VG Gold and Lexam Explorations to Combine

September 29 2010 - 9:07AM

Marketwired

VG GOLD CORP. (TSX: VG)(FRANKFURT: VN3)(OTCQX: VGGCF) and LEXAM

EXPLORATIONS INC. (TSX VENTURE: LEX) are pleased to announce that

they have reached an agreement in principle to combine the two

companies to create a well funded exploration company focused on

the Timmins mining camp in Northern Ontario. The combination would

be effected through a Plan of Arrangement under which common

shareholders of VG Gold would receive one common share of the

combined company for every common share of VG Gold currently held,

and common shareholders of Lexam would receive 2.1 common shares of

the combined company for every common share of Lexam currently

held. Under the proposed transaction, Rob McEwen, the current

Chairman and CEO of Lexam, would acquire a major stake in the

combined company through a private placement of $5 million and his

current 49% percent ownership interest in Lexam. Rob McEwen will

become the Chairman of the combined company and Tom Meredith, the

current President and CEO of VG Gold, will hold those positions in

the combined company.

Highlights of the combined company would include:

- Strategic land position: Well positioned around Goldcorp's Dome Mine

that has produced 17 million ounces of gold.

- Growing resource base with initial Paymaster West estimate due at year-

end.

- Aggressive exploration: $10.0 million exploration program over next

twelve months.

- Strong treasury: Approximately $15.0 million in cash and no debt.

- Attractive valuation versus Timmins peer group.

- Combined company to be named "Lexam VG Gold Inc."

"Northern Ontario is an area that has been particularly kind to

me and I am a firm believer that there remains a lot more gold to

be found. By combining VG Gold and Lexam we are creating a vehicle

that has excellent properties and a strong treasury, enabling the

company to aggressively explore for the next major gold discovery,"

stated Rob McEwen, Chairman and CEO of Lexam.

"The combination of VG Gold and Lexam creates a compelling

opportunity for shareholders of both companies! The addition of Rob

McEwen as Lexam VG Gold's Chairman is a testament to the value

enhancing opportunities that exist before the combined company,"

stated Tom Meredith, President and CEO of VG Gold.

The share ratio under the proposed transaction represents an

approximate share value equal to $1.01 per Lexam common share based

on VG Gold's closing market price on September 28, 2010. This

amount represents an approximate 10% premium over Lexam's Net Asset

Value. The calculation of Lexam's Net Asset Value excludes the

company's Baca Oil and Gas and Otish Uranium projects.

The transaction is subject to board approval of a definitive

agreement between VG Gold and Lexam, the satisfactory completion of

due diligence investigations and the receipt of an opinion by each

company's financial advisors that the consideration offered under

the offer is fair, from a financial point of view, to its

shareholders. In addition, an independent valuation for the benefit

of VG Gold shareholders will be completed. VG Gold and Lexam have

agreed to negotiate exclusively with each other for 21 days.

Under the terms of the agreement in principle, Rob McEwen will

invest $5 million in the combined company by way of private

placement of 10,416,667 common shares at $0.48 per share plus, for

each common share purchased in the private placement, a two-year

half-warrant, with each full warrant exercise price of $1.00. After

completion of the Plan of Arrangement and private placement, Mr.

McEwen will personally own approximately 28% of the combined

company's outstanding shares and 30% on a partially diluted basis

assuming exercise of the warrants.

The following table illustrates on a pro-forma basis, the share

structure of the combined company after giving effect to the

proposed transaction and Mr. McEwen's private placement:

----------------------------------------------------------------------------

VG Gold common shares outstanding 180,378,727

----------------------------------------------------------------------------

Shares issuable in exchange for Lexam common shares (+) 101,848,503

----------------------------------------------------------------------------

Shares of VG Gold owned by Lexam to be cancelled (-) (75,000,000)

----------------------------------------------------------------------------

Shares issued to Rob McEwen in $5 million private placement (+) 10,416,667

----------------------------------------------------------------------------

Pro-forma common shares outstanding 217,643,897

----------------------------------------------------------------------------

VG Gold warrants outstanding 5,340,750

----------------------------------------------------------------------------

VG Gold options outstanding 4,325,000

----------------------------------------------------------------------------

VG Gold warrants to Rob McEwen in $5 million private placement 5,208,333

----------------------------------------------------------------------------

Lexam options converted into VG Gold options 525,000

----------------------------------------------------------------------------

Pro-Forma fully diluted shares 233,042,980

----------------------------------------------------------------------------

SHAREHOLDER AND REGULATORY APPROVALS

If a definitive agreement is reached, the transaction will be

conditional on VG Gold obtaining majority of minority shareholder

approval for VG Gold, meaning approval of more than 50% of the

shares voted, excluding shares held by Lexam, its insiders and

other parties related to Lexam. The transaction is also conditional

upon Lexam obtaining 66-2/3% approval from shareholders and other

customary conditions. In addition, both companies would be entitled

to a termination fee of $1.25 million upon the occurrence of

customary termination fee events, including the termination of the

definitive agreement by either company in order to enter into a

superior proposal with a third party.

The transaction is also subject to all applicable regulatory

approvals, including stock exchange approval.

Boards of both companies have established committees of

independent directors to evaluate the combination and make a

recommendation to their respective full board of directors.

CAUTIONARY STATEMENT

Some of the statements contained in this release are

"forward-looking statements". Such forward looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to

differ materially from the anticipated results, performance or

achievements expressed or implied by such forward looking

statements. Factors that could cause actual results to differ

materially from anticipated results include risks and uncertainties

such as: ability to raise financing for further exploration and

development activities; risks as to business integration; risks

relating to estimates of reserves, deposits and production costs;

extraction and development risks; the risk of commodity price

fluctuations; political, regulatory and environmental risks; and

other risks and uncertainties in the reports and disclosure

documents filed by VG Gold and Lexam from time-to-time with

Canadian securities regulatory authorities. The companies disclaim

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Neither the TSX nor the TSX-Venture has reviewed and does not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management.

Contacts: VG Gold Corp. Tom Meredith President & CEO (416)

368-0099 (416) 368-1539 (FAX) vgir@vggoldcorp.com

www.vggoldcorp.com Lexam Explorations Inc. Daniela Ozersky Manager,

Investor Relations (647) 258-0395 or Toll Free: (866) 441-0690

(647) 258-0408 (FAX) info@lexamexplorations.com

www.lexamexplorations.com

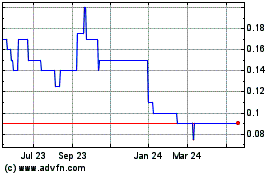

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Dec 2024 to Jan 2025

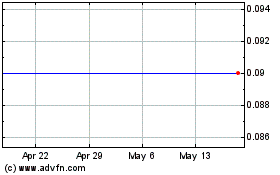

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Jan 2024 to Jan 2025