Tornado Global Hydrovacs Reports Record 2023 Results

April 24 2024 - 7:30AM

Tornado Global Hydrovacs Ltd. (“Tornado” or the “Company”) (TSX-V:

TGH; OTCQX: TGHLF) today reported its audited consolidated

financial results for the year ended December 31, 2023, with

comparisons to last year. The audited consolidated financial

statements and related management discussion and analysis are

available on the Company’s issuer profile in Canada on SEDAR+ at

www.sedarplus.com, the United States at www.otcmarkets.com and

on the Company’s website www.tornadotrucks.com. All amounts

reported in this news release are in thousands ($000’s CAD) except

per share amounts.

2023 Overview

- The Company achieved record sales,

gross profit, EBITDAS and net income in 2023.

- In July 2022, the Company entered

into a Product Supply and Development Agreement for the

co-development and supply of customized hydrovac trucks (the

“Supply Contract”) with Ditch Witch, a division of The Toro Company

(“Ditch Witch”). The Supply Contract contains a commitment for the

delivery of a number of innovative, proprietary hydrovac trucks to

Ditch Witch that are estimated to generate minimum gross revenue

for the Company in the amount of $44 million U.S. Dollars (“USD”)

during the four-year term. In addition, the agreement provides for

the transfer and sale of certain intellectual property rights

(“IP”) relating to the proprietary hydrovac trucks developed for

Ditch Witch.

- Net income per share (diluted) of

$0.053 increased by $0.034 (178.9%) compared to $0.019 in 2022. Net

income of $7,342 increased by $4,887 (199.1%) in 2023 compared to

$2,455 in 2022. This increase was principally due to increased

revenue and the associated increased EBITDAS.

- EBITDAS per share (diluted) of

$0.090 increased by $0.056 (164.7%) compared to $0.034 in 2022.

EBITDAS of $12,433 increased by $7,965 (178.3%) compared to $4,468

in 2022. This increase was principally due to increased revenue and

the associated increased gross profit.

- Revenue of $105,008 increased by

$45,492 (76.4%) in 2023 compared to $59,516 in 2022 as a result of:

(i) the positive impact of the Supply Contract with Ditch Witch;

(ii) the increase in sales from the exclusive sales arrangement

with Custom Truck One Source (“Custom Truck”); (iii) the increase

in sales pricing to customers; and (iv) the increase in demand for

hydrovac trucks in North America.

- Gross profit of $19,600 increased

by $8,744 (80.5%) compared to $10,856 in 2022 principally due to

increased revenue. Gross profit was also positively impacted by the

benefits from cost savings on parts sourced globally during 2023.

However, Gross profit was negatively impacted by the increased

costs associated with materials purchased in North America during

2023.

- General and administrative expense

of $7,572 increased in 2023 by $1,150 compared to $6,422 in 2022.

The increase was principally due to general increased employee

costs in North America to handle present and anticipated

growth.

1 EBITDAS is calculated by subtracting interest,

tax, depreciation and amortization, gain/loss on disposal of fixed

assets and stock-based compensation from earnings. EBITDAS per

share (diluted) is calculated by dividing EBITDAS by the total

number of diluted common shares. The terms EBITDAS and EBITDAS per

share (diluted) are non-IFRS financial measures, and readers are

cautioned that EBITDAS and EBITDAS per share (diluted) should not

be considered to be more meaningful than net income determined in

accordance with IFRS.

4Q/2023 Overview

- The Company achieved record

quarterly sales, gross profit, EBITDAS and net income in Q4/2023.

This is the seventh consecutive quarter in which the Company

achieved record revenue.

- Net income per share (diluted) of

$0.033 increased by $0.029 (725.0%) compared to $0.004 in 2022. Net

income of $4,559 increased by $4,006 (724.4% ) compared to $553 in

Q4/2022. This was principally due to the factors discussed above,

with 2023 results partially offset by an increase in income tax

expense of $1,965.

- EBITDAS per share (diluted) of

$0.048 increased by $0.041 (585.71%) compared to $0.007 in 2022.

EBITDAS of $6,582, increased by $5,644 (601.7%) compared to $938 in

Q4/2022, due to increased revenue and gross profit.

- Revenue of $33,302 increased by

$12,566 (60.6%) compared to $20,736 in Q4/2022 as customer demand

continued to grow, particularly sales relating to the Supply

Contract and to the Custom Truck. In Q4/2023, the Company recorded

the sale of IP relating to the proprietary hydrovac trucks for

$3,933 (Q4/2022 - $3,915).

- Gross profit of $8,249, increased

by $5,445 (194.2%) compared to $2,804 in Q4/2022 principally due to

increased revenue. Gross profit in Q4/2023 and Q4/2022 also

benefited from the gross profit on the sale of IP. Gross profit in

Q4/22 was negatively impacted by inventory adjustments resulting

from year end inventory count and warranty provisions and increased

material and freight costs due to supply chain issues.

Financial and Operating

Highlights (in CAD $000’s except outstanding

common share and per share data)

|

|

|

Three months ended December 31 |

|

Year ended December 31 |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Revenue |

|

$ |

33,302 |

|

$ |

20,736 |

|

|

$ |

105,008 |

|

$ |

59,516 |

|

|

Cost of sales |

|

|

25,053 |

|

|

17,932 |

|

|

|

85,408 |

|

|

48,660 |

|

| Gross

profit |

|

|

8,249 |

|

|

2,804 |

|

|

|

19,600 |

|

|

10,856 |

|

| |

|

|

|

|

|

|

| Selling and

general administrative expenses |

|

|

1,933 |

|

|

1,931 |

|

|

|

7,572 |

|

|

6,422 |

|

| Depreciation

and amortization |

|

|

136 |

|

|

294 |

|

|

|

840 |

|

|

1,048 |

|

| Finance

expense |

|

|

160 |

|

|

254 |

|

|

|

661 |

|

|

468 |

|

| Stock-based

compensation |

|

|

163 |

|

|

352 |

|

|

|

1,027 |

|

|

464 |

|

| Loss (gain)

on disposal of fixed assets |

|

|

11 |

|

|

(83 |

) |

|

|

11 |

|

|

(219 |

) |

|

Other (gain) loss - foreign exchange |

|

|

(160 |

) |

|

21 |

|

|

|

(111 |

) |

|

231 |

|

| |

|

|

|

|

|

|

| Income

before tax |

|

|

6,006 |

|

|

35 |

|

|

|

9,600 |

|

|

2,442 |

|

|

Income tax (expense) recovery |

|

|

(1,447 |

) |

|

518 |

|

|

|

(2,258 |

) |

|

13 |

|

| |

|

|

|

|

|

|

| Net

income |

|

$ |

4,559 |

|

$ |

553 |

|

|

$ |

7,342 |

|

$ |

2,455 |

|

| |

|

|

|

|

|

|

| EBITDAS

(1) |

|

$ |

6,582 |

|

$ |

938 |

|

|

$ |

12,433 |

|

$ |

4,468 |

|

| |

|

|

|

|

|

|

| Outstanding

common shares |

|

|

135,871,119 |

|

|

135,871,119 |

|

|

|

135,871,119 |

|

|

135,871,119 |

|

| |

|

|

|

|

|

|

| EBITDAS per

share - diluted (1) |

|

$ |

0.048 |

|

$ |

0.007 |

|

|

$ |

0.090 |

|

$ |

0.034 |

|

|

Net income per share - diluted |

|

$ |

0.033 |

|

$ |

0.004 |

|

|

$ |

0.053 |

|

$ |

0.019 |

|

1 EBITDAS is calculated by subtracting interest,

tax, depreciation and amortization, gain/loss on disposal of fixed

assets and stock-based compensation from earnings. EBITDAS per

share (diluted) is calculated by dividing EBITDAS by the total

number of diluted common shares. The terms EBITDAS and EBITDAS per

share (diluted) are non-IFRS financial measures and readers are

cautioned that EBITDAS and EBITDAS per share (diluted) should not

be considered to be more meaningful than net income determined in

accordance with IFRS.

Outlook

Management expects the Company’s production and

sales of hydrovac trucks and profitability to continue to grow in

2024 for the following reasons:

- The anticipated increasing revenues

and benefits from the Supply Contract with Ditch Witch.

- The anticipated increasing revenues

and benefits from the exclusive sales arrangement with its US

strategic partner, Custom Truck, that the Company entered into in

2019.

- Expected continued spending on

infrastructure in North America.

- The anticipated addition of new and

innovative products to its product lines that will support the

infrastructure, telecommunications and oil and gas industries.

- The Company’s commitment to

continuous improvement of its hydrovac truck design which in the

Company’s view will result in advantages over other hydrovac trucks

currently offered in the market.

- The Company’s ability to continue

to secure key manufacturing components, including chassis for

customers, into future years through strategic relationships.

- The Company has strengthened its

dealer relationships in both Canada and US to meet the expected

demand increase.

- Expanded North American coverage

for maintenance warranty and repair to serve customers better.

About Tornado Global Hydrovacs

Ltd.

Tornado is a pioneer and leader in the vacuum

truck industry and has been a choice of utility and oilfield

professionals with over 1,300 hydrovacs sold since 2005. The

Company designs and manufactures hydrovac trucks as well as

provides heavy duty truck maintenance operations in central

Alberta. It sells hydrovac trucks to excavation service providers

in the infrastructure and industrial construction and oil and gas

markets. Hydrovac trucks use high pressure water and vacuum to

safely penetrate and cut soil to expose critical infrastructure for

repair and installation without damage. Hydrovac excavation methods

are quickly becoming a standard in North America to safely excavate

in urban areas and around critical infrastructure greatly reducing

infrastructure damage and related fatalities.

For more information about Tornado Global

Hydrovacs Ltd., visit www.tornadotrucks.com or contact:

|

Brett NewtonPresident and Chief Executive OfficerPhone: (587)

802-5070Email: bnewton@tghl.ca |

Derek LiVice President, FinancePhone: (403) 204-6350Email:

dli@tghl.ca |

Advisory

Certain statements contained in this news

release constitute forward-looking statements and future oriented

financial information. These statements relate to future events.

All statements other than statements of historical fact are

forward-looking statements. The use of the words “anticipates”,

“should”, ‘‘may”, “expected”, “expects”, “believes” and other words

of a similar nature are intended to identify forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements or, as applicable, future oriented

financial information. Although Tornado believes these statements

to be reasonable, no assurance can be given that these expectations

will prove to be correct and such forward-looking statements and

future oriented financial information included in this news release

should not be unduly relied upon. Such statements include those

with respect to:

- the Company’s outlook for 2024

generally;

- the expectation of continued

spending on infrastructure in North America;

- the expectation that the Supply

Contract will generate minimum gross revenue for the Company in the

amount of $44 million USD during the four-year term;

- the anticipation of increasing

revenues and benefits from the Supply Contract.

- the expectation that the Company’s production, sales of

hydrovac trucks and profitability in 2024 will continue to

grow;

- management’s belief in the

increasing revenues and benefits from the exclusive sales

arrangement with its US strategic partner, Custom Truck;

- the expectation of adding new and

innovative products to its product lines that will support the

infrastructure, telecommunications and oil and gas industries;

- management’s belief that the

Company’s commitment to continuous improvement of its hydrovac

truck design which in the Company’s view will result in advantages

over other hydrovac trucks currently offered in the market;

- management’s belief in its

continuing ability of securing key manufacturing components,

including chassis, for customers into future years through

strategic relationships;

- management’s belief in the positive

impact of strengthened dealer relationships in both Canada and US

to meet the expected demand increase; and

- management’s belief in the positive

impact of expanded North American coverage for maintenance warranty

and repair.

These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. Actual results could differ

materially from those anticipated in these forward-looking

statements as a result of prevailing economic conditions, and other

factors, many of which are beyond the control of Tornado. Although

Tornado believes these statements to be reasonable, no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements included in this news release

should not be unduly relied upon. The forward-looking statements

contained in this news release represent Tornado’s expectations as

of the date hereof and are subject to change after such date.

Tornado disclaims any intention or obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities regulations.

The future oriented financial information

regarding the Company’s estimate of generating minimum gross

revenue in the amount of USD$44 million from the Supply Contract

contained in this news release was approved by management as of the

date hereof and is based on certain assumptions that management

believes are reasonable in the circumstances including (i) the

demand for hydrovac trucks, (ii) the ability of the Company to

fulfill its obligations under Supply Contract; and (iii) the

anticipated purchase price to be paid for hydrovac trucks. The

purpose of the future oriented financial information contained

herein is to disclose the anticipated economic value of the Supply

Contract and readers are cautioned that such information may not be

appropriate for other purposes.

Neither the Exchange nor its Regulation

Service Provider (as that term is defined in policies of the

Exchange) accepts responsibility for the adequacy or accuracy of

this news release.

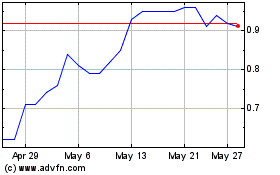

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Dec 2023 to Dec 2024