Itafos Inc. (TSX-V: IFOS) (“

Itafos” or the

“

Company”) is pleased to announce today that it

has filed an updated technical report for Itafos’ Conda project

(the “

Conda Technical Report”), a

vertically-integrated phosphate fertilizer project in Idaho (the

“

Conda Project”). The Conda Technical Report

demonstrates increased Mineral Reserves and the opportunity for

continued operations at the Conda Project through 2037.

The Conda Technical Report, titled “NI 43-101

Technical Report Itafos Conda Project Idaho, USA,” with an

effective date of July 1, 2023, was prepared for Itafos by WSP USA

Inc. (“WSP”) in accordance with National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”). The Conda Technical Report is

available on SEDAR+ (www.sedarplus.ca) under the Company’s issuer

profile and on the Company’s website (www.itafos.com).

Technical Report Highlights for Conda

Project:

- The mine schedule shows ore production for the Conda Project

through 2037.

- The Mineral Resource estimate for Husky1-South Maybe Canyon

(“H1SMC”) and North Dry Ridge

(“NDR”) (collectively “H1/NDR”)

increased from 38.1 million short tons (dry) at ~24.3% - ~27.0%

P2O5 to 40.5 million short tons (dry) at ~24.2% - 26.7% P2O5.

- The total estimated Mineral Reserves for Conda increased from

14.4 million short tons (dry) at ~26.6% P2O5 (as of July 1, 2019)

to 33.7 million short tons (dry) at ~25.0% P2O5 (as of July 1,

2023).

- The Rasmussen Valley Mine (“RVM”) block model

did not change based on the results from reconciliation between the

2019 model estimates and the production results up to the effective

date of the Conda Technical Report (July 1, 2023). The estimated

remaining Mineral Resource after the effective date of July 1, 2023

is 5.9 million short tons (dry) at ~25.9% P2O5. The estimated

remaining Mineral Reserve after the effective date of July 1, 2023

is 4.3 million short tons (dry) at ~26.0% P2O5.

David Delaney, the Company’s CEO commented, “The

updated Conda Technical Report validates and updates the proven and

probable reserve estimates that support the H1/NDR project with

proven mine life through 2037. Following the Notice to Proceed in

May 2023, we have been working diligently on capital activities

associated with the H1/NDR project with H1/NDR ore recovery

expecting to start in late 2024. The Conda Technical Report and

associated capital activities are the culmination of our strategic

objective of extending Conda’s mine life.”

The Conda Technical Report includes

Mineral Reserve estimates for RVM and H1/NDR, all of which are

wholly-owned by Itafos Conda. The Mineral Reserve estimates for

these deposits were prepared by WSP and this news release is the

initial public disclosure of such Mineral Reserve

estimates.

The effective date for the Mineral

Reserve estimate is July 1, 2023. There have been no material

changes in the available information for the deposits between the

effective date of the Mineral Reserve estimate and the date of this

news release.

Summary of Mineral Reserve

Estimates

| |

|

|

|

|

|

|

|

|

|

Property |

Resource Classification |

Volume (millions; bcf) |

Short Tons (Millions,

wet)a,b |

Short Tons (Millions,

dry)a,b |

P2O5

(wt.%)c |

MgO (wt.%) |

Fe2O3

(wt.%) |

Al2O3

(wt.%) |

|

|

|

|

|

|

|

|

|

|

|

RVM |

Proven |

62.2 |

4.6 |

4.1 |

26.0 |

0.82 |

1.1 |

3.0 |

|

Probable |

2.9 |

0.2 |

0.2 |

26.0 |

0.82 |

1.2 |

3.2 |

|

Proven + Probable |

65.1 |

4.8 |

4.3 |

26.0 |

0.82 |

1.1 |

3.0 |

|

|

|

|

|

|

|

|

|

|

|

NDRd |

Proven |

56.2 |

4.2 |

3.7 |

26.7 |

0.82 |

1.3 |

2.7 |

|

Probable |

10.0 |

0.7 |

0.7 |

26.8 |

1.05 |

1.1 |

2.3 |

|

Proven + Probable |

66.2 |

4.9 |

4.4 |

26.7 |

0.85 |

1.3 |

2.6 |

|

|

|

|

|

|

|

|

|

|

|

H1SMCe |

Proven |

282.9 |

20.9 |

18.6 |

24.3 |

0.97 |

0.9 |

2.4 |

|

Probable |

74.1 |

5.5 |

4.9 |

24.5 |

0.97 |

0.9 |

2.2 |

|

Proven + Probable |

356.9 |

26.4 |

23.5 |

24.3 |

0.97 |

0.9 |

2.3 |

|

|

|

|

|

|

|

|

|

|

|

Stockpilesf |

Proven |

0.1 |

1.7 |

1.5 |

27.7 |

0.42 |

0.64 |

1.53 |

|

|

|

|

|

|

|

|

|

|

|

Totals |

Proven |

401.3 |

31.4 |

27.9 |

25.0 |

0.90 |

0.9 |

2.4 |

|

Probable |

87.0 |

6.4 |

5.7 |

24.8 |

0.97 |

0.9 |

2.2 |

|

Proven + Probable |

488.3 |

37.8 |

33.7 |

25.0 |

0.91 |

0.9 |

2.4 |

Notes:

- A moisture content of 11% was assumed to convert from wet short

tons to dry short tons.

- A 97% mining recovery and 0% dilution was applied to the tons

selected as ore.

- A P2O5 cutoff grade of 20% was assigned as the minimum grade to

be considered ore. Grades are reported in dry basis.

- A pit optimization analysis was performed on the H1SMC deposit,

which incorporated the geotechnical parameters, mining costs of

$3.06/t wet overburden, $4.61/t wet ore, ore stockpiling and

shipping costs of $11.21/t wet. A Gross Margin available per mined

P2O5 ton (applied at the point of exchange of the tipple) of

$283.70/t dry ton P2O5 was used to define the limits of the mining

pit. The total processing costs are not disclosed in this report

but are higher for H1SMC relative to NDR due to an MgO reduction

circuit required for H1SMC.

- A pit optimization analysis was performed on the NDR deposit,

which incorporated the geotechnical parameters, mining costs of

$3.06/t wet overburden, $4.61/t wet ore, ore stockpiling and

shipping costs of $11.21/t wet. A Gross Margin available per mined

P2O5 ton (applied at the point of exchange of the tipple) of

$283.70/t dry ton P2O5 was used to define the limits of the mining

pits. The total processing costs are not disclosed in this report

but are higher for H1SMC relative to NDR due to an MgO reduction

circuit required for H1SMC.

- All stockpiles, which includes WV Tipple and plant stockpiles,

total dry tons, and average P2O5 grades are displayed.

About the Deposits

The phosphate mineralization encountered at the

deposits considered in the Conda Technical Report occur as

stratigraphically controlled sedimentary phosphate mineralization

within the Meade Peak Member of the Early Permian Phosphoria

Formation. The Meade Peak Member is further subdivided into an

Upper Phosphate Zone and a Lower Phosphate Zone, separated by an

unmineralized Center Interburden Zone. The Mineral Reserve

estimates include mineralization from both the Upper Phosphate Zone

and Lower Phosphate Zone.

Project Risks

Project risks have been outlined in the Conda

Technical Report along with mitigation plans to de-risk the Conda

Project. Costs have been estimated to a level of accuracy suitable

for a Preliminary Feasibility Study. Overall economic risks include

financing, price escalation, inflation, commodity sales price

variability and general global economic conditions. General

technical risks include project construction timeline, surface

water management, geotechnical uncertainty, mining productivity,

achieving optimum P2O5 grade and recovery, and waste

management.

Conda Technical Report and Qualified

Persons

Readers are encouraged to read the Conda

Technical Report in its entirety, including all qualifications,

assumptions and exclusions that relate to the preliminary

feasibility study. The Conda Technical Report is intended to be

read as a whole, and sections should not be read, or relied upon,

out of context.

Scientific and technical information contained

in this news release was reviewed and verified by:

Jerry DeWolfe, P.Geo,

WSP Canada Inc. (formerly WSP Golder), Geology and Mineral

ResourcesTerry L. Kremmel, P.E. WSP USA Inc. (formerly WSP Golder),

Mineral Reserves and Mining MethodsMitchell J. Hart, P.E. Arcadis

Inc., Environmental, Permitting, and Social or Community ImpactLuc

Adjanor, MIMMM, Adjanor and Associates Limited, Metallurgy and

Mineral Processing

Each of these persons is a “Qualified Person” as

defined by NI 43-101 for the Conda Project and have the ability and

authority to verify the authenticity and validity of the data and

is independent from the Company. Each of these Qualified Persons

has reviewed and verified the respective scientific and technical

disclosure contained in this news release.

Further information about the Conda Project,

including a description of the key assumptions, parameters,

description of sampling methods, data verification and QA/QC

programs, methods relating to resources and reserves and factors

that may affect those estimates will be contained in the Conda

Technical Report.

About Itafos

The Company is a phosphate and specialty fertilizer company. The

Company’s businesses and projects are as follows:

- Conda – a vertically integrated phosphate fertilizer business

located in Idaho, US with production capacity as follows:

- approximately 550 kt per year of monoammonium phosphate

(“MAP”), MAP with micronutrients (“MAP+”), superphosphoric acid

(“SPA”), merchant grade phosphoric acid (“MGA”) and ammonium

polyphosphate (“APP”); and

- approximately 27 kt per year of hydrofluorosilicic acid

(“HFSA”);

- Arraias – a vertically integrated phosphate fertilizer business

located in Tocantins, Brazil with production capacity as follows:

- approximately 500 kt per year of single superphosphate (“SSP”)

and SSP with micronutrients (“SSP+”); and

- approximately 40 kt per year of excess sulfuric acid (220 kt

per year gross sulfuric acid production capacity);

- Farim – a high-grade phosphate mine project located in Farim,

Guinea-Bissau;

- Santana – a vertically integrated high-grade phosphate mine and

fertilizer plant project located in Pará, Brazil; and

- Araxá – a vertically integrated rare earth elements and niobium

mine and extraction plant project located in Minas Gerais,

Brazil.

The Company is a Delaware corporation that is

headquartered in Houston, TX. The Company’s shares trade on the TSX

Venture Exchange (“TSX-V”) under the ticker symbol

“IFOS”. The Company’s principal shareholder is CL Fertilizers

Holding LLC (“CLF”). CLF is an affiliate of

Castlelake, L.P., a global private investment firm.

For more information, or to join the Company’s mailing list to

receive notification of future news releases, please visit the

Company’s website at www.itafos.com.

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information

(“FLI”). Except for statements of historical fact

relating to the Company, information contained herein may

constitute FLI, including any information related to: the

successful development of the Conda Project; capital expenditures;

mine life; estimates of mineral resources and mineral reserves;

development of mineral resources and mineral reserves; realization

of mineral resources and mineral reserves estimates, including

whether mineral resources will ever be developed into mineral

reserves and information and underlying assumptions related

thereto; timing and amount of future production; expected

expenditures to be made by the Company; and timing, cost, quantity,

capacity and product quality of production at the Conda Project.

The use of any of the words “intend”, “anticipate”, “plan”,

“continue”, “estimate”, “expect”, “may”, “will”, “project”,

“should”, “would”, “believe”, “predict” and “potential” and similar

expressions are intended to identify forward-looking

information.

The FLI contained in this news release is based

on the opinions, assumptions and estimates of management set out

herein, which management believes are reasonable as at the date the

statements are made. Those opinions, assumptions and estimates are

inherently subject to a variety of risks and uncertainties and

other known and unknown factors that could cause actual events or

results to differ materially from those projected in the FLI. These

include the Company’s expectations and assumptions with respect to

the following: commodity prices; operating results; safety risks;

changes to the Company’s mineral reserves and resources; risk that

timing of expected permitting will not be met; changes to mine

development and completion; foreign operations risks; changes to

regulation; environmental risks; the impact of adverse weather and

climate change; general economic changes, including inflation and

foreign exchange rates; the actions of the Company’s competitors

and counterparties; financing, liquidity, credit and capital risks;

the loss of key personnel; impairment risks; cybersecurity risks;

risks relating to transportation and infrastructure; changes to

equipment and suppliers; adverse litigation; changes to permitting

and licensing; loss of land title and access rights; changes to

insurance and uninsured risks; the potential for malicious acts;

market volatility; changes to technology; changes to tax laws; the

risk of operating in foreign jurisdictions; and the risks posed by

a controlling shareholder and other conflicts of interest. Readers

are cautioned that the foregoing list of risks, uncertainties and

assumptions is not exhaustive.

Although the Company has attempted to identify

crucial factors that could cause actual actions, events or results

to differ materially from those described in FLI, there may be

other factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

FLI will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information.

The reader is cautioned not to place undue reliance on FLI. The

Company undertakes no obligation to update forward-looking

statements if circumstances or management’s estimates, assumptions

or opinions should change, except as required by applicable

securities law. Risks and uncertainties affecting the FLI contained

in this news release are described in greater detail in the

Company’s current Annual Information Form and current Management’s

Discussion and Analysis available under the Company’s profile on

SEDAR+ at www.sedarplus.ca and on the Company’s website at

www.itafos.com. The FLI included in this news release is expressly

qualified by this cautionary statement and is made as of the date

of this news release.

NEITHER THE TSX-V NOR ITS REGULATION SERVICES PROVIDER (AS THAT

TERM IS DEFINED IN THE POLICIES OF THE TSX-V) ACCEPTS

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS

RELEASE.

For further information, please contact:

Matthew O’NeillItafos Investor

Relationsinvestor@itafos.com713-242-8446

Cautionary Note Regarding Mineral Resource and Mineral

Reserve Estimates

This press release uses Mineral Reserve and

Mineral Resource classification terms that comply with reporting

standards set forth in NI 43-101 for all public disclosure of

scientific and technical information concerning mineral projects by

Canadian registered issuers. NI 43- 101 standards differ

significantly from standards set forth by the United States

Securities and Exchange Commission (“SEC”).

Therefore, information regarding mineralization presented herein

may not be directly comparable to similar information disclosed by

companies in accordance with SEC standards. For instance, Mineral

Reserve estimates contained in this presentation may not qualify as

“reserves” under SEC standards. The reader is cautioned not to

assume that any part or all of the Mineral Resources identified as

“Mineral Resources,” “Measured Mineral Resources,” “Indicated

Mineral Resources” and “Inferred Mineral Resources” in this

presentation will ever be converted into Mineral Reserves as

defined in NI 43-101, be upgraded to a higher category, or be

economically or legally mineable.

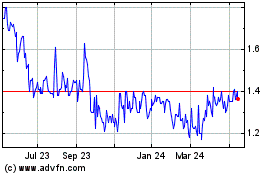

Itafos (TSXV:IFOS)

Historical Stock Chart

From Feb 2025 to Mar 2025

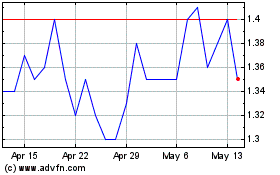

Itafos (TSXV:IFOS)

Historical Stock Chart

From Mar 2024 to Mar 2025