News Release – TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or

the Company) today announced that it has successfully completed the

sale of a 40 per cent non-controlling equity interest in its

Columbia Gas Transmission, LLC (Columbia Gas) and Columbia Gulf

Transmission, LLC (Columbia Gulf) systems to Global Infrastructure

Partners (GIP) for total cash proceeds of $5.3 billion (US$3.9

billion).

"This sizable transaction is a tangible example of

our team’s focus on achieving one of our key 2023 strategic

priorities of significantly advancing our deleveraging goals, ahead

of our year-end target," said François Poirier, TC Energy’s

President and Chief Executive Officer. "GIP is a strong and

reputable strategic and financial partner that will help unlock

incremental value on our Columbia gas systems."

Clear path toward deleveraging

- Delivering $5+ billion of cash proceeds in a single transaction

is expected to reduce TC Energy’s year-end 2023

debt-to-EBITDAi leverage metric by over 0.4 times, a major

step toward reaching its 2024 year-end objective of 4.75 times

debt-to-EBITDA.

- Demonstrated strong continued access to capital markets in

August 2023, with Columbia Pipelines Holding Company LLC (CPHC) and

Columbia Pipelines Operating Company LLC (CPOC) initially issuing

in aggregate US$5.6 billion of senior unsecured notes. Additional

indebtedness is expected to be incurred in 2024 to reach the

intended run-rate capital structure. Prior to the closing of the

offerings, all US$1.5 billion of existing Columbia Pipeline

Group, Inc. (CPG) Senior Notes were assumed by CPOC.

- The net proceeds from the offerings were used to repay existing

intercompany indebtedness with TC Energy entities and will reduce

the Company’s indebtedness or offset future debt issuance such that

the offerings are expected to be leverage-neutral to TC Energy on a

consolidated basis.

- Continuing to evaluate an incremental $3 billion of capital

rotation opportunities to achieve the Company’s desired

debt-to-EBITDA target.

- Limiting sanctioned capital spending, net of partner

contributions, to $6 to $7 billion annually, post-2024.

Collectively, these actions are expected to enable

TC Energy to continue strengthening its balance sheet and reinforce

long-term, sustainable, annual dividend growth of three to five per

cent.

TC Energy will continue to operate the systems,

focusing on maximizing value through safe operations, reliability

of service and operational excellence. Going forward, GIP will fund

its 40 per cent share of Columbia Gas and Columbia Gulf’s gross

capital expenditures. Total gross capital expenditures for these

assets are expected to average more than $1.3 billion (US$1

billion) annually over the next three years.

Transaction detailsColumbia

Pipeline Group, Inc. (CPG) contributed all of its equity interests

in its wholly-owned subsidiaries, Columbia Gas and Columbia Gulf,

to a newly formed wholly-owned entity, Columbia Pipelines Operating

Company, LLC (CPOC), which is directly held by a newly formed

entity, Columbia Pipelines Holding Company, LLC (CPHC). CPHC is the

entity through which TC Energy and GIP hold their equity

interests.

About TC EnergyWe’re a team of

7,000+ energy problem solvers working to move, generate and store

the energy North America relies on. Today, we’re taking action to

make that energy more sustainable and more secure. We’re innovating

and modernizing to reduce emissions from our business. And, we’re

delivering new energy solutions – from natural gas and renewables

to carbon capture and hydrogen – to help other businesses and

industries decarbonize too. Along the way, we invest in communities

and partner with our neighbours, customers and governments to build

the energy system of the future.

TC Energy’s common shares trade on the Toronto

(TSX) and New York (NYSE) stock exchanges under the symbol TRP. To

learn more, visit us at TCEnergy.com.

About Global Infrastructure

PartnersGlobal Infrastructure Partners (GIP) is a leading

infrastructure investor that specializes in investing in, owning

and operating some of the largest and most complex assets across

the energy, transport, digital infrastructure and water and waste

management sectors. With decarbonization central to their

investment thesis, they are well positioned to support the global

energy transition. Headquartered in New York, GIP has offices in

Brisbane, Dallas, Delhi, Hong Kong, London, Melbourne, Mumbai,

Singapore, Stamford and Sydney.

GIP has approximately $100 billion in assets under

management. Their portfolio companies have combined annual revenues

of approximately $80 billion and employ over 100,000 people. They

believe that their focus on real infrastructure assets, combined

with their deep proprietary origination network and comprehensive

operational expertise, enables them to be responsible stewards of

their investors' capital and to create positive economic impact for

communities. For more information,

visit www.global-infra.com.

NON-GAAP MEASURESThis release

contains references to debt-to-EBITDA. Adjusted debt and adjusted

comparable EBITDA are non-GAAP measures used to compute the

debt-to-EBITDA multiple. Each of adjusted debt and adjusted

comparable EBITDA measures do not have any standardized meaning

prescribed by GAAP and therefore, may not be comparable to similar

measures presented by other companies. We believe that

debt-to-EBITDA provides investors with useful information as it

reflects our ability to service our debt and other long-term

commitments.

Adjusted debt is defined as the sum of Reported

total debt, including Notes payable, Long-Term Debt, Current

portion of long-term debt and Junior Subordinated Notes, as

reported on our Consolidated balance sheet as well as Operating

lease liabilities recognized on our Consolidated balance sheet and

50 per cent of Preferred Shares as reported on our Consolidated

balance sheet due to the debt-like nature of their contractual and

financial obligations, less Cash and cash equivalents as reported

on our Consolidated balance sheet and 50 per cent of Junior

Subordinated Notes as reported on our Consolidated balance sheet

due to the equity-like nature of their contractual and financial

obligations.

Adjusted comparable EBITDA is calculated as

comparable EBITDA excluding Operating lease costs recorded in Plant

operating costs and other in our Consolidated statement of income

and adjusted for Distributions received in excess of income from

equity investments as reported in our Consolidated statement of

cash flows which is more reflective of the cash flows available to

TC Energy to service our debt and other long-term commitments.

See "Reconciliations" for reconciliations of

adjusted debt and adjusted comparable EBITDA for the years ended

December 31, 2021 and 2022.

FORWARD-LOOKING INFORMATIONThis

release contains certain information that is forward-looking and is

subject to important risks and uncertainties (such statements are

usually accompanied by words such as "anticipate", "expect",

"believe", "may", "will", "should", "estimate", "intend" or other

similar words). Forward-looking statements in this document may

include, but are not limited to, statements regarding the Company’s

projected debt-to-EBITDA leverage metrics for 2023 and 2024, our

targeted leverage metrics, the size and timing of capital rotation

opportunities, expected future average gross capital expenditures

on Columbia Gulf and Columbia Gas, the expected relative

contributions to gross capital expenditures of Columbia Gas and

Columbia Gulf from TC Energy and GIP, the Company’s expected

overall capital spending net of partner contributions, and expected

dividend growth. Key assumptions on which our forward-looking

information is based include, but are not limited to, assumptions

about the realization of expected benefits from divestitures,

anticipated construction costs, schedules and completion dates,

access to capital markets, expected industry, market and economic

conditions, inflation rates, foreign exchange and interest rates.

Forward-looking statements in this document are intended to provide

TC Energy security holders and potential investors with information

regarding TC Energy and its subsidiaries, including management's

assessment of TC Energy's and its subsidiaries' future plans and

financial outlook. All forward-looking statements reflect TC

Energy's beliefs and assumptions based on information available at

the time the statements were made and as such are not guarantees of

future performance. As actual results could vary significantly from

the forward-looking information, you should not put undue reliance

on forward-looking information and should not use future-oriented

information or financial outlooks for anything other than their

intended purpose. We do not update our forward-looking information

due to new information or future events, unless we are required to

by law. For additional information on the assumptions made, and the

risks and uncertainties which could cause actual results to differ

from the anticipated results, refer to the most recent Quarterly

Report to Shareholders and Annual Report filed under TC Energy’s

profile on SEDAR+ at www.sedarplus.ca and with the U.S. Securities

and Exchange Commission at www.sec.gov.

Reconciliations

Adjusted Debt/Adjusted Comparable EBITDA(1)

| Millions |

|

|

|

|

Year ended December 31 |

|

|

|

|

|

|

2022 |

|

2021 |

|

| Reported total

debt |

|

|

|

58,300 |

|

52,766 |

|

| Management

adjustments: |

|

|

|

|

| Debt treatment of

preferred shares(2) |

|

1,250 |

|

1,744 |

|

| Equity treatment of

junior subordinated notes(3) |

(5,248) |

|

(4,470) |

|

| Cash and cash

equivalents |

|

|

(620) |

|

(673) |

|

|

Operating lease liabilities |

|

|

|

|

433 |

|

429 |

|

|

Adjusted debt |

|

|

|

|

54,115 |

|

49,796 |

|

| |

|

|

|

|

|

|

| Comparable

EBITDA(4) |

|

|

9,901 |

|

9,368 |

|

| Operating lease

cost |

|

|

|

106 |

|

105 |

|

|

Distributions received in excess of income from equity

investments |

|

|

|

(29) |

|

77 |

|

| Adjusted

Comparable EBITDA |

|

|

|

9,978 |

|

9,550 |

|

| |

|

|

|

|

|

|

| Adjusted

Debt/Adjusted Comparable EBITDA(1) |

5.4 |

|

5.2 |

|

(1) Comparable EBITDA is a non-GAAP financial

measure. Management methodology. Individual rating agency

calculations will differ.(2) 50% debt treatment on $2.5B of

preferred shares as of December 31, 2022.(3) 50% equity treatment

on $10.5B of junior subordinated notes as of December 31, 2022.

U.S. denominated notes translated at December 31, 2022, U.S./Canada

foreign exchange rate of 1.35.(4) Comparable EBITDA is a non-GAAP

financial measure. See the "Forward-looking information" and

"Non-GAAP measures" sections for more information.

-30-

Media Inquiries:Media

Relationsmedia@tcenergy.com 403-920-7859 or 800-608-7859

Investor & Analyst

Inquiries:Gavin Wylie / Hunter

Mauinvestor_relations@tcenergy.com403-920-7911 or 800-361-6522

Global Infrastructure

Partners:Mustafa Riffatmustafa.riffat@global-infra.com

____________________________

iDebt-to-EBITDA is a non-GAAP ratio. Adjusted debt

and adjusted comparable EBITDA are non-GAAP measures used to

calculate debt-to-EBITDA. See the "Forward-looking information,"

"Non-GAAP measures" and "Reconciliations" sections for more

information.

PDF available:

http://ml.globenewswire.com/Resource/Download/2738f342-40b2-4b8d-8cbf-9e03c1b7c309

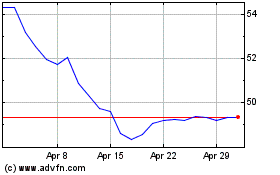

TC Energy (TSX:TRP)

Historical Stock Chart

From Dec 2024 to Jan 2025

TC Energy (TSX:TRP)

Historical Stock Chart

From Jan 2024 to Jan 2025