Quebecor Inc. ("Quebecor" or the "Company") (TSX:QBR.A)(TSX:QBR.B)

today reported its full year and fourth quarter consolidated

financial results for 2011. Quebecor consolidates the financial

results of its Quebecor Media Inc. ("Quebecor Media") subsidiary,

in which it holds a 54.7% interest.

Quebecor adopted International Financial Reporting Standards

("IFRS") on January 1, 2011. The Corporation's consolidated

financial statements for the full year and fourth quarter of 2011

have therefore been prepared in accordance with IFRS and

comparative data for 2010 have been restated. For more information,

see "Transition to IFRS" below.

Highlights

2011 financial year:

-- Revenues: up $206.5 million (5.2%) to $4.21 billion in 2011 due to

sustained growth in the Telecommunications segment.

-- Operating income(1): up $8.3 million (0.6%) from 2010 to $1.34 billion.

-- Net income attributable to shareholders: $201.0 million ($3.14 per basic

share), down $24.3 million ($0.36 per basic share) from $225.3 million

($3.50 per basic share) in 2010.

-- Adjusted income from continuing operations(2): $191.5 million in 2011

($2.99 per basic share), down $29.1 million ($0.43 per basic share) from

$220.6 million ($3.42 per basic share) in 2010.

-- Videotron Ltd. ("Videotron") added 375,800 revenue-generating units(3),

its largest annual customer growth since 2008 and a 39.3% increase over

the growth recorded in 2010:

-- Net increase of 49,900 cable television customers in 2011 (34,600 in

2010), including a 181,200-subscriber increase for the digital

service (135,500 in 2010), the strongest annual growth for the

digital service since its launch in 1999. Total revenues from cable

television services passed the $1 billion mark.

-- Net increase of 80,400 customers for the cable Internet access

service (81,500 in 2010).

-- Net increase of 91,000 customers for the cable telephony service

(100,300 in 2010).

-- Net increase of 154,500 subscriber connections for the mobile

telephony service. As of December 31, 2011, Videotron's 4G network

was available to nearly seven million people in Quebec and eastern

Ontario.

(1) See "Operating income" under "Definitions."

(2) See "Adjusted income from continuing operations" under "Definitions."

(3) Revenue-generating units are the sum of cable television, Internet

access and cable telephone service subscriptions, plus subscriber

connections to the mobile telephone service.

Fourth quarter 2011:

-- Revenues: $1.15 billion in the fourth quarter of 2011, up $59.8 million

(5.5%) from the same quarter of 2010.

-- Operating income: $369.2 million, an increase of $10.1 million (2.8%).

-- Net income attributable to shareholders: $85.4 million ($1.34 per basic

share) compared with $46.6 million ($0.72 per basic share) in the fourth

quarter of 2010, an increase of $38.8 million ($0.62 per basic share).

-- Adjusted income from continuing operations: $55.6 million in the fourth

quarter of 2011 ($0.87 per basic share), compared with $58.2 million

($0.90 per basic share) in the fourth quarter of 2010, a decrease of

$2.6 million ($0.03 per basic share).

"Quebecor grew its revenues by $206.5 million or 5.2% in 2011,

mainly because of the sustained performance of our

Telecommunications segment," commented Pierre Karl Peladeau,

President and Chief Executive Officer of Quebecor. "Videotron

achieved its largest annual customer base growth in three years,

with a 39.3% increase over the growth recorded in 2010. The strong

performance was due, among other things, to effective bundling

strategies at a time when over-the-air analog television

broadcasting was coming to an end. With respect to financial

results, the Telecommunications segment's operating income was up

$51.5 million (4.9%) from 2010, despite additional operating costs

generated by the new mobile telephony service launched in September

2010. At the end of 2011, there were 290,600 subscriber connections

to the mobile service, including 154,900 subscriber additions in

2011. It was a remarkable year in all respects for all of the

Telecommunications segment's services.

"In our News Media and Broadcasting segments, we continued

developing our business proposition to local, provincial and

national advertisers in 2011. In view of ongoing technological

change and the proliferation of media and content delivery

channels, we decided to adapt our offerings to changing and

converging communications methods and channels. The contracts

signed by our National Sales Offices in Ontario and Quebec now

combine the development, production and implementation of full,

innovative, convergent advertising and marketing plans.

Capitalizing on the strength of their well-known brands and

leveraging all forms of media creativity, our National Sales

Offices now offer advertisers one-stop shopping. We now have the

ability to run a multimedia communications campaign on all of

Quebecor Media's platforms in order to create a promotional event

that can reach target audiences quickly and on a massive scale.

"The launch of the Le Sac Plus door-knob bag in August 2011 also

illustrates our ability to interact with consumers. The contracts

to print the Jean Coutu Group (PJC) Inc. pharmacy chain's flyers

and to distribute them in the door-knob bag demonstrate the

complementary fit among Quebecor Media's multiproduct offerings. In

addition to distributing all of Quebecor Media's community

newspapers in Quebec, the Le Sac Plus bag contains advertising

materials such as flyers, leaflets, product samples, and other

value-added promotions every week.

"Keeping pace with changes in communications channels and

methods, the new Le Journal de Montreal and Le Journal de Quebec

websites launched in February 2012 offer an exceptional user

experience, in line with Sun Media Corporation's innovative

Internet approach, already implemented at other dailies. While the

new sites reflect the tone and style that have made the print

versions of the newspapers successful, they offer more videos and

photos, as well as increased opportunities for interaction with

columnists, leveraging Quebecor Media's full potential for

convergence.

"For its part, TVA Group Inc. ("TVA Group") continued

diversifying and expanding its product line-up in 2011 by launching

a number of specialty channels: the English-language news and

opinion channel Sun News Network ("Sun News"), TVA Sports, and the

women's channel Mlle. TVA Group signed agreements with, among

others, Bell and Rogers Communications Inc. in 2011 and 2012,

securing carriage of a number of its specialty channels on Canada's

largest cable providers.

"The News Media and Broadcasting segments' financial results

were affected in 2011 by the major investments required for product

and service launches, and by the impact of increased competition

and of the economic climate on the advertising market. Management

considers these investments to be necessary in order to diversify

the Corporation's activities beyond its traditional lines of

business and to optimize the significant expertise it has developed

over the decades.

"Alongside our revenue-stimulation initiatives, we launched new

restructuring and cost-containment efforts in our News Media

segment in the fourth quarter of 2011. We introduced measures that

will reduce Sun Media Corporation's staff by 400 employees and

should yield annual savings in excess of $20.0 million. However, at

the corporate level, those headcount reductions were more than

offset by the creation of approximately 1,000 jobs in our

Telecommunications segment.

"With respect to corporate expansion, the acquisition of Les

Hebdos Monteregiens in early 2011 strengthened Quebecor Media's

distribution network in Quebec. The acquisition of an interest in a

Quebec Major Junior Hockey League team in June 2011 will make new

content available on the Corporation's various media platforms.

Also, in September 2011, Quebecor Media's Nurun Inc. ("Nurun")

subsidiary acquired a digital agency located in San Francisco,

U.S.A., that has extensive expertise in brand promotion and

interactive product development. Finally, in February 2012, a joint

venture with Saguenay-area entrepreneurs created BlooBuzz Studios

L.P., a company engaged in the booming business of video game

development for occasional players; Quebecor Media is thus entering

a new market that is growing at a spectacular pace, particularly on

mobile platforms.

"As we review the events of 2011, we must also note the final

agreement on management and naming rights to the future arena in

Quebec City, for an initial 25-year period. Quebecor Media now has

all the tools it needs to pursue its goals, which are to manage a

world-class multipurpose center and to bring a National Hockey

League team to Quebec City.

"Several financial operations were completed in 2011 and early

2012 to extend the maturity dates of Quebecor's debt, increasing it

from a weighted average of 4.9 years as at December 31, 2010 to 6.6

years as at December 31, 2011, considering, on a pro forma basis,

the operations carried out at the beginning of 2012. These

transactions will also yield annual savings in financial expenses

estimated at $30.0 million. We are gratified by the confidence the

financial markets have shown in us.

"In conclusion, the many achievements of 2011 and early 2012

have laid solid foundations for several promising projects at

Quebecor and its subsidiaries. We are looking to the future with

confidence and optimism", concluded Pierre Karl Peladeau.

Table 1

Quebecor financial highlights, 2007 to 2011

(in millions of Canadian dollars, except per share data)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011(1) 2010(1) 2009(2) 2008(2) 2007(2)

----------------------------------------------------------------------------

Revenues $ 4,206.6 $ 4,000.1 $ 3,806.4 $ 3,759.4 $ 3,390.6

Operating

income(3) 1,341.7 1,333.4 1,276.7 1,121.1 948.8

Income (loss)

from continuing

operations

attributable to

shareholders 201.0 225.3 276.1 (195.3) 273.3

Net income (net

loss)

attributable to

shareholders 201.0 225.3 277.7 188.0 (968.5)

Adjusted income

from continuing

operations(4) 191.5 220.6 236.3 179.4 134.4

Per basic share:

Income (loss)

from

continuing

operations

attributable

to

shareholders 3.14 3.50 4.30 (3.04) 4.25

Net income

(net loss)

attributable

to

shareholders 3.14 3.50 4.32 2.92 (15.06)

Adjusted

income from

continuing

operations(4) 2.99 3.42 3.68 2.79 2.09

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Financial figures for 2010 and 2011 are presented in accordance with

IFRS.

(2) Financial figures for 2007 to 2009 are presented in accordance with

Canadian Generally Accepted Accounting Principles ("GAAP").

(3) See "Operating income" under "Definitions."

(4) See "Adjusted income from continuing operations" under "Definitions."

2011/2010 financial year comparison

Revenue: $4.21 billion, an increase of $206.5 million

(5.2%).

-- Revenues increased in Telecommunications ($201.9 million or 9.1% of

segment revenues), Interactive Technologies and Communications ($22.9

million or 23.4%), Leisure and Entertainment ($10.4 million or 3.4%),

and News Media ($3.4 million or 0.3%).

-- Revenues decreased in Broadcasting ($2.7 million or -0.6%).

-- Inter-segment revenues also show an unfavorable variance of $29.4

million due to new activities in 2011.

Operating income: $1.34 billion, an increase of $8.3 million

(0.6%).

-- Operating income increased in Telecommunications ($51.5 million or 4.9%)

and in Interactive Technologies and Communications ($1.9 million or

31.7%).

-- Operating income decreased in News Media ($41.3 million or -21.6% of

segment operating income), Broadcasting ($24.4 million or -32.6%), and

Leisure and Entertainment ($1.0 million or -3.6%).

-- The change in the fair value of Quebecor Media stock options resulted in

a $12.8 million favourable variance in the stock-based compensation

charge in 2011 compared with 2010. The fair value of the options

decreased in 2011, whereas it increased in 2010. The change in the fair

value of Quebecor stock options resulted in a $31.2 million favourable

variance in the Corporation's stock-based compensation charge in 2011.

-- Excluding the impact of the consolidated stock-based compensation

charge, and if the figures for prior periods were restated to

retroactively reflect the reversal in the fourth quarter of 2009 of the

accumulated Canadian Radio-television and Telecommunications Commission

("CRTC") Part II licence fee provision, operating income would have

decreased 2.6% in 2011, compared with an 8.2% increase in 2010.

Net income attributable to shareholders: $201.0 million ($3.14

per basic share) compared with $225.3 million ($3.50 per basic

share) in 2010, a decrease of $24.3 million ($0.36 per basic

share).

-- The decrease was mainly due to:

-- $113.0 million increase in amortization charge.

-- Partially offset by:

-- $8.5 million favourable variance in gain on valuation and

translation of financial instruments;

-- $8.3 million increase in operating income;

-- $6.9 million decrease in charge for restructuring of operations,

impairment of assets and other special items;

-- $5.7 million decrease in loss on debt refinancing.

Adjusted income from continuing operations: $191.5 million in

2011 ($2.99 per basic share) compared with $220.6 million ($3.42

per basic share) in 2010, an increase of $29.1 million ($0.43 per

basic share).

2011/2010 fourth quarter comparison

Revenues: $1.15 billion, an increase of $59.8 million

(5.5%).

-- Revenues increased in Telecommunications ($43.6 million or 7.4% of

segment revenues), Leisure and Entertainment ($8.6 million or 8.8%),

News Media ($8.6 million or 3.2%), and Interactive Technologies and

Communications ($8.1 million or 29.0%).

-- Revenues decreased in Broadcasting ($1.8 million or -1.3%).

Operating income: $369.2 million, an increase of $10.1 million

(2.8%).

-- Operating income increased in Telecommunications ($31.5 million or 12.0%

of segment operating income).

-- Operating income was flat in Interactive Technologies and

Communications.

-- Operating income decreased in News Media ($10.8 million or -18.7%),

Broadcasting ($8.6 million or -29.5%), and Leisure and Entertainment

($3.7 million or -32.7%).

-- The change in the fair value of Quebecor Media stock options resulted in

a $0.3 million favourable variance in the stock-based compensation

charge in the fourth quarter of 2011, compared with the same period of

2010. The change in the fair value of Quebecor stock options resulted in

an 8.3 million favourable variance in the Corporation's stock-based

compensation charge in the fourth quarter of 2011.

-- Excluding the impact of the consolidated stock-based compensation

charge, and if the figures for prior periods were restated to

retroactively reflect the reversal in the fourth quarter of 2009 of the

accumulated CRTC Part II licence fee provision, operating income would

have increased 0.4% in the fourth quarter of 2011, compared with a 3.8%

increase in the same period of 2010.

Net income attributable to shareholders: $85.4 million ($1.34

per basic share) compared with $46.6 million ($0.72 per basic

share) in the fourth quarter of 2010, an increase of $38.8 million

($0.62 per basic share).

-- The variance was mainly due to:

-- gain on valuation and translation of financial instruments: $82.5

million in the fourth quarter of 2011 compared with a $23.6 million

loss in the same quarter of 2010, a favourable variance of $106.1

million;

-- $12.2 million favourable variance in the charge for restructuring of

operations, impairment of assets and other special items;

-- $10.1 million increase in operating income.

-- Partially offset by:

-- $18.2 million increase in amortization charge.

Adjusted income from continuing operations: $55.6 million in the

fourth quarter of 2011 ($0.87 per basic share), compared with $58.2

million ($0.90 per basic share) in the fourth quarter of 2010, a

decrease of $2.6 million ($0.03 per basic share).

Financing activities

-- On March 14, 2012, Videotron issued US$800.0 million aggregate principal

amount of Senior Notes bearing interest at 5.0%, for a net proceeds of

approximately $787.6 million, net of estimated financing fees of $11.9

million.

-- On February 29, 2012, Quebecor Media announced the initiation of a cash

tender offer to purchase up to US$260.0 million in aggregate principal

amount of its 7.75% Senior Notes due March 15, 2016. The total

consideration for each US$1,000.0 principal amount of Senior Notes

tendered and purchased is US$1,028.33 for Senior Notes tendered at or

prior to March 14, 2012, or US$1,025.83 for Senior Notes tendered after

that date but prior to March 28, 2012, plus accrued and unpaid interest.

-- On February 29, 2012, Videotron issued a notice of redemption for any

and all of its outstanding 6.825% Senior Notes due January 15, 2014. The

redemption price is 100.0% of the principal amount of the notes

redeemed, plus accrued and unpaid interest, and the redemption date will

be March 30, 2012. The purchase will be carried out on Senior Notes that

not have been tendered and purchased under the Videotron cash tender

offer announced on February 29, 2012.

-- On February 29, 2012, Videotron announced the initiation of a cash

tender offer to purchase any and all of its outstanding 6.825% Senior

Notes due January 15, 2014. The total consideration for each US$1,000.0

principal amount of Senior Notes tendered and purchased is US$1,001.25

for Senior Notes tendered at or prior to March 13, 2012, or US$1,000.0

for Senior Notes tendered after that date but prior to March 28, 2012,

plus accrued and unpaid interest.

-- On February 24, 2012, TVA Group amended its bank credit facilities to

extend the maturity of its $100.0 million revolving credit facility from

December 2012 to February 2017.

-- On February 3, 2012, Sun Media Corporation repaid the $37.6 million

balance on its term loan credit facility and terminated all its credit

facilities. Sun Media Corporation's liabilities no longer include any

long-term debt.

-- On January 25, 2012, Quebecor Media amended its bank credit facilities

to extend the maturity of its $100.0 million revolving credit facility

from January 2013 to January 2016 and added a new $200.0 million

revolving credit facility "C," also maturing in January 2016.

-- On July 20, 2011, Videotron amended its $575.0 million revolving credit

facility to extend the expiry date from April 2012 to July 2016 and to

amend some of the terms and conditions.

-- On July 5, 2011, Videotron issued 6 7/8% Senior Notes maturing in 2021

in the aggregate principal amount of $300.0 million, for a net principal

amount of $294.8 million. The net proceeds were used to finance the

early repayment and withdrawal of US$255.0 million in the principal

amount of Videotron's 6 7/8% Senior Notes maturing in 2014, and to

settle the related hedges.

-- The conditions of the exchangeable debentures, Series 2001 and Series

Abitibi, were amended in February and June 2011 respectively to reduce

the interest rate from 1.50% to 0.10% on the notional principal amount

of the debentures. Other related conditions have not changed and remain

applicable. In September 2011, the Corporation redeemed exchangeable

debentures, Series 2001, in the notional principal amount of $135.0

million for nil consideration.

-- On January 5, 2011, Quebecor Media completed an issuance of Senior Notes

in the aggregate principal amount of $325.0 million, for net proceeds of

$319.9 million. The Notes bear interest at a rate of 7 3/8% and mature

in 2021. Quebecor Media used the net proceeds from the placement

primarily to finance the early repayment and withdrawal, on February 15,

2011, of all of Sun Media Corporation's outstanding 7 5/8% Senior Notes

maturing in 2013, in the aggregate principal amount of US$205.0 million,

and to finance the settlement and cancellation of related hedges.

Dividends

On March 14, 2012, the Board of Directors of Quebecor declared a

quarterly dividend of $0.05 per share on its Class A Multiple

Voting Shares and Class B Subordinate Voting Shares, payable on

April 24, 2012 to shareholders of record at the close of business

on March 30, 2012. This dividend is designated to be an eligible

dividend, as provided under subsection 89(14) of the Canadian

Income Tax Act and its provincial counterpart.

Normal course issuer bid

On August 10, 2011, the Corporation filed a normal course issuer

bid for a maximum of 985,233 ("Class A shares") representing

approximately 5% of issued and outstanding Class A shares, and for

a maximum of 4,453,304 ("Class B shares") representing

approximately 10% of the public float of Class B shares as of

August 2, 2011. The purchases can be made from August 12, 2011 to

August 10, 2012 at prevailing market prices on the open market

through the facilities of the Toronto Stock Exchange. All shares

purchased under the bid are, or will be cancelled.

In 2011, the Corporation purchased and cancelled 928,100 Class B

shares for a total cash consideration of $30.2 million. The excess

of $23.1 million of the purchase price over the carrying value of

Class B shares repurchased was recorded in a reduction to retained

earnings.

Detailed financial information

For a detailed analysis of Quebecor's full year and fourth

quarter 2011 results, please refer to the Management Discussion and

Analysis and consolidated financial statements of Quebecor,

available on the Company's website at:

http://www.quebecor.com/en/quarterly_doc_quebecor_inc or from the

SEDAR filing service at www.sedar.com.

Conference call for investors and webcast

Quebecor will hold a conference call to discuss Quebecor's full

year and fourth quarter 2011 results on March 15, 2012, at 11:00

a.m. EDST. There will be a question period reserved for financial

analysts. To access the conference call, please dial 1 877

293-8052, access code for participants 58308#. A tape recording of

the call will be available from March 15 to June 13, 2012 by

dialling 1 877 293-8133, conference number 766307#, access code for

participants 58308#. The conference call will also be broadcast

live on Quebecor's website at

www.quebecor.com/en/content/conference-call. It is advisable to

ensure the appropriate software is installed before accessing the

call. Instructions and links to free player downloads are available

at the Internet address shown above.

Transition to IFRS

On January 1, 2011, Canadian GAAP, as used by publicly

accountable enterprises, were fully converged into IFRS. Prior to

the adoption of IFRS, for all periods up to and including the year

ended December 31, 2010, the Corporation's consolidated financial

statements were prepared in accordance with Canadian GAAP. IFRS

uses a conceptual framework similar to Canadian GAAP, but there are

significant differences related to recognition, measurement and

disclosures.

The date of the opening balance sheet under IFRS and the date of

transition to IFRS are January 1, 2010. The financial data for 2010

have therefore been restated. The Corporation is also required to

apply IFRS accounting policies retrospectively to determine its

opening balance sheet, subject to certain exemptions. However, the

Corporation is not required to restate figures for periods prior to

January 1, 2010 that were previously prepared in accordance with

Canadian GAAP.

The significant accounting policies under IFRS are disclosed in

Note 1 to the consolidated financial statements for the year ended

December 31, 2011. Note 29 describes the adjustments made by the

Corporation in preparing its IFRS opening consolidated balance

sheet as of January 1, 2010 and in restating its previously

published Canadian GAAP consolidated financial statements for the

year ended December 31, 2010. Note 29 also provides details on

exemption choices made by the Corporation with respect to the

general principle of retrospective application of IFRS.

Forward-looking statements

The statements in this press release that are not historical

facts are forward-looking statements and are subject to significant

known and unknown risks, uncertainties and assumptions that could

cause Quebecor's actual results for future periods to differ

materially from those set forth in the forward-looking statements.

Forward-looking statements may be identified by the use of the

conditional or by forward-looking terminology such as the terms

"plans," "expects," "may," "anticipates," "intends," "estimates,"

"projects," "seeks," "believes" or similar terms, variations of

such terms or the negative of such terms. Certain factors that may

cause actual results to differ from current expectations include

seasonality (including seasonal fluctuations in customer orders),

operating risk (including fluctuations in demand for Quebecor's

products and pricing actions by competitors), insurance risk, risks

associated with capital investment (including risks related to

technological development and equipment availability and

breakdown), environmental risks, risks associated with labour

agreements, risks associated with commodities and energy prices

(including fluctuations in the cost and availability of raw

materials), credit risk, financial risks, debt risks, risks related

to interest rate fluctuations, foreign exchange risks, risks

associated with government acts and regulations, risks related to

changes in tax legislation, and changes in the general political

and economic environment. Investors and others are cautioned that

the foregoing list of factors that may affect future results is not

exhaustive and that undue reliance should not be placed on any

forward-looking statements. For more information on the risks,

uncertainties and assumptions that could cause Quebecor's actual

results to differ from current expectations, please refer to

Quebecor's public filings available at www.sedar.com and

www.quebecor.com including, in particular, the "Risks and

Uncertainties" section of Quebecor's Management Discussion and

Analysis for the year ended December 31, 2011.

The forward-looking statements in this press release reflect

Quebecor's expectations as of March 15, 2012, and are subject to

change after that date. Quebecor expressly disclaims any obligation

or intention to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws.

The Corporation

Quebecor Inc. (TSX:QBR.A)(TSX:QBR.B) is a holding company with a

54.7% interest in Quebecor Media Inc., one of Canada's largest

media groups, with more than 16,000 employees. Quebecor Media Inc.,

through its subsidiary Videotron Ltd., is an integrated

communications company engaged in cable television, interactive

multimedia development, Internet access services, cable telephone

services and mobile telephone services. Through Sun Media

Corporation, Quebecor Media Inc. is the largest publisher of

newspapers in Canada. It also operates Canoe.ca and its network of

English- and French-language Internet properties in Canada. In the

broadcasting sector, Quebecor Media Inc. operates, through TVA

Group Inc., the number one French-language general-interest

television network in Quebec, a number of specialty channels, and

the Sun News English-language channel. Another subsidiary of

Quebecor Media Inc., Nurun Inc., is a major interactive

technologies and communications agency with offices in Canada, the

United States, Europe and Asia. Quebecor Media Inc. is also active

in magazine publishing (TVA Publishing Inc.), video game

development (BlooBuzz Studios, L.P.), book publishing and

distribution (Sogides Group Inc. and CEC Publishing Inc.), the

production, distribution and retailing of cultural products

(Archambault Group Inc. and TVA Films), DVD, Blu-ray disc and

videogame rental and retailing (Le SuperClub Videotron Ltd.), the

printing and distribution of regional newspapers and flyers

(Quebecor Media Printing Inc. and Quebecor Media Network Inc.),

news content production and distribution (QMI Agency),

multiplatform advertising solutions (QMI Sales) and the publishing

of printed and online directories, through Quebecor

MediaPages(TM).

DEFINITIONS

Operating Income

In its analysis of operating results, the Corporation defines

operating income, as reconciled to net income under IFRS, as net

income before amortization, financial expenses, gain (loss) on

valuation and translation of financial instruments, charge for

restructuring of operations, impairment of assets and other special

items, loss on debt refinancing, and income tax. Operating income

as defined above is not a measure of results that is consistent

with IFRS. It is not intended to be regarded as an alternative to

other financial operating performance measures or to the statement

of cash flows as a measure of liquidity. It should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. Management believes

that operating income is a meaningful measure of performance. The

Corporation uses operating income in order to assess the

performance of its investment in Quebecor Media. The Corporation's

management and Board of Directors use this measure in evaluating

its consolidated results as well as the results of the

Corporation's operating segments. This measure eliminates the

significant level of depreciation and amortization of tangible and

intangible assets and is unaffected by the capital structure or

investment activities of the Corporation and its segments.

Operating income is also relevant because it is a significant

component of the Corporation's annual incentive compensation

programs. A limitation of this measure, however, is that it does

not reflect the periodic costs of tangible and intangible assets

used in generating revenues in the Corporation's segments. The

Corporation also uses other measures that do reflect such costs,

such as cash flows from segment operations and free cash flows from

operations. In addition, measures like operating income are

commonly used by the investment community to analyze and compare

the performance of companies in the industries in which the

Corporation is engaged. The Corporation's definition of operating

income may not be the same as similarly titled measures reported by

other companies.

Table 2 below provides a reconciliation of operating income with

net income as disclosed in the Corporation's consolidated financial

statements.

Table 2

Reconciliation of the operating income measure used in this press release to

the net income measure used in the consolidated financial statements

(in millions of Canadian dollars)

Year ended Three months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Operating (loss) income:

Telecommunications $ 1,098.8 $ 1,047.3 $ 294.7 $ 263.2

News Media 150.1 191.4 47.0 57.8

Broadcasting 50.5 74.9 20.6 29.2

Leisure and Entertainment 26.6 27.6 7.6 11.3

Interactive Technologies

and Communications 7.9 6.0 2.5 2.5

Head Office 7.8 (13.8) (3.2) (4.9)

----------------------------------------------------------------------------

1,341.7 1,333.4 369.2 359.1

Amortization (512.2) (399.2) (138.2) (120.0)

Financial expenses (322.9) (322.6) (77.7) (80.1)

Gain (loss) on valuation and

translation of financial

instruments 54.6 46.1 82.5 (23.6)

Restructuring of operations,

impairment of assets and

other special items (30.2) (37.1) (11.2) (23.4)

Loss on debt refinancing (6.6) (12.3) - -

Income taxes (141.4) (151.7) (60.2) (14.1)

----------------------------------------------------------------------------

Net income $ 383.0 $ 456.6 $ 164.4 $ 97.9

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted income from continuing operating activities

The Corporation defines adjusted income from continuing

operations, as reconciled to net income attributable to

shareholders under IFRS, as net income attributable to shareholders

before gain (loss) on valuation and translation of financial

instruments, charge for restructuring of operations, impairment of

assets and other special items, and loss on debt refinancing, net

of income tax and net income attributable to non-controlling

interests. Adjusted income from continuing operations, as defined

above, is not a measure of results that is consistent with IFRS. It

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS. The

Corporation's definition of adjusted income from continuing

operating activities may not be identical to similarly titled

measures reported by other companies.

Table 3 provides a reconciliation of adjusted income from

continuing operations to the net income attributable to

shareholders measure used in Quebecor's consolidated financial

statements.

Table 3

Reconciliation of the adjusted income from continuing operations measure

used in this press release to the net income attributable to shareholders

measure used in the consolidated financial statements

(in millions of Canadian dollars)

Year ended Three months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Adjusted income from

continuing operations $ 191.5 $ 220.6 $ 55.6 $ 58.2

Gain (loss) on valuation

and translation of

financial instruments 54.6 46.1 82.5 (23.6)

Restructuring of

operations, impairment

of assets and other

special items (30.2) (37.1) (11.2) (23.4)

Loss on debt refinancing (6.6) (12.3) - -

Income taxes related to

adjustment(1) (3.8) 7.9 (17.5) 19.5

Net income attributable

to non-controlling

interest related to

adjustments (4.5) 0.1 (24.0) 15.9

----------------------------------------------------------------------------

Net income attributable

to shareholders $ 201.0 $ 225.3 $ 85.4 $ 46.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Includes the impact of fluctuations in tax rates applicable to

adjusted items, either for statutory reasons or in connection with tax

planning arrangements.

Average Monthly Revenue per User

ARPU is an industry metric that the Corporation uses to measure

its monthly cable television, Internet access, cable telephony and

mobile telephony revenues per average basic cable customer. ARPU is

not a measurement that is consistent with IFRS and the

Corporation's definition and calculation of ARPU may not be the

same as identically titled measurements reported by other

companies. The Corporation calculates ARPU by dividing its combined

cable television, Internet access, cable telephony and mobile

telephony revenues by the average number of basic customers during

the applicable period, and then dividing the resulting amount by

the number of months in the applicable period.

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in millions of Canadian dollars, except for earnings per share data)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Revenues

Telecommunications $ 634.8 $ 591.2 $ 2,430.7 $ 2,228.8

News Media 275.6 267.0 1,018.4 1,015.0

Broadcasting 131.6 133.4 445.5 448.2

Leisure and Entertainment 106.2 97.6 312.9 302.5

Interactive Technologies

and Communications 36.0 27.9 120.9 98.0

Inter-segment (36.3) (29.0) (121.8) (92.4)

------------------------------------------------

1,147.9 1,088.1 4,206.6 4,000.1

Cost of sales, selling and

administrative expenses 778.7 729.0 2,864.9 2,666.7

Amortization 138.2 120.0 512.2 399.2

Financial expenses 77.7 80.1 322.9 322.6

(Gain) loss on valuation and

translation of financial

instruments (82.5) 23.6 (54.6) (46.1)

Restructuring of operations,

impairment of assets and

other special items 11.2 23.4 30.2 37.1

Loss on debt refinancing - - 6.6 12.3

------------------------------------------------

Income before income taxes 224.6 112.0 524.4 608.3

Income taxes:

Current (12.8) (9.5) (17.7) 56.4

Deferred 73.0 23.6 159.1 95.3

------------------------------------------------

60.2 14.1 141.4 151.7

------------------------------------------------

Net income $ 164.4 $ 97.9 $ 383.0 $ 456.6

------------------------------------------------

------------------------------------------------

Net income attributable to

Shareholders $ 85.4 $ 46.6 $ 201.0 $ 225.3

Non-controlling interests 79.0 51.3 182.0 231.3

------------------------------------------------

------------------------------------------------

Earnings per share

attributable to

shareholders

Basic $ 1.34 $ 0.72 $ 3.14 $ 3.50

Diluted 1.34 0.70 3.11 3.44

------------------------------------------------

------------------------------------------------

Weighted average number of

shares outstanding (in

millions) 63.5 64.3 64.0 64.3

Weighted average number of

diluted shares (in

millions) 63.8 65.0 64.4 65.1

------------------------------------------------

------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions of Canadian dollars)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Net income $ 164.4 $ 97.9 $ 383.0 $ 456.6

Other comprehensive loss:

(Loss) gain on translation

of net investments in

foreign operations - (1.1) 1.6 (2.9)

Cash flow hedges:

(Loss) gain on valuation

of derivative financial

instruments (22.9) (52.4) (9.5) 43.0

Deferred income taxes 5.1 11.1 (2.0) (2.7)

Defined benefit plans:

Acturial loss and net

change in asset limit

and in minimumfunding

liability (89.7) (61.1) (90.0) (65.3)

Deferred income taxes 23.6 16.0 23.7 17.2

Reclassification to

income:

Other comprehensive loss

related to cash flow

hedges - - 0.8 8.4

Deferred income taxes - - (0.2) (2.5)

------------------------------------------------

(83.9) (87.5) (75.6) (4.8)

------------------------------------------------

Comprehensive income $ 80.5 $ 10.4 $ 307.4 $ 451.8

------------------------------------------------

------------------------------------------------

Comprehensive income

attributable to

Shareholders $ 44.1 $ (1.1) $ 164.4 $ 223.6

Non-controlling interests 36.4 11.5 143.0 228.2

------------------------------------------------

------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

SEGMENTED INFORMATION

(in millions of Canadian dollars)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Net income before

amortization, financial

expenses, (gain) loss on

valuation and translation

of financial instruments,

restructuring of

operations, impairment of

assets and other special

items, loss on debt

refinancing and income

taxes

Telecommunications $ 294.7 $ 263.2 $ 1,098.8 $ 1,047.3

News Media 47.0 57.8 150.1 191.4

Broadcasting 20.6 29.2 50.5 74.9

Leisure and Entertainment 7.6 11.3 26.6 27.6

Interactive Technologies

and Communications 2.5 2.5 7.9 6.0

Head Office (3.2) (4.9) 7.8 (13.8)

------------------------------------------------

$ 369.2 $ 359.1 $ 1,341.7 $ 1,333.4

------------------------------------------------

------------------------------------------------

Amortization

Telecommunications $ 113.5 $ 95.1 $ 421.4 $ 305.0

News Media 14.9 16.4 56.0 61.4

Broadcasting 5.0 4.2 17.8 15.5

Leisure and Entertainment 1.9 2.5 8.7 9.8

Interactive Technologies

and Communications 1.7 0.9 4.2 3.9

Head Office 1.2 0.9 4.1 3.6

------------------------------------------------

$ 138.2 $ 120.0 $ 512.2 $ 399.2

------------------------------------------------

------------------------------------------------

Additions to property, plant

and equipment

Telecommunications $ 196.6 $ 190.6 $ 725.3 $ 651.4

News Media 2.4 4.4 13.7 11.4

Broadcasting 8.0 6.7 30.5 18.5

Leisure and Entertainment 2.3 0.8 6.3 4.2

Interactive Technologies

and Communications 0.6 0.6 4.3 2.6

Head Office 0.1 0.6 0.9 2.4

------------------------------------------------

$ 210.0 $ 203.7 $ 781.0 $ 690.5

------------------------------------------------

------------------------------------------------

Additions to intangible

assets

Telecommunications $ 20.7 $ 23.7 $ 73.2 $ 71.9

News Media 2.7 4.5 10.8 12.0

Broadcasting 2.4 1.8 5.8 5.9

Leisure and Entertainment 0.2 (0.4) 1.8 5.4

------------------------------------------------

$ 26.0 $ 29.6 $ 91.6 $ 95.2

------------------------------------------------

------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(in millions of Canadian dollars)

(unaudited)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Equity attributable to shareholders

--------------------------------------------------------

Accumulated

other com-

Capital Contributed Retained prehensive

stock surplus earnings (loss) income

----------------------------------------------------------------------------

Balance as of

December 31, 2009

aspreviously

reported under

Canadian GAAP $ 346.6 $ 4.7 $ 830.1 $ (11.0)

IFRS adjustments - (2.7) (73.5) 1.0

----------------------------------------------------------------------------

Balance as of

January 1, 2010 346.6 2.0 756.6 (10.0)

Net income - - 225.3 -

Other comprehensive

(loss) income - - (25.4) 23.7

Acquisition of non-

controlling

interests - (1.1) - -

Dividends - - (12.9) -

----------------------------------------------------------------------------

Balance as of

December 31, 2010 346.6 0.9 943.6 13.7

Net income - - 201.0 -

Other comprehensive

loss - - (31.5) (5.1)

Issuance of shares

of a subsidiary - - - -

Repurchase of Class

B shares (7.1) - (23.1) -

Dividends - - (12.8) -

----------------------------------------------------------------------------

Balance as of

December 31, 2011 $ 339.5 $ 0.9 $ 1,077.2 $ 8.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(in millions of Canadian dollars)

(unaudited)

----------------------------------------------------------------

----------------------------------------------------------------

Equity

attributable

to non-

controlling Total

interests equity

----------------------------------------------------------------

Balance as of

December 31, 2009

aspreviously

reported under

Canadian GAAP $ - $ 1,170.4

IFRS adjustments 1,162.6 1,087.4

----------------------------------------------------------------

Balance as of

January 1, 2010 1,162.6 2,257.8

Net income 231.3 456.6

Other comprehensive

(loss) income (3.1) (4.8)

Acquisition of non-

controlling

interests (1.9) (3.0)

Dividends (42.0) (54.9)

----------------------------------------------------------------

Balance as of

December 31, 2010 1,346.9 2,651.7

Net income 182.0 383.0

Other comprehensive

loss (39.0) (75.6)

Issuance of shares

of a subsidiary 1.0 1.0

Repurchase of Class

B shares - (30.2)

Dividends (46.5) (59.3)

----------------------------------------------------------------

Balance as of

December 31, 2011 $ 1,444.4 $ 2,870.6

----------------------------------------------------------------

----------------------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions of Canadian dollars)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Cash flows related to

operating activities

Net income $ 164.4 $ 97.9 $ 383.0 $ 456.6

Adjustments for:

Amortization of

property, plant and

equipment 105.9 91.9 391.3 325.4

Amortization of

intangible assets 32.3 28.1 120.9 73.8

(Gain) loss on valuation

and translation of

financial instruments (82.5) 23.6 (54.6) (46.1)

Impairment of assets - 0.8 1.5 11.9

Loss on debt refinancing - - 6.6 12.3

Amortization of

financing costs and

long-term debt discount 3.6 3.2 12.8 12.5

Deferred income taxes 73.0 23.6 159.1 95.3

Other (3.0) (1.1) (2.1) (7.9)

------------------------------------------------

293.7 268.0 1,018.5 933.8

Net change in non-cash

balances related to

operating activities (117.6) (114.3) (152.2) (123.9)

------------------------------------------------

Cash flows provided by

operating activities 176.1 153.7 866.3 809.9

------------------------------------------------

Cash flows related to

investing activities

Business acquisitions, net

of cash and cash

equivalents - - (55.7) (3.1)

Additions to property,

plant and equipment (210.0) (203.7) (781.0) (690.5)

Additions to intangible

assets (26.0) (29.6) (91.6) (95.2)

Proceeds from disposals of

assets 4.5 3.4 12.0 53.0

Net change in temporary

investments - - - 30.0

Other - (0.7) 3.2 1.7

------------------------------------------------

Cash flows used in investing

activities (231.5) (230.6) (913.1) (704.1)

------------------------------------------------

Cash flows related to

financing activities

Net change in bank

indebtedness (0.5) 1.9 (1.5) 3.9

Net change under revolving

facilities 6.7 (14.4) 2.7 (11.9)

Issuance of long-term

debt, net of financing

fees 71.0 - 685.8 292.7

Repayment of long-term

debt (6.8) (17.0) (487.9) (359.5)

Settlement of hedging

contracts - - (160.2) (32.4)

Repurchase of Class B

shares (6.2) - (30.2) -

Dividends (3.2) (3.3) (12.8) (12.9)

Dividends paid to non-

controlling shareholders (11.3) (11.9) (46.5) (42.0)

Other (0.1) - 1.0 -

------------------------------------------------

Cash flows provided by (used

in) financing activities 49.6 (44.7) (49.6) (162.1)

------------------------------------------------

Net change in cash and cash

equivalents (5.8) (121.6) (96.4) (56.3)

Effect of exchange rate

changes on cash and cash

equivalents denominated in

foreign currencies (0.2) (0.2) 0.1 (1.0)

Cash and cash equivalents at

beginning of period 152.4 364.5 242.7 300.0

------------------------------------------------

Cash and cash equivalents at

end of period $ 146.4 $ 242.7 $ 146.4 $ 242.7

------------------------------------------------

------------------------------------------------

Cash and cash equivalents

consist of

Cash $ 29.9 $ 122.1 $ 29.9 $ 122.1

Cash equivalents 116.5 120.6 116.5 120.6

------------------------------------------------

$ 146.4 $ 242.7 $ 146.4 $ 242.7

------------------------------------------------

------------------------------------------------

Non-cash investing

activities

Net change in additions to

property, plant and

equipment and intangible

assets financed with

accounts payable $ (55.4) $ 8.9 $ (26.7) $ (16.4)

------------------------------------------------

------------------------------------------------

Interest and taxes reflected

as operating activities

Cash interest payments $ 134.4 $ 117.3 $ 320.5 $ 306.0

Cash income tax payments

(net of refunds) 0.4 2.9 30.7 37.0

------------------------------------------------

------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions of Canadian dollars)

(unaudited)

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010

----------------------------------------------------------------------------

Assets

Current assets

Cash and cash equivalents $ 146.4 $ 242.7

Cash and cash equivalents in trust 0.3 5.3

Accounts receivable 603.4 588.5

Income taxes 29.0 6.4

Inventories 283.6 245.2

Prepaid expenses 31.3 38.0

--------------------------------

1,094.0 1,126.1

Non-current assets

Property, plant and equipment 3,211.1 2,805.7

Intangible assets 1,041.0 1,036.3

Goodwill 3,543.8 3,505.2

Derivative financial instruments 34.9 28.7

Deferred income taxes 20.6 20.3

Other assets 93.4 93.8

--------------------------------

7,944.8 7,490.0

--------------------------------

Total assets $ 9,038.8 $ 8,616.1

--------------------------------

--------------------------------

Liabilities and equity

Current liabilities

Bank indebtedness $ 4.2 $ 5.7

Accounts payable and accrued charges 776.5 753.6

Provisions 33.7 72.2

Deferred revenue 295.7 275.1

Income taxes 2.7 33.6

Current portion of long-term debt 114.5 30.8

--------------------------------

1,227.3 1,171.0

Non-current liabilities

Long-term debt 3,688.3 3,587.3

Derivative financial instruments 315.4 479.9

Other liabilities 344.7 274.0

Deferred income taxes 592.5 452.2

--------------------------------

4,940.9 4,793.4

Equity

Capital stock 339.5 346.6

Contributed surplus 0.9 0.9

Retained earnings 1,077.2 943.6

Accumulated other comprehensive income 8.6 13.7

--------------------------------

Equity attributable to shareholders 1,426.2 1,304.8

Non-controlling interests 1,444.4 1,346.9

--------------------------------

2,870.6 2,651.7

--------------------------------

Total liabilities and equity $ 9,038.8 $ 8,616.1

--------------------------------

--------------------------------

Contacts: Jean-François Pruneau Chief Financial Officer Quebecor

Inc. and Quebecor Media Inc. 514

380-4144jean-francois.pruneau@quebecor.com J. Serge Sasseville Vice

President, Corporate and Institutional Affairs Quebecor Media Inc.

514 380-1864serge.sasseville@quebecor.com

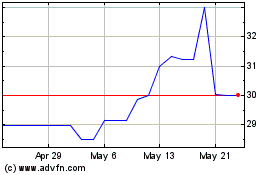

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024