Maxim Power Corp. Announces First Quarter 2009 Financial and Operating Results

May 14 2009 - 5:57PM

Marketwired Canada

Maxim Power Corp. (TSX:MXG) ("MAXIM" or the "Corporation") announced today that

it released its financial and operating results for the first quarter of 2009.

The unaudited consolidated financial statements, accompanying notes and

Management's Discussion and Analysis ("MD&A") will be available on SEDAR on May

15, 2009 and on MAXIM's website. All figures reported herein are in Canadian

dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

Three Months Ended

March 31

2009 2008

($ in thousands except per share amounts)

Revenue $ 55,276 $ 47,414

EBITDA(1) 17,433 15,489

Net income 5,003 6,090

Per share diluted $ 0.09 $ 0.14

Cash provided by operations 20,298 22,002

Per share diluted $ 0.37 $ 0.50

Electricity Deliveries (MWh) 335,009 295,546

Net Generation Capacity (MW)(2) 773 492

Average Alberta Electricity Price ($ per MWh) $ 63 $ 77

Average Milner Realized Electricity Price ($ per

MWh) $ 69 $ 77

(1) EBITDA is earnings before interest, taxes, depreciation and

amortization, and discontinued operations and is not a measure under

Canadian Generally Accepted Accounting Principles ("GAAP") and may not

be comparable to similar measures presented by other companies. Refer to

Non-GAAP measure section of the MD&A for an explanation and

reconciliation.

(2) Net generation capacity is manufacturer's nameplate capacity net of

minority ownership interests of third parties.

OPERATING RESULTS

The first quarter 2009 represented MAXIM's best first quarter ever in terms of

revenue. During the quarter, MAXIM generated revenue of $55.3 million compared

to $47.4 million for the same quarter in 2008, an increase of $7.9 million or

16.6%. Quarter over quarter, EBITDA was $17.4 million versus $15.5 million for

an increase of $1.9 million; cash provided by operations was $20.3 million

versus $22.0 for a decrease of $1.7 million; net income was $5.0 million versus

$6.1 million for a decrease of $1.1 million, and electrical generation was

335,009 MWh versus 295,546 MWh, an increase of 39,463 MWh.

The improved quarter-over-quarter performance for revenue and EBITDA was driven

by the 2008 acquisition of the Forked River and Pittsfield generating stations

and two cogeneration facilities in France, and the impact of a stronger U.S.

dollar and Euro vis-a-vis the Canadian dollar. This was offset by a lower

average power price realized at Milner of $69 per MWh during the first quarter

of 2009 versus $77 per MWh during the same period in 2008. The decrease in net

income is attributed to higher depreciation and amortization, as a result of the

acquisitions and higher interest costs resulting from the higher average debt

balance from the 2008 Milner turnaround and the acquisitions.

ACQUISITIONS

Sebi and Chabossiere

On February 27, 2009, Comax France S.A.S. ("COMAX"), MAXIM's wholly-owned

subsidiary, closed the purchase of the Sebi and Chabossiere facilities in France

for $1.6 million (EUR 1.0 million) plus working capital. These acquisitions were

initially funded through a new capital lease agreement on an existing facility

for $617 thousand (EUR 378 thousand) and internal cash flow. Subsequent to March

31, 2009, COMAX closed a loan agreement and received EUR 920 thousand to support

this acquisition. These acquisitions added 16 MW of electricity capacity,

bringing MAXIM's generating portfolio in France to 24 power plants having a

total of 148 MW electric and 127 MW thermal installed generating capacity. COMAX

intends on repowering theses facilities at an estimated cost of EUR 6.2 million

which is expected to be financed through debt. These renovations will add an

additional 10.8 MW of electrical and thermal capacity bringing the total

capacity in France to 160 MW of electrical and 137 MW of thermal.

GUIDANCE

MAXIM's results are significantly impacted by Alberta spot power prices. In

preparing its guidance, management uses Alberta forward electricity prices as a

proxy for Alberta spot electricity prices. The market for forward contracts is

relatively illiquid and forward prices may not be a good predictor of settled

prices as they may not factor in events such as unplanned outages that can cause

a significant increase in settled power prices. Notwithstanding, MAXIM prepares

its guidance using forward electricity prices from independent sources.

Management has determined that it is necessary to update its guidance due to a

reduction in forward electricity prices in Alberta.

Updated 2009 guidance

----------------------------------------------------------------------------

($000's, except per share amounts) Original Updated

Guidance Guidance

----------------------------------------------------------------------------

EBITDA 63,000 48,000

Net income 23,000 14,500

Per share - basic and diluted $ 0.42 $ 0.27

Cash provided by operations 45,000 42,000

Per share - basic and diluted (i) $ 0.82 $ 0.78

----------------------------------------------------------------------------

(i) Share data per assumptions.

The guidance provided herein is based on the following assumptions:

----------------------------------------------------------------------------

($000's, except as otherwise noted) Original Updated

Guidance Guidance

----------------------------------------------------------------------------

Electricity deliveries (MWh) 1,390,000 1,330,000

Net generation capacity at year ending

(MW) 757 773

Capital expenditures (excluding

acquisitions)

HR Milner 4,000 4,000

Other assets 6,000 6,000

Development projects 2,000 2,000

Average Alberta spot electricity price $ 82.00 $ 59.00

Average annual foreign exchange rates

C$/USD $ 1.09 $ 1.20

C$/EUR $ 1.60 $ 1.50

Weighted average shares outstanding

(000's) 54,574 54,182

----------------------------------------------------------------------------

The 2009 forecast assumes all sales of Milner output at Alberta spot market

prices. In France, the cogeneration season ends on March 31, 2009 and a new

season begins on November 1, 2009. There are no acquisitions assumed to take

place during 2009 other than the two France facilities acquired in February 2009

and the Corporation is not exposed to refinancing risk in 2009. MAXIM continues

its development initiatives related to the Milner Expansion project and the #14

Mine project. In addition, the 2009 forecast assumes turnaround maintenance will

occur in the first half of the year at both Milner and CDECCA, and in late fall

at Pawtucket. The 2009 Milner turnaround is expected to last twenty-seven days

in 2009, which is significantly shorter than the extended turnaround of eight

weeks in 2008.

CONFERENCE CALL FOR Q1 2009 RESULTS

MAXIM will host a conference call for analysts and investors on Friday, May 15,

2009 at 10:00 a.m. MDT (12:00 p.m. EDT). The call will be hosted by John

Bobenic, MAXIM's President and Chief Executive Officer and Mike Mayder, Vice

President, Finance and Chief Financial Officer.

To participate in this conference call, please dial (866) 225-2055 or (416)

340-8061 in the Toronto area. It is recommended that participants call at least

ten minutes prior to start time.

A recording of the conference call will be available from 1:00 p.m. MDT (2:00

p.m. EDT) on May 15, 2009 until May 22, 2009 at 9:59 p.m. MDT (11:59 p.m. EDT).

To access this replay, please dial (800) 408-3053 or (416) 695-5800 followed by

the passcode 4526543. In addition, the webcast will be available commencing May

28, 2009 in the Investor Relations section of MAXIM's web site at

www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an Independent Power Producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 37 power plants in

western Canada, the United States and France, having 773 MW of electric and 137

MW of thermal generating capacity. Approximately 80% of MAXIM's current

portfolio is comprised of clean burning natural gas, high efficiency

cogeneration, waste heat and landfill gas fuelled generation. MAXIM trades on

the TSX under the symbol "MXG". For more information about MAXIM, visit our

website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

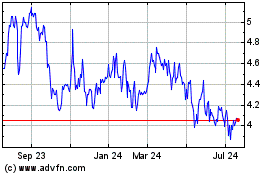

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

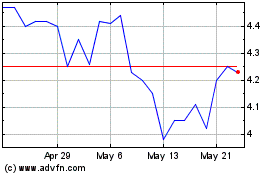

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024