AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $2,914,000 for the third quarter of 2014. Earnings per

share (basic) in the third quarter of 2014 were $0.59 versus $0.63

in the third quarter of 2013. The Bank’s “core” earnings per share

were $0.54 in the third quarter of 2014 versus $0.57 in the third

quarter of 2013.

“These results contribute to a double digit return on equity.

This was attained despite the low interest rate environment and

increased regulatory expenses we are experiencing,” said Robert

Schack, Chairman.

“Earnings in the third quarter reflected reduced income from our

securities portfolio. Despite a 9% increase in the size of the

portfolio, income generated from it was down by 10%. This was due

to a decision made by the Bank as to the allocation of assets

between higher yielding fixed rate securities and lower yielding

variable rate securities. As it is now conformed, the securities

portfolio is designed to have superior performance in a rising

interest rate environment,” said Wes Schaefer, Vice Chairman and

CFO.

Leon Blankstein, President and CEO, added: “We are very pleased

to report that our new business efforts have resulted in excellent

balance sheet growth, including a 12% increase in loan totals. This

growth, as always, emanates from new clients who are well known to

the Bank.”

Total assets increased 9% or $127 million to $1.476 billion at

September 30, 2014 as compared to $1.349 billion at September 30,

2013. The loan portfolio (net) increased 12% or $68 million to $626

million at September 30, 2014 as compared to $558 million at

September 30, 2013. Deposits increased 6% or $69 million to $1.273

billion at September 30, 2014 as compared to $1.203 billion at

September of 2013. Borrowings from the Federal Home Loan Bank

increased from $44 million at the end of the third quarter in 2013

to $78 million at the end of the third quarter in 2014.

During the third quarter of 2014, Net Interest Income increased

$195,000 or 2% to $10,259,000 from $10,064,000 during the third

quarter in 2013.

Non-Interest income during the third quarter of 2014 increased

$120,000 or 14% to $953,000 from $833,000 during the third quarter

of 2013.

Non-Interest expense during the third quarter of 2014 increased

$608,000 or 9.8% to $6,819,000 from $6,211,000 during the third

quarter in 2013. Increases in the “Other Expense” category

mentioned in the Income Statement below were driven by extra cost

incurred in customer related expenses, professional fees, promotion

expenses and regulatory fees.

Asset quality at the end of the third quarter of 2014 remains

excellent, with $42,000 of non-performing loans, or 0.01% of total

loans; and, no OREO. At the end of September 2014, the allowance

for loan losses stood at $12,531,000 or 1.96% of loans. During

the 9 months ended September 30th of 2014, the Bank has a net

recovery of previously charged-off loans totaling $631,000.

AMERICAN BUSINESS BANK, headquartered in downtown Los Angeles,

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

American Business Bank Figures in $000, except per share

amounts

CONSOLIDATED BALANCE SHEET (unaudited)

As of: September

September Change 2014

2013 %

Assets:

Cash & Equivalents $ 54,338 $ 70,668 -23.1 % Fed Funds Sold

1,000 1,000 0.0 % Interest Bearing Balances 528 28 1785.7 %

Investment

Securities:

US Agencies 481,336 359,695 33.8 % Mortgage Backed Securities

78,674 155,317 -49.3 % State & Municipals 178,616 161,988 10.3

% Other 3,308 3,139 5.4 %

Total Investment Securities 741,934 680,139 9.1 %

Gross

Loans:

Commercial Real Estate 384,317 334,810 14.8 % Commercial &

Industrial 202,232 193,217 4.7 % Other Real Estate 46,872 36,713

27.7 % Other 5,288 4,745

11.4 % Total Gross Loans 638,709 569,485 12.2 % Allowance for Loan

& Lease Losses (12,531 ) (10,924 )

14.7 % Net Loans 626,178 558,561 12.1 % Premises & Equipment

1,073 726 47.8 % Other Assets 50,790

37,689 34.8 %

Total Assets $

1,475,841 $ 1,348,811 9.4

%

Liabilities:

Demand Deposits $ 612,342 $ 573,039 6.9 % Money Market 585,053

549,875 6.4 % Time Deposits and Savings 75,530

80,469 -6.1 % Total Deposits 1,272,925

1,203,383 5.8 % FHLB Advances / Other Borrowings 78,400 44,000 78.2

% Other Liabilities 9,341 6,031

54.9 %

Total Liabilities $

1,360,666 $ 1,253,414 8.6

%

Shareholders'

Equity:

Common Stock & Retained Earnings $ 116,827 $ 103,878 12.5 %

Accumulated Other Comprehensive Income / (Loss)

(1,652 ) (8,481 ) -80.5 %

Total Shareholders'

Equity $ 115,175 $

95,397 20.7 %

Total Liabilities &

Shareholders' Equity $ 1,475,841

$ 1,348,811 9.4 %

Capital

Adequacy:

Tangible Common Equity / Tangible Assets 7.80 % 7.07 % -- Tier 1

Leverage Ratio 8.06 % 7.79 % -- Tier 1 Capital Ratio / Risk

Weighted Assets 15.51 % 15.61 % -- Total Risk-Based Ratio 16.77 %

16.87 % --

Per Share

Information:

Common Shares Outstanding 4,953,774 4,898,911 -- Book Value Per

Share $ 23.25 $ 19.47 19.4 % Tangible Book Value Per Share $ 23.25

$ 19.47 19.4 %

American Business Bank Figures in

$000, except per share amounts

CONSOLIDATED

INCOME STATEMENT (unaudited) For the 3-month

period ended: September September

Change 2014 2013

%

Interest

Income:

Loans & Leases $ 7,057 $ 6,499 8.6 % Investment Securities

3,574 3,984 -10.3 % Total

Interest Income 10,631 10,483 1.4 %

Interest

Expense:

Money Market, NOW Accounts & Savings 283 311 -9.0 % Time

Deposits 68 85 -20.0 % Repurchase Agreements / Other Borrowings

21 23 -8.7 % Total

Interest Expense 372 419 -11.2 % Net Interest Income

10,259 10,064 1.9 % Provision for Loan Losses (198 )

(300 ) -34.0 % Net Interest Income After Provision

for Loan Losses 10,061 9,764 3.0 %

Non-Interest

Income:

Deposit Fees 356 312 14.1 % Realized Securities Gains 372 451 -17.5

% Other 225 70 221.4 %

Total Non-Interest Income 953 833 14.4 %

Non-Interest

Expense:

Compensation & Benefits 3,993 3,860 3.4 % Occupancy &

Equipment 530 491 7.9 % Other 2,296

1,860 23.4 % Total Non-Interest Expense 6,819 6,211

9.8 % Pre-Tax Income 4,195 4,386 -4.4 % Provision for

Income Tax (1,281 ) (1,295 ) -1.1 %

Net Income $ 2,914 $

3,091 -5.7 % Less: After-Tax Realized Securities

Gains $ 258 $ 318

Core Net Income $ 2,656

$ 2,773 -4.2 %

Per Share

Information:

Average Shares Outstanding (for the quarter) 4,953,774 4,895,700 --

Earnings Per Share - Basic $ 0.59 $ 0.63 -6.8 %

Earnings Per Share "CORE" - Basic

$ 0.54 $ 0.57 -5.4 %

American Business Bank Figures

in $000, except per share amounts

September September Change

2014 2013 %

Performance

Ratios

Return on Average Assets (ROAA) 0.82 % 1.09 % -- Return on Average

Equity (ROAE) 10.83 % 13.93 % --

Return on Average Assets "CORE" (ROAA)

0.78 % 0.67 % --

Return on Average Equity "CORE" (ROAE)

10.32 % 8.59 % --

Asset Quality

Overview

Non-Performing Loans $ - $ - NA Loans 90+Days Past Due

42 979 -95.7 % Total

Non-Performing Loans $ 42 $ 979 -95.7 % Restructured Loans

(TDR's) $ 2,512 $ 1,911 31.4 % Other Real Estate Owned 0 0

-- ALLL / Gross Loans 1.96 % 1.92 % -- ALLL / Non-Performing

Loans * 29835.71 % 1115.83 % -- Non-Performing Loans / Total Loans

* 0.01 % 0.17 % -- Non-Performing Assets / Total Assets * 0.00 %

0.07 % -- Net Charge-Offs $ (631 ) $ 1,063 -- Net Charge-Offs /

Average Gross Loans -0.10 % 0.20 % --

* Excludes Restructured Loans

AMERICAN BUSINESS BANKWes E. SchaeferVice Chairman and Chief

Financial Officer213-430-4000

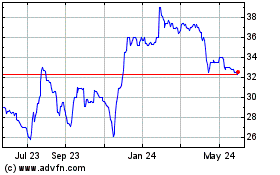

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

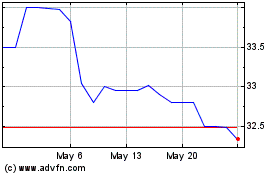

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025