Hanstone Gold Closes Private Placement

April 26 2022 - 8:30AM

Hanstone Gold Corp. (TSXV: HANS) (FSE: HGO)

("

Hanstone" or the "

Company") is

pleased to announce that it has closed its previously announced

non-brokered private placement (the “

Offering”)

under which Hanstone raised aggregate gross proceeds of $500,000.

The Offering consisted of the issuance of an

aggregate of 2,000,000 “flow-through” units of the Company (the

“FT Units”) at a price of $0.25 per FT Unit. Each

FT Unit is comprised of one “flow-through” common share of the

Company (a “FT Common Share”) and one common share

purchase warrant (a “Warrant”). Each Warrant is

exercisable to acquire an additional common share (a

“Warrant Share”, which will not be issued on a

“flow-through” basis) at a price of $0.30 per Warrant Share until

April 26, 2023.

In connection with closing, the Company paid

finder’s fees of $1,750 and issued 7,000 non-transferable

compensation options, each entitling the holder thereof to purchase

one common share at an exercise price of $0.30 until April 26,

2024.

The securities issued under the Offering are

subject to a four month hold period expiring August 27, 2022. There

is no material fact or material change about the Company that has

not been generally disclosed.

Insiders of the Company purchased an aggregate

of 300,000 FT Units under the Offering, for gross proceeds of

$75,000, which constituted a “related party transaction” as defined

under Multilateral Instrument 61-101 (“MI

61-101”). This participation is exempt from the formal

valuation and minority shareholder approval requirements of MI

61-101 as the fair market value of such participation does not

exceed 25% of the market capitalization of the Company, as

determined in accordance with MI 61-101.

This press release is not an offer to sell or

the solicitation of an offer to buy the securities in the United

States or in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to qualification or registration under

the securities laws of such jurisdiction. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and such

securities may not be offered or sold within the United States or

to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from U.S. registration

requirements and applicable U.S. state securities laws.

About Hanstone Gold

Hanstone is a precious and base metals explorer

with its current focus on the Doc and Snip North Projects optimally

located in the heart of the prolific mineralized area of British

Columbia known as the Golden Triangle. The Golden Triangle is an

area which hosts numerous producing and past-producing mines and

several large deposits that are approaching potential development.

The Company holds a 100% earn in option in the 1,704-hectare Doc

Project and owns a 100% interest in the 3,336-hectare Snip North

Project. Hanstone has a highly experienced team of industry

professionals with a successful track record in the discovery of

gold deposits and in developing mineral exploration projects

through discovery to production.

Ray Marks, President and Chief Executive

Officer

For Further Information

Contact:Carrie Howes, Director of

Communications,

+1-(778)-551-8488, carrie@hanstonegold.comOr visit

the Company’s website at www.hanstonegold.com

Cautionary Statement Regarding Forward

Looking Information:

The information contained herein contains

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

“forward-looking information” within the meaning of applicable

Canadian securities legislation. “Forward-looking information”

includes, but is not limited to, statements with respect to the

activities, events, or developments that the Company expects or

anticipates will or may occur in the future. Generally, but not

always, forward-looking information and statements can be

identified using words such as “plans”, “expects”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, or “believes” or the negative connotation thereof or

variations of such words and phrases or state that certain actions,

events, or results “may”, “could”, “would”, “might” or “will be

taken”, “occur” or “be achieved” or the negative connotation

thereof.

Forward-looking information and statements are

based on the then current expectations, beliefs, assumptions,

estimates and forecasts about Hanstone’s business and the industry

and markets in which it operates and will operate. Forward-looking

information and statements are made based upon numerous

assumptions, including among others, the results of planned

exploration activities are as anticipated, the price of gold, the

cost of planned exploration activities, that financing will be

available if needed and on reasonable terms, that third party

contractors, equipment, supplies and governmental and other

approvals required to conduct Hanstone’s planned exploration

activities will be available on reasonable terms and in a timely

manner and that general business and economic conditions will not

change in a material adverse manner. Although the assumptions made

by the Company in providing forward-looking information or making

forward-looking statements are considered reasonable by management

at the time, there can be no assurance that such assumptions will

prove to be accurate.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

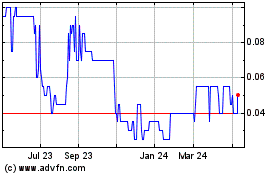

Hanstone Gold (TSXV:HANS)

Historical Stock Chart

From Dec 2024 to Jan 2025

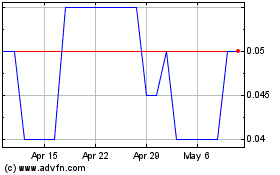

Hanstone Gold (TSXV:HANS)

Historical Stock Chart

From Jan 2024 to Jan 2025