Maxim Power Corp. (TSX:MXG) ("MAXIM" or the "Corporation") announced today the

release of financial and operating results for its fourth quarter and year ended

December 31, 2008. The audited financial statements, accompanying notes and

Management Discussion and Analysis will be available on SEDAR on March 30, 2009

and on MAXIM's website. All figures reported herein are Canadian dollars unless

otherwise stated.

FINANCIAL HIGHLIGHTS

----------------------------------------------------------------------------

Three Months Ended Twelve Months Ended

December 31 December 31

($ in thousands except per share

amounts) 2008 2007 2008 2007

----------------------------------------------------------------------------

Revenue $ 53,429 $ 37,945 $ 146,682 $ 124,525

EBITDA (1) 18,251 12,223 39,387 40,449

Net income 7,520 2,338 11,312 13,724

Per share basic and diluted $ 0.15 $ 0.05 $ 0.23 $ 0.31

Cash provided by operations 14,225 7,797 28,588 35,347

Per share basic and diluted $ 0.26 $ 0.18 $ 0.58 $ 0.79

Electricity Deliveries (MWh) 338,762 305,460 1,005,172 1,158,389

Net Generation Capacity (MW) (2) 758 492 758 492

Average Alberta Power Prices

($ per MWh) $ 95 $ 62 $ 90 $ 67

(1) EBITDA is earnings before interest, taxes, depreciation and amortization

and is not a measure under Canadian Generally Accepted Accounting

Principles ("GAAP") and may not be comparable to similar measures

presented by other companies. Refer to Non-GAAP measures section of

the MD&A for an explanation and reconciliation.

(2) Generation capacity is manufacturer's nameplate capacity net of minority

ownership interests of third parties.

OPERATING RESULTS

During 2008, MAXIM generated record revenue of $146.7 million, an increase of

$22.2 million or 17.8% over 2007 revenue of $124.5 million. The increase in

revenue resulted from the acquisitions in 2008 of Forked River and Pittsfield

generating stations, two cogeneration facilities in France, the full year

results of the eight cogeneration facilities acquired in 2007, and higher

average Alberta power pool price of $90 per MWh in 2008 compared to $67 per MWh

in 2007.

During the year, MAXIM completed a successful eight week turnaround at its H.R.

Milner facility ("Milner"), which, along with planned maintenance at other

facilities and certain mechanical issues at Milner resulted in production

decreasing by 153,217 MWh to 1,005,172 MWh in 2008 from 1,158,389 MWh in 2007.

Extended turnarounds occur at Milner on a six year cycle with the next extended

turnaround estimated to occur in 2014. The turnaround was financed by drawing an

additional $14.9 million as long-term debt under the Bank of Montreal ("BMO")

Facility B. As a result, earnings before interest, taxes, depreciation and

amortization (refer to Non-GAAP measures - "EBITDA" in the MD&A), decreased $1.0

million to $39.4 million in 2008 from $40.4 million in 2007, net income was

$11.3 million compared to 2007 of $13.7 million, and cash flows from operations

decreased $6.8 million to $28.6 million compared to $35.3 million in 2007.

During the fourth quarter of 2008, MAXIM also generated record revenue of $53.4

million compared to $37.9 million for 2007 and EBITDA was $18.3 million compared

to $12.2 million in 2007. Total production for the fourth quarter was 338,762

MWh compared to 305,460 MWh in 2007, primarily due to the acquisitions of the

Pittsfield and Forked River generating facilities, and two cogeneration

facilities in France. Milner produced 242,601 MWh during the fourth quarter of

2008 compared to 247,975 MWh for the same period in 2007.

Commencing October 1, 2008, MAXIM's Capital District Energy Centre Cogeneration

Associates ("CDECCA") facility in Hartford, Connecticut entered into a new steam

and chilled water agreement with the State of Connecticut Department of Public

Works for a period of ten and a half years, which provides CDECCA with a fixed

monthly payments along with recovery of the cost of production. This agreement

replaces a steam and chilled water contract assumed on the acquisition of the

facility that had since terminated.

During 2008, MAXIM issued 10,211,500 common shares through a private placement

offering for gross proceeds of $66.4 million. Proceeds were used for the

purchase of the Pittsfield facility, development costs for the Deerland

generating facility, and working capital purposes. MAXIM also issued 101,607

common shares under the employee stock option plan for proceeds of $0.6 million

and repurchased 344,100 common shares for a total cost of $1.3 million under the

normal course issuer bid ("NCIB") for cancellation at an average price of $3.68

per share.

RESTATEMENT OF PRIOR PERIOD RESULTS

During the year the Corporation determined it was necessary to revise the

accounting for future income taxes disclosed in note 17. Future tax asset and

future income tax liability include amounts related to the Corporation's

property, plant and equipment. It was determined that a portion of amounts do

not reflect a future benefit to the Corporation. Accordingly, a reduction was

required to future tax asset and an increase was required to future income tax

liability. Prior periods have been restated to reflect this change. The effect

of the restatement on the year beginning January 1, 2007 and year ended December

31, 2007 is outlined below:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(Amounts in $000's) 2007 Previously 2007

Reported Adjustment Restated

----------------------------------------------------------------------------

Future income tax asset $ 4,132 $ (1,543) $ 2,589

Future income tax liability 9,593 834 10,427

Accumulated other

comprehensive income (6,226) 171 (6,055)

Retained earnings, beginning

of year 34,088 (871) 33,217

Retained earnings, end of year 49,489 (2,548) 46,941

Future income tax recovery (2,880) 1,677 (1,203)

Net income 15,401 (1,677) 13,724

Other comprehensive income (6,229) 188 (6,041)

Earnings per share $ 0.35 $ (0.04) $ 0.31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The effect of the restatement on the first three quarters of 2008 is:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(Amounts in $000's) Q1 2008

Previously Q1 2008

Reported Adjustment Restated

----------------------------------------------------------------------------

Future income tax asset $ 4,594 $ (1,471) $ 3,123

Future income tax liability 13,714 938 14,652

Accumulated other comprehensive

income 1,168 (167) 1,001

Retained earnings, beginning of

year 49,489 (2,548) 46,941

Retained earnings, end of period 55,445 (2,414) 53,031

Future income tax recovery (4,380) (134) (4,514)

Net income 5,956 134 6,090

Other comprehensive income 7,394 (167) 7,227

Earnings per share $ 0.13 $ - $ 0.13

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(Amounts in $000's) Q2 2008

Previously Q2 2008

Reported Adjustment Restated

----------------------------------------------------------------------------

Future income tax asset $ 4,582 $ (1,566) $ 3,016

Future income tax liability 11,203 927 12,130

Accumulated other comprehensive

income (297) (141) (438)

Retained earnings, beginning of

year 49,489 (2,548) 46,941

Retained earnings, end of period 49,255 (2,523) 46,732

Future income tax recovery (6,925) (25) (6,950)

Net income (37) 25 (12)

Other comprehensive income 5,929 (141) (5,788)

Earnings per share $ - $ - $ -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(Amounts in $000's) Q3 2008

Previously Q3 2008

Reported Adjustment Restated

----------------------------------------------------------------------------

Future income tax asset $ 3,560 $ (1,623) $ 1,937

Future income tax liability 11,769 862 12,631

Accumulated other comprehensive

income (2,200) (148) (2,348)

Retained earnings, beginning of

year 49,489 (2,548) 46,941

Retained earnings, end of period 52,966 (2,509) 50,457

Future income tax recovery (4,327) (39) (4,366)

Net income 3,753 39 3,792

Other comprehensive income 4,026 148 4,174

Earnings per share $ 0.08 $ - $ 0.08

----------------------------------------------------------------------------

----------------------------------------------------------------------------

GROWTH INITIATIVES

MAXIM remains committed to building a portfolio of innovative and

environmentally responsible electric power generating assets. Approximately 80%

of MAXIM's current portfolio of 773 MW is comprised of clean burning natural

gas, high efficiency cogeneration, waste heat and landfill gas fuelled

generation. MAXIM will continue to pursue acquisition opportunities consistent

with this strategy and is pursuing the following clean coal and natural

gas-fired greenfield development opportunities in Alberta.

Deerland Peaking Station

In June 2008, MAXIM received regulatory approvals from the Alberta Utilities

Commission and Alberta Environment to construct and operate the Deerland Peaking

Station, a proposed 190 MW natural gas-fired peaking facility. The station will

be located immediately adjacent to the existing Deerland high voltage substation

in Alberta's industrial heartland, an area expected to experience significant

growth in electrical demand. MAXIM has an option to lease up to 30 acres of land

for the station. This is an attractive asset as it provides land for future

expansion. MAXIM expects peaking requirements to continue to grow to meet

overall demand growth and to provide firm backup for additional intermittent

wind resources. Commercial operation for the Deerland Peaking Station is

expected to be achieved in 2010, subject to equipment deliveries, electricity

market conditions and MAXIM's ability to conclude all commercial arrangements

necessary to support construction.

#14 Mine Project

MAXIM has entered the final stage of obtaining approvals to construct and

operate an underground coal mine on its #14 Mine leases, located near Milner in

Grande Cache, Alberta. Applications were filed with Alberta Environment and the

Energy Resources Conservation Board in August 2007 for the development of coal

leases representing 13 million tonnes of recoverable coal. MAXIM anticipates

that it will receive the required approvals in 2009.

Milner Expansion

In January 2009 MAXIM submitted applications to the Alberta Utilities Commission

and Alberta Environment to construct and operate a 500 MW coal-fired generation

facility adjacent to its existing Milner facility. Approvals are anticipated

early in 2010.

CONFERENCE CALL FOR 2008 RESULTS

MAXIM will host a conference call for analysts and investors on Thursday, April

2, 2009 at 9:00 a.m. MDT (11:00 a.m. EDT). The call will be hosted by John

Bobenic, MAXIM's President and Chief Executive Officer, and by Mike Mayder, Vice

President, Finance and Chief Financial Officer.

To participate in this conference call, please dial (866) 225-2055 or (416)

340-8061 in the Toronto area. It is recommended that participants call at least

ten minutes prior to start time.

A recording of the conference call will be available from 12:00 p.m. MDT (2:00

p.m. EDT) on Thursday, April 2, 2009 until Thursday, April 9, 2009 at 9:59 p.m.

MDT (11:59 p.m. EDT). To access this replay, please dial (800) 408-3053 or (416)

695-5800 followed by the passcode 1761472#. In addition, the webcast will be

available commencing April 8, 2008 in the Investor Relations section of MAXIM's

web site at www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an independent power producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 37 power plants in

Western Canada, United States and France, having 773 MW of electric and 137 MW

of thermal generating capacity. MAXIM will continue to execute on its strategy

as an independent power producer and is targeting significant growth through

acquisitions and development of power projects which utilize hydrocarbon based

fuels and renewables in the markets of Western Canada, United States and France.

MAXIM trades on the TSX under the symbol "MXG". For more information about

MAXIM, visit our website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM will update or revise any forward-looking statements as

required pursuant to applicable securities laws, whether as a result of new

information, future events or changing market and business conditions.

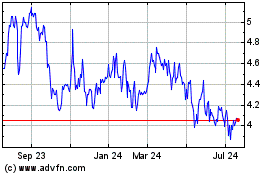

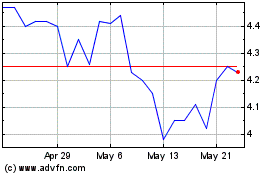

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024