Maxim Power Corp. Announces First Quarter 2011 Financial and Operating Results

June 09 2011 - 8:29PM

Marketwired Canada

Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX:MXG) announced today the

release of financial and operating results for its first quarter ended March 31,

2011. The unaudited financial statements, accompanying notes and Management

Discussion and Analysis will be available on SEDAR on June 10, 2011 and on

MAXIM's website. All figures reported herein are Canadian dollars unless

otherwise stated.

FINANCIAL HIGHLIGHTS

Three Months Ended

March 31

($ in thousands except per share amounts) 2011 2010

Revenue $ 54,997 $ 50,775

Adjusted EBITDA (1) 15,792 12,561

Net income for the period 4,559 24,240

Per share - basic $ 0.08 $ 0.45

- diluted $ 0.08 $ 0.44

Funds from operations (1) 14,312 11,521

Per share - basic $ 0.26 $ 0.21

- diluted $ 0.26 $ 0.21

Generation (MWh) 392,005 384,635

Net Generation Capacity (MW) (2) 809 809

Average Alberta Power Price ($ per MWh) $ 83 $ 41

(1) Select financial information was derived from the consolidated financial

statements and is prepared in accordance with International Financial

Reporting Standards ("IFRS"), except Adjusted EBITDA and Funds from

operations ("FFO"). Adjusted EBITDA is provided to assist management and

investors in determining the Corporation's approximate operating cash flows

before interest, income taxes, and depreciation and amortization and FFO is

provided to assist management and investors in determining the Corporation's

cash flows generated by operations before the cash impact of working capital

fluctuations. Adjusted EBITDA and FFO do not have any standardized meaning

prescribed by IFRS and may not be comparable to similar measures presented

by other companies. Refer to Non-IFRS measures for reconciliations between

non-IFRS financial measures and comparable measures calculated in accordance

with IFRS.

(2) Generation capacity is manufacturer's name plate capacity net of

minority ownership interests of third parties.

OPERATING RESULTS

Effective January 1, 2011, MAXIM began reporting its financial results in

accordance with International Financial Reporting Standards ("IFRS"). Prior year

comparative amounts reported under Canadian GAAP have been restated to reflect

the effects of transition from Canadian GAAP to IFRS.

MAXIM generated a record 392,005 MWh in first quarter of 2011 compared to

384,635 MWh for the same quarter in 2010, which is an increase of 7,370 MWh or

2.0%. Revenue for 2011 increased $4.2 million or 8.3% to $55.0 million. Earnings

before interest, taxes, depreciation and amortization (refer to Non-IFRS

measures - "EBITDA" in the MD&A), increased $3.2 million to $15.8 million in the

first quarter of 2010 from $12.6 million in the same quarter of 2010. These

improvements are attributable to higher Alberta wholesale electricity prices and

increased electricity demand in the Northeast US, the effects of which were

partially offset by the expiration of the Pittsfield facility's RMR contract,

which provided fixed monthly capacity payments, in May 2010.

Net income for the first quarter of 2011 was $4.6 million compared to the same

period in 2010 of $24.2 million. Net income in the first quarter of 2010

includes the recognition of gain of $22.7 million as a result of the EarthFirst

amalgamation.

Funds from operations in the first quarter of 2011 of $14.3 million were $2.8

million higher compared to $11.5 million in the same quarter of 2010 primarily

as a result of higher power prices realized at the Milner generating facility

and increased electricity demand in the US Northeast.

GROWTH INITIATIVES

Mine 14

On April 20, 2011, the ERCB granted Milner Power Inc. the license to commence

underground mining of the Mine 14 coal reserve. MAXIM considers Mine 14 to have

significant value as a fuel source for MAXIM's existing Milner plant and its

proposed Milner Expansion Project, as well as for the sale of metallurgical

coal.

Extraction and testing of unoxidized coal is currently underway in order to

prepare detailed metallurgical specifications of the low volatile resource and

finalize the wash plant design. Subject to confirmation of satisfactory

financing arrangements, construction activities are targeted to commence this

summer and MAXIM anticipates that Mine 14 will be fully commissioned and

producing coal in 2013. Various options to capitalize/monetize Mine 14 are still

under evaluation.

Milner Expansion

In January 2009, MAXIM submitted regulatory applications to construct and

operate a 500 MW coal-fired generation facility (the "Milner Expansion Project"

or "M2") adjacent to the existing Milner Power Plant. M2 will utilize

state-of-the-art, supercritical, pulverized coal technology, making it the most

fuel-efficient coal-fired plant in Canada. The Environmental Impact Assessment

for the project was deemed complete by Alberta Environment on November 24, 2010,

and final regulatory approvals are anticipated in 2011.

Deerland Peaking Station

MAXIM received all required regulatory approvals to construct and operate the

Deerland Peaking Station which is a 190 MW natural gas-fired peaking facility

that will be located in Bruderheim, Alberta, immediately adjacent to the

existing Deerland high voltage substation in Alberta's Industrial Heartland.

This area is expected to experience significant growth in electrical demand.

Subject to satisfactory electricity market conditions and our ability to

conclude all commercial arrangements necessary to support the investment, MAXIM

will initiate construction of this shovel-ready project.

Buffalo Atlee

The Buffalo Atlee Power Project, situated near Brooks, Alberta, has the

potential for over 200 MW of wind generation capacity. Wind data has been

collected on the 22,000 acre project site for 5 years. MAXIM holds an

exploratory Crown land permit with a term of five years, expiring on January 1,

2016. The addition of wind generation to MAXIM's existing portfolio of assets

would diversify MAXIM's generation fuel types.

CONFERENCE CALL FOR Q1 2011 RESULTS

MAXIM will host a conference call for analysts and investors on June 15, 2011 at

10:00 a.m. MT (12:00 p.m. ET). The call will be hosted by John Bobenic, MAXIM's

President and Chief Executive Officer, and by Mike Mayder, Vice President,

Finance and Chief Financial Officer. To participate in this conference call,

please dial (866) 226-1792 or (416) 340-2216 in the Toronto area. It is

recommended that participants call at least ten minutes prior to start time.

A recording of the conference call will be available from 1:00 p.m. MT (3:00

p.m. EDT) on June 15, 2011 until June 22, 2011 at 9:59 p.m. MDT (11:59 p.m. ET).

To access this replay, please dial (800) 408-3053 or (416) 694-9451 followed by

the passcode 3376050. In addition, the call will be available commencing June

13, 2011 in the Investor Relations section of MAXIM's website at

www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an Independent Power Producer ("IPP")

engaged in the acquisition and development, ownership and operation of power

generation facilities and the resultant sale of generating capacity, electricity

and thermal energy. At March 31, 2011 MAXIM had forty-four power plants with 809

MW of electric and 117 MW of thermal net generating capacity operating in three

identifiable geographic segments: Canada, United States and France. MAXIM trades

on the TSX under the symbol "MXG". For more information about MAXIM, visit our

website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

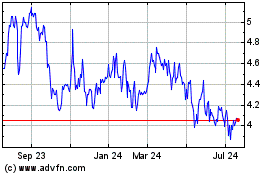

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

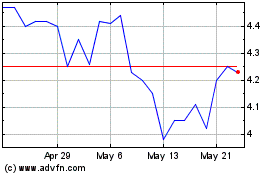

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024