Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”)

today announces the 2023 surface exploration drilling results from

the Presqu’île Zone located 1.3 km north-west of the Company’s 100%

owned Kiena Mine Complex in Val d'Or, Quebec.

Recent drilling at Presqu’île is part of an

ongoing exploration program focussing on near surface gold

potential along strike from Kiena that remains under explored.

Drilling results from the Shawkey and Dubuisson Zones, located

further to the east along strike, were released earlier this year

(see May 23, 2023 release, “Wesdome Drilling Southeast of Kiena

Mine Identifies Potential Bulk Tonnage Underground Target;

Returning 2.3 g/t Gold Over 72 m Core Length”). Ongoing drilling

highlights the potential of this area to add to the existing

resource base proximal to mine infrastructure and remains a

priority for the Company (Figure 1).

Highlights of recent in-fill drilling are listed

below and are summarized in Table 1. Assay results for nine (9) of

thirty-two (32) diamond drill holes planned are pending.

- Hole PR-23-070:

32.5 g/t over 3.0 m core length (30.0 g/t Au

capped*, 2.9 true width) PR-2A Zone.

- Hole PR-23-084 : 14.0 g/t Au

over 5.3 m core length (14.0 g/t Au capped*, 4.0 m

true width) PR-2 Zone.

- Hole PR-23-058A : 9.31 g/t Au

over 4.6 m core length (9.31 g/t Au capped*, 4.3 m

true width) PR-2 Zone.

* All assays capped at 90 g/t. Au. True widths

are estimated based on 3D model construction.

Ms. Anthea Bath, President and CEO commented,

“We are pleased with the recent surface drill results that confirm

continuity of mineralization at Presqu’île. The Presqu’île Zone is

just one of several zones having the potential to offer a

supplementary source of mill feed near-surface or in the upper mine

area for the underutilized Kiena mill. Recent drilling results from

the Shawkey and Dubuisson Zones, both adjacent to the existing

33-level track drift development that extends over three kilometres

east of the Kiena mine shaft, further reinforces the potential of

this area. As our exploration continues and the refinement of the

geologic model increases, we are confident we will identify more

zones of gold mineralization accessible from 33 level, as well as

additional down plunge extensions similar to the Kiena Deep

Zone.

Recent drilling supports the decision to proceed

with the exploration ramp from surface later this year to further

assess the continuity of the mineralization and test the down

plunge extension of the deposit. The excavation of the ramp is

expected to proceed in Q4 2023 once required permits are secured.

This ramp can also be integrated with Kiena's existing underground

ramp network, providing additional access to surface for ongoing

operations and future mining of deposits such as Dubuisson from 33

level further to the east.”

Since 2020, drilling at Presqu’île has

identified five gold-rich zones crosscutting mafic rocks (Zones

PR-1, 2 and 2A) and ultramafic rocks (Zones PR-3 and 4). PR-1 and

PR-2A are parallel to each other trending east-west and dipping

north, while PR-2 strikes southeast-northwest and crosscut the

east-west zones. Gold mineralization is associated with traces to

5% disseminated sulphides (pyrite, pyrrhotite, chalcopyrite,

sphalerite and galena) and local gold grains occurring in

quartz-chlorite-carbonate or quartz (grey) vein contacts as well as

in moderately to strongly chloritized and biotitized host

rocks.

The 2023 surface drilling program, which is

expected to be completed by the end of September, was designed to

increase the size and confidence in the mineral resources for Zones

PR-1, 2 and 2A (Figure 2). The 2023 drilling program confirmed not

only the continuity of the gold mineralization at Presqu’île and

the validity of the geologic model, but also the potential for down

plunge extensions toward east of Zones PR-2 and PR-2A. Both zones

are interpreted as excellent target for a follow up drilling

program from surface or from underground with development of an

exploration ramp.

Presqu’île has a mineral resource estimation of

138,000 tonnes grading 8.2 g/t Au totalling 37,000 oz as Indicated

Mineral Resources and Inferred Mineral Resource of 202,000 tonnes

grading 7.4 g/t and totalling 48,000 oz of gold from the three

lenses (PR-1, PR-2, and PR-2A Zones) as of December 31, 2022.

TECHNICAL DISCLOSURE

The technical and geoscientific content of this

release has been compiled and reviewed by Denys Vermette, P. Geo.,

(OGQ #564) Exploration Manager of the Company, and a "Qualified

Person" as defined in National Instrument 43-101 -Standards of

Disclosure for Mineral Projects.

Sample preparation and analytical work was

performed by ALS Minerals of Winnipeg (Manitoba), a certified

commercial laboratory (Accredited Lab #689). Assaying comprised

fire assay methods with an atomic absorption finish. Any sample

assaying >3 g/t Au was rerun by fire assay method with

gravimetric finish, and any sample assaying >10 g/t Au was rerun

with the metallic sieve method. In addition to laboratory internal

duplicates, standards, and blanks, the geology department inserts

blind duplicates, standards, and blanks into the sample stream at a

frequency of one in twenty to monitor quality control.

ABOUT WESDOMEWesdome is a

Canadian focused gold producer with two high grade underground

assets, the Eagle River mine in Ontario and the recently

commissioned Kiena mine in Quebec. The Company’s primary goal is to

responsibly leverage this operating platform and high-quality

brownfield and greenfield exploration pipeline to build Canada’s

next intermediate gold producer. Wesdome trades on the Toronto

Stock Exchange under the symbol “WDO,” with a secondary listing on

the OTCQX under the symbol “WDOFF.”

For further information, please

contact:

Lindsay Carpenter DunlopVP Investor

Relations416-360-3743 ext. 2025lindsay.dunlop@wesdome.com

220 Bay St, Suite 1200Toronto, ON, M5J 2W4

Toll Free: 1-866-4-WDO-TSXPhone: 416-360-3743,

Fax: 416-360-7620Website: www.wesdome.com

This news release contains “forward-looking

information” which may include, but is not limited to, statements

with respect to the future financial or operating performance of

the Company and its projects. Often, but not always,

forward-looking statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or variations (including negative variations) of such words and

phrases, or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Forward-looking statements contained herein are made as of the date

of this press release and the Company disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or results or otherwise. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The Company

undertakes no obligation to update forward-looking statements if

circumstances, management’s estimates or opinions should change,

except as required by securities legislation. Accordingly, the

reader is cautioned not to place undue reliance on forward-looking

statements. The Company has included in this news release certain

non-IFRS performance measures, including, but not limited to, mine

operating profit, mining and processing costs and cash costs. Cash

costs per ounce reflect actual mine operating costs incurred during

the fiscal period divided by the number of ounces produced. These

measures are not defined under IFRS and therefore should not be

considered in isolation or as an alternative to or more meaningful

than, net income (loss) or cash flow from operating activities as

determined in accordance with IFRS as an indicator of our financial

performance or liquidity. The Company believes that, in addition to

conventional measures prepared in accordance with IFRS, certain

investors use this information to evaluate the Company's

performance and ability to generate cash flow

Table 1: Kiena Complex Surface Drilling Assay and

Composite Results

Composites

|

|

|

Hole ID |

Zone |

From (m) |

To (m) |

Core length(m) |

Estimatedtrue width (m) |

Au (g/tFINAL) |

Au (g/t FINAL(cut 90)) |

|

PR-23-058A |

PR_2A |

362.5 |

366.0 |

3.5 |

3.3 |

3.85 |

3.85 |

|

PR-23-058A |

PR_2 |

392.0 |

396.6 |

4.6 |

4.3 |

9.31 |

9.31 |

|

PR-23-059 |

PR_2 |

363.0 |

366.0 |

3.0 |

2.9 |

3.32 |

3.32 |

|

PR-23-061 |

PR_2A |

354.4 |

357.4 |

3.0 |

2.8 |

5.02 |

5.02 |

|

PR-23-069 |

PR_2 |

235.0 |

238.0 |

3.0 |

2.8 |

9.41 |

9.41 |

|

PR-23-070 |

PR_2A |

207.5 |

210.5 |

3.0 |

2.9 |

32.51 |

30.01 |

|

PR-23-070 |

PR_2 |

216.0 |

219.0 |

3.0 |

2.9 |

15.62 |

15.62 |

|

PR-23-072 |

PR_2A |

206.0 |

209.0 |

3.0 |

2.9 |

4.88 |

4.88 |

|

PR-23-073 |

PR_2A |

230.7 |

233.7 |

3.0 |

2.5 |

9.06 |

9.06 |

|

PR-23-074 |

PR_2 |

259.4 |

266.0 |

6.6 |

5.2 |

3.94 |

3.94 |

|

PR-23-075A |

PR_2A |

195.7 |

199.7 |

4.0 |

3.2 |

6.97 |

6.97 |

|

PR-23-076 |

PR_2A |

159.6 |

163.6 |

4.0 |

3.7 |

14.94 |

14.94 |

|

PR-23-076 |

PR_2 |

192.9 |

195.9 |

3.0 |

2.8 |

3.69 |

3.69 |

|

PR-23-077 |

PR_2 |

174.0 |

180.4 |

6.4 |

6.0 |

6.12 |

6.12 |

|

PR-23-079 |

PR_2 |

168.2 |

172.0 |

3.8 |

3.4 |

2.92 |

2.92 |

|

PR-23-081 |

PR_2A |

153.0 |

157.0 |

4.0 |

3.2 |

7.12 |

7.12 |

|

PR-23-082 |

PR_2A |

134.2 |

137.2 |

3.0 |

2.8 |

8.12 |

8.12 |

|

PR-23-084 |

PR_2 |

164.6 |

169.9 |

5.3 |

4.0 |

13.96 |

13.96 |

|

|

|

|

|

|

|

|

|

- Mineralized zones

were expanded to a miniumum 2.8 metre true width maintaining a

grade over 2.8 g/t

Assays

|

Hole ID |

Zone |

From(m) |

To (m) |

Sample number |

Corelength |

Au (g/t FINAL) |

Au (g/t) FINAL(cut 90) |

|

PR-23-058A |

PR_2A |

362.5 |

363.5 |

E769531 |

1.0 |

0.02 |

0.02 |

|

PR-23-058A |

363.5 |

365.0 |

E769532 |

1.5 |

0.18 |

0.18 |

|

PR-23-058A |

365.0 |

366.0 |

E769533 |

1.0 |

13.2 |

13.2 |

|

|

|

|

|

|

|

|

|

|

PR-23-058A |

PR_2 |

392.0 |

393.0 |

E769536 |

1.0 |

0.02 |

0.02 |

|

PR-23-058A |

393.0 |

394.0 |

E769537 |

1.0 |

42.3 |

42.3 |

|

PR-23-058A |

394.0 |

395.3 |

E769538 |

1.3 |

0.15 |

0.15 |

|

PR-23-058A |

395.3 |

396.6 |

E769539 |

1.3 |

0.25 |

0.25 |

|

|

|

|

|

|

|

|

|

|

PR-23-059 |

PR_2 |

363.0 |

364.5 |

E762761 |

1.5 |

0.01 |

0.01 |

|

PR-23-059 |

364.5 |

366.0 |

E762762 |

1.5 |

6.63 |

6.63 |

|

|

|

|

|

|

|

|

|

|

PR-23-061 |

PR_2A |

354.4 |

355.4 |

E769691 |

1.0 |

14.15 |

14.15 |

|

PR-23-061 |

355.4 |

356.4 |

E769692 |

1.0 |

0.06 |

0.06 |

|

PR-23-061 |

356.4 |

357.4 |

E769694 |

1.0 |

0.84 |

0.84 |

|

|

|

|

|

|

|

|

|

|

PR-23-069 |

PR_2 |

235.0 |

236.0 |

E769521 |

1.0 |

22.8 |

22.8 |

|

PR-23-069 |

236.0 |

237.0 |

E769522 |

1.0 |

0.05 |

0.05 |

|

PR-23-069 |

237.0 |

238.0 |

E769523 |

1.0 |

5.39 |

5.39 |

|

|

|

|

|

|

|

|

|

|

PR-23-070 |

PR_2A |

207.5 |

208.5 |

E769525 |

1.0 |

0.01 |

0.01 |

|

PR-23-070 |

208.5 |

209.5 |

E769526 |

1.0 |

97.5 |

90,00 |

|

PR-23-070 |

209.5 |

210.5 |

E769527 |

1.0 |

0.01 |

0.01 |

|

|

|

|

|

|

|

|

|

|

PR-23-070 |

PR_2 |

216.0 |

217.0 |

E762564 |

1.0 |

14.8 |

14.8 |

|

PR-23-070 |

217.0 |

217.8 |

E762565 |

0.8 |

18.25 |

18.25 |

|

PR-23-070 |

217.8 |

219.0 |

E762566 |

1.2 |

14.55 |

14.55 |

|

|

|

|

|

|

|

|

|

|

PR-23-072 |

PR_2A |

206.0 |

207.0 |

E769614 |

1.0 |

14.4 |

14.4 |

|

PR-23-072 |

207.0 |

208.0 |

E769616 |

1.0 |

0.21 |

0.21 |

|

PR-23-072 |

208.0 |

209.0 |

E769617 |

1.0 |

0.03 |

0.03 |

|

|

|

|

|

|

|

|

|

|

PR-23-073 |

PR_2A |

230.7 |

231.7 |

E769563 |

1.0 |

0.02 |

0.02 |

|

PR-23-073 |

231.7 |

232.7 |

E769564 |

1.0 |

27.1 |

27.1 |

|

PR-23-073 |

232.7 |

233.7 |

E769565 |

1.0 |

0.05 |

0.05 |

|

|

|

|

|

|

|

|

|

|

PR-23-074 |

PR_2 |

259.4 |

260.4 |

E769645 |

1.0 |

8.79 |

8.79 |

|

PR-23-074 |

260.4 |

261.4 |

E769646 |

1.0 |

0.02 |

0.02 |

|

PR-23-074 |

261.4 |

262.4 |

E769647 |

1.0 |

0.02 |

0.02 |

|

PR-23-074 |

262.4 |

263.4 |

E769648 |

1.0 |

0,00 |

0,00 |

|

PR-23-074 |

263.4 |

264.0 |

E769650 |

0.6 |

0,00 |

0,00 |

|

PR-23-074 |

264.0 |

265.0 |

E769651 |

1.0 |

16.2 |

16.2 |

|

PR-23-074 |

265.0 |

266.0 |

E769652 |

1.0 |

0.95 |

0.95 |

|

|

|

|

|

|

|

|

|

|

PR-23-075A |

PR_2A |

195.7 |

196.7 |

E769541 |

1.0 |

0.02 |

0.02 |

|

PR-23-075A |

196.7 |

197.7 |

E769542 |

1.0 |

0.02 |

0.02 |

|

PR-23-075A |

197.7 |

198.7 |

E769543 |

1.0 |

27.8 |

27.8 |

|

PR-23-075A |

198.7 |

199.7 |

E769545 |

1.0 |

0.03 |

0.03 |

|

|

|

|

|

|

|

|

|

|

PR-23-076 |

PR_2A |

159.6 |

160.6 |

E769547 |

1.0 |

0.05 |

0.05 |

|

PR-23-076 |

160.6 |

161.6 |

E769548 |

1.0 |

0.04 |

0.04 |

|

PR-23-076 |

161.6 |

162.6 |

E769549 |

1.0 |

59.4 |

59.4 |

|

PR-23-076 |

162.6 |

163.6 |

E769551 |

1.0 |

0.06 |

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PR-23-076 |

PR_2 |

192.9 |

193.9 |

E769559 |

1.0 |

1.23 |

1.23 |

|

PR-23-076 |

193.9 |

194.9 |

E769560 |

1.0 |

9.39 |

9.39 |

|

PR-23-076 |

194.9 |

195.9 |

E769561 |

1.0 |

0.46 |

0.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PR-23-077 |

PR_2 |

174.0 |

174.8 |

E769582 |

0.8 |

4.73 |

4.73 |

|

PR-23-077 |

174.8 |

175.6 |

E769583 |

0.8 |

39.9 |

39.9 |

|

PR-23-077 |

175.6 |

176.6 |

E769585 |

1.0 |

0.06 |

0.06 |

|

PR-23-077 |

176.6 |

177.6 |

E769586 |

1.0 |

0.77 |

0.77 |

|

PR-23-077 |

177.6 |

178.5 |

E769587 |

0.9 |

0.08 |

0.08 |

|

PR-23-077 |

178.5 |

179.4 |

E769588 |

0.9 |

0.9 |

0.9 |

|

PR-23-077 |

179.4 |

180.4 |

E769589 |

1.0 |

1.74 |

1.74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PR-23-079 |

PR_2 |

168.2 |

169.2 |

E769607 |

1.0 |

0.01 |

0.01 |

|

PR-23-079 |

169.2 |

170.2 |

E769608 |

1.0 |

3.92 |

3.92 |

|

PR-23-079 |

170.2 |

171.0 |

E769609 |

0.8 |

8.96 |

8.96 |

|

PR-23-079 |

171.0 |

172.0 |

E769610 |

1.0 |

0.01 |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PR-23-081 |

PR_2A |

153.0 |

154.0 |

E769664 |

1.0 |

0.11 |

0.11 |

|

PR-23-081 |

154.0 |

155.0 |

E769665 |

1.0 |

0.02 |

0.02 |

|

PR-23-081 |

155.0 |

156.0 |

E769666 |

1.0 |

0.25 |

0.25 |

|

PR-23-081 |

156.0 |

157.0 |

E769668 |

1.0 |

28.1 |

28.1 |

|

|

|

|

|

|

|

|

|

|

PR-23-082 |

PR_2A |

134.2 |

135.2 |

E769659 |

1.0 |

0.14 |

0.14 |

|

PR-23-082 |

135.2 |

136.2 |

E769660 |

1.0 |

0.53 |

0.53 |

|

PR-23-082 |

136.2 |

137.2 |

E769661 |

1.0 |

23.7 |

23.7 |

|

|

|

|

|

|

|

|

|

|

PR-23-084 |

PR_2 |

164.6 |

165.7 |

E769683 |

1.1 |

59.3 |

59.3 |

|

PR-23-084 |

165.7 |

166.7 |

E769684 |

1.0 |

5.26 |

5.26 |

|

PR-23-084 |

166.7 |

167.7 |

E769685 |

1.0 |

0.21 |

0.21 |

|

PR-23-084 |

167.7 |

168.7 |

E769686 |

1.0 |

0.07 |

0.07 |

|

PR-23-084 |

168.7 |

169.9 |

E769687 |

1.2 |

2.66 |

2.66 |

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae6f6268-465f-47b3-b594-065d85b93f76

https://www.globenewswire.com/NewsRoom/AttachmentNg/42e269a3-2407-4c4b-a608-b8d47c942ba5

PDF

available: http://ml.globenewswire.com/Resource/Download/e9849d9b-c083-4aa3-887d-462f7acdbe75

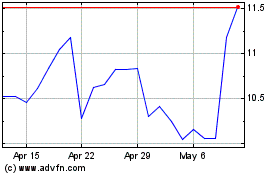

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Jan 2024 to Jan 2025