New Zealand Energy Corp. (TSX VENTURE:NZ)(OTCQX:NZERF) ("NZEC" or the "Company")

today announced that it has closed the acquisition of strategic upstream and

midstream assets (the "Acquisition") from Origin Energy Resources NZ (TAWN)

Limited. NZEC now owns a 50% interest in the Tariki, Waihapa and Ngaere

Petroleum Mining Licences ("TWN Licences") in the main Taranaki Basin production

fairway, as well as the Waihapa Production Station and associated gathering and

sales infrastructure (collectively, "TWN Assets"). NZEC and L&M Energy Limited

("L&M") have acquired the assets jointly and formed a 50/50 joint venture to

explore, develop and operate the TWN Assets, with NZEC as the operator. NZEC

will immediately commence its development and exploration program for the TWN

Assets.

Concurrent with closing of the Acquisition, NZEC has booked additional reserves

and resources (Table 1). NZEC's 50% share of Proved and Probable Reserves (2P

Reserves)(1) attributable to the TWN Licences is estimated to have a before tax

net present value ("NPV") of $31.4 million (10% discount rate). NZEC's 50% share

of 2P Reserves is estimated at 926,350 barrels of oil, 723.9 million cubic feet

of natural gas and 25,350 barrels of natural gas liquids, collectively 1,072,350

barrels of oil equivalent(2) ("boe"). NZEC's share of Contingent Resources(1) is

estimated at 580,000 boe, with Prospective Resources(1) estimated at 11,706,000

boe. NZEC's current reserve portfolio is summarized in Table 1. Additional

information regarding the Company's reserves and resources is available in the

Company's Form 51-101F1 Statement of Reserves Data dated April 22, 2013 and in

the Company's Interim Statement of Reserves and Resources dated October 28,

2013, both of which are filed on SEDAR at www.sedar.com.

"This acquisition more than doubles the Company's oil and gas reserves and

expands NZEC's presence in New Zealand from both an exploration and

infrastructure perspective," said John Proust, Chief Executive Officer and

Director of NZEC. "The new properties offer immediate production and cash flow

potential from existing wells, and significant exploration potential across

multiple horizons, including the Mt. Messenger and the deeper productive

Tikorangi and Kapuni formations. We will move quickly to implement our

development plans for the TWN Assets and look forward to demonstrating the value

of this acquisition as our exploration and development program unfolds."

NZEC also announced that the Company has closed a $16.1 million non-brokered

private placement, raising $1.1 million more than the original $15 million

objective. Of the funds raised, $8.2 million will be used for financing costs

and general working capital while the remainder was used to finance the

Acquisition (plus a $6 million deposit paid previously).

The Company issued 48.9 million subscription receipts ("Subscription Receipts")

at a price of $0.33 per Subscription Receipt. The Subscription Receipts are

convertible into units (the "Units") consisting of one common share (a "Share")

and one-half of one non-transferable share purchase warrant (each whole warrant

referred to as a "Warrant") of the Company. Each Warrant will entitle the holder

to acquire one Share at a price of $0.45 with an expiry date of October 28,

2014.

NZEC will file a short form prospectus with the applicable regulatory

authorities in each of the provinces of Canada where Subscription Receipts were

sold. Each Subscription Receipt will automatically convert into one Unit on the

date that a final receipt for the prospectus has been issued by the applicable

regulatory authorities. The Shares and the Shares underlying the Warrants will

be free-trading on conversion of the Subscription Receipts and exercise of the

Warrants.

In relation to the private placement, NZEC paid $1 million in finder's fees and

issued three million finder's special warrants. The special warrants will

automatically convert into finder's warrants on the date that a final receipt

for the prospectus has been issued by the applicable regulatory authorities.

Each finder's warrant entitles the finder to acquire one Share at an exercise

price of $0.33 with an expiry date of October 28, 2014. The Shares underlying

the finder's warrants will be free-trading on conversion of the special warrants

and exercise of the finder's warrants.

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

(1) Reserve and resource estimates for the TWN Licences prepared by Deloitte

LLP, with an effective date of April 30, 2013. See Table 1, Cautionary Note

Regarding Reserve and Resource Estimates, NZEC's Form 51-101F1 Report and NZEC's

Interim Statement of Reserves and Resources.

(2) Barrels of oil equivalent (boe) is calculated using a conversion rate of 6

Mcf : 1 bbl and may be misleading, particularly if used in isolation. The boe

conversion ratio is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

wellhead.

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the production, development

and exploration of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers approximately 2.25 million acres

(including permits and acquisitions pending) of conventional and unconventional

prospects in the Taranaki Basin and East Coast Basin of New Zealand's North

Island. The Company's management team has extensive experience exploring and

developing oil and natural gas fields in New Zealand and Canada. NZEC plans to

add shareholder value by executing a technically disciplined exploration and

development program focused on the onshore and offshore oil and natural gas

resources in the politically and fiscally stable country of New Zealand. NZEC is

listed on the TSX Venture Exchange under the symbol "NZ" and on the OTCQX

International under the symbol "NZERF". More information is available at

www.newzealandenergy.com or by emailing info@newzealandenergy.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-looking Information

This document contains certain forward-looking information and forward-looking

statements within the meaning of applicable securities legislation (collectively

"forward-looking statements"). The use of any of the words "will" and similar

expressions are intended to identify forward-looking statements. These

statements involve known and unknown risks, uncertainties and other factors that

may cause actual results or events to differ materially from those anticipated

in such forward-looking statements. Such forward-looking statements should not

be unduly relied upon. The Company believes the expectations reflected in those

forward-looking statements are reasonable, but no assurance can be given that

these expectations will prove to be correct. This document contains

forward-looking statements and assumptions pertaining to the following: business

strategy, strength and focus; the granting of regulatory approvals; the timing

for receipt of regulatory approvals; geological and engineering estimates

relating to the resource potential of the properties; the estimated quantity and

quality of the Company's oil and natural gas resources; supply and demand for

oil and natural gas and the Company's ability to market crude oil, natural gas

and; expectations regarding the ability to raise capital and to continually add

to reserves and resources through acquisitions and development; the Company's

ability to obtain qualified staff and equipment in a timely and cost-efficient

manner; the ability of the Company's subsidiaries to obtain mining permits and

access rights in respect of land and resource and environmental consents; the

recoverability of the Company's crude oil, natural gas reserves and resources;

and future capital expenditures to be made by the Company.

Actual results could differ materially from those anticipated in these

forward-looking statements as a result of the risk factors set forth below and

elsewhere in the document, such as the speculative nature of exploration,

appraisal and development of oil and natural gas properties; uncertainties

associated with estimating oil and natural gas resources; changes in the cost of

operations, including costs of extracting and delivering oil and natural gas to

market, that affect potential profitability of oil and natural gas exploration;

operating hazards and risks inherent in oil and natural gas operations;

volatility in market prices for oil and natural gas; market conditions that

prevent the Company from raising the funds necessary for exploration and

development on acceptable terms or at all; global financial market events that

cause significant volatility in commodity prices; unexpected costs or

liabilities for environmental matters; competition for, among other things,

capital, acquisitions of resources, skilled personnel, and access to equipment

and services required for exploration, development and production; changes in

exchange rates, laws of New Zealand or laws of Canada affecting foreign trade,

taxation and investment; failure to realize the anticipated benefits of

acquisitions; and other factors. Readers are cautioned that the foregoing list

of factors is not exhaustive. Statements relating to "reserves and resources"

are deemed to be forward-looking statements, as they involve the implied

assessment, based on certain estimates and assumptions, that the resources

described can be profitably produced in the future. The forward-looking

statements contained in the document are expressly qualified by this cautionary

statement. These statements speak only as of the date of this document and the

Company does not undertake to update any forward-looking statements that are

contained in this document, except in accordance with applicable securities

laws.

Cautionary Note Regarding Reserve and Resource Estimates

The oil and gas reserve and resource calculations and net present value

projections were estimated in accordance with the Canadian Oil and Gas

Evaluation Handbook ("COGEH") and National Instrument 51-101 ("NI 51-101"). The

term barrels of oil equivalent ("boe") may be misleading, particularly if used

in isolation. A boe conversion ratio of six Mcf: one bbl was used by NZEC. This

conversion ratio is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

wellhead. Reserves are estimated remaining quantities of oil and natural gas and

related substances anticipated to be recoverable from known accumulations, as of

a given date, based on: the analysis of drilling, geological, geophysical, and

engineering data; the use of established technology; and specified economic

conditions, which are generally accepted as being reasonable. Reserves are

classified according to the degree of certainty associated with the estimates.

Proved Reserves are those reserves that can be estimated with a high degree of

certainty to be recoverable. It is likely that the actual remaining quantities

recovered will exceed the estimated proved reserves. Probable Reserves are those

additional reserves that are less certain to be recovered than proved reserves.

It is equally likely that the actual remaining quantities recovered will be

greater or less than the sum of the estimated proved plus probable reserves.

Revenue projections presented are based in part on forecasts of market prices,

current exchange rates, inflation, market demand and government policy which are

subject to uncertainties and may in future differ materially from the forecasts

above. Present values of future net revenues do not necessarily represent the

fair market value of the reserves evaluated. Information concerning reserves may

also be deemed to be forward looking as estimates imply that the reserves

described can be profitably produced in the future. These statements are based

on current expectations that involve a number of risks and uncertainties, which

could cause the actual results to differ from those anticipated. Contingent

resources are those quantities of oil and gas estimated on a given date to be

potentially recoverable from known accumulations using established technology or

technology under development, but which are not currently considered to be

commercially recoverable due to one or more contingencies. Contingencies may

include factors such as economic, legal, environmental, political and regulatory

matters, or a lack of markets. Prospective resources are those quantities of oil

and gas estimated on a given date to be potentially recoverable from

undiscovered accumulations. The resources reported are estimates only and there

is no certainty that any portion of the reported resources will be discovered

and that, if discovered, it will be economically viable or technically feasible

to produce.

Table 1 - Marketable Oil and Gas Reserves Attributable to New Zealand Energy

Corp.

Waihapa & Ngaere Petroleum Mining Licenses (1)

As at April 30, 2013

----------------------------------------------------------------------------

Light & Natural Barrels NPV

Medium Natural Gas Oil (Before Tax,

Reserves Oil Gas Liquids Equivalent 10%

Category (bbl) (MMcf) (bbl) (boe) Discount)

----------------------------------------------------------------------------

Proved Developed (Non-

producing) 491,850 381.00 13,350 568,700 $ 18,071,000

Proved Undeveloped 129,050 103.25 3,600 149,900 3,670,000

Total Proved 620,900 484.25 16,950 718,550 21,741,000

Probable 305,450 239.65 8,400 353,800 9,696,500

Proved + Probable 926,350 723.90 25,350 1,072,350 31,437,500

Possible - - - - -

Proved + Probable +

Possible 926,350 723.90 25,350 1,072,350 $ 31,437,500

----------------------------------------------------------------------------

Eltham Permit(2)

As at December 31, 2012

----------------------------------------------------------------------------

Light & Natural Barrels NPV

Medium Natural Gas Oil (Before Tax,

Reserves Oil Gas Liquids Equivalent 10%

Category (bbl) (MMcf) (bbl) (boe) Discount)

----------------------------------------------------------------------------

Proved Developed

(Producing) 307,800 594.90 38,700 445,650 14,400,000

Proved Undeveloped 20,600 31.90 2,000 27,917 893,000

Total Proved 328,400 626.80 40,700 473,567 15,293,000

Probable 158,300 329.60 21,500 234,733 7,320,000

Proved + Probable 486,700 956.40 62,200 708,300 22,613,000

Possible 195,600 398.10 25,800 287,750 7,549,000

Proved + Probable +

Possible 682,300 1,354.50 88,000 996,050 30,162,000

----------------------------------------------------------------------------

Notes:

1. Reserves attributable to the Waihapa and Ngaere Petroleum Mining

Licenses (two of the three permits in the TWN Licences) were estimated

by Deloitte LLP with an effective date of April 30, 2013, as announced

by NZEC on June 17, 2013. The assumptions used in these estimations are

outlined in the Interim Reserve and Resource Report filed on SEDAR at

www.SEDAR.com.

2. Reserves attributable to the Eltham Permit were estimated by Deloitte

LLP with an effective date of December 31, 2012, as announced by NZEC on

April 25, 2013. The assumptions used in these estimations were reported

in NZEC's NI 51-101 reserve reports filed on SEDAR at www.SEDAR.com.

3. Reserves are presented before the deduction of royalty obligations

payable to Origin and to the New Zealand government.

4. MMcf - million cubic feet. Barrels of oil equivalent (boe) is calculated

using a conversion ratio of 6 Mcf : 1 bbl. Barrels of oil equivalent may

be misleading, particularly if used in isolation. The boe conversion

ratio is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency

at the wellhead.

5. Proved Reserves are those reserves that can be estimated with a high

degree of certainty to be recoverable. It is likely that the actual

remaining quantities recovered will exceed the estimated proved

reserves. Probable Reserves are those additional reserves that are less

certain to be recovered than proved reserves. It is equally likely that

the actual remaining quantities recovered will be greater or less than

the sum of the estimated proved plus probable reserves. See Cautionary

Note Regarding Reserve and Resource Estimates.

FOR FURTHER INFORMATION PLEASE CONTACT:

New Zealand Energy Corp.

John Proust

Chief Executive Officer & Director

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Bruce McIntyre

Executive Director

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Rhylin Bailie

Vice President Communications & Investor Relations

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Chris Bush

New Zealand Country Manager

New Zealand: 64-6-757-4470

info@newzealandenergy.com

www.newzealandenergy.com

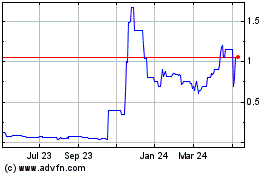

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

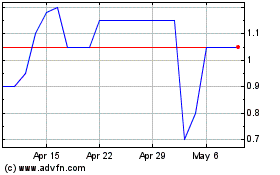

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jul 2023 to Jul 2024