Stella-Jones Updates Its Financial Objectives Building on Sustained Growth

May 25 2023 - 6:00AM

Stella-Jones Inc. (TSX : SJ) (“Stella-Jones” or the “Company”)

today updated its three-year objectives, reflecting the years

2023–2025. The Company will be featuring its new financial targets

at its Investor Day, being held this morning in Toronto, Ontario.

“Following a record year in 2022, coupled with our outstanding

start to 2023, we are excited to share updated financial objectives

that reflect Stella-Jones’ performance and growth potential,” said

Eric Vachon, President and Chief Executive Officer of Stella-Jones.

“In light of our favourable position to meet or exceed our original

financial targets, we are raising our 2025 sales target to almost

20% above 2022 sales and the 2023–2025 EBITDA margin goal to 16%,

primarily driven by the accelerating demand for our higher margin

utility poles business.”

“Over its 30-year history, Stella-Jones has cultivated

industry-shaping success through customer partnerships, premium

product offerings and an unwavering focus on our network. This has

culminated in a unique leadership position for our business—one

that allows us to leverage the significant capital generated by our

strong performance to fuel investments and seize opportunities for

growth, while creating continued value for our shareholders. Our

inaugural investor day today sets the stage for us to share our new

targets and build on what we believe is a defining time for us and

for the essential infrastructure businesses we serve.”

UPDATED FINANCIAL

OBJECTIVES

The Company’s record financial performance over

the last year has provided Stella-Jones with the ability to update

its three-year financial targets, which now extend to 2025.

Excluding future acquisitions, the Company’s financial objectives

are as follows:

|

(in millions of dollars, except percentages and ratios) |

Initial 2022–2024 Objectives

(2) |

Updated 2023–2025 Objectives

(3) |

|

Sales |

$2,700-$3,000 |

>$3,600 |

|

EBITDA margin (1) |

≥ 15% |

16% |

|

Return to Shareholders |

$500-$600 |

>$500 |

|

Net Debt-to-EBITDA (1) |

2.0x-2.5x |

2.0x-2.5x |

GROWING SALES AND EBITDA

MARGIN

After achieving the high-end of its sales target

in the first year of the Company’s 2022–2024 financial objectives,

Stella-Jones expects sales to increase organically at a compound

annual growth rate of approximately 6% to over $3.6 billion by

2025. This growth is expected to be driven by a 9% compound annual

sales increase of the Company’s infrastructure-related businesses.

Led by an improvement in its product mix, Stella-Jones has also

increased its target EBITDA margin to 16% for the 2023–2025 period,

up from its previous target of approximately 15%.

LEVERAGING STRONG CASH GENERATING

PROFILE

Stella-Jones has an established track record of

generating consistent and strong cashflows which provides

flexibility to deliver significant value to shareholders. The

Company is pursuing growth investments to enhance its utility poles

capacity for the growing demand, while reaffirming its commitment

to return capital to shareholders in excess of $500 million

through dividends and share repurchases, in the 2023–2025 period.

The Company continues to maintain its net leverage target range of

2.0x to 2.5x. Given its strong cashflow generating profile, the

Company may temporarily exceed its target leverage ratio to finance

strategic growth opportunities related to its

infrastructure-related businesses.

INVESTOR DAY

Stella-Jones will elaborate on its 2023–2025

financial objectives at the Company’s investor day for

institutional investors and research analysts, which is taking

place today in Toronto, Ontario.

The event will begin at 8 a.m. Eastern

Daylight Time (EDT). After the presentation, the leadership team

will be available to answer questions. The live webcast can be

accessed at the following link: https://web.lumiagm.com/411173957.

An investor presentation will also be made available on the

Investor Relations, Events and Presentations page of the Company’s

website.

A replay will be available at the same link as

the webcast, and on the Investor Relations section of the Company’s

website following the event.

(1) Refer to the section entitled “Non-GAAP and

Other Financial Measures” of the first quarter 2023

Management’s Discussion & Analysis for an explanation of the

non-GAAP and other financial measures used and presented by the

Company.(2) Refer to the 2021 Annual Management’s Discussion &

Analysis for further details and assumptions used in preparing the

2022–2024 financial objectives. (3) Foreign Exchange: Assumes

Canadian dollar will trade, on average, at approximately C$1.30 per

U.S. dollar, with sales in the U.S. representing approximately 70%

of total sales.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX : SJ) is North

America’s leading producer of pressure-treated wood products. It

supplies the continent’s major electrical utilities and

telecommunication companies with wood utility poles and North

America’s Class 1, short line and commercial railroad

operators with railway ties and timbers. Stella-Jones also provides

industrial products, which include wood for railway bridges and

crossings, marine and foundation pilings, construction timbers and

coal tar-based products. Additionally, the Company manufactures and

distributes premium treated residential lumber and accessories to

Canadian and American retailers for outdoor applications, with a

significant portion of the business devoted to servicing the

Canadian market through its national manufacturing and distribution

network. The Company’s common shares are listed on the Toronto

Stock Exchange.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS

Except for historical information provided

herein, this press release may contain information and statements

of a forward-looking nature concerning the future performance of

the Company. These statements are based on suppositions and

uncertainties as well as on management’s best possible evaluation

of future events. Such items include, among others: general

political, economic and business conditions, evolution in customer

demand for the Company’s products and services, product selling

prices, availability and cost of raw materials, climate change,

failure to recruit and retain qualified workforce, information

security breaches or other cyber-security threats, changes in

foreign currency rates, the ability of the Company to raise capital

and factors and assumptions referenced herein and in the Company’s

continuous disclosure filings. As a result, readers are advised

that actual results may differ from expected results. Unless

required to do so under applicable securities legislation, the

Company does not assume any obligation to update or revise

forward-looking statements to reflect new information, future

events or other changes after the date hereof.

|

Head Office3100 de la Côte-Vertu Blvd.,

Suite 300Saint-Laurent, QuébecH4R 2J8Tel. :

(514) 934-8666Fax : (514) 934-5327 |

Exchange ListingsThe Toronto Stock ExchangeStock

Symbol: SJTransfer Agent and

RegistrarComputershare Investor Services Inc. |

Investor RelationsSilvana TravagliniSenior

Vice-President and Chief Financial OfficerTel.:

(514) 934-8660Fax:

(514) 934-5327stravaglini@stella-jones.com |

|

Source: |

Stella-Jones Inc. |

Stella-Jones Inc. |

| |

|

|

|

Contacts: |

Silvana Travaglini,

CPA |

Stephanie

Corrente |

| |

Senior Vice-President and Chief

Financial OfficerStella-Jones |

Director, Corporate

CommunicationsStella-Jones |

| |

Tel.: (514) 934-8660 |

|

| |

stravaglini@stella-jones.com |

communications@stella-jones.com |

| |

|

|

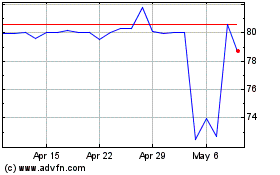

Stella Jones (TSX:SJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Stella Jones (TSX:SJ)

Historical Stock Chart

From Dec 2023 to Dec 2024