West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or

“WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) is

pleased to announce that it has entered into an agreement with

Raymond James Ltd. as sole bookrunner, on behalf of a syndicate of

underwriters (collectively, the “Underwriters”), pursuant to which

the Underwriters have agreed to purchase, on a “bought deal” basis,

27,778,000 units (the “Units”) and 11,236,000 charity-flow through

units (the “Charity Flow-Through Units”) of the Company at a price

of C$0.72 per Unit (the “Unit Issue Price”) and C$0.89 per Charity

Flow-Through Unit (the “Charity Flow-Through Issue Price”),

respectively, for aggregate gross proceeds to the Company of

approximately C$30 million (the “Offering”).

Each Unit will consist of one common share of

the Company (“Common Shares”) and one-half of one common share

purchase warrant (each whole common share purchase warrant, a

“Warrant”). Each Warrant will entitle the holder to acquire one

common share of the Company for an exercise price of $1.00 per

share for 24 months from the Closing Date. The Warrants will be

subject to an acceleration provision pursuant to which, in the

event that the ten (10) trading day volume weighted average closing

price of the Company’s Shares on the TSX Venture Exchange (the

“TSX-V”) is equal to or greater than $1.70 (or such other price to

be determined and agreed to by both RJL and the Company), then the

Company will earn the right, by providing notice to the Warrant

holder(s) (the “Acceleration Notice”), to accelerate the expiry

date of the Warrants to that date which is 30 days from the date of

the Acceleration Notice.

The Company has agreed to grant the Underwriters

an over-allotment option to purchase up to an additional 15% of the

aggregate number of Units at the Unit Issue Price, exercisable in

whole or in part at any time for a period ending 30 days from the

closing of the Offering.

The net proceeds pursuant to the issuance of the

Units are expected to be used to continue to advance the

development of a restart plan for the Madsen Gold Mine as well as

for working capital and general corporate purposes. The gross

proceeds pursuant to the issuance of the Charity Flow-Through Units

will be used to incur qualifying Canadian development expenses on

the Company’s assets.

The Units and Charity Flow-Through Units will be

offered under the short form base shelf prospectus (the “Base

Prospectus”) of the Company dated April 30, 2024, as supplemented

by a shelf prospectus supplement (the “Supplement”) to be prepared

and filed in each of the provinces of Canada, other than the

Province of Quebec (collectively, the “Jurisdictions”). The

Units will also be offered by way of a private placement in the

United States, and in those jurisdictions outside of Canada and the

United States which are agreed to by the Company and the

Underwriters, where the Units can be issued on a private placement

basis, exempt from any prospectus, registration or other similar

requirements.

The Offering is expected to close on or about

May 15, 2024 and is subject to certain conditions including, but

not limited to, the receipt of all necessary approvals, including

the approval of the TSX Venture Exchange.

The securities have not been, and will not be,

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any U.S. state securities

laws, and may not be offered or sold in the United States without

registration under the U.S. Securities Act and all applicable state

securities laws or compliance with the requirements of an

applicable exemption therefrom. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy

securities in the United States, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About West Red Lake Gold

Mines

West Red Lake Gold Mines Ltd. is a mineral

exploration company that is publicly traded and focused on

advancing and developing its flagship Madsen Gold Mine and the

associated 47 km2 highly prospective land package in the Red Lake

district of Ontario. The highly productive Red Lake Gold District

of Northwest Ontario, Canada has yielded over 30 million ounces of

gold from high-grade zones and hosts some of the world’s richest

gold deposits. WRLG also holds the wholly owned Rowan Property in

Red Lake, with an expansive property position covering 31 km2

including three past producing gold mines – Rowan, Mount Jamie, and

Red Summit.

On behalf of West Red Lake Gold Mines Ltd.

“Shane Williams”

Shane

Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Freddie Leigh

Tel: (604) 609-6132

Email: investors@westredlakegold.com or visit the

Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward looking information

Certain statements contained in this news

release may constitute “forward-looking information” within the

meaning of applicable securities laws. Forward-looking information

generally can be identified by words such as “anticipate”,

“expect”, “estimate”, “forecast”, “planned”, and similar

expressions suggesting future outcomes or events. Forward-looking

information is based on current expectations of management;

however, it is subject to known and unknown risks, uncertainties

and other factors that may cause actual results to differ

materially from the forward-looking information in this news

release and include without limitation, statements relating to the

closing of the Offering, the exercise of the over-allotment option

and the expected closing date of the Offering. Readers are

cautioned not to place undue reliance on forward-looking

information.

Forward‐looking information involve numerous

risks and uncertainties and actual results might differ materially

from results suggested in any forward-looking information. These

risks and uncertainties include, among other things, market

volatility; the state of the financial markets for the Company’s

securities; fluctuations in commodity prices and changes in the

Company’s business plans. Forward-looking information is based on a

number of key expectations and assumptions, including without

limitation, that the Company will continue with its stated business

objectives and its ability to raise additional capital to proceed.

Although management of the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such forward-looking information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such forward-looking information. Accordingly,

readers should not place undue reliance on forward-looking

information. Readers are cautioned that reliance on such

information may not be appropriate for other purposes. Additional

information about risks and uncertainties is contained in the

Company’s management’s discussion and analysis for the year ended

November 30, 2023, and the Company’s annual information form for

the year ended November 30, 2023, copies of which are available on

SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management’s

current beliefs and is based on information currently available to

the Company. The forward-looking information is made as of the date

of this news release and the Company assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For more information on the Company, investors

should review the Company’s continuous disclosure filings that are

available on SEDAR+ at www.sedarplus.ca.

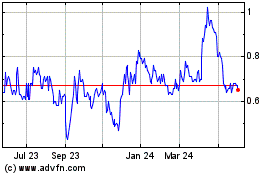

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Dec 2024 to Jan 2025

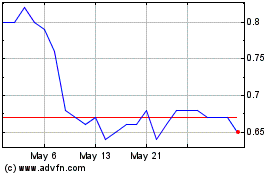

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Jan 2024 to Jan 2025