Last Chance for Canadian Content: Quebecor Tells CRTC Canada Must Move Quickly to Meet the Challenges of the Digital Age

April 15 2008 - 9:01AM

Marketwired Canada

Canada must prepare to meet the challenges of the digital age by promoting the

production of high-quality Canadian content and meeting the needs of consumers,

who increasingly are able to watch the programs they are interested in when and

where they want, on the platform that suits them best. If it fails to adjust to

the new realities, Canada will, to all intents and purposes, have chosen to lock

itself out of the global television industry. Pierre Karl Peladeau, President

and Chief Executive Officer of Quebecor Inc., made the comments today, arguing

that the approximately 400 rules and regulations governing Canada's broadcasting

industry - many of which were designed for a world that no longer exists - are

stifling this country's potential to play a leading role in the industry.

Reforming the regulatory framework to promote Canadian content

Mr. Peladeau surveyed the new digital environment and maintained that Canada

needs to realize that its broadcasting system cannot long survive in its current

state, with potentially dire repercussions for Canadian content and the people

who produce it. "Within a few years, the Internet may be the main distributor of

television programs, piping content over a global network that escapes

regulation."

Mr. Peladeau noted that a distribution monopoly no longer exists in Canada:

consumers can almost always choose between cable and satellite, and increasingly

can opt for new distribution services such as IPTV, mobile broadcasting and the

Internet. "Given this context, if regulation has the effect of limiting consumer

choice or artificially increasing the cost of services without adding value,

consumers will simply turn their backs on the system and find what they want

elsewhere."

Specialty channels

"The specialty channels are no longer fringe players. The regulatory setup that

allows the specialty channels access to advertising revenues in addition to

mandatory carriage fees gives them a formidable position in the advertising

marketplace, since they are able to offer advertisers very attractive

multi-channel packages. Together, they dominate the market, while the market

share of conventional broadcasters is melting like snow in the sun."

Private conventional broadcasters are being squeezed. They cannot count on

advertising revenues to ensure their profitability and survival. Meanwhile, they

are subject to wildly disproportionate regulatory obligations and costs, when

compared with the specialty channels. And yet it is up to the conventional

broadcasters to provide the lion's share of Canadian content in the form of full

news and current affairs coverage, major dramatic series and diverse

programming. "We have to try to square the circle and survive without carriage

fees, with falling advertising revenues and an unchanging regulatory burden.

This is a situation that cannot long endure."

Fees for all channels

Quebecor believes that all broadcasting services - conventional broadcasters and

specialty channels alike - should be entitled to collect carriage fees. The

offering party, the broadcaster, should be able to sit down with the distributor

to settle on a fair price for the product, terms and conditions for the

distribution of the service, and its inclusion in the packages offered to

consumers. Quebecor believes each broadcaster should be entitled to a fair price

for its products, which means the right to withhold permission for a distributor

to carry its channel or channels. The resulting dynamic would force the three

central players in the broadcasting system - broadcasters, producers and

distributors - to excel in order to claim their place in an industry that soon

will have no borders:

Undue advantages for public broadcasting?

Mr. Peladeau also pointed out that the public broadcaster is in a much more

advantageous position, with four revenue streams: a substantial government

subsidy, a large portion of the funds distributed by the Canadian Television

Fund, advertising revenues, and carriage fees from its specialty channels.

"It is baffling that while the LCN all-news channel, owned by TVA, has the

largest audience share in its market, RDI, the CBC's French-language news

channel, collects a carriage fee three times as high. It is also shocking to

learn that the public broadcaster is now calling for carriage fees for its two

main channels. As a public service, the CBC cannot contend it is part of the

same free market as private broadcasters that take real risks to offer their

audiences a quality product, and lay claim to parliamentary appropriations,

advertising revenues, the Canadian Television Fund, and carriage fees for its

conventional and specialty channels, all at the same time."

Canadians want Canadian content

According to a Praxicus survey commissioned by Quebecor, the public agrees: 86%

of respondents favour policies to promote the production of Canadian programming

and Canadian content; 74% support change and innovation in the television

industry; 65% believe the regulatory framework should be reformed to allow

Canada to join the digital revolution as soon as possible.

Repeating Quebecor's commitment to the production of quality Canadian content

and to maintaining the predominance of Canadian content, Mr. Peladeau argued:

"If our goal is to enable Canadians to compete in this lucrative industry, which

is part and parcel of the knowledge economy and a creator of wealth in advanced

societies, we have no choice but to rely as much as possible on the laws of the

market."

www.ocanada.tv website informs Canadians:

Quebecor took the opportunity to announce the launch of a new website,

www.ocanada.tv, which seeks to inform Canadians of the potential for Canadian

television in the future. The site is divided into four fact-filled sections

covering television production, distribution, broadcasting and regulation in

Canada. Each of the four sections contains three subsections: "Did you know,"

which provides information on the state of Canadian television; "The new digital

environment," which surveys the opportunities created by digitization; and

"Building a new world," which discusses ways to promote the creation and

distribution of Canadian content.

Quebecor Inc.

Quebecor Inc. (TSX:QBR.A)(TSX:QBR.B) is a holding company with interests in two

companies, Quebecor Media Inc. and Quebecor World Inc. Quebecor holds a 54.7%

interest in Quebecor Media, which owns operating companies in numerous

media-related businesses: Videotron Ltd., the largest cable operator in Quebec

and a major Internet Service Provider and provider of telephone and business

telecommunications services; Sun Media Corporation, the largest publisher of

newspapers in Canada; Quebecor MediaPages, a publisher of print and online

directories; TVA Group Inc., operator of the largest French-language

over-the-air television network in Quebec, a number of specialty channels, and

the English-language over-the-air station Sun TV; Canoe Inc., operator of a

network of English- and French-language Internet properties in Canada; Nurun

Inc., a major interactive technologies and communications agency with offices in

Canada, the United States, Europe and Asia; magazine publisher TVA Publishing

Inc.; book publisher and distributor Quebecor Media Book Group Inc.; Archambault

Group Inc. and TVA Films, companies engaged in the production, distribution and

retailing of cultural products, and Le SuperClub Videotron ltee, a DVD and

console game rental and retail chain. Quebecor World is a commercial print media

services company with operations in North America, Europe, Latin America and

Asia.

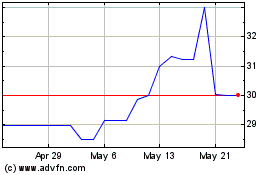

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024