New Zealand Energy's Copper Moki-1 Well Tests 1,100 Barrels of Oil Per Day

August 24 2011 - 8:30AM

Marketwired Canada

New Zealand Energy Corp. ("NZEC" or the "Company"), an oil and natural gas

company with exploration and development prospects in New Zealand, has completed

its Copper Moki-1 well and initiated the steps to obtain a mining permit to

achieve long-term production.

NZEC's 100%-owned Copper Moki-1 well production tested the Mt. Messenger

formation over a 48-hour period and flowed 41.8 API(1) oil at a consistent rate

of 1,100 barrels per day along with 855 mcf(2) per day of natural gas. Pressure

recorders have been run for an extended build-up and the well will be placed on

an extended production test to determine the reservoir size and flow conditions.

Copper Moki-1 is well positioned in close proximity to oil and gas

infrastructure, including production stations and oil and gas pipelines. NZEC

has entered into a contract whereby its test volumes of oil will be sold at a

premium to the Brent reference price(3).

"Our team is working to advance Copper Moki-1 into production while continuing

our aggressive exploration program to test additional targets," said Bruce

McIntyre, President of NZEC. "We will continue to explore in the Copper Moki

area and initiate testing of the extensive shale formations on our East Coast

permits, and look forward to reporting the results of our efforts as the

projects advance."

The Copper Moki-1 well was completed in three sands over an interval of 12.2

metres within the Mt. Messenger Formation, a thick sequence of turbidite

sandstones at a depth of approximately 1,800 metres in New Zealand's Taranaki

Basin. NZEC also perforated and tested a portion of the shallower Urenui

Formation in the Copper Moki-1 well. While preliminary results from the Urenui

Formation show the potential for oil and gas production, NZEC has suspended the

Urenui zone for the near-term to focus on oil production from the Mt. Messenger

Formation.

About New Zealand Energy

NZEC is an oil and natural gas company engaged in the exploration, acquisition

and development of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers nearly two million acres in the Taranaki

Basin and East Coast Basin of New Zealand's North Island. NZEC holds two

petroleum exploration permits (Eltham Permit and Castlepoint Permit) and a 50%

interest in a petroleum exploration permit (Alton Permit, pending completion of

certain conditions), one pending petroleum exploration permit pursuant to an

assignment agreement (Ranui Permit), and one pending non-competitive petroleum

exploration permit application (East Cape Permit).

The Company's management team has extensive experience exploring and developing

oil and natural gas fields in New Zealand and Canada, and takes a

multi-disciplinary approach to value creation with a track record of successful

discoveries. NZEC plans to add shareholder value by executing a technically

disciplined exploration program focusing on the discovery of onshore and

offshore oil and natural gas resources in the politically and fiscally stable

country of New Zealand. The Company's strategy is to develop its existing

portfolio of assets and to pursue further exploration opportunities in other

areas with proven hydrocarbon systems. NZEC will continue to evaluate strategic

acquisitions from time to time where it views further exploration and

development opportunities exist, and may participate in future tenders offered

by the Government of New Zealand to acquire additional petroleum exploration

permits or petroleum mining permits.

On behalf of the Board of New Zealand Energy Corp.

Bruce McIntyre, President and Director

Forward-looking Statements

This news release contains certain forward-looking information and

forward-looking statements within the meaning of applicable securities

legislation (collectively "forward-looking statements"). The use of any of the

words "initiated", "will be", "will" and similar expressions are intended to

identify forward-looking statements. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual results or events

to differ materially from those anticipated in such forward-looking statements,

including without limitation, the speculative nature of exploration, appraisal

and development of oil and natural gas properties; uncertainties associated with

estimating oil and natural gas resources; changes in the cost of operations,

including cots of extracting and delivering oil and natural gas to market, that

affect potential profitability of oil and natural gas exploration; operating

hazards and risks inherent in oil and natural gas operations; volatility in

market prices for oil and natural gas; market conditions that prevent the

Company from raising the funds necessary for exploration and development on

acceptable terms or at all; global financial market events that cause

significant volatility in commodity prices; unexpected costs or liabilities for

environmental matters; competition for, among other things, capital,

acquisitions of resources, skilled personnel, and access to equipment and

services required for exploration, development and production; changes in

exchange rates, laws of New Zealand or laws of Canada affecting foreign trade,

taxation and investment; failure to realize the anticipated benefits of

acquisitions; and other factors discussed under "Risk Factors" in NZEC's

Prospectus dated July 19, 2011. NZEC believes the expectations reflected in

those forward-looking statements are reasonable, but no assurance can be given

that these expectations will prove to be correct. Such forward-looking

statements included in this news release should not be unduly relied upon. These

statements speak only as of the date of this news release and NZEC does not

undertake to update any forward-looking statements that are contained in this

news release, except in accordance with applicable securities laws. In addition,

this news release may contain forward-looking statements attributed to

third-party industry sources.

(1) American Petroleum Institute

(2) Thousand cubic feet

(3) The reference against which two thirds of the world's internationally traded

crude oil supplies are priced.

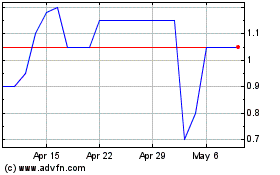

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

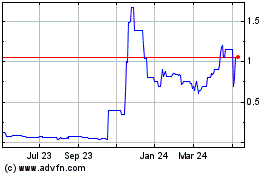

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jul 2023 to Jul 2024