Filed pursuant to Rule 424(b)(5)

Registration No. 333-252358

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 16, 2021)

Up to $10,000,000 of Shares of Common Stock

AiAdvertising , Inc. is offering up to

$10,000,000 in shares of our common stock to GHS Investments, LLC (“GHS”) under a purchase agreement entered into on

March 28, 2022 (the “Purchase Agreement”). GHS may be deemed to be an “underwriter” within the meaning of

Section 2(a)(11) of the Securities Act. At any time until March 28, 2023, subject to the terms of the Purchase Agreement, the Company

shall have the right, but not the obligation, to direct the Investor by its delivery to the Investor of a Purchase Notice from time

to time, to purchase a minimum of ten thousand dollars ($10,000) worth of shares and up to a maximum of the lower of: (1) one

hundred percent (100%) of the average daily trading dollar volume for the Company’s common stock during the ten Trading Days

preceding the Purchase Date; or (2) one million dollars ($1,000,000). See “Purchase Agreement with GHS Investments, LLC on

page S-4 of this prospectus supplement for a description of the Purchase Agreement.

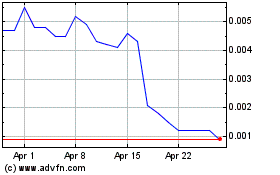

Our common stock is quoted on the OTC Pink under

the symbol “AIAD.” On March 28, 2022, the last reported sales price of our common stock on the OTC Pink was $0.0290 per share.

Investing in our securities involves significant

risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement and in the documents incorporated by reference

into this prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus

supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March

28, 2022.

TABLE OF CONTENTS

PROSPECTUS

You should rely only on the information incorporated

by reference or provided in this prospectus supplement and the accompanying prospectus. We have not have authorized anyone to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus

supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase, the securities

offered by this prospectus supplement and the accompanying prospectus in any jurisdiction where it is unlawful to make such offer or solicitation.

You should assume that the information contained in this prospectus supplement or the accompanying prospectus, or any document incorporated

by reference in this prospectus supplement or the accompanying prospectus, is accurate only as of the date of those respective documents. Neither

the delivery of this prospectus supplement nor any distribution of securities pursuant to this prospectus supplement shall, under any

circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this

prospectus supplement or in our affairs since the date of this prospectus supplement. Our business, financial condition, results of operations

and prospects may have changed since that date.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is

this prospectus supplement, which describes the specific terms of this offering of securities. The second part is the accompanying prospectus,

which provides more general information, some of which may not apply to this offering. The information included or incorporated by reference

in this prospectus supplement also adds to, updates and changes information contained or incorporated by reference in the accompanying

prospectus. If information included or incorporated by reference in this prospectus supplement is inconsistent with the accompanying prospectus

or the information incorporated by reference therein, then this prospectus supplement or the information incorporated by reference in

this prospectus supplement will apply and will supersede the information in the accompanying prospectus and the documents incorporated

by reference therein.

This prospectus supplement is part of a registration

statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process, under

the Securities Act of 1933, as amended (the “Securities Act”).

Under the shelf registration process, we may from

time to time offer and sell any combination of the securities described in the accompanying prospectus up to a total dollar amount of

$100,000,000, of which this offering is a part.

In this prospectus

supplement and the accompanying prospectus, unless the context otherwise requires, references to AiAdvertising” the “Company,”

“we,” “us,” “our” refer to AiAdvertising, Inc. together with its subsidiaries.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information

about our company, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus, and

in the documents we incorporate by reference. This summary is not complete and does not contain all the information that you should consider

before investing in our securities. You should read this entire prospectus supplement and the accompanying prospectus carefully, including

the “Risk Factors” contained in this prospectus supplement beginning on page S-5, and the risk factors, financial statements

and notes incorporated by reference herein, before making an investment decision. This prospectus supplement may add to, update or change

information in the accompanying prospectus.

Company Overview

AiAdvertising’s primary focus is to disrupt

the digital advertising world by offering a solution that harnesses the power of artificial intelligence (AI) to enable marketers to increase

productivity, efficiency and performance.

Our proprietary software empowers marketers by

intelligently automating data- driven, repetitive tasks, and improving their ability to make predictions at scale.

In the past we have contracted with clients to

deliver technology enabled services. These services were project-based and delivered against a contracted SOW (Statement of Work). Beginning

in the fourth quarter of 2022, we pivoted to a software licensing and delivery model, whereby our software is centrally hosted and licensed

on a monthly subscription basis. We believe this shift towards SaaS recurring revenue can potentially be highly valuable to the Company

and its shareholders.

Our Software Platform

Our

software platform harnesses the power of machine learning and artificial intelligence to eliminate guesswork, predict what works, and

prove advertising's impact on financial results. Key features of our platform include:

Alignment - We start

with the end in mind and use a comprehensive discovery process to outline goals and key performance indicators (KPIs) to connect them

to revenue targets. By aligning on the desired outcomes, our platform renders marketing and content calendars built upon the defined goals

and objectives.

Insights - AI Data

Services inventories and aggregates data from all of a client’s tools, such as customer relationship management (CRM), sales, marketing,

accounting, and customer service tools into a unified data warehouse where it is cleaned, organized, and tagged. This allows the artificial

intelligence in our platform to segment customers and prospective customers by revealing patterns, signals, and insights to draw commonalities

between points and grouping them into personas (fictional characters used to represent larger groups that share similarities). Once these

audiences are segmented, we use unique engagement predictors leveraging psychographic models to identify motivations, behaviors, influences,

and interests. These insights inform the type of creative assets these audience segments will most likely respond to. The models are leveraged

to find new incremental audiences.

Activate – Our

AI platform scores our clients’ existing creative assets and intelligently recommends enhancements to optimize performance. Our

AI leverages the audience personas of who will see the ads to accurately personalize and predict more successful creative assets. This

predictive engine allows clients to know the likelihood that their ad will resonate with their audiences before placing the ad. Our AI

can then dynamically create hundreds or thousands of variations of highly targeted ads based on what our AI knows about the specific audience

personas. Combined with our software, our teams then help our clients place these ads through the channels that will produce the highest

results.

Decisions – The

AiAd dashboard aggregates data from all marketing channels to connect marketing strategies to financial results. Our platform continuously

monitors and validates each campaign's impact and provides recommendations to maximize their effectiveness. Leveraging machine learning,

it provides ongoing analysis and optimization of behavioral profiles, creative, audience segments, and media activation. Our platform

empowers marketers to know what works, what doesn't, what's next, and why so they can make the most informed decisions.

Corporate Information

We were incorporated in Nevada on January 22, 2022.

Our principal executive offices are located at 321 Sixth Street, San Antonio, TX 78215, and our telephone number is 805-964-3313. Our

website address is www.aiadvertising.com. The information contained therein or connected thereto shall not be deemed to be

incorporated into this prospectus or the registration statement of which it forms a part. The information on our website is not part of

this prospectus. Effective August 5, 2021, the Company changed its name from CloudCommerce, Inc. to AiAdvertising, Inc.

THE OFFERING

| Securities we are offering |

|

Up to $10,000,000 of shares of our common stock we may sell from time to time, at our sole discretion, subject to the terms of the Purchase Agreement to GHS over the next year in accordance with the Purchase Agreement. |

| |

|

|

| Common stock to be outstanding after the offering |

|

1,400,384,104 shares |

| |

|

|

| Use of proceeds |

|

We estimate the net proceeds to us from this offering will be approximately $9,765,000 million

after deducting estimated offering expenses payable by us. We intend to use the net proceeds from the sale of the securities offered

by this prospectus for working capital and general corporate purposes. |

| |

|

|

| OTC Pink symbol for common stock |

|

Our common stock is quoted on the OTC Pink under the symbol “AIAD.” |

| |

|

|

| Risk factors |

|

Investing in our securities involves significant risks. See “Risk Factors” beginning

on page S-5 of this prospectus supplement. |

The number of shares of common

stock shown above to be outstanding after this offering is based on 1,055,556,518 shares outstanding as of March 23, 2022, and

excludes:

| ● | 450,625,000

shares of common stock issuable upon conversion of 18,025 outstanding shares of Series B

Preferred Stock; |

| | | |

| ● | 144,250,000

shares of common stock issuable upon conversion of 14,425 outstanding shares of Series C

Preferred Stock; |

| | | |

| ● | 215,052,500

shares of common stock issuable upon conversion of 86,021 outstanding shares of Series D

Preferred Stock; |

| | | |

| ● | 20,000,000

shares of common stock issuable upon conversion of 10,000 outstanding shares of Series E

Preferred Stock; |

| | | |

| ● | 136,684,211

shares of common stock issuable upon conversion of 2,597 outstanding shares of Series G Preferred

Stock; |

| | | |

| ● | 890,733,332

shares of common stock issuable upon exercise of outstanding stock options, with a weighted

average exercise price of $.0093 per share; and |

| | | |

| ● | 162,709,169 shares of common stock issuable upon exercise of warrants,

with an exercise price of $0.0479. |

Purchase Agreement

with GHS Investments, LLC

On March 28, 2022, we entered

into the Purchase Agreement with GHS, which provides that, upon the terms and subject to the conditions and limitations set forth therein,

we have the right to sell to GHS up to $10,000,000 of shares (“Purchase Shares”) of our common stock as described below.

The Company has the right,

in its sole discretion, subject to the conditions and limitations in the Purchase Agreement, to direct GHS, by delivery of a purchase

notice from time to time (a “Purchase Notice”) to purchase (each, a “Purchase”) over the one-year term of the

Purchase Agreement, a minimum of $10,000 and up to a maximum of the lower of: (1) one hundred percent (100%) of the average daily trading

dollar volume of the Company’s common stock during the ten trading days preceding the Purchase Date; or (2) one million dollars

($1,000,000), provided that the parties may agree to waive such limitations. The aggregate value of Purchase Shares sold to GHS may not

exceed $10,000,000. Each Purchase Notice will set forth the Purchase Price and number of Purchase Shares in accordance with the terms

of this Agreement.

The number of Purchase Shares

we will issue under each Purchase will be equal to 112.5% of the Purchase Amount sold under such Purchase, divided by the Purchase Price

per share (as defined under the Purchase Agreement).

The Purchase Price is defined

as the lower of (a) 90% of the lowest volume weighted average price during the Valuation Period; or (b) the Closing Price for our common

stock on the trading day preceding the date of the Purchase Notice. The Purchase Price will be subject to a floor of $.01 per share, at

or below which the Company will not deliver a Purchase Notice. The Valuation Period is the ten consecutive business days immediately preceding,

but not including, the date a Purchase Notice is delivered.

The Purchase Agreement prohibits

us from directing GHS to purchase any shares of common stock if those shares, when aggregated with all other shares of our common stock

then beneficially owned by GHS and its affiliates, would result in GHS and its affiliates having beneficial ownership, at any single point

in time, of more than 4.99% of the then total outstanding shares of our common stock.

There are no trading volume

requirements or restrictions under the Purchase Agreement. We will control the timing and amount of any sales of our common stock to GHS.

Events of default under the Purchase

Agreement include the following:

| |

● |

the effectiveness of the registration

statement for the Purchase Shares lapses for any reason or is unavailable for the issuance to or resale by GHS of the Purchase

Shares; |

| |

● |

the suspension of our common stock from trading for a period of two business days; |

| |

● |

the delisting of the Company’s common

stock from the OTC Pink; provided, however, that the common stock is not immediately thereafter trading on the Nasdaq Capital

Market, New York Stock Exchange, the Nasdaq Global Market, the Nasdaq Global Select Market, the NYSE American, or the OTCQB or

OTCQX; |

| |

● |

the failure for any reason by the transfer

agent to issue Purchase Shares to GHS within three business days after the applicable date on which GHS is entitled to receive such

securities; |

| |

● |

any breach of the representations and

warranties or covenants contained in the Purchase Agreement if such breach would reasonably be expected to have a material adverse

effect and such breach is not cured within five business days; |

| |

● |

insolvency or bankruptcy proceedings are

commenced by or against us, as more fully described in the Purchase Agreement; or |

| |

● |

if at any time we are not eligible to transfer our common stock electronically via DWAC. |

So long as an event of default

(all of which are outside the control of GHS) has occurred and is continuing, the Company may not deliver a Purchase Notice to GHS.

This offering will terminate

on the date that all shares offered by this prospectus supplement have been sold or, if earlier, the expiration or termination of the

Purchase Agreement. We and GHS each have the right to terminate the Purchase Agreement at any time upon thirty days notice. In the event

of bankruptcy proceedings by or against us, the Purchase Agreement will automatically terminate without action of any party.

The above description of the Purchase Agreement

is qualified in its entirety by reference to the Purchase Agreement, which is incorporated by reference into this prospectus supplement.

RISK FACTORS

Any investment

in our securities involves a high degree of risk, including the risks described below. Before purchasing our common stock, you should

carefully consider the risk factors set forth below, as well as all other information contained in this prospectus supplement and the

accompanying prospectus and incorporated by reference, including our consolidated financial statements and the related notes and the additional

risk factors contained in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as any amendments thereto,

as filed with the SEC, before deciding whether to invest in our common stock. Our business, financial condition and results of operations

could suffer as a result of these risks. As a result, the trading price of our stock could decline and you could lose all or part of your

investment. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those

discussed in these forward-looking statements. See the section entitled “Forward-Looking Information”.

Risks Related to Our Business

Issues in the use of AI in our offerings

may result in reputational harm or liability.

As with many disruptive innovations,

AI presents risks and challenges that could affect its adoption, and therefore our business. AI algorithms may be flawed. Datasets may

be insufficient or contain biased information. Inappropriate or controversial data practices by us or others could impair the acceptance

of AI solutions. These deficiencies could undermine the decisions, predictions, or analysis AI applications produce, subjecting us to

competitive harm, legal liability, and brand or reputational harm. Some AI scenarios present ethical issues. If we enable or offer AI

solutions that are controversial because of their impact on human rights, privacy, employment, or other social issues, we may experience

brand or reputational harm.

We are subject

to payment-related risks if customers dispute or do not pay their invoices, and any decreases or significant delays in payments could

have a material adverse effect on our business, results of operations and financial condition. These risks may be heightened as a result

of the COVID-19 pandemic and resulting economic downturn.

We

may become involved in disputes with our customers over the operation of our platform, the terms of our agreements or our billings for

purchases made by them through our platform. In the past, certain customers have sought to slow their payments to us or been forced into

filing for bankruptcy protection, resulting in delay or cancelation of their pending payments to us. These challenges have been exacerbated

by the COVID-19 pandemic and resulting economic impact, and a number of our customers are experiencing financial difficulties

and liquidity constraints. In certain cases, customers have been unable to timely make payments, and we have suffered losses. Certain

of our contracts with marketing agencies state that if their customer does not pay the agency, the agency is not liable to us, and we

must seek payment solely from their customer, a type of arrangement called sequential liability. Contracting with these agencies, which

in some cases have or may develop higher-risk credit profiles, may subject us to greater credit risk than if we were to contract directly

with the customer.

If we are unable to collect

customers’ fees on a timely basis or at all, we could incur write-offs for bad debt, which could have a material adverse effect

on our results of operations for the periods in which the write-offs occur. In the future, bad debt may exceed reserves for such contingencies,

and our bad debt exposure may increase over time. Any increase in write-offs for bad debt could have a materially negative effect on our

business, financial condition and operating results. Even if we are not paid by our customers on time or at all, we may still be obligated

to pay for the inventory we have purchased for our customers’ marketing campaigns, and consequently, our results of operations and

financial condition would be adversely impacted.

The reliability of some of our product solutions

is dependent on data and software from third-parties and the integrity and quality of that data and software..

Some of the data and software

that we use is licensed from third-party data suppliers, and we are dependent upon our ability to obtain necessary data licenses on commercially

reasonable terms. We could suffer material adverse consequences if our data suppliers were to withhold their data from us. For example,

data suppliers could withhold their data from us if there is a competitive reason to do so; if we breach our contract with a supplier;

if they are acquired by one of our competitors; if legislation is passed restricting the use or dissemination of the data they provide;

or if judicial interpretations are issued restricting use of such data. Additionally, we could terminate relationships with our data suppliers

if they fail to adhere to our data quality standards. If a substantial number of data suppliers were to withdraw or withhold their data

from us, or if we sever ties with our data suppliers based on their inability to meet our data standards, our ability to provide products

and services to our clients could be materially adversely impacted, which could result in decreased revenues.

The reliability of our solutions

depends upon the integrity and quality of the data provided us by our clients and that which we can license from third party providers.

A failure in the integrity or a reduction in the quality of our data could cause a loss of customer confidence in our solutions, resulting

in harm to our brand, loss of revenue and exposure to legal claims. We may experience an increase in risks to the integrity of our database

and quality of our data as we move toward real-time, non-identifiable, consumer- powered data through our products. We must continue to

invest in our database to improve and maintain the quality, timeliness and coverage of the data if we are to maintain our competitive

position. Failure to do so could result in a material adverse effect on our business, growth and revenue prospects.

Our business practices with respect to data

and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements

or industry standards relating to consumer privacy, data protection and consumer protection.

Federal, state and international

laws and regulations govern the collection, use, retention, sharing and security of data that we collect. We strive to comply with all

applicable laws, regulations, self-regulatory requirements and legal obligations relating to privacy, data protection and consumer protection,

including those relating to the use of data for marketing purposes. It is possible, however, that these requirements may be interpreted

and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. We cannot

assure you that our practices have complied, comply, or will comply fully with all such laws, regulations, requirements and obligations.

Any failure, or perceived failure, by us to comply with federal, state or international laws or regulations, including laws and regulations

regulating privacy, data security, marketing communications or consumer protection, or other policies, self-regulatory requirements or

legal obligations could result in harm to our reputation, a loss in business, and proceedings or actions against us by governmental entities,

consumers, retailers or others. We may also be contractually liable to indemnify and hold harmless performance marketing networks or other

third parties from the costs or consequences of noncompliance with any laws, regulations, self-regulatory requirements or other legal

obligations relating to privacy, data protection and consumer protection or any inadvertent or unauthorized use or disclosure of data

that we store or handle as part of operating our business. Any such proceeding or action, and any related indemnification obligation,

could hurt our reputation, force us to incur significant expenses in defense of these proceedings, distract our management, increase our

costs of doing business and cause consumers and retailers to decrease their use of our marketplace, and may result in the imposition of

monetary liability. Furthermore, the costs of compliance with, and other burdens imposed by, the data and privacy laws, regulations, standards

and policies that are applicable to the businesses of our clients may limit the use and adoption of, and reduce the overall demand for,

our products.

A significant breach of the

confidentiality of the information we hold or of the security of our or our customers’, suppliers’, or other partners’

computer systems could be detrimental to our business, reputation and results of operations. Our business requires the storage, transmission

and utilization of data. Although we have security and associated procedures, our databases may be subject to unauthorized access by third

parties. Such third parties could attempt to gain entry to our systems for the purpose of stealing data or disrupting the systems. We

believe we have taken appropriate measures to protect our systems from intrusion, but we cannot be certain that advances in criminal capabilities,

discovery of new vulnerabilities in our systems and attempts to exploit those vulnerabilities, physical system or facility break-ins and

data thefts or other developments will not compromise or breach the technology protecting our systems and the information we possess.

Furthermore, we face increasing cyber security risks as we receive and collect data from new sources, and as we and our customers continue

to develop and operate in cloud-based information technology environments. In the event that our protection efforts are unsuccessful,

and we experience an unauthorized disclosure of confidential information or the security of such information or our systems are compromised,

we could suffer substantial harm. Any breach could result in one or more third parties obtaining unauthorized access to our customers’

data or our data, including personally identifiable information, intellectual property and other confidential business information. Such

a security breach could result in operational disruptions that impair our ability to meet our clients’ requirements, which could

result in decreased revenues. Also, whether there is an actual or a perceived breach of our security, our reputation could suffer irreparable

harm, causing our current and prospective clients to reject our products and services in the future and deterring data suppliers from

supplying us data. Further, we could be forced to expend significant resources in response to a security breach, including repairing system

damage, increasing cyber security protection costs by deploying additional personnel and protection technologies, and litigating and resolving

legal claims, all of which could divert the attention of our management and key personnel away from our business operations. In any event,

a significant security breach could materially harm our business, financial condition and operating results.

Significant system disruptions, loss of

data center capacity or interruption of telecommunication links could adversely affect our business and results of operations.

Our product platform is hosted

and managed on Microsoft Azure Cloud servers and takes full advantage of open standards for processing, storage, security and big data

technology. Significant system disruptions, loss of data center capacity or interruption of telecommunication links could adversely affect

our business, results of operations and financial condition. Our business is heavily dependent upon highly complex data processing capability.

The ability of our platform hosts and managers to protect these data centers against damage or interruption from fire, flood, tornadoes,

power loss, telecommunications or equipment failure or other disasters is beyond our control and is critical to our ability to succeed.

We need to protect our intellectual property

or our operating results may suffer.

Third parties may infringe

our intellectual property and we may suffer competitive injury or expend significant resources enforcing our rights. As our business is

focused on data-driven results and analytics, we rely heavily on proprietary information technology. Our proprietary portfolio consists

of various intellectual property including source code, trade secrets, and know-how. The extent to which such rights can be protected

is substantially based on federal, state and common law rights as well as contractual restrictions. The steps we have taken to protect

our intellectual property may not prevent the misappropriation of our proprietary information or deter independent development of similar

technologies by others. If we do not enforce our intellectual property rights vigorously and successfully, our competitive position may

suffer which could harm our operating results.

We could incur substantial costs and disruption

to our business as a result of any claim of infringement of another party’s intellectual property rights, which could harm our business

and operating results.

From time to time, third parties

may claim that one or more of our products or services infringe their intellectual property rights. We analyze and take action in response

to such claims on a case-by-case basis. Any dispute or litigation regarding patents or other intellectual property could be costly and

time-consuming due to the complexity of our technology and the uncertainty of intellectual property litigation, which could divert the

attention of our management and key personnel away from our business operations. A claim of intellectual property infringement could force

us to enter into a costly or restrictive license agreement, which might not be available under acceptable terms or at all, or could subject

us to significant damages or to an injunction against development and sale of certain of our products or services.

We may be unable to maintain a competitive

technology advantage in the future.

Our ability to generate revenues

is substantially based upon our proprietary intellectual property that we own and protect through trade secrets and agreements with our

employees to maintain ownership of any improvements to our intellectual property. Our ability to generate revenues now and in the future

is based upon maintaining a competitive technology advantage over our competition. We can provide no assurances that we will be able to

maintain a competitive technology advantage in the future over our competitors, many of whom have significantly more experience, more

extensive infrastructure and are better capitalized than us.

We may not be able to integrate, maintain

and enhance our advertising solutions to keep pace with technological and market developments.

The market for digital advertising

solutions is characterized by rapid technological change, evolving industry standards and frequent introductions of new products and services.

To keep pace with technological developments, satisfy increasing publisher and advertiser requirements, maintain the attractiveness and

competitiveness of our advertising solutions and ensure compatibility with evolving industry standards and protocols, we will need to

anticipate and respond to varying product lifecycles, regularly enhance our current advertising solutions and develop and introduce new

solutions and functionality on a timely basis. This requires significant investment of financial and other resources. For example, we

will need to invest significant resources into expanding and developing our platforms in order to maintain a comprehensive solution. Ad

technology platforms and other technological developments may displace us or introduce an additional intermediate layer between us and

our customers and digital media properties that could impair our relationships with those customers.

If we default on our credit obligations,

our operations may be interrupted and our business and financial results could be adversely affected.

Vendors extend us credit

terms for the purchase of advertising inventory. We currently have outstanding payables to existing vendors. If we are unable to pay our

publishers in a timely fashion, they may elect to no longer sell us inventory to provide for sale to advertisers. Also, it may be necessary

for us to incur additional indebtedness to maintain operations of the Company. If we default on our credit obligations, our lenders and

debt financing holders may, among other things:

| ● | require

repayment of any outstanding obligations or amounts drawn on our credit facilities; |

| | | |

| ● | stop

delivery of ordered equipment; |

| | | |

| ● | discontinue

our ability to acquire inventory that is sold to advertisers; |

| | | |

| ● | require

us to accrue interest at higher rates; or |

| | | |

| ● | require

us to pay significant damages. |

If some or all of these events

were to occur, our operations may be interrupted and our ability to fund our operations or obligations, as well as our business, financial

results, and financial condition, could be adversely affected.

Risks Related to our Common Stock

and this Offering

There is a limited existing market

for our common stock and we do not know if a more liquid market for our common stock will develop to provide you with adequate liquidity.

Prior to this

offering, there has been a limited public market for our common stock as quoted on the OTC Pink, and a more active trading market for

our common stock may not develop or be maintained following this offering. You may not be able to sell your shares quickly or at the market

price if trading in our securities is not active. The public offering price for the shares of common stock will be determined by negotiations

between us and the underwriter and may not be indicative of prices that will prevail in the trading market. In the absence of an active

public trading market:

| ● | you

may not be able to resell your shares of common stock at or above the public offering price; |

| | | |

| ● | the

market price of our common stock may experience more price volatility; and |

| | | |

| ● | there

may be less efficiency in carrying out your purchase and sale orders. |

You may experience immediate and substantial

dilution in the net tangible book value per share of the common stock you purchase in the offering. In addition, we may issue additional

equity or convertible debt securities in the future, which may result in additional dilution to you.

The offering price per share in this offering may

exceed the net tangible book value per share of our common stock outstanding as of September 30, 2021. Assuming that we sell an

aggregate of 344,827,586 shares of our common stock for aggregate gross proceeds of $10,000,000, and after deducting estimated

aggregate offering expenses payable by us, you will experience immediate dilution of approximately $0.0028 per share, representing

the difference between our pro forma as adjusted net tangible book value per share as of September 30, 2021 after giving effect to

this offering and the assumed effective offering price. See the section titled “Dilution” below for a more detailed

illustration of the dilution you would incur if you participate in this offering.

Management

will have broad discretion in determining how to use the proceeds of this offering.

Our

management will have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering

in ways our stockholders may not agree with or that do not yield a favorable return, if at all. We currently intend to use the net proceeds

from this offering for general corporate purposes, including general working capital purposes. If we do not invest or apply the proceeds

of this offering in ways that improve our operating results, we may fail to achieve expected financial results, which could cause the

market price of our common stock to decrease.

Additional stock offerings in the future may dilute then existing

stockholders’ percentage ownership of our company.

Given our plans and expectations that we will need

additional capital, we anticipate that we will need to issue additional shares of common stock or securities convertible or exercisable

for shares of common stock, including convertible preferred stock, convertible notes, stock options or warrants. The issuance of additional

securities in the future will dilute the percentage ownership of then existing stockholders.

We have a substantial number of convertible

securities outstanding. The exercise of our outstanding warrants/options and conversion of our outstanding preferred shares can have a

dilutive effect on our common stock.

We have a substantial number of convertible

securities outstanding. The exercise of our outstanding options and conversion of our outstanding convertible preferred stock can

have a dilutive effect on our common stock. As of March 23, 2022, we had (i)

outstanding options to purchase approximately 890,733,332 shares of our common stock at a weighted average exercise price of $0.0093

per shares; (ii) outstanding warrants to purchase approximately 162,709,169 shares of our common stock at an exercise price of

$0.0479; and (iii) outstanding shares of our Series B, C, D, E, and G Preferred Stock that, upon conversion without regard to any

beneficial ownership limitations, would provide the holders with an aggregate of 966,611,711 shares of our common stock. The

issuance of shares of common stock upon exercise of outstanding options and warrant or conversion of preferred stock could result in

substantial dilution to our stockholders, which may have a negative effect on the price of our common stock.

FORWARD-LOOKING INFORMATION

The

prospectus and this prospectus supplement, including the documents that we incorporate by reference, contain forward-looking statements. These

statements are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking

statements include statements concerning:

| ● | our

possible or assumed future results of operations; |

| | | |

| ● | our

business strategies; |

| | | |

| ● | our

ability to attract and retain customers; |

| | | |

| ● | our

ability to sell additional products and services to customers; |

| | | |

| ● | our

cash needs and financing plans; |

| | | |

| ● | our

competitive position; |

| | | |

| ● | our

industry environment; |

| | | |

| ● | our

potential growth opportunities; |

| | | |

| ● | expected

technological advances by us or by third parties and our ability to leverage them; |

| | | |

| ● | the

effects of future regulation; and |

| | | |

| ● | the

effects of competition. |

All statements

in this prospectus supplement, the prospectus and the documents and information incorporated by reference in this prospectus supplement

and the documents and information incorporated by reference in the prospectus that are not historical facts are forward-looking statements.

We may, in some cases, use terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would” or similar expressions or the negative of such items

that convey uncertainty of future events or outcomes to identify forward-looking statements.

You

should read the prospectus and this prospectus supplement and the documents that we reference herein and therein and have filed as exhibits

to the registration statement, of which the prospectus and this prospectus supplement is part, completely and with the understanding that

our actual future results may be materially different from what we expect. You should assume that the information appearing in the prospectus

and this prospectus supplement is accurate as of the date on the front cover of the prospectus or this prospectus supplement only. Because

the risk factors referred to or incorporated by reference in this prospectus supplement could cause actual results or outcomes to differ

materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on

any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake

no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made

or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which

factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the

information presented in the prospectus and this prospectus supplement, and particularly our forward-looking statements, by these cautionary

statements.

USE OF PROCEEDS

We estimate that the net proceeds from this offering,

after deducting estimated offering expenses payable by us, will be approximately $9,765,000.

We intend to use

the net proceeds from this offering for working capital and general corporate purposes.

As of the date

of this prospectus supplement, we cannot specify with certainty all of the particular uses of the proceeds from this offering. We may

find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in using these proceeds.

Investors will be relying on our judgment regarding the use of the net proceeds from this offering. Pending the use of proceeds as described

above, we plan to invest the net proceeds that we receive in short-term and intermediate-term interest-bearing obligations, investment-grade

investments, certificates of deposit or direct or guaranteed obligations of the U.S. government. We cannot predict whether the invested

proceeds will yield a favorable return.

DILUTION

If you invest in our common stock, your interest

will be diluted immediately to the extent of the difference between the offering price per share and the as adjusted net tangible book

value per share of our common stock after this offering.

Our

net tangible book value as of September 30, 2021 was a surplus of approximately $2,471,154, or positive $0.0025 per share of common stock.

Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of our shares

of common stock outstanding as of that respective date.

After giving effect to the sale of an assumed aggregate of 344,827,586

shares of our common stock for aggregate gross proceeds of $10,000,000 (assuming the sale of the maximum offering amount, and based on

a number of shares equal to 112.5% of $10,000,000 divided by 90% of the closing price of our common stock of $0.0290 on March 28, 2022,

for an effective assumed offering price per share of $0.0290 ) in this offering, and after deducting estimated offering expenses payable

by us, our pro forma as adjusted net tangible book value as of September 30, 2021 would have been approximately ($12,471,154 ) million,

or approximately ($0.0092 ) per share of our common stock. This represents an immediate increase in net tangible book value of $0.0068

per share of our common stock to our existing stockholders and an immediate dilution in net tangible book value of approximately $0.0028

per share of our common stock to new investors. The following table illustrates per share dilution:

The

following table illustrates this dilution on a per share basis:

| Assumed effective offering price per share | |

$ | 0.0290 | |

| Net tangible book value per share as of September 30, 2021 | |

$ | 0.0025 | |

| | |

| | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 0.0068 | |

| | |

| | |

| Pro forma net tangible book value per share, to give effect to this offering | |

$ | 0.0092 | |

| Dilution per share to new investors participating in this offering | |

$ | 0.0028 | |

The

above discussion and table, prior to adjustments and the pro forma adjustment, are based on 1,007,953,473 shares of common stock issued

and outstanding as of September 30, 2021 and excludes:

| ● | 450,625,000

shares of common stock issuable upon conversion of 18,025 outstanding shares of Series B Preferred Stock; |

| | | |

| ● | 144,250,000

shares of common stock issuable upon conversion of 14,425 outstanding shares of Series C Preferred Stock; |

| | | |

| ● | 215,052,500

shares of common stock issuable upon conversion of 86,021 outstanding shares of Series D Preferred Stock; |

| | | |

| ● | 20,000,000

shares of common stock issuable upon conversion of 10,000 outstanding shares of Series E Preferred Stock; |

| | | |

| ● | 136,684,211

shares of common stock issuable upon conversion of 2,597 outstanding shares of Series G Preferred Stock; |

| | | |

| ● | 890,733,332

shares of common stock issuable upon exercise of outstanding stock options, with a weighted average exercise price of $.0093 per share; |

| | | |

| ● | 151,000,000

shares of common stock issuable upon exercise of common stock warrants, with an exercise price of $0.0454; and |

| | | |

| ● | 10,714,286

shares of common stock issuable upon exercise of common stock warrants, with an exercise price of $.0875. |

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

In this offering, we are offering

shares of our common stock. The material terms and provisions of our common stock are described under the captions “Description

of Capital Stock” beginning on page 10 of the accompanying prospectus.

PLAN OF DISTRIBUTION

We are filing this prospectus

supplement to cover the offer and sale of up to $10,000,000 of shares of our common stock, which we may sell from time to time in our

sole discretion to GHS over the next year, subject to the conditions and limitations in the Purchase Agreement.

We entered into the Purchase

Agreement with GHS on March 28, 2022. The Purchase Agreement provides that, upon the terms and subject to the conditions set forth therein,

GHS is committed to purchase an aggregate of up to $10,000,000 of shares of our common stock over the one-year term of the Purchase Agreement.

See “The Offering—Purchase Agreement with GHS Investments, LLC.” GHS may be deemed to be an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act.

The Company has the right,

in its sole discretion, subject to the conditions and limitations in the Purchase Agreement, to direct GHS, by delivery of a purchase

notice from time to time (a “Purchase Notice”) to purchase (each, a “Purchase”) over the one-year term of the

Purchase Agreement, a minimum of a minimum of $10,000 and up to a maximum of the lower of: (1) one hundred percent (100%) of the average

daily trading dollar volume of the Company’s common stock during the ten trading days preceding the Purchase Date; or (2) one million

dollars ($1,000,000), provided that the parties may agree to waive such limitations. The aggregate value of Purchase Shares sold to GHS

may not exceed $10,000,000. Each Purchase Notice will set forth the Purchase Price and number of Purchase Shares in accordance with the

terms of the Purchase Agreement.

The number of Purchase Shares

we will issue under each Purchase will be equal to 112.5% of the Purchase Amount sold under such Purchase, divided by the Purchase Price

per share (as defined in the Purchase Agreement).

The Purchase Price is defined

as the lower of (a) 90% of the lowest volume weighted average price during the Valuation Period; or (b) the Closing Price for our common

stock on the trading day preceding the date of the Purchase Notice. The Purchase Price will be subject to a floor of $.01 per share, at

or below which the Company will not deliver a Purchase Notice. The Valuation Period is the ten consecutive business days immediately preceding,

but not including, the date a Purchase Notice is delivered. The Company may not deliver a Purchase Notice prior to five business days

from the most recent receipt by GHS’s broker of Purchase Shares, except as the parties may otherwise agree.

We estimate our total expenses

for this offering, assuming we sell the maximum offering amount of $10,000,000, will be approximately $235,000.

This offering will terminate

on the date that all shares offered by this prospectus supplement have been sold or, if earlier, the expiration or termination of the

Purchase Agreement. We and GHS each have the right to terminate the Purchase Agreement at any time upon thirty days notice. In the event

of bankruptcy proceedings by or against us, the Purchase Agreement will automatically terminate without action of any party.

LEGAL MATTERS

The validity of the securities being offered under

this prospectus by us will be passed upon for us by Sichenzia Ross Ference LLP, New York, New York.

EXPERTS

The financial statements

incorporated by reference into this prospectus have been so included in reliance on the reports of M&K CPAs, PLLC, an independent

registered public accounting firm, related to the consolidated financial statements as of December 31, 2020 and 2019 and for the

years then ended, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of

the Exchange Act and file annual, quarterly and current reports, and other information with the SEC. These reports, proxy statements and

other information are available at the SEC’s website at http://www.sec.gov.

This prospectus supplement and the accompanying

prospectus are only part of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act and therefore

omit certain information contained in the registration statement. We have also filed exhibits and schedules with the registration statement

that are excluded from this prospectus supplement and the accompanying prospectus, and you should refer to the applicable exhibit or schedule

for a complete description of any statement referring to any contract or other document. The registration statement, including the exhibits

and schedules, without charge, are available at the SEC’s website.

We also maintain a website at www.cloudcommerce.com,

through which you can access our SEC filings. The information set forth on our website is not part of this prospectus supplement or the

accompanying prospectus.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows

us to “incorporate by reference” into this prospectus the information that we file with them, which means that we can disclose

important information to you by referring you to those documents. The information incorporated by reference is considered to be part of

this prospectus, and information that we file later with the SEC will automatically update and supersede this information. The following

documents are incorporated by reference and made a part of this prospectus:

| ● | our Annual Report on Form 10-K and Form 10-K/A for

the fiscal year ended December 31, 2020 (filed with the SEC on March 15, 2021 and March 18, 2021, respectively); |

| ● | Our Quarterly Reports on Form 10-Q for the quarter ended

March 31, 2021 (filed with the SEC on May 17, 2021), for the quarter ended June 30, 2021 (filed with the SEC on August 16, 2021),

and for the quarter ended September 30, 2021 (filed with the SEC on November 15, 2021); |

| ● | our Current Reports on Form 8-K filed with the SEC on January 11, 2021, January 15, 2021, February 2, 2021, February 9, 2021, February 22, 2021, March 8, 2021, March 22, 2021, April 19, 2021,

August 6, 2021, October 1, 2021, October 12, 2021, October 26, 2021, November 4, 2021, December 3, 2021; |

| ● | The description of our common stock contained in Exhibit 4.2 to

our Annual Report on Form 10-K for the year ended December 31, 2020; and |

| ● | all reports and other documents subsequently filed by us pursuant

to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of this offering. |

Nothing in this

prospectus shall be deemed to incorporate information furnished but not filed with the SEC (including without limitation, information

furnished under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Any statement contained

in this prospectus or in a document incorporated or deemed to be incorporated by, reference in this prospectus shall be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained herein or in the applicable prospectus supplement

or in any other subsequently filed document which also is or is deemed to be incorporated by reference modifies or supersedes the statement.

Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

The information

about us contained in this prospectus should be read together with the information in the documents incorporated by reference. You may

request a copy of any or all of these filings, at no cost, by writing or telephoning us at: AiAdvertising, Inc. 321 Sixth Street, San

Antonio, TX 78215. Our telephone number is +1-805-964-3313. Information about us is also available at our website at www.aiadvertising.com

However, the information in our website is not a part of this prospectus and is not incorporated by reference.

Prospectus

CloudCommerce,

Inc.

$100,000,000

COMMON STOCK

PREFERRED STOCK

WARRANTS

SUBSCRIPTION RIGHTS

DEPOSITARY SHARES

PURCHASE CONTRACTS

UNITS

We may offer and sell from time to time, in one or more series or issuances

and on terms that we will determine at the time of the offering, any combination of the securities listed below and described in this

prospectus, up to an aggregate amount of $100,000,000:

| ● | warrants to purchase our securities; |

| ● | subscription rights to purchase

any of the foregoing securities; |

| ● | units comprised of, or other

combinations of, the foregoing securities. |

We may offer and sell these securities separately or together, in one

or more series or classes and in amounts, at prices and on terms described in one or more offerings. We may offer securities through underwriting

syndicates managed or co-managed by one or more underwriters or dealers, through agents or directly to purchasers. The prospectus supplement

for each offering of securities will describe in detail the plan of distribution for that offering. For general information about the

distribution of securities offered, please see “Plan of Distribution” in this prospectus.

Each time our securities are offered, we will provide a prospectus

supplement containing more specific information about the particular offering and attach it to this prospectus. The prospectus supplements

may also add, update or change information contained in this prospectus. This prospectus may not be used to offer or sell securities

without a prospectus supplement which includes a description of the method and terms of this offering.

In addition, we have registered for resale by means of separate prospectus

(the “Selling Stockholder Prospectus”) 38,001,563 outstanding shares of common stock held by certain Selling Stockholders

named in the Selling Stockholder Prospectus and up to 10,912,852 shares of common stock issuable upon exercise of warrants held by the

Selling Stockholders. Sales of our securities registered in this prospectus and in the Selling Stockholder Prospectus may result in two

offerings taking place sequentially or concurrently, which could affect the price and liquidity of, and demand for, our securities.

Our common stock is quoted on the OTC Pink market under the symbol

“CLWD.” The last reported sale price of our common stock on OTC Pink market on February 12, 2021, was $0.1285 per share. On

December 11, 2020, it was $0.006.

During calendar year 2020, our common stock traded at a low of $0..001

and a high of $0.0163. From the beginning of 2021 through February 12, 2021, our common stock traded at a low of $0.00596 and a high of

$0.185. We do not believe that this volatility corresponds to any recent change in our financial condition. However, our recent launch

of an artificial intelligence (AI) venture focused on using AI to enhance our existing SWARM solution with the goal of cutting advertising

costs, as well as conditions in the financial markets generally, may have caused or contributed to this volatility. The stock market in

general, and the market for technology companies in particular, have experienced extreme price and volume fluctuations that have often

been unrelated or disproportionate to the operating performance of those companies.

If we decide to seek a listing or qualification for trading of any

preferred stock, warrants, subscriptions rights, depositary shares or units offered by this prospectus, the related prospectus supplement

will disclose the exchange or market on which the securities will be listed or traded, if any, or where we have made an application for

listing or trading, if any.

Investing in our securities involves a high degree of risk, including

but not limited to the volatility of our stock price, which may cause the price of any securities we may offer hereunder to decline below

the initial offering price. See “Risk Factors” beginning on page 4 and the risk factors in our most recent Annual Report on

Form 10-K, which are incorporated by reference herein, as well as in any other more recently filed annual, quarterly or current reports

and, if any, in the relevant prospectus supplement. We urge you to carefully read this prospectus and the accompanying prospectus supplement,

together with the documents we incorporate by reference, describing the terms of these securities before investing.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this Prospectus is February 16, 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that

we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. Under this shelf registration

process, we may offer and sell, either individually or in combination, in one or more offerings, any of the securities described in this

prospectus, for total gross proceeds of up to $100,000,000. This prospectus provides you with a general description of the securities

we may offer. Each time we offer securities under this prospectus, we will provide a prospectus supplement to this prospectus that will

contain more specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be

provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing

prospectus that we may authorize to be provided to you may also add, update or change any of the information contained in this prospectus

or in the documents that we have incorporated by reference into this prospectus.

We urge you to read carefully this prospectus, any applicable prospectus

supplement and any free writing prospectuses we have authorized for use in connection with a specific offering, together with the information

incorporated herein by reference as described under the heading “Incorporation of Documents by Reference,” before investing

in any of the securities being offered. You should rely only on the information contained in, or incorporated by reference into, this

prospectus and any applicable prospectus supplement, along with the information contained in any free writing prospectuses we have authorized

for use in connection with a specific offering. We have not authorized anyone to provide you with different or additional information.

This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is

lawful to do so.

The information appearing in this prospectus, any applicable prospectus

supplement or any related free writing prospectus is accurate only as of the date on the front of the document and any information we

have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery

of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

This prospectus contains summaries of certain provisions contained

in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries

are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed

or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain

copies of those documents as described below under the section entitled “Where You Can Find Additional Information.”

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement and the

documents incorporated by reference herein may contain forward looking statements that involve risks and uncertainties. All statements

other than statements of historical fact contained in this prospectus and any accompanying prospectus supplement and the documents incorporated

by reference herein, including statements regarding future events, our future financial performance, business strategy, and plans and

objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements

by terminology including “anticipates,” “believes,” “can,” “continue,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although

we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined

under “Risk Factors” or elsewhere in this prospectus and the documents incorporated by reference herein, which may cause our

or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time

to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking

statements.

We have based these forward-looking statements largely on our current

expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations,

business strategy, short term and long term business operations, and financial needs. These forward-looking statements are subject to

certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements.

Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this prospectus, and in

particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file

with the Securities and Exchange Commission (the “Commission”). This prospectus should be read in conjunction with the consolidated

financial statements as of and for the years ended December 31, 2019 and 2018, and as of, and for the three and nine months ended September

30, 2020 and 2019, and related notes thereto, incorporated by reference into this prospectus. We undertake no obligation to revise or

publicly release the results of any revision to these forward-looking statements, except as required by law. In light of these risks,

uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results

could differ materially and adversely from those anticipated or implied in the forward-looking statement. You should not place undue reliance

on any forward-looking statement, each of which applies only as of the date of this prospectus. You are advised, however, to consult any

further disclosures we make on related subjects in our reports on Forms 10-K, 10-Q and 8-K filed with the Commission after the date of

this prospectus.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere

in this prospectus. This summary does not contain all the information that you should consider before investing in our Company. You should

carefully read the entire prospectus, including all documents incorporated by reference herein. In particular, attention should be directed

to our “Risk Factors,” “Information with Respect to the Company,” “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise

incorporated by reference hereto, before making an investment decision.

All references herein to “CloudCommerce,”

“we,” “us,” “our,” and the “Company” mean CloudCommerce, Inc. and its subsidiaries.

Business Overview

CloudCommerce is a leading provider of digital advertising solutions.

Our flagship solution, SWARM, analyzes a robust mix of audience data to help businesses find who to talk to, what to say to them, and

how to market to them. We do this by applying advanced data science, behavioral science, artificial intelligence, and market research

techniques to discover, develop and create custom audiences for highly targeted digital marketing campaigns.

SWARM- An Audience Intelligence Solution

SWARM is an end-to-end solution that helps businesses find who to talk

to, what to say to them, and how to motivate them to take meaningful action. It does this by applying advanced data science, behavioral

science, artificial intelligence, and market research techniques to discover, develop and create custom audiences for any business activity.

With applications, such as marketing, brand perception, customer relationship management, human resources management and operational logistics,

SWARM delivers powerful audience-driven business intelligence to convert opportunities into business success.

The Problem

Marketers have largely taken a blanket approach to communication. The

same message is often sent across an entire customer audience with little regard for how different groups of people communicate, build

communities, and develop their purchasing habits. When they do segment audiences, they tend to use very objective selection criteria,

such as income, geography, education or purchase history to deduce attitudes or intentions.

However, research has shown that attitudes and intentions are weak

predictors of behavior, which is ultimately what marketers want to influence and affect. Instead, we believe motivations and feelings

are much better at predicting behavior. But they are also can be the hardest to deduce from audience data.

The Solution – SWARM

SWARM is a behavioral science approach to audience creation and communication.

It helps marketers probe deep consumer motivations and triggers, in order to effectively predict and influence their actions. We believe

if marketers can influence action, they can get people to buy, change the opinion of, or support a particular brand, business, or person.

There are 4 major products in SWARM:

BUZZ - Behavior Based Market Research

We believe that market research is evolving and that the techniques

being developed today are more sophisticated and backed by strong data science. Despite these changes, many traditional research firms

have failed to innovate, including: small sample sizes, survey design bias, improper weighting, and gut intuition sampling are just some

of the issues that plague the industry. BUZZ is designed with the ability to put a finger on the pulse of the marketplace in the moment.

It does this by deducing attitudes, emotions, and opinions from various internal and external data sources such as customer data, social

media activity, or micro and macro trends. We have automated the market research process that we believe provides a level of statistical

depth beyond what traditional firms can offer.

THE SWARM – Intelligent Audience Building

The core of our solution, and what we believe separates us from other

audience data companies, is our unique approach to audience building. The concept of ‘personas’ has been around for decades,

but we aim take that general concept to the next level. THE SWARM was developed to solve not only who to talk to, but also what to say

to them, and how to motivate them to take meaningful action. Using our proprietary clustering and behavioral analysis techniques, we believe

we are able to create audiences that are more efficient, targeted, and focused than traditional methods. Our clustering is designed to

not only finds the right people to talk to, but also the message that motivate them.

HIVE – Redefined Geographic Targeting

Our approach is that conventional geographic audience targeting is

outdated. Arbitrary units of location like counties, cities, DMAs, and regions were created hundreds of years ago based on land rights

ownership. We believe their use in understanding people’s behavior, purchase habits, and underlying values is minimal. We try to

solve this by clustering people into granular geographic tribes, called “Hives.” We define Hives by attributes such as common

language (e.g., colloquialisms), shared experience and narratives (e.g., climate, history), and concentrated demography and biology (e.g.,

ethnicity, age). Based on the needs of our clients, we can redraw the geographic lines based on various Hive selection criteria, which

can make marketing more efficient, business decisions more intelligent, and growth more plausible.

HONEY – Advanced Reporting and Visualization

We believe advanced audience data analysis technologies are useless

if it doesn’t produce simple, powerful and actionable business intelligence. HONEY comes with user-friendly reporting and visualization

tools intended to organize and explain all of the advance data science into a simple to understand format for decision makers. HONEY is

designed to combine the intelligence of client CRM data with third-party consumer data and targeted market research to create a powerful

foundation for any audience intelligence solution.

Comprehensive Product Ecosystem

We are constantly striving to help our clients better understand both

their current audience and the larger marketplace. Our team has developed a series of products intended to challenge the status quo of

how intelligence is done within the marketing industry. Each of our products can stand alone, but grow more powerful as part of a larger

ecosystem.

Core Services

Together with its wholly-owned subsidiaries, CloudCommerce can deliver

end-to-end marketing solutions through a range of services and capabilities. SWARM implementations can include some or all of these capabilities.

Data Propria – Data Analytics

To deliver the highest Return on Investment (“ROI”) for

our customers’ digital marketing campaigns, we utilize sophisticated data science to identify the correct universes to target relevant

audiences. Our ability to understand and translate data drives every decision we make. By listening to and analyzing our customers’

data we are able to make informed decisions that positively impact our customers’ business. We leverage industry-best tools to aggregate

and visualize data across multiple sources, and then our data and behavioral scientists segment and model that data to be deployed in

targeted marketing campaigns. We have data analytics expertise in retail, wholesale, distribution, logistics, manufacturing, political,

and several other industries.

Parscale Digital – Digital Marketing

We help our customers get their message out, educate their market and

tell their story. We do so creatively and effectively by deploying powerful call-to-action digital campaigns with national reach and boosting

exposure and validation with coordinated advertising in print media. Our fully-developed marketing plans are founded on sound research

methodologies, brand audits and exploration of the competitive landscape. Whether our customer is a challenger brand, a political candidate,

or a well-known household name, our strategists are skillful at leveraging data and creating campaigns that move people to make decisions.

Giles Design Bureau – Branding and Creative Services

We approach branding from a “big picture” perspective,

establishing a strong identity and then building on that to develop a comprehensive branding program that tells our customer’s story,

articulates what sets our customer apart from their competitors and establishes our customer in their market.

WebTegrity – Development and Managed Infrastructure Support

Commerce-focused, user-friendly digital websites and apps elevates

our customer’s marketing position and draw consumers to their products and services. Our platform-agnostic approach allows us to

architect and build solutions that are the best fit for each customer. Once the digital properties are built, our experts will help manage