Dear Desert Gold Shareholder:

On November 30, 2011, Desert Gold Ventures Inc. (TSX VENTURE:DAU) ("Desert Gold"

or "we") completed the acquisition (the "Acquisition") of all of the outstanding

shares of TransAfrika Belgique S.A. ("TransAfrika"), a private Belgian company

which owns interests in three advanced exploration-stage gold deposits in

central and western Africa through subsidiaries in Rwanda, Mali and Senegal.

The Acquisition has refocused the company into primarily developing its

promising West African and Rwanda permits to proven resource status and develop

those properties to mining operations, in a socially and environmentally

responsible manner. The Company is very excited to have acquired such highly

prospective gold properties, particularly in Mali and Rwanda, the latter having

a 43-101 compliant(1) inferred mineral resource of 5,551,000 tons at a grade of

1.48 Au g/t for 265,000 oz of gold.

Desert Gold also continues to own a 50% interest in the Goldbanks Project

located in Nevada, USA, under the terms of a joint venture agreement entered

into with a wholly-owned subsidiary of Kinross Gold Corporation

(TSX:K)(NYSE:KGC) which has a 43-101 compliant inferred resource of 28,310,000

tons at a grade of 0.57 Au g/t for 556,000 oz of gold.

In light of these recent developments, the Company would like to provide our

shareholders with a brief update on Desert Gold, our current objectives as a

company, and the leadership group in place to ensure that we achieve our goals.

Share Capital

Immediately prior to the Acquisition, Desert Gold had 19,118,370 common shares

outstanding. As consideration for the Acquisition, Desert Gold issued a total of

20,000,000 common shares to TransAfrika Resources (Mauritius) Limited

("TransAfrika Mauritius") as ultimate parent company of TransAfrika, 10,000,000

of which are being distributed, by way of dividend, to the TransAfrika Mauritius

shareholders pro rata to their shareholdings in TransAfrika Mauritius(2).

(1) SAMREC stands for the South African Code for Reporting of Exploration

Results, Mineral Resources and Mineral Reserves. As more particularly described

in the technical reports filed with the TSX Venture Exchange and other

regulatory authorities and available under Desert Gold's SEDAR profile at

www.sedar.com, the mineral resource categories of the SAMREC Code reported above

reconcile with the same mineral resource categories in the Canadian Institute of

Mining, Metallurgy and Petroleum ("CIM") Definition Standards adopted by the CIM

Council and incorporated into National Instrument 43-101 - Standards of

Disclosure for Mineral Projects of the Canadian Securities Administrators.

(2) TransAfrika Mauritius is a widely-held private company that has raised over

$40 million in financing since 2007 principally to fund the advancement of the

TransAfrika material properties recently acquired by Desert Gold. TransAfrika

Mauritius also owns interests in base metals properties in the DRC and

Mauritania which did not form part of the Acquisition.

Desert Gold is required to issue a further 12,000,000 common shares (the

"Performance Shares"), in the aggregate, to TransAfrika Mauritius and its

shareholders in the event that within a two year period from closing of the

Acquisition, Desert Gold publishes an NI 43-101-compliant resource calculation

disclosing that the TransAfrika material properties contain at least an

additional 1,000,000 ounces of gold or gold equivalent in the inferred mineral

resource category.

In addition, concurrent with the Acquisition, Desert Gold raised $3.7 million

through the issue of 4,949,665 units at a subscription price of $0.75 per unit

(the "Financing"). Each unit consisted of one common share and one-half of one

common share purchase warrant, with each whole warrant entitling the holder to

subscribe for one additional common at an exercise price of $1.00 for a period

of 24 months from closing of the Acquisition, provided that, in the event that

the closing price of the Desert Gold common shares on the TSX Venture Exchange

is greater than $1.50 for a period of 20 consecutive trading days at any time

following closing of the Acquisition, Desert Gold may, at its option, accelerate

the expiry date of the warrants by giving written notice to the holders thereof

and in such case the warrants will expire on the date which is the earlier of:

(i) the 30th day after the date on which such notice is given; and (ii) 24

months from closing of the Acquisition.

Overall, a total of 44,038,035 common shares, 2,474,832 warrants, 2,051,625

stock options, and 49,496 broker warrants (issued to MGI Securities Inc. as lead

agent in connection with the Financing) are currently outstanding.

Board and Management

----------------------------------------------------------------------------

Name, Municipality of

Residence, Position with

Desert Gold Selected Biographical Information

----------------------------------------------------------------------------

Roeland van Kerckhoven Mr. van Kerckhoven has spent more than 29

(Bryanston, South Africa) years of his career with the Anglo American

President, Chief Executive group of companies, serving for the last 15

Officer and Director years as CFO and business development director

of Anglo Platinum until he retired in March

2007.At various times during his career at

Anglo Platinum, he also headed the;

exploration, legal, corporate finance,

investor relations and corporate

communications portfolios. Since joining

TransAfrika Mauritius in 2008 as President and

Chief Executive Officer, he has overseen the

discovery and evaluation of a portfolio of

assets and has been actively involved in

negotiations with African governments and

joint venture partners. He earned both his MBL

and B.Comm degrees from the University of

South Africa.

----------------------------------------------------------------------------

Theo Christodoulou Mr. Christodoulou worked at

(Johannesburg, South Africa) PricewaterhouseCoopers for nearly 5 years,

Director after which he joined Deutsche Bank. He worked

for the bank for 11 years, which included 5

years as Director (and head of Metals and

Mining in South Africa). Mr. Christodoulou

then founded the corporate finance company, AC

Squared Solutions in 2010. He has extensive

experience in advising on mining initiatives,

project finance planning and management, M&A,

IPO's and BEE structuring across Africa. Mr.

Christodoulou holds an MBA from Duke

University.

----------------------------------------------------------------------------

Louw van Schalkwyk Mr. Schalkwyk started his career as an

(Northern Cape, South exploration geologist with Gold Fields of

Africa) South Africa Limited in 1984 and was promoted

Vice-President, Exploration, to senior geologist. In 1992 he moved to

Director consulting and contracting geology, working on

gold and base metal exploration for various

major and junior exploration and mining

companies in sub-Saharan Africa. These include

Rio Tinto Plc, Anglo American, Iscor Limited

and Pangea Minerals Ltd. His ability to

integrate geology with applied exploration

techniques led to the discovery of the Gams

East Zinc deposit while working as project

manager for Anglo American. Mr. Schalkwyk

obtained a BSc Geology (Hons) degree from the

University of Stellenbosch in 1984.

----------------------------------------------------------------------------

Jared Scharf Mr. Scharf has been serving as CFO of Desert

(Ontario, Canada) Gold since 2009. Mr. Scharf's background is in

Chief Financial Officer, private investment and management consulting

Secretary in the areas of corporate finance and

financial accounting. Over the last 7 years

Mr. Scharf has focused much of his time on the

acquisition and development of mining and

alternative energy projects in Africa and

North and Central America. Mr. Scharf is also

a Director of EasyMed Services Inc., a

publicly-traded Canadian healthcare technology

company. Mr. Scharf holds an Honors Commerce

degree in Finance from the Telfer School of

Management at the University of Ottawa as well

as a Bachelors of Administration also from the

University of Ottawa.

----------------------------------------------------------------------------

Mohd Ayub Khan Mr. Khan brings over 19 years of experience in

(Geneva, Switzerland) operations, public markets and finance to the

Non-Executive Chairman of Resulting Issuer. Over the last 19 years he

the Board of Directors has been involved in acquiring, restructuring

and financing public companies. His experience

in public markets includes acquisitions of

companies in Europe and South America. Mr.

Khan is a professional Asset Manager currently

based in Geneva, Switzerland and travels

extensively in order to oversee his company's

considerable business interests. Mr. Khan

holds a B.Sc. in Business Administration and

Finance from Ball State University of Muncie,

Indiana, U.S.A.

----------------------------------------------------------------------------

Thomas R. Tough Mr. Tough has more than 40 years experience as

(British Columbia, Canada) a self-employed consulting Professional

Director Engineer in 40 different countries, in both

the western and eastern hemispheres. In the

course of his career he has been involved in

many capacities of the mining industry. He has

held numerous directorships and officer

positions in public and private companies,

including the role of President, CEO and

Director of Desert Sun Mining Corp. for 18

years. In April 2006, Yamana Gold Inc.

purchased Desert Sun and its producing gold

mine in Brazil. In 2003 Mr. Tough also joined

the boards of TSX listed Potash One Inc.,

where he also served as President and CEO, and

TSXV listed Maxtech Ventures Inc., where he

still serves as President & CEO. Since 2008 he

has served on the board of Aroway Minerals

Inc. and in 2010 he became President, CEO and

a director of Firebird Resources Inc., both

listed on the TSXV. He is a member of the

Association of Professional Engineers and

Geoscientists of British Columbia and holds a

B.Sc. in Geology from the University of

British Columbia.

----------------------------------------------------------------------------

Sonny Janda He is the President & CEO of Grand Peak

(British Columbia, Canada) Capital Corp., a TSXV listed company that

Director invests in public and private corporations. He

also serves on the board of Maxtech Ventures

Inc., Lucky Minerals Inc. and EasyMed Services

Inc. He holds a bachelor's degree in Economics

from Simon Fraser University in Vancouver, BC.

----------------------------------------------------------------------------

Exploration Programs

Desert Gold is in the process of carrying out a $5 million exploration program

in respect of the Rwanda and Mali properties, as recommended by Coffey

International Limited, authors of the independent technical reports (the

"Technical Reports") filed with the TSX Venture Exchange and other regulatory

authorities and available in their entirety under Desert Gold's SEDAR profile at

www.sedar.com.

Coffey International Limited is a specialist professional services consultancy

with expertise in geosciences, international development, and project

management. Coffey is listed on the Australian Securities Exchange (ASX:COF).

Set forth below, for your reference, are excerpts from the Technical Reports

summarizing the proposed 2012 work programs at the Rwanda and Mali projects:

Rwanda

Work completed by TransAfrika on its Rwanda permits thus far has been largely

focused on the Byumba Project with soil sampling surveys carried out on the

Rusizi and Nyamugali Projects. The recommended exploration priority is to

increase and improve the mineral resource for the Byumba Project.

The total budget required for Rwanda is USD 3,200,000 as presented in Table 1

below. At the completion of the diamond drilling a decision will be taken on

commencing a Scoping Study based on the drill results returned.

----------------------------------------------------------------------------

Table 1

Bumba, Nyamugali and Rusizi Project

Estimated Exploration Budget. (USD '000s)

----------------------------------------------------------------------------

Item Total

----------------------------------------------------------------------------

Drilling $1,929

----------------------------------------------------------------------------

Logistics and equipment $239

----------------------------------------------------------------------------

Consulting and salaries $430

----------------------------------------------------------------------------

Laboratories $227

----------------------------------------------------------------------------

Kigali and Johannesburg office $375

----------------------------------------------------------------------------

TOTAL $3,200

----------------------------------------------------------------------------

The scheduling of the exploration is presented in Table 2 and the associated

costing in Table 3.

Coffey Mining considers the exploration rationale to be appropriate for this

stage of the projects. Additional funding may be required at a later stage.

----------------------------------------------------------------------------

Table 2

Summary of Work Schedules by Permit Area

----------------------------------------------------------------------------

Q3 Q4 Q1 Q2

Permit 2011 2011 2012 2012

----------------------------------------------------------------------------

Rusizi Limited work

recommended

----------------------------------------------------------------------------

Byumba Establishment, Diamond Diamond Modelling and

rig drilling, soil drilling, resource

mobilization, sampling Metallurgical estimate

construct drill test work

platforms,

Diamond drilling

----------------------------------------------------------------------------

Nyamugali Target Public liaison,

generation Mapping

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Table 3

Summary of the proposed Spending of the Exploration Budget for Rwanda

(USD)

----------------------------------------------------------------------------

Q3 Q4 Q1 Q2

Permit 2011 2011 2012 2012 Total

----------------------------------------------------------------------------

Corporate RSA &

Mali/Senegal $112,500 $112,500 $112,500 $37,500 $375,000

----------------------------------------------------------------------------

Logistics & Equipment $75,200 $75,800 $76,800 $11,600 $239,400

----------------------------------------------------------------------------

Field Teams & Technical

Consulting $112,600 $133,600 $148,600 $35,000 $429,800

----------------------------------------------------------------------------

Drilling & Geophysical

Contractors $226,400 $928,800 $774,000 $0 $1,929,200

----------------------------------------------------------------------------

Laboratories $30,200 $95,200 $98,800 $2,500 $226,700

----------------------------------------------------------------------------

Total $556,900 $1,345,900 $1,210,700 $86,600 $3,200,100

----------------------------------------------------------------------------

Mali

Farabantourou Permit

Farabantourou has an initial budget estimated to the end of Q2 2012 (Table 1).

Geological mapping should be carried out over the entire permit area with

emphasis on structural geology. Once the structure is better understood, drill

results from all known prospects should be reinterpreted. The soil-sampling grid

should be extended to cover the entire permit area.

All geological, geophysical and geochemical data should be integrated at the end

of phase 1 and drill targets prioritized. Should the assessment be positive a

drilling budget should be compiled to allow for drilling to start in Q4 2012.

The nature of the drill program will be determined by Phase I exploration

results.

The following phased exploration program is proposed:

Phase 1: Prioritization of areas for resource drilling, Phase I will include

site establishment, geological mapping, soil sampling, integration of geology IP

data and soil sampling data, trenching and pitting over selected areas and drill

planning.

The budget to completion of phase 1 is USD $576,100 (table 1)

Phase 2: Exploration drilling. This phase was not budgeted.

Phase 3: Resource drilling. This phase was not budgeted.

----------------------------------------------------------------------------

Table 1

Summary of Budget for Farabantourou Permit Area

(USD)

----------------------------------------------------------------------------

Q3 Q4 Q1 Q2

Permit 2011 2011 2012 2012 Total

----------------------------------------------------------------------------

Corporate RSA & Mali/Senegal $67,500 $67,500 $67,500 $67,500 $270,000

----------------------------------------------------------------------------

Logistics & Equipment $57,000 $30,300 $30,300 $10,800 $128,400

----------------------------------------------------------------------------

Field Teams & Technical

Consulting $36,400 $36,400 $36,400 $28,500 $137,700

----------------------------------------------------------------------------

Laboratories $15,500 $15,500 $9,000 $0 $40,000

----------------------------------------------------------------------------

Total $176,400 $149,700 $143,200 $106,800 $576,100

----------------------------------------------------------------------------

Loulo-Est and Segala-Ouest Permit

Loulo-Est and Segala-Ouest have a combined budget estimated to the end of Q2

2012 (Table 2). TransAfrika have applied to the Malian Government and were

successful in getting the two permits combined and they are considered one

project. The following phased work program is recommended:

Phase 1: Prioritization of areas for resource drilling. This will include:

-- Soil sampling should be extended to cover the whole of Segala-Ouest.

Soil sampling results should be reprocessed using geostatistical

estimation methods to identify gold anomalies and trends as this appears

to give better results than simpler contour methods.

-- Geological mapping of the permits

-- IP surveys

-- Pitting and trenching

-- Target generation. While various targets have been identified, this has

not been done on a fully integrated geological model for the area. A

fully integrated geological interpretation needs to be undertaken so

that the geology can be better understood and targets for follow-up

surface surveys can be better delineated.

-- Drill program planning.

The budget allows for USD $690,100 to complete this phase (Table 2).

Phase 2: Exploration drilling. The nature of the drilling depends on the results

of from Phase 1, hence this phase was not budgeted.

Phase 3: Resource drilling. The nature of the drilling depends on the results of

from the previous phases. This phase was not budgeted.

----------------------------------------------------------------------------

Table 2

Summary of Budget for Loulo-Est, Segala-Ouest Area

(USD)

----------------------------------------------------------------------------

Q3 Q4 Q1 Q2

2011 2011 2012 2012 Total

----------------------------------------------------------------------------

Corporate RSA & Mali $67,500 $67,500 $67,500 $67,500 $270,000

----------------------------------------------------------------------------

Logistics & Equipment $57,000 $30,300 $55,300 $10,800 $153,400

----------------------------------------------------------------------------

Field Teams & Technical

Consulting $36,400 $36,400 $126,400 $28,500 $227,700

----------------------------------------------------------------------------

Laboratories $15,000 $15,000 $9,000 $0 $39,000

----------------------------------------------------------------------------

Total $175,900 $149,200 $258,200 $106,800 $690,100

----------------------------------------------------------------------------

In light of challenging financial market conditions, Desert Gold is delighted to

have completed the Acquisition TransAfrika and the subsequent Financing. The

Company is committed to expanding and further proving the significant potential

of the TransAfrika mineral properties for the benefit of our shareholders. To

this end, the Company anticipates raising $10 million of additional funding

during the first half of this year to pursue the drilling program on

Farabantourou, our most prospective property in Mali. All the while, the Company

will continue its drilling program in Rwanda where we look to significantly

increase the current resource estimate in the short to medium term. At current

levels, management feels that the Company's share price is undervalued and we

will be undertaking a sustained marketing and investor awareness campaign to

increase exposure in the investor community. To our shareholders, we thank you

for your continued support as we look to meet our corporate milestones with the

aim of building a world-class gold company.

Sincerely yours,

Roeland van Kerckhoven, President and CEO

For further information concerning Desert Gold and the TransAfrika material

properties, please refer to Desert Gold's SEDAR profile at www.sedar.com.

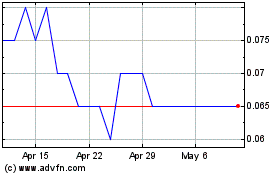

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jul 2023 to Jul 2024