Pinetree Capital Ltd Announces Unaudited Financial Results for the Period Ended September 30, 2019

November 06 2019 - 4:01PM

Pinetree Capital Ltd. (TSX:PNP) (“Pinetree” or the “Company”) today

announced its financial results for the three and nine months ended

September 30, 2019. All financial information provided in

this press release is unaudited and all figures are in $’000 except

per share amounts and shares outstanding.

Unaudited financial results for the period ended

September 30, 2019

The following information should be read in

conjunction with our annual audited Consolidated Financial

Statements, prepared in accordance with International Financial

Reporting Standards (“IFRS”) and our annual Management Discussion

and Analysis for the year ended December 31, 2018, which can be

found on SEDAR at www.sedar.com.

Selected Financial Information

|

|

|

|

|

|

Three months endedSeptember

30, |

Nine months endedSeptember

30, |

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| Net investment gains

(losses) |

$ |

(108 |

) |

$ |

(2,503 |

) |

$ |

1,441 |

|

$ |

(1,834 |

) |

| Other income |

|

136 |

|

|

80 |

|

|

256 |

|

|

201 |

|

| Total expenses |

|

(83 |

) |

|

(176 |

) |

|

(382 |

) |

|

(346 |

) |

| Net income (loss) for the

period |

|

(55 |

) |

|

(2,599 |

) |

|

1,315 |

|

|

(1,979 |

) |

|

Earnings (loss) per share – basic & fully

diluted |

|

(0.01 |

) |

|

(0.29 |

) |

|

0.15 |

|

|

(0.22 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

The net investment losses for the three months

ended September 30, 2019 was $108 (nine months ended September 30,

2018 –$2,503) as a result of net realized losses on investments

offset by a net change in unrealized gains as described below.

For the three months ended September 30, 2019,

the Company had $4,408 net realized losses on disposal of

investments as compared to net realized losses of $697 for the

three months ended September 30, 2018. The realized losses

were primarily from legacy investments with little or no value,

partially offset by realized gains from new investments.

For the three months ended September 30, 2019,

the Company had a net change in unrealized gains on investments of

$4,300 as compared to net change in unrealized losses on

investments of $1,806 for the three months ended September 30,

2018. The net change in unrealized gains were primarily

from the reversal of previously recognized net unrealized losses on

the disposition of investments and the net write-up to market on

the Company’s investments.

For the three months ended September 30, 2019,

other income totalled $136 as compared to other income of $80 for

the three months ended September 30, 2018. Other income is

comprised of interest and dividend income.

|

|

|

|

|

|

As at September 30, 2019 |

As at December 31, 2018 |

|

Total assets |

$ |

17,581 |

$ |

16,375 |

| Total liabilities |

|

286 |

|

395 |

| Net asset value |

|

17,295 |

|

15,980 |

| Shares outstanding |

|

9,045,198 |

|

9,045,198 |

| Net

asset value per share – basic* |

$ |

1.91 |

$ |

1.77 |

| |

|

|

|

|

As at September 30, 2019, the Company held

investments at fair value totaling $8,025 as compared to $8,969 as

at December 31, 2018, a 11% increase, attributable to net

dispositions of investments offset by net investment gains during

the nine months ended September 30, 2019.The following is

Pinetree's NAV per share and Operating Expenses per NAV for the

eight most recently completed interim financial periods:

|

|

SharesOutstanding |

Net AssetValue (NAV) |

OperatingExpenses2(excluding F/X

g(l))(OpEx) |

NAV per share – basic1 |

QuarterlyOpEx per NAV1 |

| |

|

$'000s |

$'000s |

$ |

% |

|

Sep-30-19 |

9,045,198 |

17,295 |

80 |

1.91 |

0.5 |

|

Jun-30-19 |

9,045,198 |

17,350 |

118 |

1.92 |

0.7 |

|

Mar-31-19 |

9,045,198 |

17,106 |

119 |

1.89 |

0.7 |

|

Dec-31-18 |

9,045,198 |

15,980 |

103 |

1.77 |

0.6 |

|

Sept-30-18 |

9,045,198 |

16,326 |

171 |

1.80 |

1.0 |

|

Jun-30-18 |

9,045,198 |

18,925 |

121 |

2.09 |

0.6 |

|

Mar-31-18 |

9,045,198 |

18,639 |

139 |

2.06 |

0.7 |

|

Dec-31-17 |

9,045,198 |

18,305 |

195 |

2.02 |

1.1 |

| |

|

|

|

|

|

1 Refer to “Use of Non-GAAP Financial Measures”Shares

Outstanding and Net Asset Value amounts are as at the Quarter End

dateOperating Expenses amounts are for the Three months ending the

Quarter End date2 Operating Expenses do not include Foreign

Exchange gain (loss) on financial assets other than investments

Forward Looking Statements

Certain statements herein may be “forward

looking” statements that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Pinetree or the industry to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements involve significant

risks and uncertainties, should not be read as guarantees of future

performance or results, and will not necessarily be accurate

indications of whether or not such results will be achieved.

A number of factors could cause actual results to vary

significantly from the results discussed in the forward-looking

statements. These forward-looking statements reflect current

assumptions and expectations regarding future events and operating

performance and are made as of the date hereof and Pinetree assumes

no obligation, except as required by law, to update any

forward-looking statements to reflect new events or

circumstances.

Non-IFRS Measures, Non-GAAP

Measures

NAV (net asset value per share) is a non-IFRS

(international financial reporting standards) measure calculated as

the value of total assets less the value of total liabilities

divided by the total number of common shares outstanding as at a

specific date. The term NAV does not have any standardized meaning

according to IFRS and therefore may not be comparable to similar

measures presented by other companies. There is no comparable

IFRS measure presented in Pinetree’s consolidated financial

statements and thus no applicable quantitative reconciliation for

such non-IFRS financial measure. The Company has calculated

NAV consistently for many years and believes that NAV can provide

information useful to its shareholders in understanding its

performance and may assist in the evaluation of its business

relative to that of its peers.

About Pinetree Capital Ltd.

Pinetree is a value-oriented investment and

merchant banking company focused on the technology sector.

Pinetree’s common shares are listed on the Toronto Stock Exchange

(TSX) under the symbol “PNP”.

For further information:John BouffardChief

Financial

Officer416-941-9600jbouffard@pinetreecapital.comwww.pinetreecapital.com

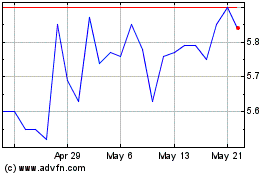

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Dec 2023 to Dec 2024