Quebecor Media Inc. ("Quebecor Media") today announced the early

acceptance of tendered 7 3/4% Senior Notes due March 15, 2016

(CUSIP 74819RAG1) (the "Notes") in connection with its previously

announced cash tender offer (the "Tender Offer") to purchase up to

US$260,000,000 in aggregate principal amount of Notes (the "Maximum

Tender Amount"). The Tender Offer is being made pursuant to an

Offer to Purchase (the "Offer to Purchase") dated February 29, 2012

and the related Letter of Transmittal.

The tender and information agent for the Notes under the Tender

Offer has advised Quebecor Media that US$78,527,000 aggregate

principal amount of the Notes had been validly tendered and not

withdrawn pursuant to the Tender Offer at or prior to 5:00 p.m.,

New York City time, on March 14, 2012 (the "Early Participation

Date"). Such amount represents approximately 14.96% of the

aggregate principal amount outstanding of Notes.

Quebecor Media today accepted for purchase, in accordance with

the previously announced terms of the Tender Offer, all Notes

validly tendered and not withdrawn pursuant to the Tender Offer at

or prior to the Early Participation Date, representing

US$78,527,000 aggregate principal amount of Notes, at a purchase

price of US$1,028.33 for each US$1,000.00 principal amount of Notes

accepted, plus accrued and unpaid interest to but excluding the

payment date. Quebecor Media intends to settle payment for the

Notes accepted for purchase by end of today.

Notes may be validly tendered by holders until 12:01 a.m., New

York City time, on March 28, 2012 unless extended or earlier

terminated (such date and time, as the same may be extended or

earlier terminated, the "Expiration Date"). Holders of Notes

validly tendered after the Early Participation Date but at or prior

to the Expiration Date, and accepted for purchase, subject to the

Maximum Tender Amount and proration, if applicable, will receive

the applicable Tender Offer Consideration, but not the Early

Participation Amount, specified in the Offer to Purchase. In

addition, all holders of Notes accepted for purchase in the Tender

Offer will also receive accrued and unpaid interest on the Notes

from the last interest payment date to, but not including, the

applicable payment date.

As announced on March 14, 2012, Quebecor Media intends to

redeem, on April 13, 2012, US$100,000,000 aggregate principal

amount of Notes outstanding on April 13, 2012 at a price equal to

102.583% of such Notes, plus accrued and unpaid interest pursuant

to the terms of the indenture governing the Notes.

The terms of the Tender Offer remain unchanged and are as set

forth in the Offer to Purchase. Quebecor Media anticipates that it

will accept for purchase and pay for all Notes validly tendered at

or prior to the Expiration Date and not validly withdrawn, subject

to the Maximum Tender Amount and proration, if applicable, or

previously accepted on the date hereof, within two business days

following the Expiration Date.

None of Quebecor Media or its board of directors, the dealer

managers or the tender and information agent, or the trustee for

the Notes makes any recommendation that holders tender or refrain

from tendering all or any portion of the principal amount of their

Notes, and no one has been authorized by us or any of them to make

such a recommendation. Holders must make their own decision as to

whether to tender their Notes, and, if so, the principal amount of

Notes to tender.

All the Notes are held in book-entry form through the facilities

of The Depository Trust Company. If you hold Notes through a

broker, dealer, bank, trust company or other intermediary or

nominee (an "Intermediary"), you must contact such Intermediary if

you wish to tender Notes in the Tender Offer. You should check with

such Intermediary to determine whether such Intermediary will

charge you a fee for tendering Notes on your behalf. You should

also confirm with the Intermediary any deadlines by which you must

provide your tender instructions, because the relevant deadline set

by such Intermediary will be earlier than the deadlines set forth

herein.

Quebecor Media has retained BofA Merrill Lynch and Citigroup to

serve as dealer managers for the Tender Offer, and Global

Bondholder Services Corporation to serve as the tender and

information agent for the Tender Offer.

For additional information regarding the terms of the Tender

Offer, please contact BofA Merrill Lynch at (888) 292-0070 (toll

free) or (646) 855-3401 (collect), or Citigroup at (800) 558-3745

(U.S. toll free) or (212) 723-6106 (collect). Requests for a copy

of the Offer to Purchase and the Letter of Transmittal relating to

the Notes, and questions regarding the tender of the Notes may be

directed to Global Bondholder Services Corporation at (866)

937-2200 (toll free) or (212) 430-3774 (collect).

This announcement does not constitute an offer to buy or the

solicitation of an offer to sell securities in any jurisdiction or

in any circumstances in which such offer or solicitation is

unlawful. In those jurisdictions where the securities laws require

the Tender Offer to be made by a licensed broker or dealer, the

Tender Offer will be deemed to be made by the Dealer Managers or

one or more registered brokers or dealers licensed under the laws

of such jurisdiction. The securities mentioned herein have not been

and will not be qualified for sale to the public under applicable

Canadian securities laws.

About Quebecor Media

Quebecor Media Inc. is a subsidiary of Quebecor Inc. (TSX:

QBR.A, QBR.B), one of Canada's largest telecommunications and media

holding companies. Quebecor Media has over 16,000 employees in a

number of media-related operating companies: Videotron Ltd., an

integrated communications company engaged in cable television,

interactive multimedia development, Internet access services, cable

telephone service and mobile telephone service; Sun Media

Corporation, the largest publisher of newspapers in Canada;

Canoe.ca, operator of a Canadian network of English- and

French-language Internet properties; TVA Group Inc., operator of

the largest French-language conventional television network in

Quebec, a number of specialty channels, and the English-language

Sun News Network; and Nurun Inc., a major interactive technologies

and communications agency with offices in Canada, the United

States, Europe and Asia. Quebecor Media Inc. is engaged in magazine

publishing (TVA Publishing Inc.); book publishing and distribution

(Sogides Group Inc. and CEC Publishing Inc.); production,

distribution and retailing of entertainment products (Archambault

Group Inc. and TVA Films); rental and retailing of DVDs, Blu-ray

discs and console games (Le SuperClub Videotron ltee); printing and

distribution of community newspapers and flyers (Quebecor Media

Printing Inc. and Quebecor Media Network Inc.); production and

dissemination of news content (QMI Agency); multiplatform

advertising (QMI Sales); and print and online directories (Quebecor

MediaPages(TM)).

Forward-Looking Statements

This news release contains "forward-looking information" within

the meaning of applicable Canadian securities legislation and

"forward-looking statements" within the meaning of United States

federal securities legislation (collectively, "forward-looking

statements"). All statements other than statements of historical

facts included in this press release, including statements

regarding our industry and our prospects, plans, financial position

and business strategy, may constitute forward-looking statements.

These forward-looking statements are based on current expectations,

estimates, forecasts and projections about the industries in which

we operate as well as beliefs and assumptions made by our

management. Such statements include, in particular, statements

about our plans, prospects, financial position and business

strategies.

Words such as "may," "will," "expect," "continue," "intend,"

"estimate," "anticipate," "plan," "foresee," "believe" or "seek" or

the negatives of these terms or variations of them or similar

terminology are intended to identify such forward-looking

statements. Although we believe that the expectations reflected in

these forward-looking statements are reasonable, these statements,

by their nature, involve risks and uncertainties and are not

guarantees of future performance. Such statements are also subject

to assumptions concerning, among other things: our anticipated

business strategies; anticipated trends in our business; and our

ability to continue to control costs. We can give no assurance that

these estimates and expectations will prove to have been correct.

Actual outcomes and results may, and often do, differ from what is

expressed, implied or projected in such forward-looking statements,

and such differences may be material. Some important factors that

could cause actual results to differ materially from those

expressed in these forward-looking statements include, but are not

limited to: general economic, financial or market conditions; the

intensity of competitive activity in the industries in which we

operate, including competition from alternative means of programs

and content transmission; new technologies that would change

consumer behaviour toward our product suite; unanticipated higher

capital spending required or to address continued development of

competitive alternative technologies or the inability to obtain

additional capital to continue the development of our business; our

ability to implement successfully our business and operating

strategies and manage our growth and expansion; disruptions to the

network through which we provide our digital television, Internet

access and telephony services, and our ability to protect such

services from piracy; labour disputes or strikes; changes in our

ability to obtain services and equipment critical to our

operations; changes in laws and regulations, or in their

interpretations, which could result, among other things, in the

loss (or reduction in value) of our licenses or markets or in an

increase in competition, compliance costs or capital expenditures;

our substantial indebtedness, the tightening of credit markets, and

the restrictions on our business imposed by the terms of our debt;

and interest rate fluctuations that affect a portion of our

interest payment requirements on long-term debt. We caution you

that the above list of cautionary statements is not exhaustive.

These and other factors could cause actual results to differ

materially from our expectations expressed in the forward-looking

statements included in this press release, and you are encouraged

to read "Item 3. Key Information - Risk Factors" as well as

statements located elsewhere in Quebecor Media's annual report on

Form 20-F for the year ended December 31, 2010 for further details

and descriptions of these and other factors. Each of these

forward-looking statements speaks only as of the date of this press

release. We will not update these statements unless applicable

securities laws require us to do so.

Contacts: Jean-Francois Pruneau Chief Financial Officer Quebecor

Inc. and Quebecor Media Inc. 514

380-4144jean-francois.pruneau@quebecor.com J. Serge Sasseville Vice

President, Corporate and Institutional Affairs Quebecor Media Inc.

514 380-1864serge.sasseville@quebecor.com

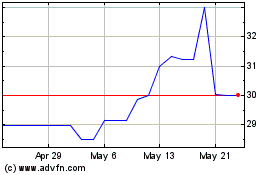

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024