Wesdome Gold Mines Ltd. (TSX: WDO, OTCQX: WDOFF)

(“

Wesdome” or the “

Company”)

today announces its production results for the fourth quarter and

full year ended December 31, 2024 and provides a multi-year

operational outlook. The Company plans to release its fourth

quarter and full year 2024 financial results after markets close on

Wednesday, March 19, 2025 and host a conference call and webcast

the following morning. All amounts are expressed in Canadian

dollars unless otherwise indicated.

Q4 2024 and Full Year 2024 Operating

Results

|

|

Q4 2024 |

Q4 2023 |

2024 |

2023 |

| Ore

milled (tonnes) |

|

|

|

|

|

Eagle River |

60,358 |

54,669 |

222,526 |

228,777 |

|

Kiena |

62,421 |

49,649 |

216,754 |

191,148 |

|

Total ore milled |

122,779 |

104,318 |

439,280 |

419,925 |

|

|

|

|

|

|

| Head

grade (grams per tonne) |

|

|

|

|

|

Eagle River |

14.3 |

14.1 |

13.7 |

12.4 |

|

Kiena |

11.5 |

7.7 |

11.2 |

5.9 |

|

|

|

|

|

|

| Gold

production (oz) |

|

|

|

|

|

Eagle River |

26,702 |

24,072 |

94,562 |

87,799 |

|

Kiena |

22,865 |

12,144 |

77,472 |

35,537 |

|

Total production |

49,567 |

36,216 |

172,034 |

123,336 |

|

Production sold (oz) |

48,700 |

37,620 |

167,300 |

126,620 |

Anthea Bath, President and CEO of Wesdome,

commented, “In 2024, for the second consecutive year, we met our

initial production guidance while improving health and safety

performance. This achievement underscores our commitment to

operational excellence, consistent delivery and responsible mining

practices. Record production further reflects a stronger

operational foundation as well as the experience and commitment of

our team. Through improved planning and disciplined execution, we

expect to continue delivering sustainable growth and returns to our

shareholders.

“In 2025, our efforts will centre on delivering

consistently, operating safely and responsibly and unlocking

additional value from our high-grade assets in Ontario and Quebec.

A full year of production from the high-grade Kiena Deep Zone and

the addition of ore from Presqu'île late in the year will be the

key drivers of increased production at Kiena, while Eagle River

will continue to benefit from development and efficiency

improvements. Together, these operations are expected to drive

another substantial increase in annual production to between

190,000 and 210,000 ounces, with costs in the lower half of the

industry cost curve, further solidifying our position as a

high-quality, all-Canadian, low-cost gold producer.

“Exploration remains the core of our strategy

with a record $38 million program aimed at growing existing

high-grade zones, such as Kiena Deep and the 300 Zone at Eagle

River, while also targeting shallower zones like Dubuisson and 6

Central. Our goal is to build on recent exploration success by

delivering resource and reserve growth that extends mine life and

enhances the value of our assets. In parallel, we are investing in

infrastructure projects to support both near-term objectives and

future growth.

“With the advancement of the fill-the-mill

strategy, we expect to deliver increasing and sustainable

production levels with strong operating margins, driven by mine

plan optimization, continuous operational improvements, anticipated

resource growth and strategic investment in our operations. With a

strong balance sheet, robust free cash flow and a clear vision,

Wesdome is well positioned to invest in the future and create

substantial long-term value.”

2025 Guidance

|

|

|

Eagle River |

Kiena |

Consolidated Guidance |

|

Production |

|

|

|

|

| Head

grade |

(g/t) |

13.0 - 15.0 |

10.0 - 11.0 |

11.0 - 13.0 |

| Gold

production |

(oz) |

100,000 - 110,000 |

90,000 - 100,000 |

190,000 - 210,000 |

|

|

|

|

|

|

|

Operating Costs |

|

|

|

|

|

Depreciation and depletion |

($M) |

$55 |

$65 |

$120 |

| Corporate

and general1 |

($M) |

$12 |

$12 |

$24 |

|

Exploration and evaluation2 |

($M) |

$5 |

$10 |

$15 |

| Cash

costs3 |

($/oz) |

$1,225 - $1,350 |

$1,025 - $1,150 |

$1,125 - $1,250 |

| All-in

sustaining costs3 |

($/oz) |

$1,875 - $2,075 |

$1,650 - $1,875 |

$1,775 - $1,975 |

| All-in

sustaining costs3 |

(US$/oz) |

$1,400 - $1,550 |

$1,225 - $1,400 |

$1,325 - $1,475 |

|

|

|

|

|

|

|

Capital Investment4 |

|

|

|

|

| Total

capital |

($M) |

$65 |

$95 |

$160 |

|

Sustaining capital |

($M) |

$60 |

$55 |

$115 |

|

Growth capital |

($M) |

$5 |

$40 |

$45 |

Notes:

- Consolidated

2025 guidance for corporate and general costs excludes an estimated

$4 million in stock-based compensation. Corporate G&A of $24

million is allocated equally to each mine and is included in the

Company’s all-in sustaining cost calculation.

- Exploration and

evaluation costs primarily include surface drilling activities and

regional office expenses.

- This is a

financial measure or ratio that is a non-IFRS financial measure or

ratio. Certain additional disclosures for non-IFRS financial

measures and ratios have been incorporated by reference and

additional detail can be found at the end of this press release and

in the section ‘Non-IFRS Performance Measures’ in the Company’s

management discussion and analysis for the three and nine months

ended September 30, 2024.

- Total capital

expenditures are the sum of sustaining and growth capital

expenditures and are reported under investing activities on the

statements of cash flows in the Company’s consolidated financial

statements.

2025 Guidance Commentary

- Consolidated

production is expected to be between 190,000 and 210,000 ounces,

which, based on the midpoint, represents an approximately 16%

increase compared to 2024. Production is anticipated to strengthen

in the second half of 2025, with the first and fourth quarters

accounting for approximately 20% and 30% of total gold production,

respectively.

- The gold

production outlook for Eagle River of 100,000 to 110,000 ounces

reflects a 10% increase compared to the prior year driven by the

establishment of new underground areas, enabling increased

throughput levels. Production at Eagle River in the second half of

the year is expected to represent approximately 55% of its full

year 2025 output.

- Kiena gold

production guidance of 90,000 to 100,000 ounces represents a

material increase over 2024, with four full quarters of production

sourced from the Kiena Deep A Zone, augmented by approximately

10,000 ounces of pre-commercial production from the Presqu'île

Zone. Grade variability is expected to decrease in 2025 as the

majority of the planned mining reserves have now been substantially

delineated. Additionally, dilution control is improving and

enhanced mining execution – such as the selective application of a

hybrid long-hole and cut-and-fill mining strategy – is contributing

to more consistent performance. While initial stope production at

Presqu'île remains on track for late 2025, the expected receipt of

a bulk sample permit early in the year may allow for the

stockpiling of development ore with processing projected to

commence in the fourth quarter. The second half of the year is

expected to represent approximately 60% of Kiena’s annual

production.

- Consolidated

cash costs in 2025 are expected to be $1,125 to $1,250 per ounce,

lower than the prior year as a result of ongoing cost control

initiatives and an increase in gold sales.

- Eagle River

cash costs in 2025 are expected to be $1,225 to $1,350 per ounce,

below 2024 levels due to increased volumes and reflecting various

cost containment initiatives.

- Kiena cash cost

guidance of $1,025 to $1,150 per ounce is lower than the prior year

as increased production offsets higher planned development and

delineation costs.

- All-in

sustaining costs per ounce are expected to be $1,775 to $1,975

(US$1,325 to US$1,475). Due to the projected profile of production

and capital outlays, the Company expects all-in sustaining costs

per ounce in the first half of the year to be approximately 15%

higher than full year guidance.

- Consolidated

sustaining and growth capital investment is expected to be $160

million in 2025. This includes the remaining capital required to

complete the Presqu'île exploration ramp, together with investment

in development, infrastructure, equipment upgrades and underground

exploration at both sites. These initiatives are expected to drive

high-return production growth over the coming years. Both sites

have budgeted for increased development to open new mining fronts

as part of the Company’s fill-the-mill strategy, enhancing

operating flexibility and improving equipment utilization.

- Total capital

investment at Eagle River is expected to be $65 million in 2025.

Sustaining capital includes $25 million in deferred development, $8

million in delineation and exploration drilling and $27 million in

mobile and fixed infrastructure upgrades to support the

fill-the-mill strategy. Growth capital of $5 million includes power

line enhancements as well as tailings engineering and design

work.

- Total capital

investment at Kiena is expected to be $95 million in 2025.

Sustaining capital of $55 million includes $15 million in deferred

development, $13 million in delineation and exploration drilling,

$20 million in tailings and other infrastructure, and $6 million in

mobile equipment, including new battery electric trucks. Growth

capital is expected to be $40 million, mostly related to remaining

development of the exploration ramp from surface to level 33.

- At prevailing

gold prices, the Company is well positioned to deliver robust free

cash flow and further strengthen available liquidity in 2025,

driven by increased production and reduced costs. This strong

financial performance will support the Company’s continued focus on

high return long-term organic growth initiatives. The estimated

impact of a US$100 per ounce change in realized gold prices on

annual free cash flow is approximately $20 million. The Company

also projects an effective tax rate of approximately 35%,

reflecting the use of available tax attributes and applicable tax

rates.

Operational Outlook

Gold production is expected to continue to

increase in 2026 to between 195,000 and 220,000 ounces. Consistent

levels of production from Eagle River will be primarily driven by

higher expected throughput levels, benefitting from planned

infrastructure and optimization improvements, as well as

delineation drilling around existing development, a strategic

priority for the operation. At Kiena, a full year of production

from the Presqu'île Zone is expected to drive an increase in

processed ore and gold production.

|

|

|

Eagle River |

Kiena |

Consolidated Guidance |

| Gold production |

(oz) |

100,000 - 110,000 |

95,000 - 110,000 |

195,000 - 220,000 |

Achieving long-term sustainable production

growth consistent with recent years will require success across

operations, technical services and exploration to drive targeted

efficiencies, optimization, infrastructure upgrades, and resource

development initiatives. These initiatives, coupled with a

commitment to cost management and operational excellence, provide a

credible and achievable framework to deliver value for

shareholders.

At Eagle River, production is expected to

benefit from a significant contribution from the high-grade 300

Zone as well as from Wesdome’s global resource model initiative.

This program aims to unlock economic mineralization close to

surface and existing development through the digitization of

historic mine data, deployment of alternative mining methods as

well as the use of incremental and break-even cut-off grade

analysis. Improved development performance is expected to increase

access to ore and improve mill utilization, allowing for the

consistent delivery of ore to the 1,200 tonnes per day mill. As the

mine advances the 300 Zone at depth, these efforts are projected to

support consistent annual production levels. A planned increase in

deferred development in 2025 is anticipated to enable greater

access to drilled inventory going forward, supporting operational

flexibility and reducing risks to production targets.

At Kiena, consistent and efficient mining of the

Kiena Deep A Zone will remain the cornerstone of production over

the medium term. Steady improvements in hoisting and underground

infrastructure, including ventilation and electric haulage

infrastructure, are expected to support higher mining rates and

efficiency gains. Completion of stope development in the Presqu'île

Zone as well as the exploration ramp to level 33 at Kiena will

allow access to high-potential mining targets, facilitating future

production from the 33-level drift. Other near-surface deposits

such as Dubuisson are expected to be delineated in the medium term

and integrated into mine plans, contributing to potential mine life

extension and increased utilization of the 2,040 tonnes per day

mill.

The Company believes that consolidated cash

costs and all-in sustaining costs per ounce in the lower half of

the industry cost curve are achievable. As effective mill

utilization increases at Eagle River and Kiena, the benefits of

planned investment and economies of scale are expected to drive

down unit costs and improve margins. Sustaining and growth capital

spend will remain disciplined with targeted investments in

infrastructure, equipment and exploration aimed at supporting

production growth and enhancing long-term asset value. Total annual

sustaining expenditures over the next two years are expected to be

between $100 and $120 million, including $20 to $30 million per

year allocated to underground exploration and delineation drilling

to make new discoveries, extend mine life and expand reserves

adjacent to current infrastructure.

The Company is currently evaluating the timing

of completing updated NI 43-101 technical reports to incorporate

strategic asset optimization initiatives currently underway.

Conference Call and Webcast

Management will host a conference call and

webcast to discuss the Company’s fourth quarter and 2024 financial

and operating results. A question-and-answer session will follow

management’s prepared remarks. Details of the webcast are as

follows:

|

Date and time: |

Thursday, March 20, 2025 at 10:00 a.m. ET |

| |

|

| Participant registration: |

https://register.vevent.com/register/BI29417595e5b640209667946bbfcd2902Click

on the link above and complete the online registration form. Upon

registering you will receive the dial-in info and a unique PIN to

join the call as well as an email confirmation with the

details. |

| |

|

| Webcast link: |

https://edge.media-server.com/mmc/p/h5gafw4x |

| |

|

| Notes: |

Pre-registration is required for

this event. It is recommended you join 10 minutes prior to the

start of the event. The webcast can also be accessed under the news

and events section of the Company’s website. |

| |

|

The financial statements and management’s

discussion and analysis will be available on the Company’s website

at www.wesdome.com and on SEDAR+ www.sedarplus.ca the evening of

March 19, 2025.

About Wesdome Gold Mines

Ltd.

Wesdome is a Canadian-focused gold producer with

two high-grade underground assets, the Eagle River mine in Ontario

and the Kiena mine in Québec. The Company’s primary goal is to

responsibly leverage its operating platform and high-quality

brownfield and greenfield exploration pipeline to build Canada’s

next intermediate gold producer.

For further information, please

contact: Raj Gill, SVP, Corporate Development &

Investor RelationsTrish Moran, VP, Investor RelationsPhone: +1

(416) 360-3743E-Mail: invest@wesdome.com

Technical Disclosure

The technical and scientific information

relating to exploration activities disclosed in this document was

prepared under the supervision of and verified and reviewed by Guy

Belleau, P. Eng, Chief Operating Officer of the Company and Niel de

Bruin, P. Geo, Director of Geology for Wesdome, each a "Qualified

Person" as defined in National Instrument 43-101 - Standards of

Disclosure for Mineral Projects.

Forward-Looking Statements

This news release contains “forward-looking

information” which may include, but is not limited to, statements

with respect to the future financial and operating performance of

the Company and its projects. Often, but not always,

forward-looking statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or variations (including negative variations) of such words and

phrases, or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Forward-looking statements contained herein are made as of the date

of this press release and the Company disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or results or otherwise. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements.

Forward-looking statements or information

contained in this press release include, but are not limited to,

statements or information with respect to: the Company’s 2025

guidance, including expected gold production, cost and capital

expenditure guidance, all-in sustaining costs and cash costs per

ounce cost guidance, our expected 2025 production levels, costs and

free cash flow generation, future growth and returns to

shareholders and their respective drivers, the goals of our planned

exploration program, the expected timing of the strengthening of

the 2025 production, the primary sources of the 2025 production,

expected grade variability in 2025, the expected receipt of permits

in 2025 and its anticipated benefits, the variability of production

levels throughout the year by quarter and half, expected available

liquidity, and anticipated effective tax rates; the Company’s

strategic outlook, including expected 2026 gold production levels,

expected throughput levels and its benefits on production, a full

year of production from the Presqu'île Zone and its benefits,

achieving long-term sustainable production growth consistent with

recent years and the requirements to achieve this, expected

benefits to Eagle River production, an increase in deferred

development at Eagle River and its expected benefits, drivers of

higher mining rates and efficiency gains at Kiena, the anticipated

delineation of near-surface deposits and its anticipated benefits,

the achievable consolidated cash costs and all-in sustaining costs

per ounce and their drivers, and our anticipated decline of total

sustaining expenditures over the next two years; our expectations

as to our future financial and operating performance, including

future cash flow, estimated cash costs, expected metallurgical

recoveries and gold price outlook; and our strategy, plans and

goals, including our proposed exploration, development,

construction, permitting and operating plans and priorities,

related timelines and schedules. Forward-looking statements and

forward-looking information by their nature are based on

assumptions and involve known and unknown risks, uncertainties and

other factors, which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: production and cost profile expectations; our development

work at Kiena and Presqu'île; our ability to execute our

development plans, including the timing thereof; our ability to

obtain all required approvals and permits; cost estimates in

respect of operating and exploration activities; changes in the

Company’s input costs; geotechnical risk; the impact of inflation;

the geopolitical, economic, permitting and legal climate that we

operate in; potential disruptions relating to natural disasters

such as forest fires; operational exposure to diseases, epidemics

and pandemics; timing, cost and results of our construction,

improvements and exploration; rising costs or availability of

labour, electricity, supplies, fuel and equipment; the future price

of gold and other commodities; exchange rates; relationships with

communities, governments and other stakeholders; compliance with

debt obligations; anticipated values, costs, expenses and working

capital requirements; production and metallurgical recoveries;

mineral reserves and resources; and the impact of acquisitions,

dispositions, suspensions or delays on our business and the ability

to achieve our goals. In addition, except where otherwise stated,

we have assumed a continuation of existing business operations on

substantially the same basis as exists at the time of this press

release. Even though our management believes that the assumptions

made and the expectations represented by such statements or

information are reasonable in the circumstances, there can be no

assurance that the forward-looking statement or information will

prove to be accurate. Many assumptions may be difficult to predict

and are beyond the Company’s control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors including those risk

factors discussed in the sections titled “Cautionary Note Regarding

Forward Looking Information” and “Risks and Uncertainties” in the

Company’s most recent Annual Information Form. Readers are urged to

carefully review the detailed risk discussion in our most recent

Annual Information Form which is available on SEDAR+ and on the

Company’s website.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. The Company undertakes no

obligation to update forward-looking statements if circumstances,

management’s estimates or opinions should change, except as

required by securities legislation. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

Non-IFRS Performance

Measures

Wesdome uses non-IFRS performance measures

throughout this news release as it believes that these generally

accepted industry performance measures provide a useful indication

of the Company’s operational performance. These non-IFRS

performance measures do not have standardized meanings defined by

IFRS and may not be comparable to information in other gold

producers’ reports and filings. Accordingly, it is intended to

provide additional information and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS.

Cash costs per ounce of gold sold

Cash cost per ounce of gold sold is a non-IFRS

performance measure and does not constitute a measure recognized by

IFRS and does not have a standardized meaning defined by IFRS, as

well it may not be comparable to information in other gold

producers’ reports and filings. The Company has included this

non-IFRS performance measure throughout this document as Wesdome

believes that this generally accepted industry performance measure

provides a useful indication of the Company’s operational

performance. The Company believes that, in addition to conventional

measures prepared in accordance with IFRS, certain investors use

this information to evaluate the Company’s performance and ability

to generate cash flow. Accordingly, it is intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS.

All-in sustaining costs per ounce of

gold sold

All-in sustaining costs include mine site

operating costs incurred at Wesdome mining operations, sustaining

mine capital and development expenditures, mine site exploration

expenditures and equipment lease payments related to the mine

operations and corporate administration expenses. The Company

believes that this measure represents the total costs of producing

gold from current operations and provides Wesdome and other

stakeholders with additional information that illustrates the

Company’s operational performance and ability to generate cash

flow. This cost measure seeks to reflect the full cost of gold

production from current operations on a per-ounce of gold sold

basis. New project and growth capital are not included.

PDF

available: http://ml.globenewswire.com/Resource/Download/94fa7ca6-6879-497a-b989-85cc9a4c78c9

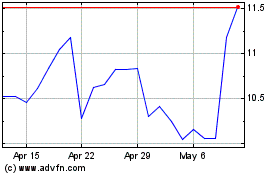

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Jan 2024 to Jan 2025