American Business Bank Announces Steady Earnings Growth for 1st Quarter

April 17 2006 - 5:03PM

Business Wire

American Business Bank (OTCBB:AMBZ) today reported net earnings for

the first quarter of $1.21 million, or $0.56 per share, a 4 percent

increase from earnings of $1.15 million, or $0.57 per share, for

the same period a year ago. The earnings growth represents the 29th

consecutive increase in comparable earnings since the bank's

founding in 1998. While quarter-end assets declined from $484

million at the close of the first quarter in 2005 to $464 million

this year, a decrease of 4 percent, average assets for the quarter

increased by 2 percent. Included in the bank's growth in average

assets was an increase in average loans outstanding of 21 percent

over the same period last year. Overall, the bank reported an 18

percent increase in total loans, net of reserves, to $185 million

at the end of the quarter. There are currently zero non-performing

loans in the bank's portfolio. "Our average deposits decreased

slightly from the first quarter of 2005, reflecting an

industry-wide pullback, but our average demand deposits actually

increased 16 percent from the prior year," said Wes Schaefer, vice

chairman and chief financial officer of Los Angeles-based American

Business Bank. "The combination of higher loan outstandings and

higher demand deposits resulted in another strong quarter for the

bank." Founded in 1998, American Business Bank offers a wide range

of financial services to businesses in the middle market. Clients

include wholesalers, manufacturers, service businesses,

professionals and non-profit organizations. The bank is

headquartered in downtown Los Angeles and can be found on the

Internet at www.americanbusinessbank.com.

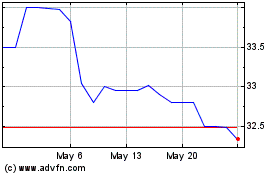

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025