News Release – TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or

the Company) is pleased to announce today that its Board of

Directors has approved plans for TC Energy to separate into two

independent, investment-grade, publicly listed companies through

the spinoff of TC Energy’s Liquids Pipelines business (the

Transaction). The decision comes as a result of a two-year

strategic review and is anticipated to be completed on a tax-free

basis in the second half of 2024.

The spinoff will unlock shareholder value by providing both

companies with the flexibility to pursue their own growth

objectives through disciplined capital allocation, enhancing

efficiencies and driving operational excellence. Once completed,

the spinoff will result in two high-quality, focused energy

industry leaders that are committed to providing safe and reliable

service to their customers and the communities in which they

operate.

- TC Energy post-Transaction: A diversified,

industry-leading natural gas and energy solutions company, uniquely

positioned to meet growing industry and consumer demand for

reliable, lower-carbon energy, by leveraging complementary business

sets.

- Liquids Pipelines Company: A critical

infrastructure company with highly strategic assets that connect

resilient and secure supply to the highest demand markets, while

delivering incremental growth and value creation

opportunities.

“This transformative announcement sets us up to deliver superior

shareholder value for the next decade and beyond. Fundamentals have

always driven our strategic direction, and as a result, we have

grown into a premier energy company with incumbency across a wide

range of energy infrastructure platforms. As we have become the

partner of choice for a magnitude of accretive, high-quality

opportunities, we have determined that as two separate companies we

can better execute on these distinct opportunity sets to unlock

shareholder value,” said François Poirier, TC Energy’s President

and Chief Executive Officer.

Following the Transaction, TC Energy will focus on natural gas

infrastructure, supported by strong, long-term fundamentals and

power and energy solutions, driven by nuclear, pumped hydro energy

storage and new energy opportunities while continuing its history

of maximizing asset value and operational performance.

“TC Energy’s expansive strategic asset base highlights our

competitive advantage in capturing opportunities and translating

them into enduring value for our shareholders. We will be an

increasingly utility-weighted business with a stable balance sheet,

a higher expected comparable EBITDA1,2 compound annual growth rate

of 7 per cent and a solid 3-5 per cent annual dividend growth

outlook,” continued Poirier. “Our spinoff announcement supports our

2023 priorities by maximizing the value of our assets. This week,

we also accelerated our deleveraging goal by entering into

definitive agreements to raise $5.2 billion in total cash proceeds

ahead of our year-end target with the announced sale of a 40 per

cent equity interest in the Columbia Gas and Columbia Gulf systems.

Further, we are safely delivering our major projects such as

Coastal GasLink and Southeast Gateway on the planned cost and

schedule.”

The new Liquids Pipelines Company will focus on enhancing the

value of its unrivalled asset base by increasing capacity on

underutilized portions of the system and increasing connectivity to

additional receipt and delivery points. As a low-risk business with

96 per cent investment-grade customers and 88 per cent of

comparable EBITDA3 contracted, the Liquids Pipelines Company

retains the TC Energy premium value proposition, and expands upon

it with the flexibility to focus on its competitive advantages.

“This team has created one of the most competitive Liquids

systems in North America, with the most direct, cost-effective and

highest quality paths to key demand markets. It is a highly

contracted business with stable, robust cash flows supported by

long-term customers. Following the spinoff, they will have

increased financial flexibility to leverage their well-established

expertise and competitive footprint to originate accretive,

disciplined growth opportunities. As its own entity, the Liquids

Pipelines Company’s comparable EBITDA3 is expected to grow at a two

to three per cent compound annual growth rate through 2026 with a

commensurate dividend growth outlook, delivering sustainable

shareholder value,” added Poirier.

Experienced leadership at the helm

François Poirier will remain as President and CEO of TC Energy

with the continued guidance of Siim A. Vanaselja, Chair of TC

Energy’s Board. Effective immediately, Stanley (Stan) G.

Chapman, III is promoted to Executive Vice-President and Chief

Operating Officer, Natural Gas Pipelines, to integrate our

geographically dispersed natural gas business units into a single,

unified natural gas pipelines business. This integration will

strengthen our business model through alignment and simplification,

leading to safety, operational, commercial, asset management and

project execution excellence.

The new Liquids Pipelines Company will be led by Bevin Wirzba as

President and CEO, and will be supported by a proven leadership

team with deep capabilities and skillsets directly related to the

portfolio. The company will be headquartered in Calgary, Alberta,

with an office in Houston, Texas. A highly respected Board Chair

has been identified and will be announced along with additional

members of the new Liquids’ leadership team and Board of Directors

in the coming months.

Please see TC Energy’s website for the biographies of its

leadership team and Board of Directors.

Creating two high-quality, focused energy industry

leaders

TC Energy post-Transaction: Energy infrastructure

company with strong alignment across its Natural Gas Pipelines and

Power and Energy Solutions business units.

- Safely operates one of North America’s largest natural gas

energy infrastructure networks spanning 93,700 km (58,200 miles),

connecting the lowest cost basins to key demand and export

markets.

- Strategic outlook is grounded in fundamentals supporting

synergistic attributes of natural gas and energy solutions

businesses.

- Delivers approximately 30 per cent of total natural gas supply

for LNG export from the U.S. and will provide Canada’s first direct

connection to LNG markets with the completion of Coastal

GasLink.

- Over 30 years in the power business focused on customer-driven

decarbonization solutions with the capacity to provide 4,600 MW of

electricity.

- Commitment to strong balance sheet fundamentals and continuing

to advance deleveraging goals to further enhance shareholder

value.

- 96 per cent of business rate-regulated and/or long-term

contracted offers premium value proposition.

- Disciplined sanctioned net capital spending of between $6-$7

billion annually post 2024.

- Over 60 per cent of $30+ billion secured capital program

directly enables global climate goals.

- 2022 comparable EBITDA of $8.5 billion expected to grow at

seven per cent compounded annual growth rate through 2026.

- Sustainable annual dividend growth rate of three to five per

cent supported by conservative payout ratios and one of North

America’s largest regulated natural gas businesses.

Liquids Pipelines Company: One of the most competitive

liquids connectivity platforms between key supply and demand

markets, with incremental organic growth

opportunities.

- Safely and reliably operates 4,900 km (3,045 miles) of crude

oil pipeline infrastructure supplying crude to over 14 Mbbl/d of

refining and export capacity and transporting 16 per cent of crude

exported from the Western Canadian Sedimentary Basin (WCSB).

- Delivers stable WCSB supply to the most resilient refining

markets in PADD 2 and 3, with export connectivity in the Gulf

Coast.

- Unmatched footprint includes intra-Alberta assets (Grand Rapids

and White Spruce) as well as the Keystone system and Marketlink

that connects Alberta and domestic U.S. crude oil supplies to U.S.

refining markets in Illinois, Oklahoma and the U.S. Gulf Coast,

including storage facilities at Hardisty, Alberta; Cushing,

Oklahoma; and Houston, Texas.

- Maintains a strong commitment to ESG and sustainability

priorities, including decarbonization, and supports WCSB oil and

its producers’ goal to reduce emissions to net zero by 2050.

- Differentiated through an industry-leading, highly competitive

service offering with one of the lowest-cost, fastest and

highest-quality preservation paths delivering supply to critical

demand markets.

- Low-risk cash flow profile with minimal volumetric and

commodity price risk, 88 per cent of comparable EBITDA contracted

and 96 per cent of volumes underpinned by investment-grade or

equivalent counterparties.

- Utilize cash flow and increased financial flexibility to

originate organic growth opportunities to expand and enhance

delivery into existing markets while accelerating

deleveraging.

- 2022 comparable EBITDA of $1.4 billion expected to grow at a

two to three per cent compound annual growth rate through

2026.

- Sustainable annual dividend growth of two to three per cent

expected to be commensurate with comparable EBITDA growth outlook,

while adhering to conservative dividend payout ratios.

TC Energy intends that the initial combined dividends of the two

companies will be equivalent to TC Energy’s annual dividend

immediately prior to the completion of the Transaction, and that

over time the combined value of the two companies’ dividends is

expected to remain consistent. Dividends will be at the discretion

of the respective boards of directors of each company following the

Transaction.

Management intends to capitalize the Liquids Pipelines Company

with a financial structure that aligns with its asset base,

business model and growth plans. Following the Transaction,

management anticipates that TC Energy will retain its current

credit ratings and that the Liquids Pipelines Company will have

investment-grade credit ratings. TC Energy plans to transition an

approximately proportionate share of its long-term debt to the

Liquids Pipelines Company on a cost-effective basis.

Transaction details, approvals and business

continuity Under the proposed Transaction, TC Energy

shareholders will retain their current ownership in TC Energy’s

common shares (TRP: TSX, TRP: NYSE) and receive a pro-rata

allocation of common shares in the new Liquids Pipelines Company.

The Transaction is expected to be tax-free for TC Energy’s Canadian

and U.S. shareholders. The determination of the number of common

shares in the new Liquids Pipelines Company to be distributed to TC

Energy shareholders will be determined prior to the closing of the

proposed transaction.

TC Energy expects to seek shareholder approval of the

Transaction at a meeting of shareholders in mid-2024. The

Transaction will be implemented through a court-approved plan of

arrangement under the Canada Business Corporations Act. In addition

to TC Energy shareholder and court approvals, the Transaction is

subject to receipt of favourable tax rulings from Canadian and U.S.

tax authorities, receipt of necessary regulatory approvals and

satisfaction of other customary closing conditions. TC Energy

expects that the Transaction will be completed in the second half

of 2024.

TC Energy will ensure business continuity and reliable services

to its valued customers throughout the separation. A separation

management office will be established guiding the successful

coordination and governance including the development of a

separation agreement and a transition service agreement between the

two entities once the Transaction is complete.

For additional detail on the Transaction, investor presentation

materials and more, please visit our website at

www.tcenergy.com/liquids-spinoff.

There can be no assurance that the Transaction will ultimately

occur or, if it does occur, what its structure, terms or timing

will be.

AdvisorsRBC Capital Markets and JP Morgan

Securities Canada are acting as financial advisors to TC Energy.

Evercore is acting as financial advisor to the TC Energy Board of

Directors. Blake, Cassels & Graydon LLP and White & Case

LLP are acting as legal advisors. TC Energy has also engaged Bain

& Company to advise on the separation process.

Conference call and webcastTC Energy will hold

a teleconference and webcast on Friday, July 28, 2023, to discuss

today’s announcement along with its second quarter financial

results.

François Poirier, TC Energy President and Chief Executive

Officer; Joel Hunter, Executive Vice-President and Chief Financial

Officer; Bevin Wirzba, Executive Vice-President and Group

Executive, Canadian Natural Gas Pipelines and Liquids Pipelines,

and President, Coastal GasLink; and Stanley (Stan) G. Chapman, III,

Executive Vice-President and Chief Operating Officer, Natural Gas

Pipelines will discuss the financial results and Company

developments at 6:30 a.m. MDT / 8:30 a.m. EDT.

Members of the investment community and other interested parties

are invited to participate by calling 1-800-319-4610. No passcode

is required. Please dial in 15 minutes prior to the start of the

call. A live webcast of the teleconference will be available on TC

Energy’s website at https://www.tcenergy.com/investors/events/ or

via the following URL: https://www.gowebcasting.com/12631.

About TC EnergyWe’re a team of 7,000+ energy

problem solvers working to move, generate and store the energy

North America relies on. Today, we’re taking action to make that

energy more sustainable and more secure. We’re innovating and

modernizing to reduce emissions from our business. And, we’re

delivering new energy solutions – from natural gas and renewables

to carbon capture and hydrogen – to help other businesses and

industries decarbonize too. Along the way, we invest in communities

and partner with our neighbours, customers and governments to build

the energy system of the future.

TC Energy’s common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at TCEnergy.com.

For more information about TC Energy’s Executive Leadership

Team, visit: TCEnergy.com/about/people

FORWARD-LOOKING INFORMATIONThis release

includes certain forward-looking information, including future

oriented financial information or financial outlook, which is

intended to help current and potential investors understand

management’s assessment of our future plans and financial outlook,

and our future prospects overall. Statements that are

forward-looking are based on certain assumptions and on what we

know and expect today and generally include words like anticipate,

expect, believe, may, will, should, estimate or other similar

words.

Forward-looking statements do not guarantee future performance.

Actual events and results could be significantly different because

of assumptions, risks or uncertainties related to our business, the

Transaction or events that happen after the date of this release.

Our forward-looking information in this release includes, but is

not limited to, statements related to: the Transaction, including

the terms, conditions, structure and timing thereof, reasons

therefor and anticipated impacts and benefits thereof, including

the anticipated benefits for shareholders, employees, customers and

other stakeholders; the expected attributes and intentions of TC

Energy and the Liquids company following the completion of the

Transaction, including in relation to future dividends,

capitalization, management, credit ratings, ESG and

sustainability-related matters, energy security, leverage and

capital allocation and the ability to transition a portion of TC

Energy’s long-term debt to the Liquids company on a cost-effective

basis; expectations regarding future energy demand; projections

regarding TC Energy and the Liquids company, including projections

of 2022-2026 compounded annual comparable EBITDA growth rate; the

anticipated tax impact of the Transaction on shareholders,

including the expectation that the separation will be achieved on a

tax-free basis for TC Energy shareholders; TC Energy's intentions

with respect to the period preceding the completion of the

Transaction; the expected timing of a meeting of TC Energy

shareholders to approve the Transaction; and our ability to

complete the announced sale of a 40 per cent equity interest in the

Columbia Gas and Columbia Gulf systems.

Our forward-looking information is based on certain key

assumptions and is subject to risks and uncertainties, including

but not limited to the realization of the anticipated benefits of

the Transaction; the terms, timing and completion of the

Transaction, including the timely receipt of all necessary court,

regulatory, third-party and shareholder approvals; the timely

receipt of advance tax rulings from the Canada Revenue Agency and

Internal Revenue Service, in each case, in form and substance

satisfactory to TC Energy and that such rulings are not withdrawn

or modified; the growth of the North American energy market; the

ability of TC Energy and the Liquids Company to successfully

implement their respective strategic priorities and whether they

will yield the expected benefits; the ability of TC Energy and the

Liquids Company to implement capital allocation strategies aligned

with maximizing shareholder value; the operating performance of the

respective assets of TC Energy and the Liquids Company; the amount

of capacity sold and rates achieved in the pipeline businesses of

TC Energy and the Liquids Company; the amount of capacity payments

and revenues from TC Energy's power generation assets due to plant

availability; production levels within supply basins; construction

and completion of capital projects; cost and availability of, and

inflationary pressure on, labour, equipment and materials; the

availability and market prices of commodities; access to capital

markets on competitive terms, including the Liquids company’s

access to capital markets to provide for the transition a portion

of TC Energy’s long-term debt to the Liquids company on a

cost-effective basis; interest, tax and foreign exchange rates;

performance and credit risk of counterparties; our and the Liquids

company’s ability to maintain their respective credit ratings;

regulatory decisions and outcomes of legal proceedings, including

arbitration and insurance claims; our ability to effectively

anticipate and assess changes to government policies and

regulations, including those related to the environment and

COVID-19; our ability and the ability of the Liquids company to

realize the value of tangible assets and contractual recoveries

from impaired assets, including the Keystone XL pipeline project;

competition in the businesses in which TC Energy and the Liquids

company will operate; unexpected or unusual weather; acts of civil

disobedience; cyber security and technological developments;

ESG-related risks; impact of energy transition on our business and

the future business of the Liquids company; economic conditions in

North America as well as globally; and global health crises, such

as pandemics and epidemics and the impacts related thereto.

As actual results could vary significantly from the

forward-looking information, you should not put undue reliance on

forward-looking information, which is given as of the date it is

expressed in this release or otherwise, and should not use

future-oriented information or financial outlooks for anything

other than their intended purpose. We do not update our

forward-looking statements due to new information or future events,

unless we are required to by law. For additional information on the

assumptions made, and the risks and uncertainties which could cause

actual results to differ from the anticipated results, refer to the

most recent Quarterly Report to Shareholders and Annual Report

filed under TC Energy’s profile on SEDAR+ at www.sedarplus.ca and

with the U.S. Securities and Exchange Commission at

www.sec.gov.

NON-GAAP MEASURESThis release refers to

comparable EBITDA which does not have any standardized meaning as

prescribed by U.S. GAAP and therefore may not be comparable to

similar measures presented by other entities. The most directly

comparable measure presented in the financial statements is

segmented earnings. For reconciliations of comparable EBITDA to

segmented earnings for the years ended December 31, 2022 and 2021,

refer to the applicable business segment in our management’s

discussion and analysis (MD&A) for such periods, which sections

are incorporated by reference herein. Refer to the non-GAAP

measures section of the MD&A in our most recent quarterly

report for more information about the non-GAAP measures we use,

which section of the MD&A is incorporated by reference herein.

The MD&A can be found on SEDAR+ at www.sedarplus.ca under TC

Energy’s profile.

Media Inquiries:Media

Relationsmedia@tcenergy.com 403-920-7859 or 800-608-7859

Investor & Analyst Inquiries:Gavin Wylie /

Hunter Mauinvestor_relations@tcenergy.com403-920-7911 or

800-361-6522

________________________1 Comparable EBITDA is a non-GAAP

measure, which does not have any standardized meaning under GAAP

and therefore is unlikely to be comparable to similar measures

presented by other companies. The most directly comparable measure

presented in our financial statements is segmented earnings.2 Our

full-year segmented earnings, excluding our Liquids Pipelines

business segment, for 2022 and 2021 were $2.5 billion and $5.7

billion, respectively. Our full-year comparable EBITDA, excluding

our Liquids Pipelines business segment, for 2022 and 2021 were $8.5

billion and $7.8 billion, respectively. See "Forward-Looking

Information" and "Non-GAAP Measures" for more information.3

Full-year segmented earnings/(losses) for our Liquids Pipelines

business segment for 2022 and 2021 were $1.1 billion and ($1.6

billion), respectively. Full-year comparable EBITDA for our Liquids

Pipelines business segment for 2022 and 2021 were $1.4 billion and

$1.5 billion, respectively. See "Forward-Looking Information" and

"Non-GAAP Measures" for more information.

PDF

available: http://ml.globenewswire.com/Resource/Download/52bfefbe-fee8-4d2d-b6ac-ead5593bc7be

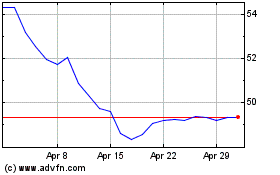

TC Energy (TSX:TRP)

Historical Stock Chart

From Dec 2024 to Jan 2025

TC Energy (TSX:TRP)

Historical Stock Chart

From Jan 2024 to Jan 2025