Prosper Gold Corp. ("

Prosper Gold" or the

"

Company") (TSXV:PGX) is pleased to report it has

(i) commenced its maiden diamond drilling program at the Skinner

North Target and (ii) closed a $725,000 first tranche of a

non-brokered private placement of up to $2,000,000 of hard dollar

units (“

HD Units”) and flow-through units

(“

FT Units”) of the Company (the

“

Financing”).

“We are excited to commence the first ever

drilling at this new target area,” commented Peter Bernier, CEO.

“Trenching at the Skinner North prospect has demonstrated grade and

width at surface. Additional targets in the immediate area with

similar geological and geophysical characteristics will also be

tested.”

Drilling at Skinner North Target

Area

The Skinner Target Area is 4 kilometres

northwest of the Golden Corridor and was identified by prospecting

and 2021-2022 till sampling results. The Company completed

stripping, channel sampling, and ground magnetics at the Skinner

North Target area for which results have been reported (see the

Company's Sep. 7, 2022 news releases for details). The 2,500-metre

proposed diamond drilling program will be testing multiple

exploration targets at the Skinner North prospect.

Channel sampling results at the Skinner North

trench 1 include 9.69 gpt gold over 3.0 metres and 13.13 gpt gold

over 1.8 metres, within a 6- to 12-metre-wide quartz-carbonate vein

bearing shear zone. Gold mineralization comprises finely

disseminated, fracture filling and locally semi-massive pyrite ±

chalcopyrite with associated silica-ankerite alteration.

Mineralization persists in quartz-carbonate veins and within

sheared mafic volcanic wallrock. The shear zone and majority of the

quartz-carbonate veins trend 100° to 110° and dip approximately 70°

to the north.

400 metres southwest of the Skinner North trench

1, grab samples up to 6.84 gpt gold are associated with strongly

sheared and silica-ankerite altered mafic volcanics with

quartz-pyrite ± chalcopyrite veining, similar to the mineralization

that persists at the Skinner North trench 1. Shearing and

quartz-carbonate veining at this target trend between 80° and 105°

and dip 55° to 65° to the north.

Non-brokered Private

Placement

The Company has closed the first tranche (the

“First Tranche”) of the Financing consisting of

(i) 1,300,000 HD Units at a price of $0.20 per HD Unit and (ii)

1,860,000 FT Units at a price of $0.25 per FT Unit, for aggregate

gross proceeds to the Company under the First Tranche of $725,000.

Each HD Unit consists of one common share of the Company (a

“Common Share”) and one common share purchase

warrant (a “HD Warrant”). Each HD

Warrant entitles the holder to acquire one Common Share at a price

of $0.30 for a period of 24 months following the closing date. Each

FT Unit consists of one Common Share that qualifies as a

“flow-through share” for the purposes of the Income Tax Act

(Canada) (a “FT Share”) and one–half of one

non-transferable non-flow through common share purchase warrant

(each whole warrant, a “NFT Warrant” and together

with the HD Warrants, the “Warrants”). Each whole

NFT Warrant entitles the holder thereof to purchase one Common

Share at an exercise price of $0.30 per Common Share for a period

of 24 months following the closing date.

In the event that the Common Shares trade at a

closing price on the TSX Venture Exchange (the

“TSX-V”) of greater than $0.80 per common share

for a period of 20 consecutive trading days at any time after the

closing date, Prosper Gold may accelerate the expiry date of the

Warrants by giving notice to the holders thereof and in such case

the Warrants will expire on the 30th day after the date on which

such notice is given by Prosper Gold (the “Acceleration

Trigger”).

In connection with the First Tranche and in

accordance with the policies of the TSX-V, finder's fees totaling

approximately $33,000 in cash were paid and approximately 136,750

common share purchase warrants (each, a "Finder

Warrant") were issued. Each Finder Warrant is

non-transferable and exercisable for one Prosper Share for a period

of 24 months following closing at an exercise price equal to $0.30.

The Finder Warrants terms contain the same Acceleration Trigger as

the Warrants.

The Company expects to close a second tranche of

the Financing of up to $1,275,000 on or about November 15th,

2022.

Prosper Gold expects to use the net proceeds

from the Financing to fund exploration activities at the Golden

Sidewalk Project and for working capital and general corporate

purposes.

The Financing involves related parties (as such

term is defined under Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI

61-101”)) and therefore constitutes a related party

transaction under MI 61-101. This transaction is exempt from the

formal valuation and minority shareholder approval requirements of

MI 61-101 pursuant to sections 5.5(a) and 5.7(a) of MI 61-101, as

the fair market value of the securities to be distributed and the

consideration to be received for the securities under the Financing

does not exceed 25% of the Company's market capitalization.

All securities issued pursuant to the Financing

will be subject to a four month and one day hold period in

accordance with applicable securities laws. The securities

described herein have not been, and will not be, registered under

the United States Securities Act of 1933, as amended, and were not

permitted to be offered or sold within the United States absent

registration or an applicable exemption from the registration

requirements of such Act.

About the Golden Sidewalk

The Golden Sidewalk is a district-scale gold

exploration project covering over 160 square kilometres of

contiguous mineral claims and mining leases (see the Company's Aug.

10, Sept. 8, and Sept. 15, 2020 news releases for details) in the

western Birch-Uchi Greenstone Belt, approximately 60 km east of Red

Lake, Ontario. The vehicle-accessible project straddles 12

kilometres of the Balmer Assemblage – Narrow Lake Assemblage

unconformity, a regional-scale feature that has been the Red Lake

exploration guide, but which has seen limited exploration in the

project area. The “Golden Corridor” lies immediately north of the

unconformity and is characterized as a highly prospective trend of

coincident favourable magnetic and resistivity lineaments supported

by highly anomalous gold-in-till samples covering 7.0 by 0.5

kilometres. An additional highly prospective target area was

defined in 2021, termed the Skinner North Target Area, where 2022

channel sampling results include 9.69 gpt gold over 3.0 metres and

13.13 gpt gold over 1.8 metres and till samples containing up to

1,014 gold grains have not been followed up with drilling.

QA/QC Procedures

The location of channel samples was designed by

the on-site geologist and were cut in cleaned bedrock with gas

powered rock-saws by field personnel. Channel samples were cut to

medial depths of 2.5 to 3” and medial widths of 2”. Sample interval

lengths were between 0.5 and 1.5 metres. Quality assurance and

quality control measures implemented by the Company include the

insertion of certified reference materials in the sample sequence

at a rate of 1 in 20 for both blank material and certified

reference standards. Analytical results for reference standard and

blank samples are scrutinized internally to ensure adequate

analytical precision and accuracy in both sample preparation and

instrumental procedures. A chain of custody is strictly monitored

to ensure sample and analytical integrity and reliability. Channel

samples are sent to AGAT Laboratories in Thunder Bay, Ontario,

where they are analyzed in 50-gram aliquots using Fire-Assay with

ICP-OES finish. Any overlimit analyses (>10 g/t Au) are

re-analyzed with a pulp metallic screen method designed to give the

most accurate representation of gold concentration in each sample.

AGAT Laboratories in Thunder Bay, ON, is an accredited testing

laboratory having been assessed by the Standards Council of Canada

(SCC) and found to conform with the requirements of ISO/IEC

17025:2017.

Qualified Person

The scientific and technical information in this

news release has been reviewed by Rory Ritchie, P.Geo.,

Vice-President of Exploration for Prosper Gold and a Qualified

Person under National Instrument 43-101.

For a detailed overview of Prosper Gold please

visit www.ProsperGoldCorp.com.

ON BEHALF OF THE BOARD OF

DIRECTORS

Per: “Peter Bernier”Peter BernierPresident &

CEO

For further information, please contact:

Peter BernierPresident & CEOProsper Gold

Corp.Cell: (250) 316-6644Email: Pete@ProsperGoldCorp.com

Information set forth in this news release may

involve forward-looking statements under applicable securities

laws. Forward-looking statements are statements that relate to

future, not past, events. In this context, forward-looking

statements often address expected future business and financial

performance, and often contain words such as "anticipate",

"believe", "plan", "estimate", "expect", and "intend", statements

that an action or event "may", "might", "could", "should", or

"will" be taken or occur, or other similar expressions. All

statements, other than statements of historical fact, included

herein including, without limitation, statements about the use of

proceeds from the Financing, the timing of the close of the second

tranche, the exercise of the Warrants and the planned exploration

of the Golden Sidewalk project, are forward-looking statements. By

their nature, forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause our actual

results, performance or achievements, or other future events, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors include, among others, the following

risks: the need for additional financing; operational risks

associated with mineral exploration; fluctuations in commodity

prices; title matters; environmental liability claims and

insurance; reliance on key personnel; the potential for conflicts

of interest among certain officers, directors or promoters with

certain other projects; the absence of dividends; competition;

dilution; the volatility of our common share price and volume and

the additional risks identified the management discussion and

analysis section of our interim and most recent annual financial

statement or other reports and filings with the TSX Venture

Exchange and applicable Canadian securities regulations.

Forward-looking statements are made based on management's beliefs,

estimates and opinions on the date that statements are made and the

Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or other

circumstances should change, except as required by applicable

securities laws. Investors are cautioned against attributing undue

certainty to forward-looking statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

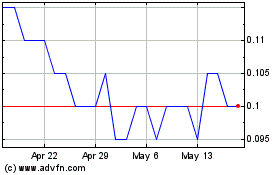

Prosper Gold (TSXV:PGX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Prosper Gold (TSXV:PGX)

Historical Stock Chart

From Jan 2024 to Jan 2025