TABLE OF CONTENTS

You should read this prospectus, any applicable prospectus supplement and the information incorporated by

reference in this prospectus before making an investment in the securities of BG Medicine, Inc. See “Where You Can Find More Information” on page 23 for more information. You should rely only on the information contained in or incorporated

by reference in this prospectus or a prospectus supplement. The Company has not authorized anyone to provide you with different information. This document may be used only in jurisdictions where offers and sales of these securities are permitted.

You should assume that information contained in this prospectus, or in any document incorporated by reference, is accurate only as of any date on the front cover of the applicable document. Our business, financial condition, results of operations

and prospects may have changed since that date. Unless otherwise noted in this prospectus, (1) the term “BG Medicine” refers to BG Medicine, Inc., a Delaware corporation, (2) the terms “BG Medicine,” the

“Company,” “we,” “us,” and “our,” refer to the ongoing business operations of BG Medicine, and (3) the term “Common Stock” refers to shares of BG Medicine, Inc.’s Common Stock and the term

“stockholder(s)” refers to the holders of Common Stock or securities exercisable for Common Stock.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into it contain, in addition to historical information, certain information,

assumptions and discussions that may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as

amended, or the Exchange Act. We have made these statements in reliance on the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are subject to certain risks and uncertainties, which could cause actual

results to differ materially from those projected or anticipated. Although we believe our assumptions underlying our forward-looking statements are reasonable as of the date of this prospectus, we cannot assure you that the forward-looking

statements set out in this prospectus will prove to be accurate. We typically identify these forward-looking statements by the use of forward-looking words such as “expect,” “potential,” “continue,” “may,”

“will,” “should,” “could,” “would,” “seek,” “intend,” “plan,” “estimate,” “anticipate” or the negative version of those words or other comparable words.

Forward-looking statements contained in this prospectus include, but are not limited to, statements about:

|

|

•

|

|

our estimates of future performance, including the commercialization and sales of our galectin-3 test;

|

|

|

•

|

|

our ability to provide sufficient evidence of clinical utility for our galectin-3 test and to differentiate it from competing cardiovascular

diagnostics tests;

|

|

|

•

|

|

our ability to obtain regulatory clearance from the U.S. Food and Drug Administration, or FDA, for our CardioSCORE test and certain additional

indications for our galectin-3 test;

|

|

|

•

|

|

our ability to successfully market, commercialize and achieve widespread market penetration for our cardiovascular diagnostic tests;

|

|

|

•

|

|

our ability to conduct the clinical studies required for regulatory clearance or approval and to demonstrate the clinical benefits and

cost-effectiveness to support commercial acceptance of our products;

|

|

|

•

|

|

the timing, costs and other limitations involved in obtaining regulatory clearance or approval for any of our products;

|

|

|

•

|

|

the potential benefits of our cardiovascular diagnostic tests over current medical practices or other diagnostics;

|

|

|

•

|

|

willingness of third-party payers to reimburse for the cost of our tests;

|

|

|

•

|

|

the ability of our automated partners to develop and obtain regulatory clearance of galectin-3 tests that can be performed on their automated platforms

and to commercialize any such tests;

|

|

|

•

|

|

estimates of market sizes and anticipated uses of our cardiovascular diagnostic tests;

|

|

|

•

|

|

our ability to enter into collaboration and distribution agreements with respect to our cardiovascular diagnostic tests, the performance of our

partners under such agreements and the potential benefits of these arrangements;

|

|

|

•

|

|

our ability to obtain and maintain intellectual property protections for our products and operate our business without infringing upon the intellectual

property rights of others;

|

|

|

•

|

|

the expected timing, progress or success of our development and commercialization efforts;

|

|

|

•

|

|

our ability to successfully obtain sufficient and appropriate blood samples for our validation tests in support of our regulatory filings for our

cardiovascular tests;

|

|

|

•

|

|

our ability to continue as a going concern;

|

|

|

•

|

|

our ability to obtain additional financing on terms acceptable to us;

|

ii

|

|

•

|

|

our expectations regarding the use of our Purchase Agreement to obtain additional capital through sales of our common stock to Aspire Capital and the

trading price of our common stock being above the $1.00 minimum floor price that is required for us to use this facility;

|

|

|

•

|

|

our ability to maintain compliance with the continued listing requirements of The NASDAQ Capital Market;

|

|

|

•

|

|

the success of our efforts to remediate the material weakness we identified in fiscal 2012 and to satisfactorily improve our internal controls over

financial reporting;

|

|

|

•

|

|

the success of competing cardiovascular diagnostic tests that are or become available;

|

|

|

•

|

|

regulatory developments in the United States and other countries in which we sell or plan to sell our tests;

|

|

|

•

|

|

the performance of our third-party suppliers and the manufacturer of our galectin-3 tests;

|

|

|

•

|

|

our ability to service the principal and interest amounts payable under our secured term loan facility; and

|

|

|

•

|

|

our estimates regarding anticipated operating losses, future revenue, expenses, capital requirements and our needs for additional financing.

|

This prospectus also contains estimates and other statistical data provided by independent parties and by us relating to

market size and growth and other industry data. These and other forward-looking statements made in this prospectus are presented as of the date on which the statements are made. We have included important factors in the cautionary statements

included in this prospectus, particularly in the section entitled “Risk Factors,” that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do

not reflect the potential impact of any new information, future events or circumstances that may affect our business after the date of this prospectus. Except as required by law, we do not intend to update any forward-looking statements after the

date on which the statement is made, whether as a result of new information, future events or circumstances or otherwise.

iii

PROSPECTUS SUMMARY

This summary highlights some information from this prospectus. It may not contain all the information important to making an

investment decision. You should read the following summary together with the more detailed information regarding our Company and the securities being sold in this offering, including “Risk Factors” and other information incorporated by

reference herein.

Overview

We are developing and commercializing diagnostic products that may be used to help guide the care and management of patients who suffer from heart failure and related disorders.

Our BGM Galectin-3

®

Test is our first U.S. Food and Drug Administration, or FDA, cleared and CE Marked diagnostic product. It is currently available as a blood test in the United States

and the European Union, or EU. Our BGM Galectin-3 Test was included in the 2013 American College of Cardiology Foundation and the American Heart Association (ACCF/AHA) Guideline for the Management of Heart Failure.

We market and sell our BGM Galectin-3 Test kits to clinical laboratories, hospitals, and health care providers. We hope to accelerate the

clinical and commercial adoption of galectin-3 testing by generating, publishing and publicizing data derived from clinical research studies that have incorporated our BGM

Galectin-3

Test and by expanding our

BGM Galectin-3 Test’s indications for use. We have entered into licensing agreements with leading diagnostic instrument manufacturers to develop and commercialize galectin-3 assays that will be performed on automated platforms that have been

incorporated into routine practice in laboratories throughout the world.

We are developing a pipeline of diagnostic products

by leveraging our intellectual property and the mining of data generated from a patient cohort and specimen repository to which we have exclusive access for the development of diagnostic products. Among the products in development is our BGM

CardioSCORE™ Test, a biomarker-based blood test designed as an aid in the assessment of near-term risk for significant cardiovascular events, such as heart attack and stroke.

Our BGM Galectin-3 Test

Our BGM Galectin-3 Test is our first FDA

cleared and CE Marked diagnostic product. It is an

in vitro

diagnostic device that quantitatively measures galectin-3 in serum or plasma by enzyme linked immunosorbent assay (ELISA) on a microtiter plate platform. Heart failure patients with

elevated galectin-3 levels as measured using our BGM Galectin-3 Test have been found to be at significantly greater risk of adverse outcomes, including death or hospitalization. Measurement of this protein biomarker is intended to be used in

conjunction with clinical evaluation.

Galectins are a family of proteins that play many important roles in inflammation,

immunity and cancer. Galectin-3, a member of this family of proteins, is a protein biomarker that has been shown to play an important role in heart failure in both animal and human studies. In animal experiments, administration of galectin-3 to the

heart led to the development of cardiac fibrosis, or stiffening, in the heart muscle, a process that is often referred to as cardiac remodeling. In these animal studies, adverse remodeling reduced the heart’s ability to pump normally, causing

the animals to develop heart failure. This link between galectin-3 and cardiac remodeling is significant and suggests that galectin-3 may be a useful biomarker for adverse cardiac remodeling, an important determinant of the clinical outcome of

patients suffering from heart failure. We have obtained an exclusive worldwide license to certain galectin-3 rights that relate to the association of this protein biomarker with heart failure. We have also filed several of our own patent

applications related to galectin-3.

1

Our BGM Galectin-3 Test is currently available as a blood test in the United States and the

EU. The following table summarizes the current indications for use and commercial status of our BGM Galectin-3 Test:

|

|

|

|

|

|

|

Test / Disease Area

|

|

Indications

|

|

Regulatory and Commercial Status

|

|

BGM Galectin-3 Test

|

|

An aid in assessing the prognosis of chronic heart failure

|

|

— Marketed in the U.S. and Europe

— FDA 510(k) cleared

November 2010

— CE Mark obtained October 2009

|

|

|

|

|

|

|

|

An aid in assessing the prognosis of acute heart failure

|

|

— Marketed in Europe

— CE Mark obtained October

2009

|

|

|

|

|

|

|

|

An aid to identify adults at elevated risk of developing heart failure

|

|

— Marketed in Europe

— CE Mark obtained May

2012

|

Automated Testing For Galectin-3

Overview

We believe that automation of our galectin-3 test will

broaden its acceptance by laboratory customers and, as a result, accelerate its clinical adoption. To that end, we have entered into licensing and commercialization agreements with four leading diagnostic instrument manufacturers to develop and

commercialize automated instrument versions of our galectin-3 test. We have entered into worldwide license, development and commercialization agreements with Abbott Laboratories, or Abbott, bioMérieux SA, or bioMérieux, Siemens

Healthcare Diagnostics Inc., or Siemens, and Alere Inc., or Alere. These diagnostic instrument manufacturers account for a significant percentage of the automated laboratory testing instruments that are used throughout the world. The installed

customer base of these automated partners reflects all major segments of the diagnostics market, including hospital laboratories, national reference laboratories, regional laboratories and others.

Progress to Date

In January 2013, bioMérieux obtained a CE Mark for its

VIDAS

®

Galectin-3 assay and initiated its commercial launch in the EU. The VIDAS

®

Galectin-3 assay was developed by bioMérieux for the quantitative measurement of galectin-3 levels in blood

using the bioMérieux VIDAS

®

automated and multiparametric immunoassay testing system.

In April 2013, Abbott obtained a CE mark for its ARCHITECT

®

Galectin-3 assay and initiated its commercial launch in the EU. Abbott is offering the ARCHITECT

®

Galectin-3 assay on its

ARCHITECT

®

immunoassay platform. In the United States, Fujirebio Diagnostics, Incorporated, or Fujirebio, on

behalf of Abbott, is the first of our automated partners to have filed for 510(k) regulatory clearance of an automated version of the galectin-3 test. Fujirebio is developing the test for use on Abbott’s ARCHITECT

®

immunochemistry instrument platform. Fujirebio initially submitted its 510(k) to the FDA in July 2012. Subsequently,

Fujirebio received a letter from the FDA requesting additional information on various matters, including the geographic composition of the patient cohort that provided the blood samples used to support the 510(k) submission. Due to the nature of the

additional information requested and the time required to address the FDA’s questions, Fujirebio was unable to submit a complete response to the FDA by the FDA-designated deadline on February 25, 2013 and withdrew the submission. Fujirebio

submitted its new 510(k) to the FDA in February 2014.

2

Recognition of Galectin-3 Testing in U.S. Guideline for the Management of Heart Failure

In June 2013, galectin-3 testing was recognized for the first time in the newly issued 2013 American College of Cardiology Foundation and

the American Heart Association Guideline for the Management of Heart Failure. The ACCF/AHA Guideline is designed to assist clinicians in selecting the best management strategy for individual patients and provides expert analysis of data on

prevention, diagnosis, risk stratification, and treatment. Galectin-3 testing has been assigned a Level of Evidence of ‘A’, multiple populations evaluated, and a Class of Recommendation corresponding to ‘May Be Considered’ for

the purpose of additive risk stratification of acute heart failure patients, and a Level of Evidence of ‘B’, limited populations evaluated, and a Class of Recommendation of ‘May Be Considered’ for risk stratification of

ambulatory heart failure patients. The guideline further notes that testing for galectin-3 is predictive of risk of adverse outcomes in heart failure, including hospitalization, and is additive to BNP and NT-proBNP testing for heart failure patient

risk stratification. The American College of Cardiology Foundation and the American Heart Association have jointly produced guidelines in the area of cardiovascular disease since 1980. The ACCF/AHA Task Force on Practice Guidelines is charged with

developing, updating and revising practice guidelines for cardiovascular diseases and procedures. Writing committees are charged with regularly reviewing and evaluating all available evidence to develop balanced, patient-centric recommendations for

clinical practice. The guidelines for heart failure management were last revised in 2009.

Reimbursement for Galectin-3 Testing

Approximately 70% of heart failure patients in the United States are of Medicare age. Therefore,

reimbursement by Medicare is of considerable interest to our laboratory customers. In the United States, for the 2014 calendar year, the Centers for Medicare and Medicaid Services (CMS) published a 2014 Medicare national limitation amount for the

galectin-3 blood test (analyte-specific CPT

®

Code 82777) at the amount of a crosswalked test (analyte-specific

CPT

®

Code 84244) whose 2014 national limitation amount is $30.01. This national limitation replaces the

galectin-3 blood test’s national limitation amount of $17.80 that was effective in 2013. The 2014 national limitation amount applies across the U.S. except in Ohio and West Virginia where rates of $23.99 and $26.40, respectively, will apply. In

Europe, the Company’s sales efforts are currently directed to hospital situated emergency departments whose reimbursement is covered under the hospital budgeting process.

Our Product Pipeline

New Clinical Claims and Indications for the BGM Galectin-3 Test

We believe that the clinical and commercial value of our BGM Galectin-3 Test may extend beyond its current indications

for use. We expect to pursue new clinical claims and indications for its use in assessing heart failure, as well as, in related disorders. Expansion of the product label to include new clinical claims and indications for use will require additional

clinical studies and clearance, or approval, by regulatory bodies, such as the FDA, and inclusion in our CE Mark for use in the EU.

CardioSCORE™ Test

CardioSCORE test is a multi-analyte biomarker-based blood test that is designed as an aid in the assessment of near-term risk for significant atherothrombotic cardiovascular events, such as heart attack

and ischemic stroke. The CardioSCORE test is a proprietary

in vitro

diagnostic multi-analyte assay in which the levels of multiple biomarkers are measured in blood and the results are mathematically integrated to yield a single numerical

score that is predictive of an individual’s near-term atherothrombotic cardiovascular risk. Our development work indicates that the CardioSCORE test has the potential to offer significant improvement over conventional risk factor-based

diagnostics, such as the Framingham Risk Score, to identify near-term cardiovascular risk.

In December 2012, we obtained a CE

Mark for the CardioSCORE test, which will enable us to market the test in Europe and other countries that recognize CE Mark. However, as a result of our decision to focus our

3

efforts on increasing the adoption and sales of our galectin-3 test, we have decided to redirect investments from a launch of the CardioSCORE test in Europe to support our galectin-3 efforts. We

may move forward with a European launch in test markets, when and if appropriate partnership opportunities arise.

In December

2011, we submitted a 510(k) to the FDA in order to obtain regulatory clearance to market the CardioSCORE test in the United States as an aid in the assessment of near-term risk for significant cardiovascular events, such as heart attack and stroke.

In response to this submission, FDA requested that we engage an independent committee of physicians to conduct a medical review and adjudication of clinical endpoints reported in the submission. Due to the time involved in responding to this

request, we withdrew the 510(k) on August 8, 2012. Our medical review also included the assessment of sample stability and the evaluation of other technical issues raised by the FDA. We are currently analyzing the results of the medical review.

When completed, the results obtained from our analysis of data collected from the medical review will guide our go-forward regulatory, commercial and investment strategy for the CardioSCORE test in the United States.

BioImage Study Patient Cohort and Banked Specimens

We have exclusive rights to diagnostic inventions arising from our analysis of a proprietary observational and community-based cohort of over 6,800 individuals who have been followed since 2009. Baseline

blood serum, plasma, DNA, and RNA samples collected from all participants have been stored and are available for our analysis. In addition, insurance claims data, including information regarding diagnoses, procedures, and therapies related to over

1,200 non-fatal cardiovascular events that were experienced by participants in the cohort over the more than four years since follow-up was initiated is available to us for data mining. We believe that this asset provides us with a unique and

proprietary platform from which we may develop new diagnostic products.

Risk Factors

Our business is subject to numerous risks as discussed more fully in the section entitled “Risk Factors” beginning on page 8.

Principal risks of our business include, but are not limited to, the following: our history of operating losses and our need for additional financing to fund our operations; our ability to generate sufficient product revenue to sustain our

commercial diagnostics business; our estimates of future performance, including the expected timing of the launch of our products; our expectations regarding the impact on our galectin-3 test sales as a result of focusing our sales efforts on the

hospital readmissions problem and associated penalties facing our customers; our ability to conduct the clinical studies required for regulatory clearance or approval and to demonstrate the clinical benefits and cost-effectiveness to support

commercial acceptance of our products; the timing, costs and other limitations involved in obtaining regulatory clearance or approval for any of our products; the potential benefits of our products over current medical practices or other

diagnostics; our ability to successfully develop, receive regulatory clearance or approval, commercialize and achieve market acceptance for any of our products; the willingness of third-party payers to reimburse for the cost of our tests at prices

that allow us to generate sufficient profit margins; our reliance on third parties to develop and distribute our products, including our ability to enter into collaboration agreements with respect to our products and the performance of our

collaborative partners under such agreements; our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others; the expected timing, progress or success of our research and

development and commercialization efforts; our estimates regarding anticipated operating losses, future revenue, expenses, capital requirements and our needs for additional financing; our ability to recruit, hire and retain qualified personnel; and

the limited public float and trading volume for our common stock and volatility in our stock price.

Corporate History and Available

Information

We were incorporated in Delaware in February 2000 and later that year chose the name Beyond Genomics, Inc. In

October 2004, we changed our name to BG Medicine, Inc. We maintain our operations at 880 Winter Street, Suite 210, Waltham, Massachusetts 02451, and our phone number is (781) 890-1199. Our

4

Internet website address is www.bg-medicine.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or

furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are available free of charge through the investor relations page of our internet website as soon as reasonably practicable

after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

5

THE OFFERING

Common stock covered

|

by this Prospectus:

|

Up to 4,106,071 shares of Common Stock, including 132,743 shares currently outstanding.

|

Common stock outstanding as of

|

June 30, 2014:

|

34,417,249 shares, including 132,743 shares issued to Aspire Capital on January 24, 2013.

|

|

Use of proceeds:

|

Aspire Capital will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We will not receive proceeds from the sale of the shares by Aspire

Capital. However, we may receive up to $12 million in gross proceeds from the sale of our Common Stock to Aspire Capital under the Purchase Agreement described below, which we currently intend to use to fund our operations, advance commercialization

of our cardiovascular diagnostic tests in the United States and Europe; and other general corporate purposes, including, but not limited to, capital expenditures, licensing of intellectual property, repayment of indebtedness and working capital. See

“Use of Proceeds.”

|

|

Risk factors:

|

The shares offered hereby involve a high degree of risk. See “Risk Factors” beginning on page 8.

|

|

Dividend policy:

|

We have not paid dividends to our stockholders since our inception and we are currently prohibited from making any dividend payments under the terms of the term loan facility with our lenders.

We currently intend to retain all available funds and any future earnings to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable future.

|

|

Trading Symbol:

|

Our Common Stock currently trades on the NASDAQ Capital Market under the symbol “BGMD”.

|

Our Purchase Agreement with Aspire Capital Fund, LLC

On January 24,

2013, we entered into a common stock purchase agreement, or the Purchase Agreement, with Aspire Capital Fund, LLC, or Aspire Capital, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital

is committed to purchase up to an aggregate of $12 million of shares of our Common Stock, or the Purchase Shares, over the 24-month period ending on May 24, 2015.

In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase Agreement, we issued to Aspire Capital 132,743 shares of our Common Stock, or the Commitment

Shares, as a commitment fee. We refer to the Commitment Shares and the Purchase Shares collectively as the Shares. As of the filing date of this prospectus, we had not issued any shares to Aspire Capital under the Purchase Agreement, other than the

Commitment Shares. Other terms and conditions of the Purchase Agreement are described below.

Concurrently with our entering

into the Purchase Agreement, we also entered into a registration rights agreement with Aspire Capital, or the Registration Rights Agreement. The Registration Rights Agreement provides, among other things, that we will file one or more registration

statements, as necessary, to register under

6

the Securities Act, the sale of the Shares that have been and may be issued to Aspire Capital under the Purchase Agreement. We further agreed to keep the registration statement effective and to

indemnify Aspire Capital for certain liabilities in connection with the sale of the Shares under the terms of the Registration Rights Agreement.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering under the Securities Act 4,106,071 shares of our Common Stock, which includes the 132,743 Commitment Shares

that have already been issued to Aspire Capital, as well as an additional 3,973,328 Purchase Shares that we may issue to Aspire Capital. As of the filing date of this prospectus, we had not issued any shares to Aspire Capital under the Purchase

Agreement, other than the Commitment Shares. All 4,106,071 shares of Common Stock are being offered pursuant to this prospectus.

As of June 30, 2014, there were 34,417,249 shares of our Common Stock outstanding, including the 132,743 Commitment Shares, but excluding the 3,973,328 Purchase Shares that we may sell to Aspire

Capital pursuant to the Purchase Agreement. If all of the 4,106,071 shares of our Common Stock offered hereby were issued and outstanding as of June 30, 2014, such shares would represent approximately 10.7% of our Common Stock outstanding or

approximately 14.9% of the non-affiliate shares of our Common Stock, or our public float, outstanding as of June 30, 2014. The number of shares of our Common Stock ultimately offered for sale by Aspire Capital is dependent upon the number of

shares we choose to sell to Aspire Capital under the Purchase Agreement.

As described in more detail below, generally under

the Purchase Agreement we have two ways we can elect to sell shares of Common Stock to Aspire Capital on any business day we select: (1) through a regular purchase of up to 100,000 shares (but not to exceed $500,000) at a known price based on

the market price of our Common Stock prior to the time of each sale, and (2) through a volume-weighted average price, or VWAP, purchase of a number of shares up to 30% of the volume traded on the purchase date at a price equal to the lesser of

the closing sale price or 95% of the VWAP for such purchase date.

On any business day on which the closing sale price of our

Common Stock equals or exceeds $1.00 per share, over the 24-month period ending on May 24, 2015, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice directing Aspire Capital to purchase up to 100,000

shares of our Common Stock per business day; however, no sale pursuant to such purchase notice may exceed $500,000 per business day. The purchase price per share is the lower of (i) the lowest sale price for our Common Stock on the purchase

date or (ii) the arithmetic average of the three lowest closing sale prices for our Common Stock during the 12 consecutive business days ending on the business day immediately preceding the purchase date. The applicable purchase price will

be determined prior to delivery of any purchase notice.

In addition, on any date on which we have submitted a purchase notice

to Aspire Capital in the amount of 100,000 shares, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice, or a VWAP Purchase Notice, directing Aspire Capital to purchase an

amount of our Common Stock equal to a percentage (not to exceed 30%) of the aggregate shares of Common Stock traded on the NASDAQ Capital Market on the next business day subject to a maximum number of shares determined by us. The purchase price per

share pursuant to such VWAP Purchase Notice shall be generally the lower of (i) the closing sale price on the purchase date and (ii) 95% of the VWAP of our Common Stock traded on the NASDAQ Capital Market on the purchase date.

The number of Purchase Shares covered by, and the timing of, each purchase notice are determined by us, at our sole discretion. We may

deliver multiple purchase notices to Aspire Capital from time to time during the term of the Purchase Agreement, so long as the most recent purchase has been completed. There are no trading volume requirements or other restrictions under the

Purchase Agreement. Aspire Capital has no right to require any sales from us, but is obligated to make purchases as directed in accordance with the Purchase Agreement.

The Purchase Agreement contains customary representations, warranties, covenants, closing conditions and indemnification and termination provisions. The Purchase Agreement may be terminated by us at any

time, at our

7

discretion, without any cost or penalty. Aspire Capital has covenanted not to cause or engage in any manner whatsoever, any direct or indirect short selling or hedging of our Common Stock. We did

not pay any additional amounts to reimburse or otherwise compensate Aspire Capital in connection with the transaction other than the Commitment Shares. There are no limitations on use of proceeds, financial or business covenants, restrictions on

future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement.

Our gross proceeds will depend on the purchase prices and the frequency of sales of shares to Aspire Capital;

provided

,

however

, that the maximum aggregate proceeds from sales of shares is $12 million. Our delivery of purchase notices will be made subject to market conditions, in light of our anticipated capital needs from time to time and under the

limitations contained in the Purchase Agreement. We expect to use proceeds from sales of shares for general corporate purposes and working capital requirements.

The issuance of the shares to Aspire Capital under the Purchase Agreement is exempt from registration under the Securities Act, pursuant to the exemption for transactions by an issuer not involving any

public offering under Section 4(a)(2) of the Securities Act.

Effect of Issuances of Shares to Aspire Capital; Dilution

The issuances of the shares to Aspire Capital under the Purchase Agreement will have no effect on the rights or privileges

of existing holders of our Common Stock, except that the economic and voting interests of each stockholder will be diluted as a result of any such issuances. What this means is that, although the number of shares of our Common Stock that current

stockholders presently own will not decrease, the shares that are held by our current stockholders will represent a smaller percentage of our total shares that will be outstanding after any issuances of shares of our Common Stock to Aspire Capital.

RISK FACTORS

A purchase of shares of our Common Stock is an investment in our securities and involves a high degree of risk. You should carefully consider the risks and uncertainties and all other information

contained in or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013 and our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2014. All of these risk factors are incorporated by reference herein in their entirety. If any of these risks actually occur, our business, financial condition and results of operations would

likely suffer. In that case, the market price of the Common Stock could decline, and you may lose part or all of your investment in our company. Additional risks of which we are not presently aware or that we currently believe are immaterial may

also harm our business and results of operations.

USE OF PROCEEDS

The Selling Stockholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We

will not receive proceeds from the sale of the shares by the Selling Stockholder. However, we may receive up to an aggregate of $12 million in proceeds from the sale of our Common Stock to the Selling Stockholder under the Purchase Agreement. We

will bear all reasonable expenses incident to the registration of the shares under federal and state securities laws other than expenses incident to the delivery of the shares to be sold by the Selling Stockholder. Any transfer taxes payable on

these shares and any commissions and discounts payable to underwriters, agents, brokers or dealers will be paid by the Selling Stockholder.

Assuming the sale by us of all $12 million of shares of our Common Stock to the Selling Stockholder and estimated expenses of approximately $77,964, the total net proceeds to us under the Purchase

Agreement would

8

be approximately $11.92 million. We currently expect to use the net proceeds to us from the sale of shares to the Selling Stockholder, if any, to fund our operations, advance commercialization of

our cardiovascular diagnostic tests in the United States and Europe; and other general corporate purposes, including, but not limited to, capital expenditures, licensing of intellectual property, repayment of indebtedness and working capital. We

expect from time to time to evaluate the acquisition of businesses, products and technologies for which a portion of the net proceeds may be used, although we currently are not planning or negotiating any such transactions. As of the date of this

prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from the sale of shares to the Selling Stockholder. Accordingly, we will retain broad discretion over the use of these proceeds, if any. Pending

application of the net proceeds as described above, we may initially invest the net proceeds in short-term, investment-grade, interest-bearing securities or apply them to the reduction of short-term indebtedness.

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

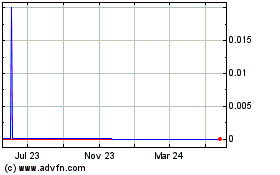

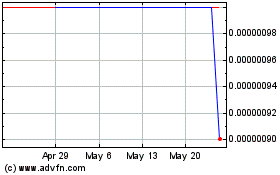

Our common stock began trading on The NASDAQ Global

Market on February 4, 2011 under the symbol “BGMD” and was transferred to The NASDAQ Capital Market on January 27, 2014 where it continues to trade under the same symbol. The following table sets forth the high and low sales

prices of our common stock as quoted on The NASDAQ Global Market or The NASDAQ Capital Market, as applicable, for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

2014:

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

2.41

|

|

|

$

|

0.99

|

|

|

Second Quarter

|

|

$

|

2.02

|

|

|

$

|

0.90

|

|

|

|

|

|

|

2013:

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

3.15

|

|

|

$

|

1.11

|

|

|

Second Quarter

|

|

$

|

2.17

|

|

|

$

|

1.21

|

|

|

Third Quarter

|

|

$

|

1.40

|

|

|

$

|

0.83

|

|

|

Fourth Quarter

|

|

$

|

1.70

|

|

|

$

|

0.55

|

|

|

|

|

|

|

2012:

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

12.80

|

|

|

$

|

4.49

|

|

|

Second Quarter

|

|

$

|

7.50

|

|

|

$

|

3.75

|

|

|

Third Quarter

|

|

$

|

7.05

|

|

|

$

|

3.35

|

|

|

Fourth Quarter

|

|

$

|

4.48

|

|

|

$

|

1.00

|

|

Stockholders

As of June 30, 2014, there were approximately 33 stockholders of record of the 34,417,249 outstanding shares of our common stock.

DIVIDEND POLICY

We have not paid dividends to our stockholders since our inception and we are currently prohibited from making any dividend payments under the terms of the term loan facility with our lenders. We

currently intend to retain all available funds and any future earnings to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable future.

9

SELLING STOCKHOLDER

We have included in this prospectus 132,743 shares of Common Stock issued to the Selling Stockholder, Aspire Capital Fund, LLC, on

January 24, 2013 and up to an additional 3,973,328 shares of Common Stock that may be issued in the future to Aspire Capital pursuant to the Purchase Agreement. Prior to entering into the Purchase Agreement on January 24, 2013, Aspire

Capital did not own any shares of our Common Stock.

The following table sets forth certain information regarding the Selling

Stockholder and the shares of Common Stock beneficially owned by it, which information is available to us as of June 30, 2014. The Selling Stockholder may offer shares under this prospectus from time to time and may elect to sell none, some or

all of the shares set forth below. As a result, we cannot estimate the number of shares of Common Stock that the Selling Stockholder will beneficially own after termination of sales under this prospectus. However, for the purposes of the table

below, we have assumed that the Selling Stockholder will sell all shares covered by this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Stockholder

|

|

Shares

Beneficially

Owned

Before

Offering(1)

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned

Before

Offering

|

|

|

Maximum

Shares to

Be Sold in the

Offering

|

|

|

Shares

Beneficially

Owned

After

Offering

|

|

|

Percentage

of

Outstanding

Shares

Beneficially

Owned

After

Offering

|

|

|

Aspire Capital Fund, LLC(2)

|

|

|

382,743

|

(3)

|

|

|

1.1

|

%

|

|

|

4,106,071

|

|

|

|

565,000

|

|

|

|

2.0

|

%

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In general, a person is deemed to be the beneficial owner of (i) any

shares of our Common Stock over which such person has sole or shared voting power or investment power, plus (ii) any shares which such person has the right to acquire beneficial ownership of within 60 days, whether through the exercise of

options, warrants or otherwise. The percentage of ownership set forth above assumes the sale by the Company to Aspire Capital of all shares being offered pursuant to this prospectus and is based on 34,417,249 shares of our Common Stock outstanding

as of June 30, 2014, which includes the 132,743 shares previously issued to Aspire Capital pursuant to the Purchase Agreement, together with securities exercisable or convertible into shares of Common Stock within 60 days of the date hereof for

the Selling Stockholder. The Company may elect in its sole discretion to sell to Aspire Capital up to an additional number of shares under the Purchase Agreement equal to $12 million in value, but Aspire Capital does not presently beneficially own

those shares as determined in accordance with the rules of the SEC.

|

|

(2)

|

As of the date of the Purchase Agreement, Aspire Capital beneficially owned no shares of Common Stock of the Company. Steven G. Martin, Erik J. Brown and Christos

Komissopoulos, the principals of Aspire Capital, are deemed to be beneficial owners of all of the shares of Common Stock owned by Aspire Capital. Although Messrs. Martin, Brown and Komissopoulos are deemed to have shared voting and investment power

over the shares being offered under the prospectus filed with the SEC in connection with the transactions contemplated under the Purchase Agreement, each disclaims beneficial ownership of these shares except to the extent of their pecuniary interest

therein. Aspire Capital is not a licensed broker dealer or an affiliate of a licensed broker dealer.

|

|

(3)

|

As of the date of the Purchase Agreement, 132,743 shares of our Common Stock were issued to Aspire Capital as a commitment fee under the Purchase Agreement. Pursuant to

the terms of the Purchase Agreement, the Company may elect in its sole discretion to sell to Aspire Capital up to an additional number of shares under the Purchase Agreement equal to $12 million in value, but Aspire Capital does not presently

beneficially own those shares as determined in accordance with the rules of the SEC.

|

10

THE ASPIRE CAPITAL TRANSACTION

General

On

January 24, 2013, we entered into the Purchase Agreement, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $12 million of shares

of our Common Stock, or the Purchase Shares, over the 24-month period ending on May 24, 2015. In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase Agreement, we issued to Aspire Capital the

Commitment Shares as a commitment fee. Concurrently with our entering into the Purchase Agreement, we also entered into the Registration Rights Agreement, in which we agreed to file one or more registration statements, as necessary, to register

under the Securities Act, the sale of the Shares that have been and may be issued to Aspire Capital under the Purchase Agreement.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering under the Securities Act 4,106,071 shares of our Common Stock, which includes the 132,743 Commitment Shares

that have already been issued to Aspire Capital, as well as an additional 3,973,328 Purchase Shares that we may issue to Aspire Capital. As of the filing date of this prospectus, we had not issued any shares to Aspire Capital under the Purchase

Agreement, other than the Commitment Shares. All 4,106,071 shares of Common Stock are being offered pursuant to this prospectus.

As of June 30, 2014, there were 34,417,249 shares of our Common Stock outstanding, including the 132,743 Commitment Shares, but excluding the 3,973,328 Purchase Shares that we may sell to Aspire

Capital pursuant to the Purchase Agreement. If all of the 4,106,071 shares of our Common Stock offered hereby were issued and outstanding as of June 30, 2014, such shares would represent approximately 10.7% of our Common Stock outstanding or

approximately 14.9% of our public float as of June 30, 2014. The number of shares of our Common Stock ultimately offered for sale by Aspire Capital is dependent upon the number of shares we choose to sell to Aspire Capital under the Purchase

Agreement.

Under the Purchase Agreement, we have the right, but not the obligation, to sell more than the 4,106,071 shares of

our Common Stock offered by this prospectus. The Purchase Agreement provides that the number of shares that may be sold pursuant to the Purchase Agreement shall be limited to 4,106,071, or the “Exchange Cap,” which represents 19.99% of our

outstanding shares as of January 24, 2013, the date we entered into the Purchase Agreement, unless we obtain shareholder approval or identify an exception to the rules of the NASDAQ Capital Market to issue more than 19.99%. This limitation

shall not apply if, at any time the Exchange Cap is reached and at all times thereafter, the average price paid for all shares issued and sold under the Purchase Agreement is equal to or greater than $2.30, which was the closing sale price of our

Common Stock on January 23, 2013. We are not required or permitted to issue any shares of Common Stock under the Purchase Agreement if such issuance would breach our obligations under the rules or regulations of the NASDAQ Capital Market. If we

elect to sell more than the 4,106,071 shares of Common Stock offered hereby, we must first obtain the approval of our stockholders to do so, if necessary, and register under the Securities Act the sale of any additional shares we may elect to sell

to Aspire Capital before we can sell such additional shares to Aspire Capital under the Purchase Agreement.

After the SEC has

declared effective the registration statement of which this prospectus is a part, we have the right, in our sole discretion, to present Aspire Capital with a Purchase Notice, directing Aspire Capital (as principal) to purchase up to 100,000 shares

of our Common Stock per business day, up to $12 million of our Common Stock in the aggregate at a Purchase Price calculated by reference to the prevailing market price of our Common Stock over a preceding 12-business day period (as more specifically

described below); however, no sale pursuant to a Purchase Notice may exceed $500,000 per trading day.

In addition, on any

date on which we submit a Purchase Notice to Aspire Capital in an amount equal to 100,000 shares, we also have the right, in our sole discretion, to present Aspire Capital with a VWAP Purchase

11

Notice directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of the Company’s Common Stock traded on the NASDAQ Capital Market on the purchase

date, subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold. The VWAP Purchase Price is calculated by reference to the prevailing market price of our Common Stock (as more specifically described below).

The Purchase Agreement provides that in no event will any shares of Common Stock be sold at a Purchase Price less than $1.00, or the

Floor Price. This Floor Price and the respective prices and share numbers in the preceding paragraphs shall be appropriately adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar

transaction. Additionally, the Purchase Agreement provides that the Company and Aspire Capital shall not effect any sales under the Purchase Agreement if such shares proposed to be issued and sold, when aggregated with all other shares of the

Company’s Common Stock that Aspire Capital and its affiliates beneficially own, would result in Aspire Capital and its affiliates beneficially owning more than 19.99% of the Company’s then issued and outstanding Common Stock.

There are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any

sales of our Common Stock to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds,

financial or business covenants, restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our

discretion, without any penalty or cost to us. The rights and obligations of Aspire Capital under the Purchase Agreement are not assignable or transferable.

Purchase of shares under the Purchase Agreement

Under the Purchase

Agreement, on any trading day selected by us on which the closing price of our Common Stock is not less than $1.00 per share, we may direct Aspire Capital to purchase up to 100,000 shares of our Common Stock per trading day so long as sales pursuant

to such Purchase Notice do not exceed $500,000 per trading day. The Purchase Price of such shares is equal to the lesser of:

|

|

•

|

|

the lowest sale price of our Common Stock on the purchase date; or

|

|

|

•

|

|

the arithmetic average of the three lowest closing sale prices for our Common Stock during the twelve consecutive trading days ending on the trading

day immediately preceding the purchase date.

|

In addition, on any date on which we submit a Purchase Notice

to Aspire Capital in an amount equal to 100,000 shares we also have the right to direct Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of the Company’s Common Stock traded on the NASDAQ Capital Market

on the purchase date, subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold, which is equal to the greater of (a) 90% of the closing price on the NASDAQ Capital Market on the business day immediately preceding

the VWAP Purchase Date or (b) such higher price as set forth by the Company in the VWAP Purchase Notice. The VWAP Purchase Price of such shares is the lower of:

|

|

•

|

|

the closing sale price on the VWAP Purchase Date; or

|

|

|

•

|

|

95% of the volume-weighted average price for our Common Stock traded on the NASDAQ Capital Market during normal trading hours:

|

|

|

a.

|

on the VWAP Purchase Date, if the aggregate shares traded on the NASDAQ Capital Market have not exceeded the VWAP Purchase Share Volume Maximum; or

|

|

|

b.

|

the portion of the VWAP Purchase Date until such time as the sooner to occur of (i) the time at which the aggregate shares traded on the NASDAQ Capital Market has

exceeded the VWAP Purchase Share Volume Maximum or (ii) the time at which the sale price of the Common Stock falls below the VWAP Minimum Price Threshold.

|

12

The Purchase Price and VWAP Purchase Price will be adjusted for any reorganization,

recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring during the period(s) used to compute such price. We may deliver multiple Purchase Notices and VWAP Purchase Notices to Aspire Capital from

time to time during the term of the Purchase Agreement, so long as the most recent purchase has been completed.

Minimum Share Price

Under the Purchase Agreement, the Company and Aspire Capital may not effect any sales of shares of our Common Stock on any

trading day that the closing sale price of our Common Stock is less than $1.00 per share.

Compliance with the NASDAQ Capital Market Price

The Purchase Agreement provides that the number of shares that may be sold pursuant to the Purchase Agreement shall be

limited to 4,106,071 shares, or the Exchange Cap, which represents 19.99% of our outstanding shares as of January 24, 2013, the date we entered into the Purchase Agreement, unless we obtain shareholder approval or identify an exception to the

rules of the NASDAQ Capital Market to issue more than 19.99%, to be in compliance with the applicable listing maintenance rules of the NASDAQ Capital Market. This limitation shall not apply if, at any time the Exchange Cap is reached and at all

times thereafter, the average price paid for all shares issued and sold under the Purchase Agreement is equal to or greater than $2.30, which was the closing sale price of our Common Stock on January 23, 2013. We are not permitted to issue any

shares of Common Stock under the Purchase Agreement if such issuance would breach our obligations under the rules or regulations of the NASDAQ Capital Market.

Beneficial Ownership Limitation

Under the Purchase Agreement, we may not

effect any sales of shares of our Common Stock to Aspire Capital if such shares proposed to be issued and sold, when aggregated with all other shares of our Common Stock then beneficially owned by Aspire Capital and its affiliates, would result in

the beneficial ownership by Aspire Capital and its affiliates of more than 19.99% of our then issued and outstanding shares of Common Stock.

Events of Default

The

following are events of default under the Purchase Agreement. If any of the following events of default occur, we may not require Aspire Capital, and Aspire Capital shall not be obligated or permitted, to purchase any shares of our Common Stock

pursuant to the Purchase Agreement. In addition, upon the occurrence of any of the following events of default, Aspire Capital may terminate the Purchase Agreement.

|

|

•

|

|

the effectiveness of any registration statement that is required to be maintained effective pursuant to the terms of the Registration Rights Agreement

between us and Aspire Capital lapses for any reason (including, without limitation, the issuance of a stop order) or is unavailable to Aspire Capital for sale of our shares of Common Stock, and such lapse or unavailability continues for a period of

ten consecutive business days or for more than an aggregate of thirty business days in any 365-day period, which is not in connection with a post-effective amendment to any such registration statement; provided, however, that in connection with any

post-effective amendment to such registration statement that is required to be declared effective by the SEC, such lapse or unavailability may continue for a period of no more than twenty consecutive business days, which such period shall be

extended for up to an additional twenty business days if we receive a comment letter from the SEC in connection therewith;

|

|

|

•

|

|

the suspension from trading or failure of our Common Stock to be listed on a Principal Market (as defined in the Purchase Agreement) for a period of

three consecutive business days;

|

13

|

|

•

|

|

the delisting of our Common Stock from the NASDAQ Capital Market, provided our Common Stock is not immediately thereafter trading on the New York Stock

Exchange, the NYSE MKT, the NASDAQ Global Select Market, the NASDAQ Global Market, the OTCQB or OTCQX market places of the OTC markets;

|

|

|

•

|

|

our transfer agent’s failure to issue to Aspire Capital shares of our Common Stock which Aspire Capital is entitled to receive under the Purchase

Agreement within five business days after an applicable purchase date;

|

|

|

•

|

|

a breach by us of the representations, warranties, covenants or other term or condition contained in the Purchase Agreement or any related agreements

that could reasonably be expected to have a material adverse effect except, in the case of a breach of a covenant which is reasonably curable, only if such breach continues for a period of at least five business days;

|

|

|

•

|

|

if at any time the issuance of shares of Common Stock upon the submission of a Purchase Notice or VWAP Purchase Notice under the Purchase Agreement

would result in the issuance of an aggregate of number of shares of Common Stock that would exceed the number of shares of Common Stock that we may issue under this agreement without breaching our obligations under the rules or regulations of the

NASDAQ Capital Market;

|

|

|

•

|

|

if we become insolvent or are generally unable to pay our debts as they become due; or

|

|

|

•

|

|

any participation or threatened participation in insolvency or bankruptcy proceedings by or against us.

|

Our Termination Rights

The Purchase Agreement may be terminated by us at any time, at our discretion, without any cost to us.

No Short-Selling or Hedging by Aspire Capital

Aspire Capital has agreed that neither it nor any of its agents, representatives and affiliates shall engage in any direct or indirect short-selling or hedging, which establishes a net short position with

respect to our Common Stock during any time prior to the termination of the Purchase Agreement.

Effect of Sales under the Purchase

Agreement on Our Stockholders

The Purchase Agreement does not limit the ability of Aspire Capital to sell any or all of

the 4,106,071 shares registered in this offering. It is anticipated that shares registered in this offering will be sold over a period of up to approximately 24 months ending on May 24, 2015. The sale by Aspire Capital of a significant amount

of shares registered in this offering at any given time could cause the market price of our Common Stock to decline or to be highly volatile. Sales to Aspire Capital by us pursuant to the Purchase Agreement also may result in dilution to the

interests of other holders of our Common Stock. However, we have the right to control the timing and amount of sales of our shares to Aspire Capital, and the Purchase Agreement may be terminated by us at any time at our discretion without any

penalty or cost to us.

Amount of Potential Proceeds to be Received under the Purchase Agreement

In connection with entering into the Purchase Agreement, we authorized the sale to Aspire Capital of up to $12 million of shares of our

Common Stock. However, we estimate that we will sell no more than 4,106,071 shares to Aspire Capital under the Purchase Agreement (inclusive of the Commitment Shares and Purchase Shares), all of which are included in this offering. Subject to

any required approval by our Board of Directors and our stockholders, we have the right but not the obligation to issue more than the 4,106,071 shares included in this prospectus to Aspire Capital under the Purchase Agreement. In the event we elect

to issue more than 4,106,071 shares under the Purchase Agreement, we will be required to file a new registration statement and

14

have it declared effective by the SEC. The number of shares ultimately offered for sale by Aspire Capital in this offering is dependent upon the number of shares we choose to sell to Aspire

Capital under the Purchase Agreement. The following table sets forth the number and percentage of outstanding shares to be held by Aspire Capital after giving effect to the sale of shares of Common Stock issued to Aspire Capital covered by the

registration statement, of which this prospectus is a part, at varying purchase prices in addition to the Commitment Shares.

|

|

|

|

|

|

|

|

|

Assumed Average

Purchase Price of the

Additional Shares Sold

Under the Purchase

Agreement

|

|

Number of Additional

Shares to be Sold(1)

|

|

Percentage of

Outstanding Shares

After Giving Effect to the

Aspire Capital

Transaction(2)

|

|

Proceeds from the

Sale of Shares to

Aspire Capital Under the

Purchase Agreement

|

|

$1.00

|

|

3,973,328

|

|

10.3%

|

|

$ 3,973,328

|

|

$1.50

|

|

3,973,328

|

|

10.3%

|

|

$ 5,959,992

|

|

$2.00

|

|

3,973,328

|

|

10.3%

|

|

$ 7,946,656

|

|

$2.50

|

|

3,973,328

|

|

10.3%

|

|

$ 9,933,320

|

|

$3.00

|

|

3,973,328

|

|

10.3%

|

|

$11,919,984

|

|

$3.50

|

|

3,428,571

|

|

9.1%

|

|

$11,999,999

|

|

$4.00

|

|

3,000,000

|

|

8.0%

|

|

$12,000,000

|

|

(1)

|

Based on total aggregate sales of the lesser of (a) $12 million of shares of Common Stock and (b) the 3,973,328 Purchase Shares registered herein. Excludes

the Commitment Shares.

|

|

(2)

|

The denominator is based on 34,417,249 shares outstanding on June 30, 2014, plus the number of shares set forth in the adjacent column which we would have sold to

Aspire Capital at the assumed price in the first column. The numerator is based on the number of shares which we would have sold under the Purchase Agreement at the corresponding assumed purchase price set forth in the first column and assuming a

maximum of $12 million of shares are sold to Aspire Capital.

|

PLAN OF DISTRIBUTION

The shares may be sold or distributed from time to time by the Selling Stockholder directly to one or more purchasers or

through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of

the shares offered by this prospectus may be effected in one or more of the following methods:

|

|

•

|

|

ordinary brokers’ transactions;

|

|

|

•

|

|

transactions involving cross or block trades;

|

|

|

•

|

|

through brokers, dealers, or underwriters who may act solely as agents;

|

|

|

•

|

|

“at the market” into an existing market for the Common Stock;

|

|

|

•

|

|

in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents in

privately negotiated transactions; or any combination of the foregoing.

|

In order to comply with the

securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the

state or an exemption from the registration or qualification requirement is available and complied with.

The Selling

Stockholder may also sell shares of Common Stock under Rule 144 promulgated under the Securities Act, if available, rather than under this prospectus. In addition, the Selling Stockholder may transfer the shares of Common Stock by other means not

described in this prospectus.

15

Brokers, dealers, underwriters, or agents participating in the distribution of the shares as

agents may receive compensation in the form of commissions, discounts, or concessions from the Selling Stockholder and/or purchasers of the Common Stock for whom the broker-dealers may act as agent. The Selling Stockholder has informed us that each

such broker-dealer will receive commissions from Aspire Capital which will not exceed customary brokerage commissions.

The

Selling Stockholder and its affiliates have agreed not to engage in any direct or indirect short selling or hedging of our Common Stock during the term of the Purchase Agreement.

The Selling Stockholder is an “underwriter” within the meaning of the Securities Act.

We have advised Selling Stockholder that while it is engaged in a distribution of the shares included in this prospectus it is required

to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes the Selling Stockholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from

bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to

stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered hereby this prospectus.

We may suspend the sale of shares by the Selling Stockholder pursuant to this prospectus for certain periods of time for certain reasons,

including if the prospectus is required to be supplemented or amended to include additional material information.

This

offering will terminate on the date that all shares offered by this prospectus have been sold by the Selling Stockholder.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

The following is a description of the transactions in which we

have engaged, over the past three years, since January 1, 2011 with our directors and officers and then beneficial owners of more than five percent of our voting securities and their affiliates.

Participation in Follow-on Underwritten Public Offering

In January 2013, we closed a follow-on underwritten public offering of 6,900,000 shares of our common stock at a price to the public of $2.00 per share, including an aggregate of 2,250,000 shares to the

following directors and beneficial owners of more than five percent of our voting securities, and their affiliates:

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Number of

Shares of

Common

Stock

|

|

|

Aggregate

Purchase

Price

|

|

|

Entities affiliated with Flagship Ventures(1)

|

|

|

2,000,000

|

|

|

$

|

4,000,000

|

|

|

Stelios Papadopoulos(2)

|

|

|

250,000

|

|

|

|

500,000

|

|

|

(1)

|

Includes 75,000 shares of common stock purchased by AGTC Advisors Fund, L.P., 500,000 shares of common stock purchased by Applied Genomic Technology Fund, L.P.,

1,050,000 shares of common stock purchased by Flagship Ventures Fund 2007, L.P., 125,000 shares of common stock purchased by NewcoGen Equity Investors LLC and 250,000 shares of common stock purchased by NewcoGen Group LLC. Noubar B. Afeyan, Ph.D.,

one of our directors, is affiliated with all entities affiliated with Flagship Ventures.

|

|

(2)

|

Dr. Papadopoulos is a director of the Company.

|

16

Participation in Initial Public Offering

In February 2011, we issued an aggregate of 5,750,000 shares of our common stock in connection with our initial public offering at an

initial public offering price of $7.00 per share, including an aggregate of 3,592,069 shares to the following directors and beneficial owners of more than five percent of our voting securities, and their affiliates:

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Number of

Shares of

Common

Stock

|

|

|

Aggregate

Purchase

Price

|

|

|

Entities affiliated with Flagship Ventures(1)

|

|

|

1,142,857

|

|

|

$

|

7,999,999

|

|

|

General Electric Pension Trust

|

|

|

428,571

|

|

|

|

2,999,997

|

|

|

Gilde Europe Food & Agribusiness Fund, B.V.(2)

|

|

|

142,857

|

|

|

|

999,999

|

|

|

Legg Mason Capital Management Special Investment Trust

|

|

|

1,428,571

|

|

|

|

9,999,997

|

|

|

Stelios Papadopoulos(3)

|

|

|

75,000

|

|

|

|

525,000

|

|

|

SMALLCAP World Fund, Inc.

|

|

|

374,213

|

|

|

|

2,619,491

|

|

|

(1)

|

Includes 14,285 shares of common stock purchased by AGTC Advisors Fund, L.P., 271,429 shares of common stock purchased by Applied Genomic Technology Fund, L.P., 714,286

shares of common stock purchased by Flagship Ventures Fund 2007, L.P., 21,428 shares of common stock purchased by NewcoGen-Long Reign Holding LLC, 10,714 shares of common stock purchased by NewcoGen-Elan LLC, 35,715 shares of common stock purchased

by NewcoGen Equity Investors LLC, 42,858 shares of common stock purchased by NewcoGen Group LLC, 10,714 shares of common stock purchased by NewcoGen-PE LLC and 21,428 shares of common stock purchased by ST NewcoGen LLC. Noubar B. Afeyan, Ph.D., one

of our directors, is affiliated with all entities affiliated with Flagship Ventures.

|

|

(2)

|

Pieter van der Meer, one of our former directors, is affiliated with Gilde Europe Food & Agribusiness Fund, B.V.

|

|

(3)

|

Dr. Papadopoulos is a director of the Company.

|

The initial public offering price of $7.00 per share was determined through negotiations between us and the representatives of the underwriters of the offering based on several factors.

Investor Rights Agreement

In connection with the Series D redeemable convertible preferred stock financing, we entered into the Fourth Amended and Restated Investor Rights Agreement, dated as of July 10, 2008, with entities

affiliated with Flagship; Gilde; Stelios Papadopoulos; Humana; Legg Mason; GE; SMALLCAP; and certain of our other stockholders. This agreement terminated upon our initial public offering, other than the portions relating to registration rights,

which will continue in effect and entitle the holders of such rights to have us register their shares of our common stock for sale in the United States. These registration rights are subject to certain conditions and limitations, including the right

of the underwriters of an offering to limit the number of shares of our common stock included in any such registration under certain circumstances. We are generally required to pay all expenses incurred in connection with registrations effected in

connection with the following rights, excluding underwriting discounts and commissions. The registration rights described below shall not apply to shares of common stock that are eligible to be sold by persons who are not affiliates of the Company

(as defined in Rule 144 of the Securities Act), and have not been affiliates of the Company during the preceding three months, pursuant to Rule 144(b)(1) under the Securities Act.

Demand Rights

. Any holder or holders who collectively hold registrable securities representing at least 40% of the registrable

securities then outstanding shall have the right, exercisable by written notice, to have us prepare and file a registration statement under the Securities Act covering the registrable securities that are the subject of such request; provided, that

we are not obligated to prepare and file a registration statement if neither Form S-3

17

nor another short form registration statement is available to us, unless the registrable securities that are the subject of such request have an expected aggregate offering price to the public of

at least $1,000,000. Subject to the foregoing, the holders shall be permitted one demand registration. In addition, under certain circumstances, the underwriters, if any, may limit the number of shares of our common stock included in any such

registration, and we may postpone or suspend the filing or effectiveness of such registration.

Piggyback Rights

. If at

any time we propose to register our common stock under the Securities Act, other than in a registration statement relating solely to sales of securities to participants in a dividend reinvestment plan, or Form S-4 or S-8 or any successor form or in

connection with an acquisition or exchange offer or an offering of securities solely to our existing stockholders or employees, we are required to (i) give prompt written notice to all holders of registrable securities of our intention to

effect such a registration and (ii) include in such registration all registrable securities which are permitted under applicable securities laws to be included in the form of registration statement we select and with respect to which we have