Talisker Resources Ltd. (“

Talisker” or the

“

Company”) (TSX: TSK, OTCQX: TSKFF) is pleased to

announce that it has secured a financing package of approximately

$21.5 million (the “

Financing Package”). The

Financing Package has three components: (i) US$11,750,000 from the

second closing (the “

Sprott Second Draw”) of the

previously announced royalty agreement with Sprott Private Resource

Streaming and Royalty (B) Corp. (“

Sprott”); (ii) a

$4,000,000 convertible debenture (the “

Convertible

Debenture”) from the Phoenix Gold Fund

(“

Phoenix”); and (iii) a non-brokered private

placement (the “

Gold-Linked Note Financing”) of up

to $1,500,000 of gold-linked notes (the “

Notes”).

Proceeds from the Financing Package will be used to continue

advancement of the Company’s flagship Bralorne Gold Project in

British Columbia and for general corporate purposes. Additional

details on the Financing Package are included below.

Terry Harbort, CEO of Talisker stated, “The

closure of this financing package places Talisker in a solid

financial position as we transition into mining at the Bralorne

Gold Project. This transition is a culmination of over five years

of dedication and hard work from the Talisker team including

165,000m of drilling, discovery of over 50 additional veins and

development of what we believe is a robust mine plan. With gold

prices sustaining strong support levels at all-time highs, we are

excited to become Western Canada’s next gold producer.”

Financing Package

Convertible Debenture

- The Convertible Debenture is an

unsecured obligation of the Company in the principal amount of $4

million. It bears interest at a rate of 12% per annum, calculated

and payable quarterly in arrears, and has a term of three

years.

- Phoenix may convert the principal

amount to common shares of Talisker (the “Shares”)

at a conversion price of $0.50, being 120% of the market price of

the Shares on the Toronto Stock Exchange (the

“TSX”) on the trading day prior to the date of the

Convertible Debenture (the “Conversion

Price”).

- Talisker has the option to convert

all or any portion of the Convertible Debenture into Shares if the

closing price of the Shares on the TSX is at least 130% of the

Conversion Price for each of the 20 trading days before a notice of

conversion is delivered to Phoenix. If Shares are issued to Phoenix

pursuant to the Company’s conversion right and Phoenix wishes to

sell any Shares, Talisker also has the right to identify a

purchaser for such Shares.

- In connection with issuing the

Convertible Debenture, the Company will issue 500,000 Shares

representing a finder’s fee of $200,000, which is equal to 5% of

the principal amount of the Convertible Debenture.

Gold-Linked Note Financing

- The Company has received

subscriptions to issue Notes in the aggregate principal amount of

$1,307,000.

- The Notes will represent senior

unsecured obligations of the Company and will not be convertible

into Shares.

- The Notes will bear interest at a

rate of 15% per annum and will mature on December 31, 2027.

- The principal amount of the Notes

will be used to calculate the quantity of gold (the “Gold

Quantity”) to be represented by the Notes, being the

deemed number of ounces of gold using a price (the “Floor

Price”) of US$2,500. The Gold Quantity will be reduced on

each of December 31, 2025, December 31, 2026 and December 31, 2027,

by that number of ounces that represents 15%, 25% and 60%,

respectively, of the Gold Quantity on the closing of the

Gold-Linked Note Financing, by the payment of the Deemed value of

such Gold Quantity. The “Deemed Value” means the

applicable Gold Quantity multiplied by the Gold Price (the

“Gold Price” being the greater of: (a) the Floor

Price; and (b) the “London Gold Fix” price per ounce (in U.S.

dollars) as of the 15th day of the month of such payment

date).

- Interest shall be calculated and

payable quarterly in arrears, with the interest payable being

calculated based on the Deemed Value of the Gold Quantity on the

applicable interest payment date.

- In connection with the Gold-Linked

Note Financing, the Company anticipates paying finder’s fees in an

amount equal to 5% of the gross proceeds of the Gold-Linked Note

Financing.

- The Gold-Linked Note Financing is

expected to close on or about October 17, 2024.

Sprott Second Draw

As part of the closing of the Sprott Second

Draw, on September 16, 2024, Sprott entered into a subordination

agreement with Osisko Gold Royalties Ltd

(“Osisko”) which, among other matters, provided

that the security interest over all present and after-acquired

personal property of Bralorne Gold Mines Ltd.

(“Bralorne”) (including a pledge of shares of

Bralorne by the Company and a debenture by Bralorne) granted in

favour of Sprott will be subordinated to the security interest over

all present and after-acquired personal property of Bralorne

(including a pledge of shares of Bralorne by the Company and a

debenture by Bralorne) granted in favour of Osisko. The Company

also entered into an agreement with Sprott to amend the royalty

agreement dated June 9, 2023, between Sprott, the Company and

Bralorne Gold Mines Ltd. (the “Sprott Royalty

Agreement”).

The material amendments to the Sprott Royalty

Agreement include the following:

- Buyback Right – The various time

frames for exercise by Bralorne of its right to buy back up to 50%

of the royalty have each been pushed back by six months, with the

first period commencing on or before June 30, 2025 (was December

31, 2024) and the outside date ending June 30, 2029 (was December

31, 2028). The Company continues to have the right to satisfy the

buyback right in cash or in Shares (subject to a 4.9% ownership

limit, calculated at the time of the buyback), at the Company’s

sole discretion (and subject to prior approval of the TSX).

- Production Target – The time frame

for the quarterly production target of 17,500 ounces has been

pushed back, such that such target applies for the quarters ending

March 31, 2028 (was September 30, 2026) and June 30, 2028 (was

December 31, 2026).

An insider is expected to participate in the

Gold-Linked Note Financing. As a result, the Gold-Linked Note

Financing may be considered a “related party transaction” pursuant

to Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”). The

Company is exempt from the requirements to obtain a formal

valuation or minority shareholder approval in connection with such

insider’s participation in the Gold-Linked Note Financing in

reliance on Sections 5.5(a) and 5.7(1)(a) of MI 61-101. A material

change report in connection with the Financing Package will be

filed less than 21 days in advance of the closing of the

Gold-Linked Note Financing, which the Company deems reasonable in

the circumstances so as to be able to avail itself of potential

financing opportunities.

This press release does not constitute an offer

to sell or a solicitation of an offer to sell any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

For further information, please contact:

Terry HarbortPresident and

CEOterry.harbort@taliskerresources.com+1 416 357 0227

About Talisker Resources Ltd.

Talisker (taliskerresources.com) is a junior

resource company involved in the exploration and development of

gold projects in British Columbia, Canada. Talisker’s flagship

asset is the high-grade, fully permitted Bralorne Gold Project

where the Company is currently transitioning into underground

production at the Mustang Mine. Talisker projects also include the

Ladner Gold Project, an advanced stage project with significant

exploration potential from an historical high-grade producing gold

mine and the Spences Bridge Project where the Company holds ~85% of

the emerging Spences Bridge Gold Belt, and several other

early-stage Greenfields projects.

Caution Regarding Forward Looking

Statements

Certain statements contained in this press

release constitute forward-looking information. These statements

relate to future events or future performance. The use of any of

the words “could”, “intend”, “expect”, “believe”, “will”,

“projected”, “estimated” and similar expressions and statements

relating to matters that are not historical facts are intended to

identify forward-looking information and are based on Talisker’s

current belief or assumptions as to the outcome and timing of such

future events. In particular, this press release contains

forward-looking information relating to, among other things, the

Gold-Linked Note Financing and the closing date of such financing,

the intended use of proceeds of the Financing Package and the

material change report to be filed in connection with the Financing

Package. Various assumptions or factors are typically applied in

drawing conclusions or making the forecasts or projections set out

in forward-looking information. Those assumptions and factors are

based on information currently available to Talisker. Although such

statements are based on reasonable assumptions of Talisker’s

management, there can be no assurance that any conclusions or

forecasts will prove to be accurate.

Forward looking information involves known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance, or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking information. Such

factors include risks inherent in the exploration and development

of mineral deposits, including risks relating to changes in project

parameters as plans continue to be redefined, risks relating to

variations in grade or recovery rates, risks relating to changes in

mineral prices and the worldwide demand for and supply of minerals,

risks related to increased competition and current global financial

conditions, access and supply risks, reliance on key personnel,

operational risks regulatory risks, including risks relating to the

acquisition of the necessary licenses and permits, financing,

capitalization and liquidity risks, title and environmental risks

and risks relating to the failure to receive all requisite

shareholder and regulatory approvals.

The forward-looking information contained in

this release is made as of the date hereof, and Talisker is not

obligated to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws. Because of the

risks, uncertainties and assumptions contained herein, investors

should not place undue reliance on forward-looking information. The

foregoing statements expressly qualify any forward-looking

information contained herein.

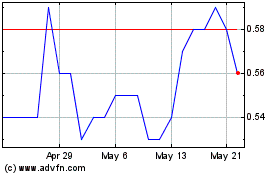

Talisker Resources (TSX:TSK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Talisker Resources (TSX:TSK)

Historical Stock Chart

From Jan 2024 to Jan 2025