Maxim Power Corp. Issues Guidance and Announces Third Quarter 2008 Results

November 12 2008 - 8:14PM

Marketwired Canada

Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX:MXG) is pleased to

announce its financial and operating results for the third quarter of 2008. The

unaudited consolidated financial statements, accompanying notes and MD&A will be

filed November 13, 2008 on SEDAR and the documents will also be available on

MAXIM's website. All figures reported herein are Canadian dollars unless

otherwise stated.

FINANCIAL HIGHLIGHTS

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

September 30 September 30

2008 2007 2008 2007

----------------------------------------------------------------------------

($ in thousands except per share

amounts)

Revenue $ 31,042 $ 33,616 $ 93,253 $ 86,580

EBITDA (1) 8,885 15,255 19,139 28,168

Net income 3,790 8,271 3,753 11,386

Per share-basic and diluted $ 0.07 $ 0.19 $ 0.08 $ 0.26

Cash provided by operations 5,355 2,670 14,363 27,550

Per share-basic and diluted $ 0.10 $ 0.06 $ 0.30 $ 0.62

Electricity Deliveries (MWh) 275,297 324,431 666,410 852,929

Net Generation Capacity (MW) (2) 757 492 757 492

Average Alberta Prices ($ per MWh) $ 80 $ 92 $ 88 $ 69

(1) EBITDA is earnings before interest, taxes, depreciation and amortization

and is not a measure under Canadian Generally Accepted Accounting

Principles ("GAAP") and may not be comparable to similar measures

presented by other companies. Refer to Non-GAAP measure section of the

MD&A for an explanation and reconciliation.

(2) Net generation capacity is manufacturer's nameplate capacity net of

minority ownership interests of third parties.

OPERATING RESULTS

During the third quarter 2008, MAXIM completed the acquisitions of the

Pittsfield Generating Company LP ("Pittsfield") and its 170 Megawatts ("MW")

electric generating facility located in Pittsfield, Massachusetts and the 3.1 MW

Beauprau cogeneration facility in France. These acquisitions, coupled with the

acquisitions in April, 2008 of the 86 MW Forked River generating facility in New

Jersey ("Forked River") and the 7 MW Somal cogeneration plants in France, and

the disposition of the 1 MW Gift Lake facility, bring MAXIM's generating

capacity to 757 MW at September 30, 2008. The benefit of these acquisitions was

offset by certain mechanical issues at the HR Milner Facility ("Milner"). Milner

encountered fuel mix ratio and air duct mechanical complications, which resulted

in a reduction of revenue, EBITDA and net income. These issues have been

resolved and the appropriate operational steps have been taken to mitigate the

risk of any reoccurrence.

For the nine months ended September 30, 2008, MAXIM's strong first quarter in

2008 offset the lower operating results in the second and third quarter.

Revenues increased $6.7 million from $86.6 million in 2007 to $93.3 million in

2008, primarily due to increased power prices and the acquisition of generating

facilities in North America and France. Decreases over the first nine months of

2008 in EBITDA, net income and cash provided by operations were primarily due to

the extended duration of the 2008 Milner turnaround during the second quarter

and the aforementioned fuel mix and air duct issues during the third quarter.

Production for Milner during the first nine months of 2008 totaled 522,067 MWh

compared to 684,775 MWh in 2007, reflecting the duration of the outages.

CDECCA CONTRACTS

MAXIM has agreed to indicative terms with the State of Connecticut Department of

Public Works for the sale of steam and chilled water from MAXIM's Capitol

District Energy Center Cogeneration Associates cogeneration facility. The

parties are finalizing definitive agreements which will replace the existing

contract for the sale of steam and chilled water to The Energy Networks Inc. The

new contract will have a term of ten and one half years.

OUTLOOK

Guidance

MAXIM is issuing guidance for projected 2008 results and preliminary forecast

results for 2009. This guidance is based on MAXIM's existing portfolio of assets

and therefore does not include the impact of possible acquisitions or

commercialization of development initiatives.

Maxim Power Corp. 2009 and 2008 Guidance Provided as at November 12, 2008

----------------------------------------------------------------------------

For the year ending For the year ending

($000's, except per share amounts) December 31, 2009 December 31, 2008

----------------------------------------------------------------------------

EBITDA 63,000 39,000

Net income 23,000 13,000

Per share - basic and diluted (1) $ 0.42 $ 0.26

Cash provided by operations 45,000 29,000

Per share - basic and diluted (1) $ 0.82 $ 0.57

----------------------------------------------------------------------------

(1) Share data per assumptions.

A $1.00/MWh increase in the average Alberta spot electricity price during the

fourth quarter of 2008 will increase 2008 EBITDA by $150 thousand and 2008 net

income by $90 thousand with corresponding changes to per share amounts. A

decrease of $1.00/MWh has the opposite effect on EBITDA, net income, and

corresponding per share amounts. A $1.00/MWh increase in the average Alberta

spot electricity price during 2009 will increase 2009 EBITDA by $950 thousand

and 2009 net income by $618 thousand with corresponding changes to per share

amounts. A decrease of $1.00/MWh has the opposite effect on EBITDA, net income,

and corresponding per share amounts.

The guidance provided herein is based on the following assumptions.

Maxim Power Corp. 2009 and 2008 Assumptions for Guidance Provided as at

November 12, 2008

----------------------------------------------------------------------------

For the year ending For the year ending

($000's, except as otherwise noted) December 31, 2009 December 31, 2008

----------------------------------------------------------------------------

Electricity deliveries (MWh) 1,390,000 966,000

Net generation capacity at year

ending (MW) 757 757

Capital expenditures (excluding

acquisitions)

HR Milner 4,000 16,000

Other assets 6,000 6,000

Development projects 2,000 2,000

Average Alberta spot electricity

price $ 82.00 $ 91.00

Average annual foreign exchange rates

C$/USD $ 1.09 $ 1.04

C$/Euro $ 1.60 $ 1.54

Weighted average shares outstanding (000's) 54,574 50,818

----------------------------------------------------------------------------

The projected results for 2008 are based on actual results reported to September

30, 2008 by the Corporation and the following assumptions for the fourth quarter

of 2008. During the fourth quarter MAXIM anticipates that 50 MW of the HR Milner

facility will be sold at a fixed price per MWh to Powerex Corp. and the

remaining output of this facility will be sold to the Alberta Electric System

Operator at spot market prices. In France, the 2008/2009 cogeneration season

which began November 1, 2008, has thirteen of the twenty-two French facilities

operating in dispatch mode and nine operating in cogeneration mode. There are no

acquisitions assumed to take place in the fourth quarter; however, MAXIM

continues its development initiatives related to its Milner expansion project

and the Mine #14 project.

The 2009 forecast assumes all sales of HR Milner output at Alberta spot market

prices. In France, the cogeneration season ends on March 31, 2009 and a new

season begins on November 1, 2009 with thirteen of the French facilities

operating in dispatch mode and nine operating in cogeneration mode. There are no

acquisitions assumed to take place during 2009 and the Corporation is not

exposed to refinancing risk in 2009. MAXIM continues its development initiatives

related to its Milner expansion project and the Mine #14 project. In addition,

the 2009 forecast assumes turnaround maintenance will occur in the first half of

the year at both Milner and CDECCA, and in late fall at Pawtucket. The 2009

Milner turnaround is expected to last one week in 2009, which is significantly

shorter than the extended turnaround of eight weeks in 2008.

Normal Course Issuer Bid

MAXIM believes that prevailing market conditions have resulted in its Common

Shares being undervalued relative to the immediate and long term value of the

Corporation. Further, the acquisition of Common Shares at current market values

would represent an appropriate use of MAXIM's cash resources, and such purchases

would enhance Shareholder value. Accordingly, MAXIM will continue to purchase

Common Shares under its Normal Course Issuer Bid ("NCIB") that commenced on

April 2, 2008. Pursuant to the NCIB, the Corporation is authorized to purchase

up to 2,220,000 Common Shares and has purchased 256,700 shares to date. Subject

to the ability of the Corporation to make one block purchase per calendar week,

under the rules of the Toronto Stock Exchange, MAXIM may purchase up to 6,264

Common Shares each trading day. The actual number of Common Shares to be

purchased during the remaining term of the NCIB and the timing of any purchases

are at the discretion of MAXIM.

GROWTH INITIATIVES

Deerland Peaking Station

In June 2008, MAXIM received regulatory approvals from the Alberta Utilities

Commission and Alberta Environment to construct and operate the Deerland Peaking

Station, a proposed 190 MW natural gas-fired peaking facility. The station will

be located immediately adjacent to the existing Deerland high voltage substation

in Alberta's industrial heartland, an area expected to experience significant

growth in electrical demand. MAXIM has an option to lease up to 30 acres of land

for the station. This is an attractive asset as it provides land for future

expansion. MAXIM expects peaking requirements to continue to grow to meet

overall demand growth and to provide firm backup for additional intermittent

wind resources. Commercial operation for the Deerland Peaking Station is

expected to be achieved in 2010, subject to equipment deliveries, electricity

market conditions and MAXIM's ability to conclude all commercial arrangements

necessary to support construction.

#14 Mine Project

MAXIM has completed and submitted the necessary application materials for the

development of three Milner coal leases at the HR Milner site, which represent

13 million tonnes of recoverable coal. The Company is currently waiting for

approval of these filings.

Milner Expansion

MAXIM is continuing the preliminary engineering and environmental studies

relating to the Milner expansion project. Once completed, the necessary

regulatory applications will be completed and submitted to the appropriate

regulatory body for approval.

CONFERENCE CALL FOR THE THIRD QUARTER 2008 RESULTS

MAXIM will host a conference call for analysts and investors on Tuesday,

November 18, 2008 at 9:00 a.m. MT (11:00 a.m. ET). The call will be hosted by

John R. Bobenic, MAXIM's President and Chief Executive Officer, and Michael R.

Mayder, MAXIM's Vice President, Finance and Chief Financial Officer.

To participate in this conference call, please dial (866) 542-4265 or (416)

641-6137 in the Toronto area. It is recommended that participants call at least

ten minutes prior to start time.

A recording of the conference call will be available from 2:00 p.m. MT (4:00

p.m. ET) on Monday, November 18, 2008 until Tuesday, November 25, 2008 at 9:59

p.m. MT (11:59 p.m. ET). To access this replay, please dial (800) 408-3053 or

(416) 695-5800 followed by the passcode 3275177#. In addition, the recording of

the call will be available commencing November 19, 2008 in the Investor

Relations section of MAXIM's web site at www.maximpowercorp.com.

ABOUT MAXIM

Based in Calgary, Alberta, MAXIM is an Independent Power Producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 35 power plants in

western Canada, United States and France, having 757 MW of electric and 135 MW

of thermal net generating capacity. MAXIM will continue to execute on its

strategy as an independent power producer and is targeting significant growth

through acquisitions and development of power projects which utilize hydrocarbon

based fuels and renewables in the markets of Western Canada, United States and

France. MAXIM trades on the TSX under the symbol "MXG". For more information

about MAXIM, visit our website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

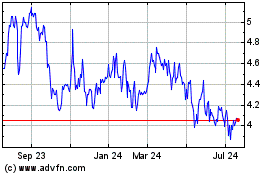

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

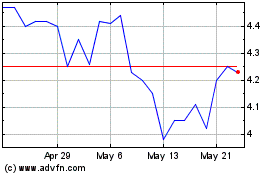

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024