Current Report Filing (8-k)

January 23 2020 - 4:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2020

ASPEN GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

|

|

001-38175

|

|

27-1933597

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

276 Fifth Avenue, Suite 505, New York, New York 10001

(Address of Principal Executive Office) (Zip Code)

(646) 448-5144

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

ASPU

|

The Nasdaq Stock Market

(The Nasdaq Global Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

|

Emerging growth company ¨

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On January 23, 2020, Aspen Group, Inc. (the “Company”) issued $5 million convertible notes (“Convertible Notes”) to each of two lenders in exchange for the two $5 million notes due under term loans entered into in 2019 (the “Term Loans”). The closing of the refinancing was conditioned upon the Company conducting an equity financing resulting in gross proceeds to the Company of at least $10 million. On January 22, 2020, the Company closed on an underwritten offering under which the net proceeds were approximately $16 million and the condition precedent to the closing of the refinancing was satisfied.

The key terms of the Convertible Notes are as follows:

·

After six months from the issuance date, the lenders have the right to convert the principal into our shares of the Company’s common stock at a conversion price of $7.15 per share;

·

The Convertible Notes automatically convert into shares of the Company’s common stock if the average closing price of our common stock is at least $10.725 over a 20 consecutive trading day period;

·

The Convertible Notes are due January 23, 2023 or approximately three years from the closing;

·

The interest rate of the Convertible Notes is 7% per annum (payable monthly in arrears) compared to 12% under the Term Loans; and

·

The Convertible Notes are secured in the same manner as the Term Loans.

The former notes under the Term Loans were due in September 2020 and were subject to a one-year extension and the payment of an extension fee for each note of $50,000 (total of $100,000). The Company also paid each lender $40,400 at closing of the Convertible Notes to cover taxes they will incur as part of the note exchange and will pay their legal fees arising from the re-financing. Effective upon issuance of the Convertible Notes, the existing notes under the Term Loans were cancelled and no amounts remain outstanding under the Term Loans.

In connection with refinancing of the Term Loans, on January 23, 2020, the Company also entered into an Investors/Registration Rights Agreement with the lenders whereby, upon request of the lenders on or after June 22, 2020, the Company must file and obtain and maintain the effectiveness of a registration statement registering the shares of common stock issued or issuable upon conversion of the Convertible Notes.

Item 8.01 Other Events.

On January 22, 2020, the Company closed on an underwritten offering of 2,415,000 shares of common stock, including 315,000 shares of common stock which were subject to a 30-day over-allotment option which was exercised by the underwriter. The offering was made pursuant to an effective shelf registration statement filed on Form S-3 (File No. 333-224230), and a final prospectus supplement filed with the Securities and Exchange Commission on January 21, 2020. After giving effect to the offering, the Company has 21,627,230 shares of common stock outstanding.

On January 23, 2020, the Company issued a press release announcing the closing of the refinancing and the public offering. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The press release contained a mistake relating to the mandatory conversion of the notes. The actual beginning date is July 22, 2020. The reference to 2022 was a mistake.

The information contained in this Item 8.01, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Furthermore, the information contained in this Item 8.01 or Exhibit 99.1 shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

ASPEN GROUP, INC.

|

|

|

|

|

|

|

|

Date: January 23, 2020

|

By:

|

/s/ Michael Mathews

|

|

|

|

|

Name: Michael Mathews

|

|

|

|

|

Title: Chief Executive Officer

|

|

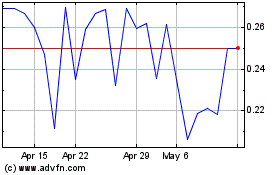

Aspen (QB) (USOTC:ASPU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aspen (QB) (USOTC:ASPU)

Historical Stock Chart

From Jan 2024 to Jan 2025