ILI Technologies Enters Into Memorandum of Understanding

April 18 2011 - 9:00AM

Marketwired Canada

ILI Technologies (TSX VENTURE:ILI) is pleased to announce that its 100% wholly-

owned Mexican subsidiary Cdn Oilfield Technologies & Solutions S. de R.L de C.V.

("COTS") has entered into a Memorandum of Understanding ("MOU") with an

established Mexican construction company (the "Company") to provide financial

and advisory services to arrange financing on a project by project basis in

exchange for revenue sharing terms. The Company is contracted to Schlumberger,

the largest oil and gas service company in Mexico, under a master agreement

("Master Agreement") with Pemex for the construction of infrastructure in urban

and suburban areas valued up to 812 million pesos (approximately 65 million

CDN$). Under the terms of the Master Agreement, all aspects of the project are

fully insured and securitized with a performance bond.

COTS will source funding on behalf of the Company, for an initial project valued

at 79,632,625 million pesos (approximately 6.5 million CDN$) for the

construction of infrastructure for an onshore platform and a right-of-way access

road for Pemex. The required funding under the MOU is estimated at 40 million

pesos (approximately 3.3 million CDN$) and the release of funds to the Company

will be allocated under a controlled monitored process to fund project

management costs, labour, the purchase of materials and construction equipment.

COTS will earn 50% of the net income from the initial project. COTS will retain

the first right of refusal for future funding for the remainder of the services

to be provided by the Company to Schlumberger and Pemex under the Master

Agreement.

The project is expected to commence in May with completion in approximately 70

days after the start of the project. Re-payment of the financing to COTS is

anticipated to be completed approximately 60 days after the completion of the

project under a direct assignment agreement between COTS and the respective

parties.

ILI is currently reviewing financing strategies to secure non-dilutive capital

under the MOU. The MOU is conditional on financing and discussions are currently

underway with key capital sources. Export Development Corporation Canada (EDC)

is listed as an approved source of financing in the Master Agreement.

Phil D'Angelo states, "This is a great window of opportunity for COTS and one

that affords alliances with credible companies in Mexico. There are multiple

projects currently under review and ILI is pleased to be considered as a revenue

partner. It's important for COTS to diversify its business in Mexico and find

multiple sources of revenue with low business risk and exposure. The opportunity

before us is solid as it comes with full securitization components attached to

the projects. COTS has and continues to align itself with credible companies, to

assist in the completion of contracts awarded to them. We now offer an ideal

platform to enter the Mexico energy sector".

Reader Advisory

Except for statements of historical fact, this news release contains certain

"forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan",

"expect", "project", "intend", "believe", "anticipate", "estimate" and other

similar words, or statements that certain events or conditions "may" or "will"

occur. In particular, forward-looking information in this press release

includes, but is not limited to, anticipated sales of the company and completion

of installation projects . Although we believe that the expectations reflected

in the forward-looking information are reasonable, there can be no assurance

that such expectations will prove to be correct. We cannot guarantee future

results, performance or achievements. Consequently, there is no representation

that the actual results achieved will be the same, in whole or in part, as those

set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management

at the date the statements are made, and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or results to

differ materially from those anticipated in the forward-looking information.

Some of the risks and other factors that could cause the results to differ

materially from those expressed in the forward-looking information include, but

are not limited to: general economic conditions in Canada and Mexico and

globally; industry conditions, governmental regulation, including environmental

regulation; unanticipated operating events or performance; failure to obtain

industry partner and other third party consents and approvals, if and when

required; the availability of capital on acceptable terms; the need to obtain

required approvals from regulatory authorities; stock market volatility;

competition for, among other things, capital, skilled personnel and supplies;

changes in tax laws; and the other industry and geographic specific risk

factors. Investors are cautioned that this list of risk factors should not be

construed as exhaustive.

The forward-looking information contained in this news release is expressly

qualified by this cautionary statement. We undertake no duty to update any of

the forward-looking information to conform such information to actual results or

to changes in our expectations except as otherwise required by applicable

securities legislation. Investors are cautioned not to place undue reliance on

forward-looking information.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of the securities in any state of

the United States or any other jurisdiction outside of Canada in which such

offer, solicitation or sale would be unlawful. The securities have not been

registered under the U.S. Securities Act of 1933, as amended, or any state

securities laws and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration requirements of

the U.S. Securities Act of 1933 and applicable state securities laws.

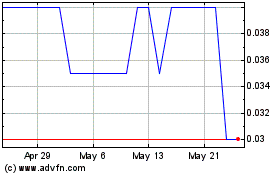

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From Feb 2025 to Mar 2025

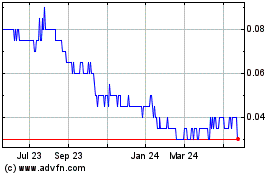

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From Mar 2024 to Mar 2025