Constellation Software Inc. and Topicus.com Inc. Announce Results for Topicus.com Inc. for the Fourth Quarter and Year Ended December 31, 2021

February 08 2022 - 5:01PM

Topicus.com Inc. (TSXV:TOI) in a joint release with Constellation

Software Inc. (TSX:CSU) today announced financial results for

Topicus.com Inc. (“Topicus” or the “Company”) for the fourth

quarter and year ended December 31, 2021. Please note that all

amounts referred to in this press release are in Euros unless

otherwise stated.

The following press release should be read in

conjunction with the Annual Consolidated Financial Statements of

Topicus.com Inc. (or the “Company”) for the year ended December 31,

2021, which we prepared in accordance with International Financial

Reporting Standards (“IFRS”) and the Company’s annual Management’s

Discussion and Analysis for the year ended December 31, 2021, which

can be found on SEDAR at www.sedar.com and on Topicus.com Inc.’s

website www.topicus.com. Additional information about Topicus.com

Inc. is also available on SEDAR at www.sedar.com.

Q4 2021 Headlines:

- Revenue increased 51% (10% organic

growth) to €207.6 million compared to €137.4 million in Q4

2020.

- Net income increased to €27.0

million (-€0.17 on a diluted per share basis) from €12.9 million

(€0.11 on a diluted per share basis) in Q4 2020.

- A number of acquisitions were

completed for aggregate cash consideration of €76.3 million (which

includes acquired cash). Deferred payments associated with these

acquisitions have an estimated value of €7.6 million resulting in

total consideration of €83.9 million.

- Cash flows from operations ("CFO")

increased €12.5 million to €42.8 million compared to €30.3 million

in Q4 2020.

- Free cash flow available to

shareholders1 ("FCFA2S") increased €5.3 million to €21.3 million

compared to €16.0 million in Q4 2020.

2021 Headlines:

- Revenue increased 50% (8% organic

growth) to €742.5 million compared to €494.0 million in 2020.

- Net loss was €2,222.2 million

(€30.16 on a diluted per share basis) compared to net income of

€63.7 million (€0.54 on a diluted per share basis) in 2020.

- A number of acquisitions were

completed for total consideration of €338.0 million including

holdbacks, contingent consideration and amounts related to

Topicus.com B.V.

- Cash flows from operations (“CFO”)

increased €24.6 million to €176.4 million compared to €151.9

million in 2020.

- Free cash flow available to

shareholders1 (“FCFA2S”) increased €0.8 million to €87.5 million

compared to €86.8 million in 2020.

Total revenue for the quarter ended December 31,

2021 was €207.6 million, an increase of 51%, or €70.2 million,

compared to €137.4 million for the comparable period in 2020. For

the year ending December 31, 2021 total revenues were €742.5

million, an increase of 50%, or €248.6 million, compared to €494.0

million for the comparable period in 2020. The increase for both

the three and twelve month periods compared to the same periods in

the prior year is primarily attributable to growth from

acquisitions as the Company experienced organic growth of 10% and

8% respectively. Organic growth is not a standardized

financial measure and might not be comparable to measures disclosed

by other issuers.

Net income for the quarter ended December 31,

2021 was €27.0 million compared to net income of €12.9 million for

the same period in 2020. On a per share basis, this translated into

net loss per basic and diluted share of €0.17 in the quarter ended

December 31, 2021 compared to net income per basic share of €0.22

and diluted share of €0.11 for the same period in 2020. The net

loss per basic and diluted share for the quarter ended December 31,

2021 results from €15.0 million being attributed to non-controlling

interests and a €25.7 million dividend that was accrued to the

preferred shareholders of Topicus subsequent to the notification of

conversion. For the year ended December 31, 2021, net loss was

€2,222.2 million or a net loss of €30.16 per basic and diluted

share compared to income of €63.7 million or €1.08 per basic share

and €0.54 per diluted share for the same period in 2020.

For the quarter ended December 31, 2021, CFO

increased €12.5 million to €42.8 million compared to €30.3 million

for the same period in 2020 representing an increase of 41%. For

the year ended December 31, 2021, CFO increased €24.6 million to

€176.4 million compared to €151.9 million for the same period in

2020 representing an increase of 16%.

For the quarter ended December 31, 2021, FCFA2S

increased €5.3 million to €21.3 million compared to €16.0 million

for the same period in 2020 representing an increase of 33%. For

the fiscal year ended December 31, 2021, FCFA2S increased €0.8

million to €87.5 million compared to €86.8 million for the 2020

fiscal year representing an increase of 1%.

Subsequent Events

On January 31, 2022, a dividend was paid in cash

on the Topicus Preferred Shares and Topicus Coop Preference Units

in the aggregate amount of €66.6 million. €40.4 million was paid to

CSI, €20.2 million was paid to the Joday Group and €6.0 million was

paid to Ijssel B.V.

On February 1, 2022, all of the issued and

outstanding Topicus Preferred Shares and Topicus Coop Preference

Units were converted to Topicus Subordinate Voting Shares and

Topicus Coop Ordinary Units respectively. Subsequent to the

conversion, Topicus will reflect an equity interest of 61.56% in

Topicus Coop and a non-controlling interest of 38.44%.

Forward Looking Statements

Certain statements herein may be “forward

looking” statements that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Topicus or the industry to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward looking statements involve significant risks

and uncertainties, should not be read as guarantees of future

performance or results, and will not necessarily be accurate

indications of whether or not such results will be achieved. A

number of factors could cause actual results to vary significantly

from the results discussed in the forward looking statements. These

forward looking statements reflect current assumptions and

expectations regarding future events and operating performance and

are made as of the date hereof and Topicus assumes no obligation,

except as required by law, to update any forward looking statements

to reflect new events or circumstances.

Non-IFRS Measures

Free cash flow available to shareholders

‘‘FCFA2S’’ refers to net cash flows from operating activities less

interest paid on lease obligations, interest paid on other

facilities, credit facility transaction costs, repayments of lease

obligations, and property and equipment purchased, and includes

interest and dividends received. The portion of this amount

applicable to non-controlling interests is then deducted. We

believe that FCFA2S is useful supplemental information as it

provides an indication of the uncommitted cash flow that is

available to shareholders if we do not make any acquisitions, or

investments, and do not repay any debts. While we could use the

FCFA2S to pay dividends or repurchase shares, our objective is to

invest all of our FCFA2S in acquisitions which meet our hurdle

rate.

FCFA2S is not a recognized measure under IFRS

and may not be comparable to similar financial measures disclosed

by other issuers. Accordingly, readers are cautioned that FCFA2S

should not be construed as an alternative to net cash flows from

operating activities.

The following table reconciles FCFA2S to net

cash flows from operating activities:

| |

|

|

Three months ended December 31, |

|

|

|

Year ended December 31, |

|

| |

|

|

2021 |

|

2020 |

|

|

|

|

2021 |

|

2020 |

|

|

| |

|

(€ in millions, except percentages) |

|

(€ in millions, except percentages) |

| |

|

|

|

|

|

|

|

|

|

|

| Net

cash flows from operating activities |

|

|

42.8 |

|

30.3 |

|

|

|

|

176.4 |

|

151.9 |

|

|

|

Adjusted for: |

|

|

|

|

|

|

|

|

|

|

| Interest

paid on lease obligations |

|

|

(0.3 |

) |

(0.3 |

) |

|

|

|

(1.2 |

) |

(1.0 |

) |

|

| Interest

paid on other facilities |

|

|

(2.0 |

) |

(1.2 |

) |

|

|

|

(7.9 |

) |

(4.6 |

) |

|

| Credit

facility transaction costs |

|

|

(0.2 |

) |

- |

|

|

|

|

(2.5 |

) |

- |

|

|

| Payments of

lease obligations |

|

|

(4.5 |

) |

(4.3 |

) |

|

|

|

(17.5 |

) |

(13.8 |

) |

|

| Property and

equipment purchased |

|

|

(2.2 |

) |

(0.6 |

) |

|

|

|

(5.4 |

) |

(2.4 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

33.6 |

|

23.9 |

|

|

|

|

142.0 |

|

130.1 |

|

|

| Less amount

attributable to |

|

|

|

|

|

|

|

|

|

|

|

non-controlling interests |

|

|

(12.3 |

) |

(8.0 |

) |

|

|

|

(54.5 |

) |

(43.3 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| Free cash

flow available to shareholders |

|

|

21.3 |

|

16.0 |

|

|

|

|

87.5 |

|

86.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Due to

rounding, certain totals may not foot. |

|

|

|

|

|

|

|

|

|

|

| Comparative financial

information amended to reflect the Combination as if it occurred

before the start of the earliest period presented. |

About Topicus.com Inc.

Topicus’ subordinate voting shares are listed on

the Toronto Venture Stock Exchange under the symbol "TOI". Topicus

acquires, manages and builds vertical market software

businesses.

About Constellation Software

Inc.

Constellation's common shares are listed on the

Toronto Stock Exchange under the symbol "CSU". Constellation

acquires, manages and builds vertical market software

businesses.

For further information:Jamal

BakshChief Financial Officer (416) 861-9677

info@topicus.comwww.topicus.com

SOURCE: TOPICUS.COM

INC.

_____________________________

- See Non-IFRS measures.

|

|

|

Topicus.com Inc. |

|

Consolidated Statements of Financial

Position |

|

(In thousands of euros, except per share amounts. Due to rounding,

numbers presented may not foot.) |

| |

|

|

|

|

|

|

December 31, 2021 |

December 31, 2020 |

| |

|

|

|

|

Assets |

|

|

| |

|

|

|

|

Current assets: |

|

|

| |

Cash |

75,326 |

|

55,635 |

|

| |

Accounts

receivable |

70,725 |

|

46,644 |

|

| |

Unbilled

revenue |

32,592 |

|

12,609 |

|

| |

Inventories |

570 |

|

375 |

|

| |

Other

assets |

21,776 |

|

14,461 |

|

| |

|

200,989 |

|

129,724 |

|

| |

|

|

|

|

Non-current assets: |

|

|

| |

Property and

equipment |

15,326 |

|

8,782 |

|

| |

Right of use

assets |

54,382 |

|

50,517 |

|

| |

Deferred

income taxes |

6,831 |

|

1,946 |

|

| |

Other

assets |

6,655 |

|

3,956 |

|

| |

Intangible assets |

744,136 |

|

446,213 |

|

| |

|

827,330 |

|

511,415 |

|

| |

|

|

|

|

Total assets |

1,028,319 |

|

641,139 |

|

| |

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

| |

|

|

|

|

Current liabilities: |

|

|

| |

Revolving

credit facility and current portion of term loans |

46,489 |

|

19,482 |

|

| |

Loan from

CSI |

29,116 |

|

- |

|

| |

Redeemable

preferred securities |

66,614 |

|

- |

|

| |

Accounts

payable and accrued liabilities |

135,993 |

|

97,386 |

|

| |

Deferred

revenue |

82,179 |

|

59,721 |

|

| |

Provisions |

1,893 |

|

1,222 |

|

| |

Acquisition

holdback payables |

8,876 |

|

12,601 |

|

| |

Lease

obligations |

16,234 |

|

13,953 |

|

| |

Income taxes

payable |

11,400 |

|

12,576 |

|

| |

|

398,794 |

|

216,941 |

|

| |

|

|

|

|

Non-current liabilities: |

|

|

| |

Term

loans |

96,113 |

|

32,572 |

|

| |

Deferred

income taxes |

125,004 |

|

79,958 |

|

| |

Acquisition

holdback payables |

945 |

|

608 |

|

| |

Lease

obligations |

38,955 |

|

37,154 |

|

| |

Other

liabilities |

12,877 |

|

9,225 |

|

| |

|

273,893 |

|

159,518 |

|

| |

|

|

|

|

Total liabilities |

672,687 |

|

376,459 |

|

| |

|

|

|

| |

|

|

|

|

Shareholders' Equity: |

|

|

| |

Preferred

shares |

2,047,473 |

|

- |

|

| |

Capital

stock |

39,412 |

|

39,412 |

|

| |

Other

equity |

(1,009,996 |

) |

- |

|

| |

Accumulated

other comprehensive income (loss) |

(380 |

) |

(1,409 |

) |

| |

Retained

earnings (deficit) |

(1,782,113 |

) |

138,572 |

|

| |

Non-controlling interests |

1,061,236 |

|

88,106 |

|

| |

|

355,632 |

|

264,680 |

|

| |

|

|

|

|

Total liabilities and shareholders' equity |

1,028,319 |

|

641,139 |

|

| |

|

|

|

|

Topicus.com Inc. |

|

|

Consolidated Statements of Income (Loss) |

|

|

(In thousands of euros, except per share amounts. Due to rounding,

numbers presented may not foot.) |

|

| |

|

|

|

|

|

|

Years ended December 31, |

|

|

|

2021 |

|

|

2020 |

|

|

| |

|

|

|

|

| Revenue |

|

|

|

|

|

License |

26,709 |

|

|

14,395 |

|

|

|

Professional services |

196,565 |

|

|

119,522 |

|

|

|

Hardware and other |

6,189 |

|

|

6,192 |

|

|

|

Maintenance and other recurring |

513,078 |

|

|

353,877 |

|

|

| |

742,541 |

|

|

493,986 |

|

|

|

Expenses |

|

|

|

|

|

Staff |

398,171 |

|

|

254,694 |

|

|

|

Hardware |

2,985 |

|

|

2,986 |

|

|

|

Third party license, maintenance and professional services |

72,027 |

|

|

45,515 |

|

|

|

Occupancy |

5,665 |

|

|

3,298 |

|

|

|

Travel, telecommunications, supplies, software and equipment |

20,383 |

|

|

12,888 |

|

|

|

Professional fees |

12,956 |

|

|

9,485 |

|

|

|

Other, net |

6,788 |

|

|

4,675 |

|

|

|

Depreciation |

24,603 |

|

|

18,703 |

|

|

|

Amortization of intangible assets |

85,060 |

|

|

50,381 |

|

|

|

|

628,640 |

|

|

402,626 |

|

|

| |

|

|

|

|

| Redeemable

preferred securities expense (income) |

2,302,185 |

|

|

- |

|

|

| Impairment

of intangible and other non-financial assets |

1,600 |

|

|

- |

|

|

| Finance and

other expenses (income) |

10,748 |

|

|

6,347 |

|

|

|

|

2,314,533 |

|

|

6,347 |

|

|

| |

|

|

|

|

| Income

(loss) before income taxes |

(2,200,632 |

) |

|

85,013 |

|

|

| |

|

|

|

|

| Current

income tax expense (recovery) |

39,494 |

|

|

28,961 |

|

|

|

Deferred income tax expense (recovery) |

(17,894 |

) |

|

(7,632 |

) |

|

| Income tax

expense (recovery) |

21,600 |

|

|

21,329 |

|

|

| |

|

|

|

|

|

Net income (loss) |

(2,222,233 |

) |

|

63,684 |

|

|

| |

|

|

|

|

| Net income

(loss) attributable to: |

|

|

|

|

|

Equity holders of Topicus |

(1,884,042 |

) |

|

42,485 |

|

|

|

Non-controlling interests |

(338,191 |

) |

|

21,199 |

|

|

|

Net income (loss) |

(2,222,233 |

) |

|

63,684 |

|

|

| |

|

|

|

|

| Weighted

average shares |

|

|

|

|

|

Basic shares outstanding |

63,318,650 |

|

|

39,412,386 |

|

|

|

Diluted shares outstanding |

129,681,740 |

|

|

118,156,055 |

|

|

| |

|

|

|

|

| Earnings

(loss) per common share of Topicus |

|

|

|

|

|

Basic |

(30.16 |

) |

|

1.08 |

|

|

|

Diluted |

(30.16 |

) |

|

0.54 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Topicus.com

Inc. |

|

|

Consolidated Statements of Comprehensive Income

(Loss) |

|

|

(In thousands of euros, except per share amounts. Due to rounding,

numbers presented may not foot.) |

|

| |

|

|

|

|

|

|

Years ended December 31, |

|

|

|

2021 |

|

|

2020 |

|

|

| |

|

|

|

|

| Net income

(loss) |

(2,222,233 |

) |

|

63,684 |

|

|

| |

|

|

|

|

| Items that

are or may be reclassified subsequently to net income (loss): |

|

|

|

|

| |

|

|

|

|

|

Foreign currency translation differences from foreign

operations and other |

1,427 |

|

|

(1,398 |

) |

|

| |

|

|

|

|

|

Other comprehensive (loss) income for the year, net of income

tax |

1,427 |

|

|

(1,398 |

) |

|

| |

|

|

|

|

|

Total comprehensive income (loss) for the year |

(2,220,806 |

) |

|

62,285 |

|

|

| |

|

|

|

|

| Total other

comprehensive income (loss) attributable to: |

|

|

|

|

|

Equity holders of Topicus |

635 |

|

|

(933 |

) |

|

|

Non-controlling interests |

792 |

|

|

(465 |

) |

|

|

Total other comprehensive income (loss) |

1,427 |

|

|

(1,398 |

) |

|

| |

|

|

|

|

| Total

comprehensive income (loss) attributable to: |

|

|

|

|

|

Equity holders of Topicus |

(1,883,407 |

) |

|

41,552 |

|

|

|

Non-controlling interests |

(337,399 |

) |

|

20,733 |

|

|

|

Total comprehensive income (loss) |

(2,220,806 |

) |

|

62,285 |

|

|

| |

|

|

|

|

| Topicus.com

Inc. |

|

| Consolidated Statement

of Changes in Shareholders' Equity

(Deficiency) |

|

| (In thousands of

euros, except per share amounts. Due to rounding, numbers presented

may not foot.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31, 2021 |

|

|

|

|

|

|

|

|

|

| |

|

Attributable to equity holders of Topicus |

|

|

|

|

|

|

Preferred

Shares |

Capital Stock |

Other

equity |

Accumulated

othercomprehensive (loss) income |

Retained

earnings (Deficit) |

Total |

Non-controlling interests |

Total

equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2021 |

- |

|

39,412 |

- |

|

(1,409 |

) |

138,572 |

|

176,575 |

|

88,106 |

|

264,680 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the year: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

- |

|

- |

- |

|

- |

|

(1,884,042 |

) |

(1,884,042 |

) |

(338,191 |

) |

(2,222,233 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation differences from |

|

|

|

|

|

|

|

|

|

| |

foreign operations and other |

- |

|

- |

- |

|

635 |

|

- |

|

635 |

|

792 |

|

1,427 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

| |

for

the year |

- |

|

- |

- |

|

635 |

|

- |

|

635 |

|

792 |

|

1,427 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the

year |

- |

|

- |

- |

|

635 |

|

(1,884,042 |

) |

(1,883,407 |

) |

(337,399 |

) |

(2,220,806 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in equity |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Issuance of

Topicus Coop Ordinary Units to non-controlling interests |

- |

|

- |

9,770 |

|

127 |

|

- |

|

9,896 |

|

(9,896 |

) |

- |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net

acquisition of non-controlling interest associated with

acquisitions and other movements |

- |

|

- |

- |

|

267 |

|

(218 |

) |

49 |

|

1,399 |

|

1,448 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Issuance of

redeemable preferred securities |

- |

|

- |

(1,001,469 |

) |

- |

|

- |

|

(1,001,469 |

) |

(124,797 |

) |

(1,126,267 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Dividends to

common shareholders of the Company |

- |

|

- |

- |

|

- |

|

(36,425 |

) |

(36,425 |

) |

(18,175 |

) |

(54,600 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Reclassification of redeemable preferred securities of Topicus from

liabilities to preferred shares |

2,073,205 |

|

- |

- |

|

- |

|

- |

|

2,073,205 |

|

- |

|

2,073,205 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Reclassification of redeemable preferred securities of Topicus Coop

from liabilities to non-controlling interest |

- |

|

- |

- |

|

- |

|

- |

|

- |

|

1,442,910 |

|

1,442,910 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Exchange of

Topicus Coop ordinary units held by non-controlling interests to

subordinate voting shares of Topicus |

- |

|

- |

(18,297 |

) |

- |

|

- |

|

(18,297 |

) |

18,297 |

|

- |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Accrued

dividends to preferred shareholders of Topicus recorded subsequent

to the Notification of Conversion |

(25,731 |

) |

- |

- |

|

- |

|

- |

|

(25,731 |

) |

- |

|

(25,731 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Accrued

dividends to preference unit holders of Topicus Coop recorded

subsequent to the Notification of Conversion |

- |

|

- |

- |

|

- |

|

- |

|

- |

|

(17,157 |

) |

(17,157 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Issuance of

equity of a subsidiary in conjunction with the acquisition of

Geosoftware |

- |

|

- |

- |

|

- |

|

- |

|

- |

|

17,950 |

|

17,950 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2021 |

2,047,473 |

|

39,412 |

(1,009,996 |

) |

(380 |

) |

(1,782,113 |

) |

(705,604 |

) |

1,061,236 |

|

355,632 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Topicus.com

Inc. |

| Consolidated Statement

of Changes in Shareholders' Equity

(Deficiency) |

| (In thousands of

euros, except per share amounts. Due to rounding, numbers presented

may not foot.) |

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31, 2020 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Attributable to equity holders of Topicus |

|

|

|

|

|

Preferred Shares |

Capital Stock |

Other equity |

Accumulated

other comprehensive (loss) income |

Retained earnings (deficit) |

Total |

Non-controlling interests |

Total

equity |

| |

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2020 |

- |

39,412 |

- |

(476 |

) |

96,087 |

135,022 |

|

67,372 |

|

202,395 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the year: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

- |

- |

- |

- |

|

42,485 |

42,485 |

|

21,199 |

|

63,684 |

|

| |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Foreign currency translation differences from |

|

|

|

|

|

|

|

|

| |

foreign operations and other |

- |

- |

- |

(933 |

) |

- |

(933 |

) |

(465 |

) |

(1,398 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss) for the

year |

- |

- |

- |

(933 |

) |

- |

(933 |

) |

(465 |

) |

(1,398 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the

year |

- |

- |

- |

(933 |

) |

42,485 |

41,552 |

|

20,733 |

|

62,285 |

|

| |

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2020 |

- |

39,412 |

- |

(1,409 |

) |

138,572 |

176,575 |

|

88,106 |

|

264,680 |

|

| |

|

|

|

|

|

|

|

|

|

|

Topicus.com Inc. |

|

|

Consolidated Statements of Cash Flows |

|

|

(In thousands of euros, except per share amounts. Due to rounding,

numbers presented may not foot.) |

|

| |

|

|

|

|

|

|

|

|

|

|

Years ended December 31, |

|

|

|

|

|

2021 |

|

|

2020 |

|

|

| |

|

|

|

|

|

|

|

Cash flows from (used in) operating activities: |

|

|

|

|

| |

Net income (loss) |

(2,222,233 |

) |

|

63,684 |

|

|

| |

Adjustments for: |

|

|

|

|

| |

|

Depreciation |

24,603 |

|

|

18,703 |

|

|

| |

|

Amortization

of intangible assets |

85,060 |

|

|

50,381 |

|

|

| |

|

Redeemable

preferred securities expense (income) |

2,302,185 |

|

|

- |

|

|

| |

|

Impairment

of intangible and other non-financial assets |

1,600 |

|

|

- |

|

|

| |

|

Finance and

other expenses (income) |

10,748 |

|

|

6,347 |

|

|

| |

|

Income tax

expense (recovery) |

21,600 |

|

|

21,329 |

|

|

| |

Change in non-cash operating assets and liabilities |

|

|

|

|

| |

|

exclusive of

effects of business combinations |

(8,044 |

) |

|

11,209 |

|

|

| |

Income taxes (paid) received |

(39,098 |

) |

|

(19,787 |

) |

|

| |

Net cash flows from (used in) operating activities |

176,423 |

|

|

151,866 |

|

|

| |

|

|

|

|

|

|

|

Cash flows from (used in) financing activities: |

|

|

|

|

| |

Interest paid on lease obligations |

(1,159 |

) |

|

(952 |

) |

|

| |

Interest paid on other facilities |

(7,875 |

) |

|

(4,643 |

) |

|

| |

Increase (decrease) in revolving credit facility |

25,000 |

|

|

(30,000 |

) |

|

| |

Proceeds from issuance of term loans |

67,227 |

|

|

- |

|

|

| |

Proceeds from issuance of loan from CSI |

28,362 |

|

|

- |

|

|

| |

Increase (decrease) in loan from Vela Software Group |

2,207 |

|

|

- |

|

|

| |

Contribution from Vela Software Group towards the acquisition of

Geosoftware |

17,950 |

|

|

- |

|

|

| |

Repayments of term loans |

(411 |

) |

|

- |

|

|

| |

Credit facility transaction costs |

(2,548 |

) |

|

- |

|

|

| |

Payments of lease obligations |

(17,459 |

) |

|

(13,776 |

) |

|

| |

Repayment of shareholder loans |

- |

|

|

(647 |

) |

|

| |

Dividends paid |

(54,600 |

) |

|

- |

|

|

| |

Net cash flows from (used in) in financing activities |

56,694 |

|

|

(50,018 |

) |

|

| |

|

|

|

|

|

|

|

Cash flows from (used in) investing activities: |

|

|

|

|

| |

Acquisition of businesses |

(241,507 |

) |

|

(85,390 |

) |

|

| |

Cash obtained with acquired businesses |

19,929 |

|

|

19,690 |

|

|

| |

Post-acquisition settlement payments, net of receipts |

(15,061 |

) |

|

(7,011 |

) |

|

| |

Receipt of additional subscription amount from the sellers of

Topicus.com B.V. |

27,589 |

|

|

- |

|

|

| |

Interest, dividends and other proceeds received |

1,010 |

|

|

870 |

|

|

| |

Property and equipment purchased |

(5,385 |

) |

|

(2,408 |

) |

|

| |

Net cash flows from (used in) investing activities |

(213,425 |

) |

|

(74,249 |

) |

|

| |

|

|

|

|

|

|

|

Effect of foreign currency on |

|

|

|

|

| |

cash and cash equivalents |

0 |

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash |

19,692 |

|

|

27,599 |

|

|

| |

|

|

|

|

|

|

|

Cash, beginning of period |

55,635 |

|

|

28,036 |

|

|

| |

|

|

|

|

|

|

|

Cash, end of period |

75,326 |

|

|

55,635 |

|

|

| |

|

|

|

|

|

|

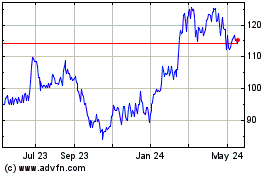

Topicus Com (TSXV:TOI)

Historical Stock Chart

From Dec 2024 to Jan 2025

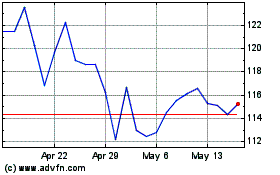

Topicus Com (TSXV:TOI)

Historical Stock Chart

From Jan 2024 to Jan 2025