Lomiko Metals Inc. (TSX.V: LMR) (“Lomiko Metals” or the

“Company”) is pleased to announce that it will apply to the TSX

Venture Exchange to close a first tranche of its previously

announced private placement pursuant to which it will issue

13,366,666 units (each a "Unit") at $0.03 per Unit for gross

proceeds of $401,000. Each unit consists of one (1) common share

and one common share purchase warrant (each a "Hard

Warrant"). Each Hard Warrant entitles the holder to acquire one

(1) common share at a price of $0.05 for a period of 60 months. In

addition, the Company secured a grant of approximately $500,000

from federal and provincial agencies to continue advancing

pre-feasibility level battery trials with its La Loutre natural

flake graphite concentrate. Lomiko will provide further detail on

this grant in the coming weeks.

The Units will be subject to a four-month “hold period”

commencing on the closing date pursuant to National Instrument

45-102 – Resale of Securities and Regulation 45-102 respecting

Resale of Securities (Québec) and the certificates or DRS advice

representing such securities will bear a legend to that effect. The

Offering remains subject to the final approval of the TSX Venture

Exchange.

On closing and subject to TSX Venture Exchange approval, the

Company anticipates paying finders' fees totalling $2,550, issuing

416,667 common shares and 85,000 warrants exercisable for five

years at $0.05.

Private Placement Use of Proceeds

The net proceeds from the sale of the Units will be used by the

Company for general corporate and working capital purposes. It

should be noted that the pre-feasibility metallurgical test work

achieved excellent results and demonstrated that an optimized

flotation plant flow sheet can achieve 94.7% graphite recovery and

average 98.7% graphitic carbon purity at the La Loutre natural

flake graphite project. Therefore, the Company will use part of the

proceeds to continue metallurgical testing, value-added testing,

and battery trials and has initiated discussions with battery

manufacturers and OEMs (Original Equipment Manufacturers).

The Company confirms there is no material fact or material

change related to the Company which has yet to be generally

disclosed.

Flow-Through Unit Revised Pricing and Upsize

The Company is also announcing an upsize and pricing revision

for the previously announced Flow-Through offering. Under the

revised Flow-Through offering, the Company may issue up to

17,700,000 flow-through units (the “FT Units“) at a price of

$0.03 per FT Unit for a total of $531,000. Each FT Unit consists of

one common share that will qualify as a “flow-through share” within

the meaning of the Income Tax Act (Canada) and one common share

purchase warrant (a “FT Warrant“), with each whole Warrant

being exercisable at a price of $0.06 per share for a period of two

years following the closing.

The Company intends to use the gross proceeds of the

Flow-Through Offering to incur Canadian Exploration Expenses and

“flow-through critical mineral mining expenditures” as defined in

the Income Tax Act (Canada) on the Company’s recently acquired

Carmin Graphite project, Laurentides regional graphite exploration

program and the Bourier Lithium property exploration program, which

will be incurred on or before December 31, 2024, and renounced with

an effective date no later than December 31, 2023, to the initial

purchasers of FT Units in an aggregate amount not less than the

gross proceeds from the sale of the FT Units. For subscribers that

are residents of Québec at all relevant times, the expenses shall

be i) expenses which qualify for inclusion in the “exploration base

relating to certain Québec exploration expenses” within the meaning

of section 726.4.10 of the Taxation Act (Québec); and ii) expenses

qualifying for inclusion in the “exploration base relating to

certain Québec surface mining expenses or oil and gas exploration

expenses” within the meaning of section 726.4.17.2 of the Taxation

Act (Québec);

Finder fees and commissions may be paid in accordance with the

TSX Venture Exchange policies.

Pursuant to applicable Canadian securities laws, all securities

issued under this private placement are subject to a hold period of

four months and one day. The private placement remains subject to

the final approval of the TSX Venture Exchange.

Closing is subject to several prescribed conditions, including,

without limitations, approval of the TSX Venture Exchange. All the

securities issued under the Offering are subject to resale

restrictions under applicable securities legislation.

About Lomiko Metals Inc.

The Company holds mineral interests in its La Loutre graphite

development in southern Quebec. The La Loutre project site is

within the Kitigan Zibi Anishinabeg (KZA) First Nation’s territory.

The KZA First Nation is part of the Algonquin Nation, and the KZA

traditional territory is situated within the Outaouais and

Laurentides regions. Located 180 kilometers northwest of Montreal,

the property consists of one large, continuous block with 76

mineral claims totaling 4,528 hectares (45.3 km2).

The Property is underlain by rocks from the Grenville Province

of the Precambrian Canadian Shield. The Grenville was formed under

conditions that were very favorable for the development of

coarse-grained, flake-type graphite mineralization from

organic-rich material during high-temperature metamorphism.

Lomiko Metals published April 13, 2023 Updated Mineral Resource

Estimate (MRE) which estimated 64.7 million tonnes of Indicated

Mineral Resources averaging 4.59% Cg per tonne for 3.0 million

tonnes of graphite, a tonnage increase of 184%. Indicated Mineral

Resources increased by 41.5 million tonnes as a result of the 2022

drilling campaign, from 17.5 million tonnes in 2021 MRE with

additional Mineral resources reported down-dip and within marble

units resulted in the addition of 17.5 million tonnes of Inferred

Mineral Resources averaging 3.51% Cg per tonne for 0.65 million

tonnes of contained graphite; and the additional 13,107 metres of

infill drilling in 79 holes completed in 2022 combined with the

refinement of the deposit and structural models contributed to the

addition of most of the Inferred Mineral Resources to the Indicated

Mineral Resource category, relative to the 2021 Mineral Resource

Estimate. The MRE assumes a US$1,098.07 per tonne graphite price

and a cut-off grade of 1.50%Cg (graphitic carbon).

In addition to La Loutre, Lomiko is working with Critical

Elements Lithium Corporation towards earning its 49% stake in the

Bourier Project as per the option agreement announced on April

27th, 2021. The Bourier project site is located near Nemaska

Lithium and Critical Elements south-east of the Eeyou Istchee James

Bay territory in Quebec which consists of 203 claims, for a total

ground position of 10,252.20 hectares (102.52 km2), in Canada’s

lithium triangle near the James Bay region of Quebec that has

historically housed lithium deposits and mineralization trends.

On behalf of the Board, Belinda Labatte CEO and Director, Lomiko

Metals Inc.

For more information on Lomiko Metals, review the website at

www.lomiko.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within

the meaning of the applicable Canadian securities legislation that

is based on expectations, estimates, projections and

interpretations as at the date of this news release. The

information in this news release about the Company; and any other

information herein that is not a historical fact may be

"forward-looking information" (“FLI”). All statements, other than

statements of historical fact, are FLI and can be identified by the

use of statements that include words such as "anticipates",

"plans", "continues", "estimates", "expects", "may", "will",

"projects", "predicts", “proposes”, "potential", "target",

"implement", “scheduled”, "intends", "could", "might", "should",

"believe" and similar words or expressions. FLI in this new release

includes, but is not limited to: the Company’s objective to become

a responsible supplier of critical minerals, exploration of the

Company’s projects, including expected costs of exploration and

timing to achieve certain milestones, including timing for

completion of exploration programs; the Company’s ability to

successfully fund, or remain fully funded for the implementation of

its business strategy and for exploration of any of its projects

(including from the capital markets); any anticipated impacts of

COVID-19 on the Company’s business objectives or projects, the

Company's financial position or operations, and the expected timing

of announcements in this regard. FLI involves known and unknown

risks, assumptions and other factors that may cause actual results

or performance to differ materially, and statements relating to the

intended use of proceeds of the Offering and the receipt of final

acceptance of the TSX Venture Exchange. This FLI reflects the

Company’s current views about future events, and while considered

reasonable by the Company at this time, are inherently subject to

significant uncertainties and contingencies. Accordingly, there can

be no certainty that they will accurately reflect actual results.

Assumptions upon which such FLI is based include, without

limitation: current market for critical minerals; current

technological trends; the business relationship between the Company

and its business partners; ability to implement its business

strategy and to fund, explore, advance and develop each of its

projects, including results therefrom and timing thereof; the

ability to operate in a safe and effective manner; uncertainties

related to receiving and maintaining exploration, environmental and

other permits or approvals in Quebec; any unforeseen impacts of

COVID-19; impact of increasing competition in the mineral

exploration business, including the Company’s competitive position

in the industry; general economic conditions, including in relation

to currency controls and interest rate fluctuations.

The FLI contained in this news release are expressly qualified

in their entirety by this cautionary statement, the

“Forward-Looking Statements” section contained in the Company’s

most recent management’s discussion and analysis (MD&A), which

is available on SEDAR at www.sedar.com, and on the investor

presentation on its website. All FLI in this news release are made

as of the date of this news release. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update or revise any such forward-looking statements

or forward-looking information contained herein to reflect new

events or circumstances, except as may be required by applicable

securities laws.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230714825350/en/

Vincent Osbourne at 647-528-1501 or Belinda Labatte at

647-402-8379 or at 1-833-456-6456 or 1-833-4-LOMIKO or email:

info@lomiko.com.

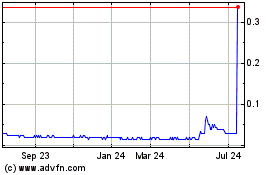

Lomiko Metals (TSXV:LMR)

Historical Stock Chart

From Oct 2024 to Nov 2024

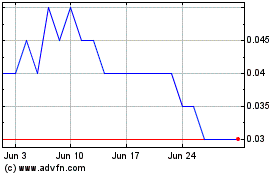

Lomiko Metals (TSXV:LMR)

Historical Stock Chart

From Nov 2023 to Nov 2024