is for information purposes only and cannot be used to vote.

SUBMITTED HEREWITH:

| Exhibit Number |

|

Description of Exhibit |

| |

|

|

| 99.1 |

|

Notice of Special Meeting of Stockholders |

| |

|

|

| 99.2 |

|

Proxy Statement |

| |

|

|

| 99.3 |

|

Form of Proxy Card |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BOX SHIPS INC. |

| |

|

| Date: December 24, 2015 |

By: |

/s/ GEORGE SKRIMIZEAS |

| |

George Skrimizeas |

| |

Chief Operating Officer |

Exhibit 99.1

BOX SHIPS INC.

15 Karamanli Ave.

166 73, Voula, Greece

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 27, 2016

To the Shareholders of Box Ships Inc.:

A Special Meeting

of Shareholders (the “Special Meeting”) of Box Ships Inc., a corporation organized under the laws of the Republic of

the Marshall Islands (the “Company” or “Box Ships”) will be held on January 27, 2016 at the principal executive

offices of Box Ships Inc. at 15 Karamanli Ave., 166 73, Voula, Greece, at 12:00 pm Greek time/5:00 am Eastern Standard Time. The

purpose of the Special Meeting is as follows:

| |

1. |

To grant discretionary authority to the Company’s board of directors to (A) amend the Amended and Restated Articles of Incorporation of the Company to effect one or more consolidations of the issued and outstanding shares of common stock, pursuant to which the shares of common stock would be combined and reclassified into one share of common stock ratios within the range from 1-for-2 up to 1-for-50 (the “Reverse Stock Split”) and (B) determine whether to arrange for the disposition of fractional interests by shareholder entitled thereto, to pay in cash the fair value of fractions of a share of common stock as of the time when those entitled to receive such fractions are determined, or to entitle shareholder to receive from the Company’s transfer agent, in lieu of any fractional share, the number of shares of common stock rounded up to the next whole number, provided that, (X) the Company shall not effect Reverse Stock Splits that, in the aggregate, exceeds 1-for-50, and (Y) any Reverse Stock Split is completed no later than the first anniversary of the date of the Special Meeting. |

Our Board of Directors

has fixed the close of business on December 14, 2015 as the record date for determining those shareholders entitled to notice of,

and to vote at, the Special Meeting and any adjournments or postponements thereof.

Whether or not you

expect to be present, please sign, date and return the enclosed proxy card in the pre-addressed envelope provided for that purpose

as promptly as possible. No postage is required if mailed in the United States.

| |

By Order of the Board of Directors, |

| |

|

| |

Aikaterini Stoupa |

| |

Secretary |

Voula, Greece

December 24, 2015

All shareholders are invited to attend

the Special Meeting in person. Those shareholders who are unable to attend are respectfully urged to execute and return the proxy

card enclosed with this Proxy Statement as promptly as possible. Shareholders who execute a proxy card may nevertheless attend

the Special Meeting, revoke their proxy and vote their shares in person. “Street name” shareholders who wish to vote

their shares in person will need to obtain a voting instruction form from the brokers or nominees in whose name their shares are

registered.

Exhibit 99.2

BOX SHIPS INC.

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 27, 2016

PROXY STATEMENT

TIME, DATE AND PLACE OF SPECIAL MEETING

This Proxy Statement

is furnished in connection with the solicitation by the Board of Directors of Box Ships Inc., a corporation organized under the

laws of the Republic of the Marshall Islands (the “Company” or “Box Ships”), of proxies from the holders

of our common stock, par value $0.01 per share, for use at a Special Meeting of Shareholders (the “Special Meeting”)

to be held at the principal executive offices of Box Ships Inc. at 15 Karamanli Ave., 166 73 Voula, Greece, at 12:00 pm Greek time/5:00

am Eastern Standard Time, on January 27, 2016, and at any adjournments or postponements thereof, pursuant to the enclosed Notice

of Special Meeting.

The approximate date

this Proxy Statement is being sent to shareholders is December 29, 2015. Shareholders should review the information provided herein

or made available in conjunction with our Special Meeting. The Notice of Special Meeting of Shareholders and related materials,

including the Company's 2014 annual report containing the Company's audited financial statements for the fiscal year ended December

31, 2014 (the "2014 Annual Report"), are available on the Company's website at http://www.box-ships.com/agm-materials.php.

Any shareholder may receive a hard copy of the 2014 Annual Report, free of charge upon request.

INFORMATION CONCERNING PROXY

The enclosed proxy

is solicited on behalf of our Board of Directors. The giving of a proxy does not preclude the right to vote in person should any

shareholder giving the proxy so desire. Shareholders have an unconditional right to revoke their proxy at any time prior to the

exercise thereof, either in person at the Special Meeting or by filing with our Secretary at our headquarters a written revocation

or duly executed proxy bearing a later date; no such revocation will be effective, however, until written notice of the revocation

is received by us at or prior to the Special Meeting.

The cost of preparing,

assembling and mailing this Proxy Statement, the Notice of Special Meeting and the enclosed proxy is to be borne by us. In addition

to the use of mail, our employees may solicit proxies personally and by telephone. Our employees will receive no compensation for

soliciting proxies other than their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries

to forward copies of the proxy materials to their principals and to request authority for the execution of proxies. We will reimburse

such persons for their expenses in doing so. In addition, we have engaged Alliance Advisors, LLC, 200 Broadacres Drive, 3rd

Floor, Bloomfield, New Jersey 07003 as our proxy solicitor to help us solicit proxies from brokers, banks or other nominees. We

will pay Alliance Advisors, LLC a fee of approximately $5,000, plus $2,000 in costs and expenses, relating to the solicitation

of proxies for the Special Meeting.

PURPOSE OF THE SPECIAL MEETING

At the Special Meeting, our shareholders

will consider and vote upon the following matter:

| |

1. |

To consider and vote upon a proposal to grant discretionary authority to the Company’s board of directors to (A) amend the Amended and Restated Articles of Incorporation of the Company to effect one or more consolidations of the issued and outstanding shares of common stock, pursuant to which the shares of common stock would be combined and reclassified into one share of common stock at ratios within the range from 1-for-2 up to 1-for-50 (the “Reverse Stock Split”) and (B) determine whether to arrange for the disposition of fractional interests by shareholder entitled thereto, to pay in cash the fair value of fractions of a share of common stock as of the time when those entitled to receive such fractions are determined, or to entitle shareholder to receive from the Company’s transfer agent, in lieu of any fractional share, the number of shares of common stock rounded up to the next whole number, provided that, (X) that the Company shall not effect Reverse Stock Splits that, in the aggregate, exceeds 1-for-50, and (Y) any Reverse Stock Split is completed no later than the first anniversary of the date of the Special Meeting. |

Unless contrary instructions

are indicated on your proxy, all shares of common stock represented by valid proxies received pursuant to this solicitation (and

which have not been revoked in accordance with the procedures set forth herein) will be voted in favor of the proposal described

in the Notice of Special Meeting. The Board of Directors knows of no other business that may properly come before the Special Meeting;

however, if other matters properly come before the Special Meeting, it is intended that the persons named in the proxy will vote

thereon in accordance with their best judgment. In the event a shareholder specifies a different choice by means of the shareholder's

proxy, the shareholder’s shares will be voted in accordance with the specification so made.

OUTSTANDING VOTING SECURITIES AND VOTING

RIGHTS

Our Board of Directors

previously set the close of business on December 14, 2015 as the record date for determining which of our shareholders are entitled

to notice of and to vote at the Special Meeting. As of the record date, there were 31,010,555 shares of our common stock that are

entitled to be voted at the Special Meeting. Each share of common stock is entitled to one vote on each matter submitted to shareholders

for approval at the Special Meeting.

The attendance, in

person or by proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Special

Meeting is necessary to constitute a quorum.

The affirmative vote

of the holders of a majority of the shares of common stock present in person or by proxy at the Special Meeting will be required

to approve the granting of discretionary authority to the Company’s board of directors to (A) amend the Amended and Restated

Articles of Incorporation of the Company to effect one or more consolidations of the issued and outstanding shares of common stock,

pursuant to which the shares of common stock would be combined and reclassified into one share of common stock at ratios within

the range from 1-for-2 up to 1-for-50 (the “Reverse Stock Split”) and (B) determine whether to arrange for the disposition

of fractional interests by shareholder entitled thereto, to pay in cash the fair value of fractions of a share of common stock

as of the time when those entitled to receive such fractions are determined, or to entitle shareholder to receive from the Company’s

transfer agent, in lieu of any fractional share, the number of shares of common stock rounded up to the next whole number, provided

that, (X) the Company shall not effect Reverse Stock Splits that, in the aggregate, exceeds 1-for-50, and (Y) any Reverse Stock

Split is completed no later than the first anniversary of the date of the Special Meeting, and for any other proposals that may

come before the Special Meeting. If less than a majority of the outstanding shares entitled to vote is represented at the Special

Meeting, a majority of the shares so represented may adjourn the Special Meeting to another date, time or place, and notice need

not be given of the new date, time or place if the new date, time or place is announced at the meeting before an adjournment is

taken.

Prior to the Special

Meeting, we will select one or more inspectors of election for the meeting. Such inspector(s) shall determine the number of shares

of common stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall receive,

count and tabulate ballots and votes and determine the results thereof. Abstentions will be considered as shares present and entitled

to vote at the Special Meeting and will be counted as votes cast at the Special Meeting, but will not be counted as votes cast

for or against any given matter.

PROPOSAL 1: REVERSE SPLIT OF THE COMMON

STOCK OF THE COMPANY

Our board of directors

has adopted resolutions (1) declaring that submitting an amendment to the Company’s Amended and Restated Articles of

Incorporation to effect the Reverse Stock Split of our issued and outstanding Common Stock, as described below, was advisable and

(2) directing that a proposal to approve the Reverse Stock Split be submitted to the holders of our Common Stock for their

approval.

The form of the proposed

amendment to the Company’s Amended and Restated Articles of Incorporation to effect reverse stock splits of our issued and

outstanding Common Stock will be substantial as set forth on Appendix A (subject to any changes required by applicable law). Approval

of the proposal would permit (but not require) our Board of Directors to effect one or more reverse stock splits of our issued

and outstanding common stock by a ratio of not less than one-for-two and not more than one-for-fifty, with the exact ratio to be

set at a number within this range as determined by our Board of Directors in its sole discretion, provided that the Board of Directors

determines to effect the Reverse Stock Split and such amendment is filed with the appropriate authorities in the Marshall Islands

no later than one year after the date of our Special Meeting. The Company shall not effect Reverse Stock Splits that, in the

aggregate, exceeds one-for-fifty. We believe that enabling our Board of Directors to set the ratio within the stated range will

provide us with the flexibility to implement the Reverse Stock Split in a manner designed to maximize the anticipated benefits

for our shareholders. In determining a ratio, if any, following the receipt of shareholder approval, our Board of Directors

may consider, among other things, factors such as:

| |

· |

the continuing listing requirements of various stock exchanges; |

| |

· |

the historical trading price and trading volume of our Common Stock; |

| |

· |

the number of shares of our Common Stock outstanding; |

| |

· |

the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split on the trading market for our Common Stock; |

| |

· |

the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs; and |

| |

· |

prevailing general market and economic conditions. |

Our board of directors

reserves the right to elect to abandon the Reverse Stock Split, including any or all proposed reverse stock split ratios, if it

determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company and its stockholders.

Depending on the ratio

for the Reverse Stock Split determined by our board of directors, no less than two and no more than fifty shares of existing Common

Stock, as determined by our board of directors, will be combined into one share of Common Stock. The Company shall not effect

Reverse Stock Splits that, in the aggregate, exceed one-for-fifty. Our Board of Directors will have the discretionary authority

to determine whether to arrange for the disposition of fractional interests by holder entitled thereto, to pay in cash the fair

value of fractions of a share as of the time when those entitled to receive such fractions are determined, or to entitle holders

to receive from the Company transfer agent, in lieu of any fractional share, the number of shares rounded up to the next whole

number. The amendment to our Articles of Incorporation to effect a Reverse Stock Split, if any, will include only the reverse

split ratio determined by our Board of Directors to be in the best interests of our shareholders and all of the other proposed

amendments at different ratios will be abandoned.

Background and Reasons for the Reverse

Stock Split; Potential Consequences of the Reverse Stock Split

Our board of directors

is submitting multiple Reverse Stock Splits to our stockholders for approval with the primary intent of increasing the market price

of our Common Stock to enhance our ability to meet the initial listing requirements of the NASDAQ Capital Market and to make our

Common Stock more attractive to a broader range of institutional and other investors. The Company currently does not have

any plans, arrangements or understandings, written or oral, to issue any of the authorized but unissued shares that would become

available as a result of the Reverse Stock Split. In addition to increasing the market price of our Common Stock, the Reverse

Stock Split would also reduce certain of our costs, as discussed below. Accordingly, for these and other reasons discussed

below, we believe that effecting the Reverse Stock Splits is in the Company’s and our stockholders’ best interests.

We believe that the

Reverse Stock Split will enhance our ability to maintain the necessary price for initial listing on the NASDAQ Capital Market. We

are contemplating the listing of our common stock on NASDAQ, although no definitive plans have been established to date. The NASDAQ

Capital Market requires, among other items, an initial bid price of least $4.00 per share and following initial listing, maintenance

of a continued price of at least $1.00 per share.

Until November 17,

2015, our common stock traded on the New York Stock Exchange (“NYSE”). The trading of our common stock was suspended

following the close of business on November 17, 2015, pursuant to Section 802.01B of the NYSE’s Listed Company Manual, because

we were not in compliance with the NYSE’s continued listing standard requiring listed companies to maintain an average global

market capitalization over a consecutive 30 trading-day period of at least $15,000,000.

In December 2014, we

received a letter from the NYSE stating that, for the previous 30 consecutive business days, the average closing price of our common

stock closed below the minimum $1.00 per share, the minimum average closing price required by the continued listing requirements

of the NYSE. In November 2015, we held our annual meeting of stockholders, at which time we requested approval from

the stockholders to approve authority of our board of directors to effectuate a reverse stock split within a range. That proposal

was not approved. We are now asking for authority to effectuate a larger reverse stock split, since the initial listing criteria

of the NASDAQ Capital Market requires a higher trading price than the current share price. In addition, to the extent necessary

under any agreements with third parties, we will effectuate a Reverse Stock Split to ensure compliance with our obligations thereunder.

Reducing

the number of outstanding shares of Common Stock should, absent other factors, increase the per share market price of the Common

Stock, although we cannot provide any assurance that we will be able to meet or maintain a bid price over the minimum initial listing

bid price requirement of NASDAQ or any other exchange. Although the board has determined that it is in the Company’s

and its shareholders’ best interests to position the Common Stock for potential listing on the NASDAQ or another stock exchange,

the board may ultimately determine to not pursue any such listing. There can be no assurance that if the Company were

to make any such application, it would result in the listing of the Common Stock on any exchange.

Additionally, we believe

that the Reverse Stock Split will make our Common Stock more attractive to a broader range of institutional and other investors,

as we have been advised that the current market price of our Common Stock may affect its acceptability to certain institutional

investors, professional investors and other members of the investing public. Many brokerage houses and institutional

investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage

individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices

may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because

brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on

higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction

costs representing a higher percentage of their total share value than would be the case if the share price were substantially

higher. We believe that the Reverse Stock Split will make our Common Stock a more attractive and cost effective investment

for many investors, which will enhance the liquidity of the holders of our Common Stock.

Reducing the number

of outstanding shares of our Common Stock through the Reverse Stock Split is intended, absent other factors, to increase the per

share market price of our Common Stock. However, other factors, such as our financial results, market conditions and

the market perception of our business may adversely affect the market price of our Common Stock. As a result, there

can be no assurance that the Reverse Stock Splits, if completed, will result in the intended benefits described above, that the

market price of our Common Stock will increase following the Reverse Stock Splits or that the market price of our Common Stock

will not decrease in the future. Additionally, we cannot assure you that the market price per share of our Common Stock

after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our Common Stock outstanding

before the Reverse Stock Split. Accordingly, the total market capitalization of our Common Stock after the Reverse Stock

Split may be lower than the total market capitalization before the Reverse Stock Split.

Procedure for Implementing the Reverse

Stock Split

The Reverse Stock Split,

if approved by our stockholders, would become effective upon the filing or such later time as specified in the filing (the “Effective

Time”) of a certificate of amendment to our Amended and Restated Articles of Incorporation with the Registrar of Corporation

of the Marshall Islands. The exact timing of the filing of the certificate of amendment that will effect the Reverse

Stock Split will be determined by our board of directors based on its evaluation as to when such action will be the most advantageous

to the Company and our stockholders. In addition, our board of directors reserves the right, notwithstanding stockholder

approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior

to filing the amendment to the Company’s Amended and Restated Articles of Incorporation, our board of directors, in its sole

discretion, determines that it is no longer in our best interest and the best interests of our stockholders to proceed with the

Reverse Stock Split. If a certificate of amendment effecting the Reverse Stock Split has not been filed with the Registrar

of Corporations of the Marshall Islands within one year from the Special Meeting, our board of directors will abandon the Reverse

Stock Split.

Effect of the Reverse

Stock Split on Holders of Outstanding Common Stock

Depending on the ratio

for the Reverse Stock Split determined by our Board of Directors, a minimum of two and a maximum of fifty shares in aggregate of

existing common stock will be combined into one new share of common stock. Based on 31,010,555 shares of common stock

issued and outstanding as of the record date, immediately following the reverse split the Company would have approximately 15,505,278

shares of common stock issued and outstanding (without giving effect to rounding for fractional shares) if the ratio for the reverse

split is 1-for-2, approximately 1,240,423 shares of common stock issued and outstanding (without giving effect to rounding for

fractional shares) if the ratio for the reverse split is 1-for-25, and approximately 620,212 shares of common stock issued and

outstanding (without giving effect to rounding for fractional shares) if the ratio for the reverse split is 1-for-50, which is

the aggregate ratio allowed under this proposal. Any other ratios selected within such range would result in a number of shares

of common stock issued and outstanding following the transaction between 620,212 and 15,505,278 shares.

The actual number of

shares issued after giving effect to the Reverse Stock Split, if implemented, will depend on the reverse stock split ratio and

the number of reverse stock splits, if any, that are ultimately determined by our board of directors.

The Reverse Stock Split

will affect all holders of our Common Stock uniformly and will not affect any stockholder’s percentage ownership interest

in the Company, except that as described below in “— Fractional Shares,” record holders of Common Stock otherwise

entitled to a fractional share as a result of the Reverse Stock Split will be rounded up to the next whole number. In

addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment

of fractional shares).

The Reverse Stock Split

may result in some stockholders owning “odd lots” of less than 100 shares of Common Stock. Odd lot shares

may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher

than the costs of transactions in “round lots” of even multiples of 100 shares.

After the Effective

Time, our Common Stock will have new Committee on Uniform Securities Identification Procedures (CUSIP) numbers, which is a number

used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be exchanged for stock

certificates with the new CUSIP numbers by following the procedures described below. After the Reverse Stock Split,

we will continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934, as amended. Our

Common Stock will continue to be traded on the OTCQX Market under the symbol “TEUFF”, subject to any decision of our

Board of Directors to list our securities on another market or exchange. The Reverse Stock Split is not intended as, and will not

have the effect of, a “going private transaction” as described by Rule 13e-3 under the Exchange Act.

After the effective

time of the Reverse Stock Split, the post-split market price of our common stock may be less than the pre-split price multiplied

by the Reverse Stock Split ratio. In addition, a reduction in number of shares outstanding may impair the liquidity for our common

stock, which may reduce the value of our common stock.

Authorized Shares of Common Stock

The Reverse Stock Split

will not change the number of authorized shares of the Company’s common stock under the Company’s Articles of Incorporation.

Because the number of issued and outstanding shares of common stock will decrease, the number of shares of common stock remaining

available for issuance will increase. Under our Articles of Incorporation, as amended, our authorized capital stock consists of

475,000,000 shares of common stock, par value $0.01, and 25,000,000 shares of preferred stock, par value $0.01. The Company does

not currently have any plans, proposal or arrangement to issue any of its authorized but unissued shares of common stock, other

than any shares to be issued in connection with the Company’s equity incentive plan.

By increasing the number

of authorized but unissued shares of common stock, the Reverse Stock Split could, under certain circumstances, have an anti-takeover

effect, although this is not the intent of the Board of Directors. For example, it may be possible for the Board of Directors to

delay or impede a takeover or transfer of control of the Company by causing such additional authorized but unissued shares to be

issued to holders who might side with the Board of Directors in opposing a takeover bid that the Board of Directors determines

is not in the best interests of the Company or its shareholders. The Reverse Stock Split therefore may have the effect of discouraging

unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts the reverse split

may limit the opportunity for the Company’s shareholders to dispose of their shares at the higher price generally available

in takeover attempts or that may be available under a merger proposal. The Reverse Stock Split may have the effect of permitting

the Company’s current management, including the current Board of Directors, to retain its position, and place it in a better

position to resist changes that shareholders may wish to make if they are dissatisfied with the conduct of the Company’s

business. However, the Board of Directors is not aware of any attempt to take control of the Company and the Board of Directors

has not approved the Reverse Stock Split with the intent that it be utilized as a type of anti-takeover device.

Beneficial Holders of Common Stock (i.e.

stockholders who hold in street name)

Upon the implementation

of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other nominee in

the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or

other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our Common Stock in street

name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders

for processing the Reverse Stock Split. Stockholders who hold shares of our Common Stock with a bank, broker, custodian

or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other

nominees.

Registered “Book-Entry”

Holders of Common Stock (i.e. stockholders that are registered on the transfer agent’s books and records but do not hold

stock certificates)

Certain of our registered

holders of Common Stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These

stockholders do not have stock certificates evidencing their ownership of the Common Stock. They are, however, provided

with a statement reflecting the number of shares registered in their accounts.

Stockholders who hold

shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic)

to receive whole shares of post-Reverse Stock Split Common Stock, subject to adjustment for treatment of fractional shares.

Holders of Certificated Shares of Common

Stock

Stockholders holding

shares of our Common Stock in certificated form will be sent a transmittal letter by our transfer agent after the Effective Time. The

letter of transmittal will contain instructions on how a stockholder should surrender his, her or its certificate(s) representing

shares of our Common Stock (the “Old Certificates”) to the transfer agent in exchange for certificates representing

the appropriate number of whole shares of post-Reverse Stock Split Common Stock (the “New Certificates”). No

New Certificates will be issued to a stockholder until such stockholder has surrendered all Old Certificates, together with a properly

completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer

or other fee to exchange his, her or its Old Certificates. Stockholders will then receive a New Certificate(s) representing

the number of whole shares of Common Stock that they are entitled as a result of the Reverse Stock Split, subject to the treatment

of fractional shares described below. Until surrendered, we will deem outstanding Old Certificates held by stockholders

to be cancelled and only to represent the number of whole shares of post-Reverse Stock Split Common Stock to which these stockholders

are entitled, subject to the treatment of fractional shares. Any Old Certificates submitted for exchange, whether because

of a sale, transfer or other disposition of stock, will automatically be exchanged for New Certificates. If an Old Certificate

has a restrictive legend on the back of the Old Certificate(s), the New Certificate will be issued with the same restrictive legends

that are on the back of the Old Certificate(s).

The Company expects

that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. No service

charges will be payable by holders of shares of Common Stock in connection with the exchange of certificates. All of such

expenses will be borne by the Company.

STOCKHOLDERS SHOULD NOT DESTROY ANY

STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional Shares

The Company does not

currently intend to issue fractional shares in connection with the Reverse Stock Split. Therefore, the Company does not expect

to issue certificates representing fractional shares. The Board of Directors will have the discretionary authority to determine

whether to arrange for the disposition of fractional interests by shareholders entitled thereto, to pay in cash the fair value

of fractions of a share as of the time when those entitled to receive such fractions are determined, or to entitle shareholders

to receive from the Company’s transfer agent, in lieu of any fractional share, the number of shares rounded up to the next

whole number.

If the Board of Directors

determines to arrange for the disposition of fractional interests by shareholders entitled thereto or to pay in cash the fair value

of fractions of a share as of the time when those entitled to receive such fractions are determined, shareholders who would otherwise

hold fractional shares because the number of shares of common stock they hold before the Reverse Stock Split is not evenly divisible

by the ratio ultimately selected by the Board of Directors will be entitled to receive cash (without interest or deduction) in

lieu of such fractional shares from either: (i) the Company, upon receipt by the transfer agent of a properly completed and duly

executed transmittal letter and, where shares are held in certificated form, upon due surrender of any certificate previously representing

a fractional share, in an amount equal to such holder's fractional share based upon the volume weighted average price of the common

stock as reported on the OTCQX Market, or other principal market of the common stock, as applicable, as of the date the Reverse

Stock Split is effected; or (ii) the transfer agent, upon receipt by the transfer agent of a properly completed and duly executed

transmittal letter and, where shares are held in certificated form, the surrender of all old certificate(s), in an amount equal

to the proceeds attributable to the sale of such fractional shares following the aggregation and sale by the transfer agent of

all fractional shares otherwise issuable. If the Board of Directors determines to dispose of fractional interests pursuant to clause

(ii) above, the Company expects that the transfer agent would conduct the sale in an orderly fashion at a reasonable pace and that

it may take several days to sell all of the aggregated fractional shares of common stock. In this event, such holders would be

entitled to an amount equal to their pro rata share of the proceeds of such sale. The Company will be responsible for any brokerage

fees or commissions related to the transfer agent's open market sales of shares that would otherwise be fractional shares.

The ownership of a

fractional share interest following the Reverse Stock Split will not give the holder any voting, dividend or other rights, except

to receive the cash payment, or, if the Board of Directors so determines, to receive the number of shares rounded up to the next

whole number, as described above.

Shareholders should

be aware that, under the escheat laws of various jurisdictions, sums due for fractional interests that are not timely claimed after

the effective time of the Reverse Stock Split may be required to be paid to the designated agent for each such jurisdiction, unless

correspondence has been received by the Company or the transfer agent concerning ownership of such funds within the time permitted

in such jurisdiction. Thereafter, if applicable, shareholders otherwise entitled to receive such funds, but who do not receive

them due to, for example, their failure to timely comply with the transfer agent's instructions, will have to seek to obtain such

funds directly from the state to which they were paid.

Effect of the Reverse Stock Split on

Employee Plans, Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable Securities

Based upon the reverse

stock split ratio determined by the board of directors, proportionate adjustments are generally required to be made to the per

share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible

or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of Common Stock. This

would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable

securities upon exercise, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange

or conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The

number of shares deliverable upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment

of fractional shares. The number of shares reserved for issuance pursuant to these securities will be proportionately

based upon the reverse stock split ratio determined by the board of directors, subject to our treatment of fractional shares.

Accounting Matters

The proposed amendment

to the Company’s Amended and Restated Articles of Incorporation will not affect the par value of our Common Stock per share,

which will remain $0.01 par value per share. As a result, as of the Effective Time, the stated capital attributable

to Common Stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Stock Split. Reported

per share net income or loss will be higher because there will be fewer shares of Common Stock outstanding.

Certain Federal Income Tax Consequences

of the Reverse Stock Split

The following summary

describes certain material U.S. federal income tax consequences of the Reverse Stock Split to holders of our Common Stock

Unless otherwise specifically

indicated herein, this summary addresses the tax consequences only to a beneficial owner of our Common Stock that is a citizen

or individual resident of the United States, a corporation organized in or under the laws of the United States or any state thereof

or the District of Columbia or otherwise subject to U.S. federal income taxation on a net income basis in respect of our Common

Stock (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to exercise

primary supervision over administration of such trust and one or more U.S. persons have the authority to control all substantial

decisions of the trust or (2) it has a valid election in place to be treated as a U.S. person. An estate whose

income is subject to U.S. federal income taxation regardless of its source may also be a U.S. holder. This summary does

not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that arise

from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be

known by investors. This summary also does not address the tax consequences to (i) persons that may be subject

to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment

companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum

tax, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our

Common Stock as part of a position in a “straddle” or as part of a “hedging,” “conversion”

or other integrated investment transaction for federal income tax purposes, or (iii) persons that do not hold our Common Stock

as “capital assets” (generally, property held for investment).

If a partnership (or

other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our Common Stock, the

U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities

of the partnership. Partnerships that hold our Common Stock, and partners in such partnerships, should consult their

own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

This summary is based

on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative rulings and judicial

authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax

law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect

on the U.S. federal income tax consequences of the Reverse Stock Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR REGARDING

THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES

UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

U.S. Holders

The Reverse Stock Split

should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, a stockholder generally will

not recognize gain or loss on the Reverse Stock Split, except to the extent of cash, if any, received in lieu of a fractional share

interest in the post-Reverse Stock Split shares. The aggregate tax basis of the post-split shares received will be equal to the

aggregate tax basis of the pre-split shares exchanged therefore (excluding any portion of the holder’s basis allocated to

fractional shares), and the holding period of the post-split shares received will include the holding period of the pre-split shares

exchanged. A holder of the pre-split shares who receives cash will generally recognize gain or loss equal to the difference between

the portion of the tax basis of the pre-split shares allocated to the fractional share interest and the cash received. Such gain

or loss will be a capital gain or loss and will be short term if the pre-split shares were held for one year or less and long term

if held more than one year. No gain or loss will be recognized by us as a result of the Reverse Stock Split.

No Appraisal Rights

Under Marshall Islands

law and our charter documents, holders of our Common Stock will not be entitled to dissenter’s rights or appraisal rights

with respect to the Reverse Stock Split.

Board Recommendation

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” APPROVAL OF AN AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO AUTHORIZE A REVERSE

STOCK SPLIT OF OUR ISSUED AND OUTSTANDING COMMON STOCK.

HOUSEHOLDING OF ANNUAL DISCLOSURE DOCUMENTS

Shareholders sharing

an address who are receiving multiple copies of our proxy materials, including this the Proxy Statement, proxy card and Annual

Report, may contact their broker, bank or other nominee if in the future they would like only a single copy of each document be

mailed to all shareholders at the shared address. In addition, if you are the beneficial owner, but not the record holder, of shares

of common stock, your broker, bank or other nominee may deliver only one copy of the proxy materials to multiple shareholders who

share an address unless that nominee has received contrary instructions from one or more of the shareholders. We will deliver promptly,

upon written or oral request, separate copies of the proxy materials to a shareholder at a shared address to which a single copy

of the document was delivered. Shareholders who wish to receive separate copies of the proxy materials, now or in the future, should

submit their request to us by phone at 011-30-210-891-4600 or by mail at 15 Karamanli Ave., 166 73, Voula, Greece.

OTHER BUSINESS

The Board of Directors

knows of no other business to be brought before the Special Meeting. If, however, any other business should properly come before

the Special Meeting, the persons named in the accompanying proxy will vote proxies as in their discretion they may deem appropriate,

unless they are directed by a proxy to do otherwise.

| |

By Order of the Board of Directors, |

| |

|

| |

|

| |

|

| |

Aikaterini Stoupa, Secretary |

Voula, Greece

December 24, 2015

APPENDIX A

ARTICLES OF AMENDMENT OF

ARTICLES OF INCORPORATION OF

BOX SHIPS INC.

UNDER SECTION 90 OF THE BUSINESS CORPORATION

ACT

The undersigned, Michael

Bodouroglou, Chief Executive Officer of Box Ships Inc., a corporation incorporated under the laws of the Republic of the Marshall

Islands (the “Corporation”), for the purpose of amending the Articles of Incorporation of said Corporation, hereby

certify:

| 1. | The

name of the Corporation is: BOX SHIPS INC. |

| 2. | The

Articles of Incorporation were filed with the Registrar of Corporations as of May 19, 2010. |

| 3. | The

Articles of Incorporation were amended and restated on April 11, 2011. |

| 4. | The

following shall be inserted immediately following the last sub-paragraph of Paragraph D of the Amended and Restated Articles of

Incorporation, effecting a combination of the outstanding shares of Common Stock: |

“Effective as of 5:01

p.m., Marshall Islands time on ________ __, 201_ (12:01 a.m., New York time on _______ __, 201_), every ________ (__) shares of

common stock of the Corporation then issued and outstanding shall, automatically and without any action on the part of the respective

holders thereof, be combined, converted and changed into one (1) share of common stock of the Corporation (the “Reverse Stock

Split”); provided, however, that the number and par value of shares of common stock and the number and par value of shares

of preferred stock authorized pursuant to this Paragraph D shall not be altered. No fractional shares shall be issued upon the

Reverse Stock Split. All shares of common stock (including fractions thereof) issuable upon the Reverse Stock Split to a given

holder shall be aggregated for purposes of determining whether the Reverse Stock Split would result in the issuance of any fractional

share. [If, after the aforementioned aggregation, the Reverse Stock Split would result in the issuance of a fraction of a share

of common stock, the Corporation shall, in lieu of issuing any such fractional share, round such fractional share up to the nearest

whole share.]”

| 5. | All

of the other provisions of the Amended and Restated Articles of Incorporation shall remain unchanged. |

| 6. | This

Amendment to the Amended and Restated Articles of Incorporation was authorized by actions of the Board of Directors and Shareholders

of the Corporation. |

IN WITNESS WHEREOF,

I have executed these Articles of Amendment on this ___ day of __________, 201_.

| |

|

| |

Michael Bodouroglou |

| |

Chief Executive Officer |

Exhibit 99.3

PROXY

BOX SHIPS

INC.

PROXY FOR SPECIAL MEETING

OF STOCKHOLDERS TO BE HELD JANUARY 27, 2016

THIS PROXY IS SOLICITED

ON BEHALF OF THE BOARD OF DIRECTORS

THIS PROXY CARD IS VALID

ONLY WHEN SIGNED AND DATED

The

undersigned shareholder hereby appoints Michael Bodouroglou and Aikaterini Stoupa, and each of them individually,

as attorneys and proxies for the undersigned, with the power to appoint his substitute, to represent and to vote all the shares

of common stock of BOX SHIPS INC. (the “Company”), which the undersigned would be entitled to vote, at the Company’s

Annual Meeting of Stockholders to be held at Company’s premises at 15, Karamanli Ave., 16673 Voula, Greece on January

27, 2016 at 12.00 p.m. and at any postponements or adjournments thereof, subject to the directions indicated on the reverse

side hereof.

In

their discretion, the Proxy is authorized to vote upon any other matter that may properly come before the meeting or any adjournments

thereof.

This

proxy, when properly executed, will be voted in the manner directed on the reverse side by the undersigned shareholder. If no

direction is made, this proxy will be voted for.

(Continued, and

to be marked, dated and signed, on the other side)

PLEASE DETACH

ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED.

Important Notice Regarding

the Availability of Proxy Materials for the Special Meeting of

Stockholders to be held

January 27, 2016

The Proxy Statement to

Stockholders is available at:

http://www.viewproxy.com/box-ships/2016SM

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” THE PROPOSAL

| The Proposal – | To

grant discretionary authority to the Company’s board of directors to (A) amend

the Amended and Restated Articles of Incorporation of the Company to effect one or more

consolidations of the issued and outstanding shares of common stock, pursuant to which

the shares of common stock would be combined and reclassified into one share of common

stock ratios within the range from 1-for-2 up to 1-for-50 (the “Reverse Stock Split”)

and (B) determine whether to arrange for the disposition of fractional interests by shareholder

entitled thereto, to pay in cash the fair value of fractions of a share of common stock

as of the time when those entitled to receive such fractions are determined, or to entitle

shareholder to receive from the Company’s transfer agent, in lieu of any fractional

share, the number of shares of common stock rounded up to the next whole number, provided

that, (X) that the Company shall not effect Reverse Stock Splits that, in the aggregate,

exceeds 1-for-50, and (Y) any Reverse Stock Split is completed no later than the first

anniversary of the date of the Special Meeting. |

¨

FOR ¨

AGAINST ¨

ABSTAIN

PLEASE MARK YOUR VOTE IN

BLUE INK AS SHOWN HERE x

WILL

ATTEND THE MEETING ¨

| PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED PRE-PAID ENVELOPE. |

| |

|

| Dated: |

|

| |

| |

| Signature(s) of Stockholder(s) |

| |

| |

| Title |

| |

| Note: Please sign exactly as your name or names appear on this card. Joint owners should each sign personally. If signing as a fiduciary or attorney, please give your exact title. |

| |

CONTROL NUMBER |

|

| |

|

|

|

|

|

PLEASE DETACH

ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED.

PROXY VOTING INSTRUCTIONS

Please have your 11 digit

control number ready when voting by Internet or Telephone.

| |

|

|

|

|

|

INTERNET

Vote Your Proxy on the

Internet:

Go

to www.cesvote.com

Have your proxy card available

when you access the above website. Follow the prompts to vote your shares.

|

|

TELEPHONE

Vote Your Proxy by Phone:

Call 1 (888) 693-8683

Use any touch-tone

telephone to vote your proxy. Have your proxy card available when you call. Follow the voting instructions to vote your shares. |

|

MAIL

Vote Your Proxy by Mail:

Mark, sign, and date your

proxy card, then detach it, and return it in the postage-paid envelope provided.

|

PLEASE DO NOT RETURN

THE PROXY CARD IF YOU ARE VOTING ELECTRONICALLY.

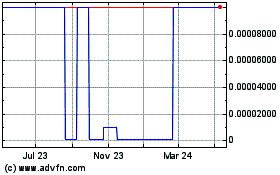

Box Ships (CE) (USOTC:TEUFF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Box Ships (CE) (USOTC:TEUFF)

Historical Stock Chart

From Jan 2024 to Jan 2025