Golconda Announces Reserves Results and Resumption in Trading

October 24 2012 - 5:39PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Golconda Resources Ltd. (the "Corporation" or "Golconda") (TSX VENTURE:GA) is

pleased to provide the following information regarding the independent reserves

assessment and evaluation of Golconda's proposed 25% working interest in

approximately 1,600 acres of Cold Lake First Nation lands (the "Lands"), which

are the subject of the previously announced joint venture among the Corporation,

a Calgary based private oil and gas company ("PrivateCo") and Tri-Rez Ebay

Energy Ltd. ("TRE") with respect to oil and gas exploration and development (the

"Joint Venture"). The evaluation was conducted by GLJ Petroleum Consultants Ltd.

("GLJ"), effective as at August 31, 2012 and was conducted pursuant to National

Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities ("NI

51-101") and the Canadian Oil and Gas Evaluation Handbook ("COGE") reserves

definitions.

Pursuant to the Joint Venture agreement, TRE has agreed with Golconda and

PrivateCo (collectively, the "Farmees") to acquire from Indian Oil and Gas

Canada ("IOGC") a lease (the "Lease") covering the Lands. The Farmees have

agreed to a ten (10) well work program over a period of three (3) years, which

shall consist of the Farmees drilling a minimum of three (3) wells prior to the

end of the first year of the Lease, a minimum of four (4) wells prior to the end

of the second year of the Lease and a minimum of three (3) additional wells

prior to the end of the third year of the Lease. The Farmees will each earn a

25% working interest in each successfully drilled or abandoned well.

RESERVES INFORMATION

The following table summarizes Golconda's proposed working interest in the oil

reserves on the Lands effective as of August 31, 2012 as evaluated by GLJ.

Light and Natural Gas Total Oil

Medium Oil Heavy Oil Liquids Equivalent(3)

----------------------------------------------------------------

RESERVES Gross(1) Net(2) Gross(1) Net(2) Gross(1) Net(2)Gross(1) Net(2)

CATEGORY (MMcf) (MMcf) (Mbbls) (Mbbls) (Mbbls) (Mbbls) (Mboe) (Mboe)

----------------------------------------------------------------------------

PROVED

Producing 0 0 0 0 0 0 0 0

Developed

Non-

producing 0 0 0 0 0 0 0 0

Undeveloped 0 0 112 87 0 0 112 87

----------------------------------------------------------------

TOTAL PROVED 0 0 112 87 0 0 112 87

TOTAL

PROBABLE 0 0 197 149 0 0 197 149

----------------------------------------------------------------

TOTAL PROVED

PLUS

PROBABLE 0 0 309 236 0 0 309 236

----------------------------------------------------------------------------

Notes:

(1) "Gross" Company reserves are the Company's total working interest share

before the deduction of any royalties and without including any royalty

interests of the Company.

(2) "Net" reserves are the Company's working interest share after deduction

of royalties but including royalty interests of the Company.

(3) In the case of BOEs, using BOEs derived by converting gas to oil

equivalent in the ratio of six thousand cubic feet of gas to one barrel

of oil (6 MCF:1 bbl). See "Reader Advisory - BOE Presentation" and

"Reader Advisory - Information Regarding Disclosure on Oil and Gas

Reserves" below.

The following table summarizes the Net Present Value of Golconda's share of oil

as reserves effective as at August 31, 2012.

UNIT VALUE

NET PRESENT VALUES OF FUTURE NET BEFORE INCOME

REVENUE BEFORE INCOME TAXES TAXES DISCOUNTED

DISCOUNTED AT (%/year) AT 10%/YEAR

----------------------------------------------------

0% 5% 10% 15% 20%

RESERVES CATEGORY (M$) (M$) (M$) (M$) (M$) ($/BOE)($/Mcfe)

----------------------------------------------------------------------------

PROVED:

Developed Producing 0 0 0 0 0 0.00 0.00

Developed Non-Producing 0 0 0 0 0 0.00 0.00

Undeveloped 2,301 1,860 1,538 1,297 1,111 17.66 2.94

----------------------------------------------------

TOTAL PROVED(1)(2) 2,301 1,860 1,538 1,297 1,111 17.66 2.94

TOTAL PROBABLE(1)(2) 4,308 3,373 2,746 2,306 1,984 18.43 3.07

----------------------------------------------------

TOTAL PROVED PLUS

PROBABLE(1)(2) 6,609 5,233 4,284 3,603 3,095 18.14 3.02

----------------------------------------------------

Notes:

(1) Forecast pricing used is based on GLJ published price forecasts

effective July 1, 2012.

(2) It should not be assumed that the net present values of future net

revenues estimated by GLJ represent fair market value of the reserves.

There is no assurance that the forecast price and cost assumptions will

be attained and variances could be material. See "Reader Advisory -

Information Regarding Disclosure on Oil and Gas Reserves" below.

Trading in the shares of Golconda on the TSX Venture Exchange will resume at the

opening of market on Friday October 26, 2012.

Forward Looking Statements

Certain statements contained in this press release may constitute

forward-looking statements. These statements relate to future events or the

Golconda's future performance. All statements other than statements of

historical fact may be forward-looking statements. Forward-looking statements

are often, but not always, identified by the use of words such as "seek",

"anticipate", "plan", "continue", "estimate", "expect", "may", "will",

"project", "predict", "potential", "targeting", "intend", "could", "might",

"should", "believe" and similar expressions. These statements involve known and

unknown risks, uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such forward-looking

statements. Golconda believes that the expectations reflected in those

forward-looking statements are reasonable, but no assurance can be given that

these expectations will prove to be correct and such forward-looking statements

included in this press release should not be unduly relied upon by investors.

These statements speak only as of the date of this press release and are

expressly qualified, in their entirety, by this cautionary statement.

In particular, this press release contains forward-looking statements,

pertaining to the following: projections of market prices and costs, supply and

demand for oil and natural gas, the quantity of reserves, oil and natural gas

production levels, capital expenditure programs, treatment under governmental

regulatory and taxation regimes, expectations regarding Golconda's ability to

raise capital and to continually add to reserves through acquisitions and

development, and projections of market prices and costs.

With respect to forward-looking statements contained in this press release,

Golconda has made assumptions regarding, among other things: the legislative and

regulatory environments of the jurisdiction where Golconda carries on business

or has operations, the impact of increasing competition, and Golconda's ability

to obtain additional financing on satisfactory terms.

Golconda's actual results could differ materially from those anticipated in

these forward-looking statements as a result of risk factors that may include,

but are not limited to: volatility in the market prices for oil and natural gas;

uncertainties associated with estimating reserves; uncertainties associated with

Golconda's ability to obtain additional financing on satisfactory terms;

geological, technical, drilling and processing problems; liabilities and risks,

including environmental liabilities and risks, inherent in oil and natural gas

operations; incorrect assessments of the value of acquisitions; competition for,

among other things, capital, acquisitions of reserves, undeveloped lands and

skilled personnel.

This forward-looking information represents Golconda's views as of the date of

this document and such information should not be relied upon as representing its

views as of any date subsequent to the date of this document. Golconda has

attempted to identify important factors that could cause actual results,

performance or achievements to vary from those current expectations or estimates

expressed or implied by the forward-looking information. However, there may be

other factors that cause results, performance or achievements not to be as

expected or estimated and that could cause actual results, performance or

achievements to differ materially from current expectations. There can be no

assurance that forward-looking information will prove to be accurate, as results

and future events could differ materially from those expected or estimated in

such statements. Accordingly, readers should not place undue reliance on

forward-looking information. Except as required by law, Golconda undertakes no

obligation to publicly update or revise any forward-looking statements.

Information Regarding Disclosure on Oil and Gas Reserves. The reserves data set

forth above is based upon an independent reserves assessment and evaluation

prepared by GLJ with an effective date of August 31, 2012 (the "GLJ Report").

The presentation summarizes Golconda's crude oil, natural gas liquids and

natural gas reserves and the net present values before income tax of future net

revenue for Golconda's reserves using forecast prices and costs based on the GLJ

Report. The GLJ Report has been prepared in accordance with the standards

contained in the COGE and the reserve definitions contained in NI 51-101. All

evaluations and reviews of future net cash flows are stated prior to any

provisions for interest costs or general and administrative costs and after the

deduction of estimated future capital expenditures for wells to which reserves

have been assigned. It should not be assumed that the estimates of future net

revenues presented in the tables above represent the fair market value of the

reserves. There is no assurance that the forecast prices and cost assumptions

will be attained and variances could be material. The recovery and reserve

estimates of our crude oil, natural gas liquids and natural gas reserves

provided herein are estimates only and there is no guarantee that the estimated

reserves will be recovered. Actual crude oil, natural gas and natural gas

liquids reserves may be greater than or less than the estimates provided herein.

The reserve data provided in this release only represents a summary of the

disclosure required under NI 51-101.

BOE Presentation. References herein to "boe" mean barrels of oil equivalent

derived by converting gas to oil in the ratio of six thousand cubic feet (Mcf)

of gas to one barrel (bbl) of oil. Boe may be misleading, particularly if used

in isolation. A boe conversion ratio of 6 Mcf: 1 bbl is based on an energy

conversion method primarily applicable at the burner tip and does not represent

a value equivalency at the wellhead.

FOR FURTHER INFORMATION PLEASE CONTACT:

Golconda Resources Ltd.

David Orr

(403) 539-4440

dorr@golconda.ca

www.golcondaresources.com

General Assembly (TSXV:GA)

Historical Stock Chart

From May 2024 to Jun 2024

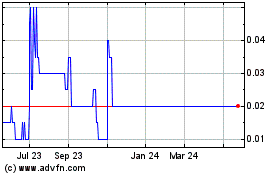

General Assembly (TSXV:GA)

Historical Stock Chart

From Jun 2023 to Jun 2024