NowVertical Group Inc. (

TSX-V: NOW)

(“

NOW” or the “

Company”), a

leading data analytics and AI solutions company, today announced

the strategic disposition of Allegient Defense, Inc.

(“

Allegient”), to a subsidiary of BCS, LLC (the

“

Purchaser”) for a gross consideration of up to

$12.5 million (the “

Disposition”). All financial

information in this press release is reported in United States

dollars (USD), unless otherwise indicated.

“The sale of Allegient aligns with our

commitment to optimize our core business strategy of integration to

build one cohesive business and unified brand,” said Sandeep

Mendiratta, CEO of NOW. “This transaction allows us to streamline

our integration operations, enhance our overall EBITDA, and

allocate resources more effectively towards the growth driven by

our integration strategy.”

Strategic Rationale:

The Company acquired Allegient, a technical

services support business focused on providing the United States

federal government with technical staffing resources for scientific

evaluation research and IT, business, financial systems support and

administrative support staffing, on April 6, 2022. In 2023,

Allegient reported revenue of $17.8 million and an income from

operations margin of 8% with $1.4M income from operations. Before

undertaking the Disposition, NOW considered multiple factors,

including:

- Focusing

on Assets that can be Integrated: Allegient specializes in

Systems Engineering and Technical Assistance (“SETA”) program

staffing support work and derives less than 5% of its revenue from

providing AI/ML and data solutions. Additionally, the level of

security and confidential nature of Allegient’s work with federal

government organisations meant that NOW could not leverage its

global capabilities from other parts of the business to support

Allegient. This strategic sale to the Purchaser enables Allegient

to thrive in its niche while NOW concentrates on its "One Business,

One Brand" strategy and vision to commercially focused data

solutions using AI.

-

Opportunities for EBITDA and Margin Enhancement:

With its cost-plus-fixed-fee structure, Allegient's focus on SETA

work provides consistent income from operations margins typically

below 10% with limited opportunity for improvement. However, the

rest of the Company's operations benefit from higher scalability

and optimization, achieving income from operations margins between

16% and 35% in the year ended December 31, 2023.

Deal Terms:

The $12.5 million of consideration for the

transaction consists of $7.5 million in cash received on closing,

$1.0 million pursuant to a secured promissory note issued to NOW at

closing and payable in installments within 18 months of closing

(the “Note”) and up to $4.0 million as an earn-out

(the “Earn-Out”) payable on Allegient achieving

certain revenue milestones. The amount of cash received at closing

exceeds 2023 Free Cash Flows from the Allegient business unit by

eleven times (11x), providing NOW with significantly enhanced

financial flexibility.

Benefits to NOW:

- Debt Reduction:

The Disposition clears $3.8 million of debt from NOW’s balance

sheet, significantly reducing overall debt liabilities.

- Deferred

Liabilities: The sale helps reduce deferred liabilities,

improving NOW's financial health.

- Growth

Facilitation: Proceeds from the Disposition support NOW's

growth plans for its integrated business, enabling strategic

investments in core areas.

Following the Disposition, the Company will

continue its operations in the government vertical, ensuring

consistent service delivery to public sector clients in North

America, UK, EMEA and Latam markets.

"We are excited about the partnership with

NowVertical through the acquisition of Allegient," said Dr. Alain

Williams, CEO of the Purchaser. "This strategic move allows us to

execute and build on Allegient's strong opportunity pipeline and

backlog. We look forward to leveraging Allegient's expertise and

capabilities to further enhance our service offerings and drive

growth in the US federal sector."

"I want to extend my genuine thanks to the

Allegient team and its leadership, particularly Angel Diaz, for

their outstanding contributions to the Company," continued Mr.

Mendiratta. "We wish them continued success in their future

endeavours."

For more detailed insights about the

Disposition, we invite interested parties to watch a video prepared

by the Company, available at:

bit.ly/NOWDealInsights.

About NowVertical Group

Inc.

The Company is a data analytics and AI solutions

company offering comprehensive solutions, software and services. As

a global provider, we deliver cutting-edge data, technology, and

artificial intelligence (AI) applications to private and public

enterprises. Our solutions form the bedrock of modern enterprises,

converting data investments into business solutions. NOW is growing

organically and through strategic acquisitions. For further details

about NOW, please visit www.nowvertical.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information, please contact:

Andre Garber, Chief Development Officer:IR@nowvertical.com

Glen Nelson, Investor Relations and Communications:

glen.nelson@nowvertical.com t: (403) 763-9797

NON-IFRS MEASURES

This news release refers to certain

non-International Financial Reporting Standards

(“IFRS”) measures. These measures are not

recognized under IFRS, do not have a standardized meaning

prescribed by IFRS, and are, therefore, unlikely to be comparable

to similar measures presented by other companies. Please refer to

the section below under the header “NON-IFRS MEASURES”. The

non-IFRS financial measures referred to in this news release are

defined below.

“EBITDA” adjusts net income

(loss) before depreciation and amortization expenses, net interest

costs, and provision for income taxes.

“Income from operations margin”

is defined as income (loss) from operations as a percentage of

revenue.

“Free Cash Flows” is defined as

income (loss) from operations less interest and debt principal

repayments.

The following table shows the Free Cash Flows

from Allegient during the year ended December 31, 2023.

|

Income from operations |

$ |

1,420,959 |

|

|

Interest payments on long-term debt |

|

(206,754 |

) |

|

Principal repayments on long-term debt |

|

(554,274 |

) |

|

Free Cash Flows |

$ |

659,932 |

|

Cautionary Note Regarding Non-IFRS

Measures

This news release refers to certain non-IFRS

measures. These measures are not recognized under IFRS, do not have

a standardized meaning prescribed by IFRS, and are, therefore,

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the Company’s results of operations from

management’s perspective. The Company’s definitions of non-IFRS

measures used in this news release may not be the same as the

definitions for such measures used by other companies in their

reporting. Non-IFRS measures have limitations as analytical tools

and should not be considered in isolation nor as a substitute for

analysis of the Company’s financial information reported under

IFRS. The Company uses non-IFRS financial measures including

“EBITDA.”These non-IFRS measures provide investors with

supplemental measures of our operating performance and eliminate

items that have less bearing on our operational performance or

operating conditions and thus highlight trends in our core business

that may not otherwise be apparent when relying solely on IFRS

measures. The Company believes that securities analysts, investors

and other interested parties frequently use non-IFRS financial

measures in the evaluation of issuers. The Company’s management

also uses non-IFRS financial measures to facilitate operating

performance comparisons from period to period and to prepare annual

budgets and forecasts.

Forward‐Looking Statements

This news release contains forward-looking

information and forward-looking information within the meaning of

applicable Canadian securities laws (together “forward-looking

statements”), including, without limitation: the aggregate

consideration to be received from the Disposition, the payment of

the Notes, potential achievement of the revenue requirements for

the Earn-Out and the total amount of such Earn-Out, and

expectations regarding the potential impact of the Disposition on

NOW’s business, finances and operations. Forward-looking statements

are necessarily based upon a number of estimates and assumptions

that, while considered reasonable by management, are inherently

subject to significant business, economic and competitive

uncertainties, and contingencies. Forward-looking statements

generally can be identified by the use of forward-looking words

such as “may”, “should”, “will”, “could”, “intend”, “estimate”,

“plan”, “anticipate”, “expect”, “believe” or “continue”, or the

negative thereof or similar variations. Forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause future results, performance, or achievements to be

materially different from the estimated future results, performance

or achievements expressed or implied by the forward-looking

statements and the forward-looking statements are not guarantees of

future performance. Forward-looking statements are qualified in

their entirety by inherent risks and uncertainties, including:

adverse market conditions; risks inherent in the data analytics and

artificial intelligence sectors in general; regulatory and

legislative changes; that future results may vary from historical

results; inability to obtain any requisite future financing on

suitable terms; any inability to realize the expected benefits and

synergies of acquisitions or the Disposition; that market

competition may affect the business, results and financial

condition of the Company and other risk factors identified in

documents filed by the Company under its profile at

www.sedarplus.com, including the Company’s managements discussion

and analysis for the year ended December 31, 2023. Further, these

forward-looking statements are made as of the date of this news

release and, except as expressly required by applicable law, the

Company assumes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

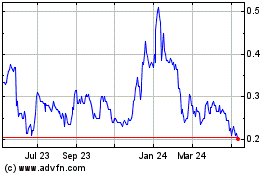

NowVertical (TSXV:NOW)

Historical Stock Chart

From Nov 2024 to Dec 2024

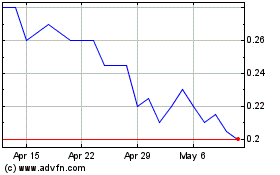

NowVertical (TSXV:NOW)

Historical Stock Chart

From Dec 2023 to Dec 2024