Maxim Power Corp. ("MAXIM") Announces Second Quarter 2008 Results

August 13 2008 - 7:05PM

Marketwired Canada

MAXIM is pleased to announce the release of financial and operating results for

its second quarter of 2008. The unaudited consolidated financial statements,

accompanying notes and MD&A will be filed August 14, 2008 on SEDAR and the

documents will also be available on MAXIM's website. All figures reported herein

are Canadian dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

($ in thousands except per share June 30 June 30

amounts) 2008 2007 2008 2007

----------------------------------------------------------------------------

Revenue $ 14,797 $ 18,979 $ 62,211 $ 52,963

EBITDA (1) (5,109) 2,912 10,254 12,913

Net income (loss) (5,993) (207) (37) 3,115

Per share-basic and diluted ($0.13) ($0.01) $ 0.00 $ 0.07

Cash provided by operations (7,966) 3,038 9,008 24,880

Per share-basic and diluted ($0.18) $ 0.07 $ 0.20 $ 0.57

Electricity Deliveries (MWh) 95,567 280,802 391,113 528,498

Net Generation Capacity (MW) (2) 584 482 584 482

Average Alberta Prices

($ per MWh) $ 108 $ 52 $ 92 $ 58

(1) EBITDA is earnings before interest, taxes, depreciation and

amortization and is not a measure under Canadian Generally Accepted

Accounting Principles ("GAAP") and may not be comparable to similar

measures presented by other companies. Refer to Non-GAAP measure

section of the MD&A for an explanation and reconciliation.

(2) Net generation capacity is manufacturer's nameplate capacity net of

minority ownership interests of third parties.

OPERATING RESULTS

During the second quarter, MAXIM successfully completed an eight week turnaround

on the HR Milner Facility, on time and on budget. This turnaround was longer

than in recent years and is part of the facility's life-cycle maintenance

program where extended work is required every six to eight years. As a result of

removing HR Milner from service for the turnaround, revenue, EBITDA, cash

provided by operations and net income all decreased compared to the same quarter

in 2007. During the quarter MAXIM also acquired the Forked River generating

facility, which contributed favorably to MAXIM's results and partially offset

impacts of the turnaround.

For the six months ended June 30, 2008, MAXIM's strong first quarter in 2008

offset the lower operating results in the second quarter. Revenues increased

$9.2 million from $53.0 million in 2007 to $62.2 million in 2008, primarily due

to increased power prices and the acquisition of generating facilities in North

America and France. Decreases over the first half of 2008 in EBITDA, net income

and cash provided by operations were primarily due to the extended duration of

the 2008 HR Milner turnaround. Production for HR Milner during the first half of

2008 totaled 289,880 MWh compared to 428,227 MWh in 2007, reflecting the

duration of this turnaround.

GROWTH INITIATIVES

Deerland Peaking Station

As previously announced, MAXIM received regulatory approvals from the Alberta

Utilities Commission and Alberta Environment to construct and operate the

Deerland Peaking Station, a 190 MW natural gas-fired peaking facility. The

station will be located immediately adjacent to the existing Deerland high

voltage substation in Alberta's industrial heartland, an area expected to

experience significant growth in electrical demand. The Deerland Peaking Station

will be constructed in two 95 MW phases with each phase configured with two

General Electric LM6000 combustion turbine generator packages. Commercial

operation for each of the phases is expected to be achieved in 2009 and 2010,

respectively, subject to electricity market conditions and the ability of MAXIM

to conclude all commercial arrangements necessary to support construction.

#14 Mine Project

MAXIM has completed and submitted the necessary application materials for the

development of three Milner coal leases on its HR Milner site, which represent

13 million tonnes of recoverable coal. The Company is currently waiting for

approval of these filings.

Milner Expansion

MAXIM is continuing the preliminary engineering and environmental studies

relating to the Milner expansion project. Once completed, the necessary

regulatory applications will be completed and submitted to the appropriate

regulatory body for approval.

CONFERENCE CALL AND WEBCAST FOR THE SECOND QUARTER 2008 RESULTS

MAXIM will host a conference call for analysts and investors on Thursday,

September 4, 2008 at 9:00 a.m. MT (11:00 a.m. ET). The call will be hosted by

John R. Bobenic, MAXIM's President and Chief Executive Officer and Michael R.

Mayder, MAXIM's Vice President, Finance and Chief Financial Officer.

To participate in this conference call, please dial (866) 542-4265 or (416)

641-6137 in the Toronto area. It is recommended that participants call at least

fifteen minutes prior to start time.

A recording of the conference call will be available from 2:00 p.m. MT (4:00

p.m. ET) on Thursday, September 4, 2008 until Thursday, September 11, 2008 at

9:59 p.m. MT (11:59 p.m. ET). To access this replay, please dial (416) 695-5800

or (800) 408-3053 followed by the passcode 3268786. In addition, the webcast

will be available commencing September 11, 2008 in the Investor Relations

section of MAXIM's web site at www.maximpowercorp.com.

ABOUT MAXIM

Based in Calgary, Alberta, MAXIM is an Independent Power Producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 34 power plants in

western Canada, United States and France, having 754 MW of electric and 132 MW

of thermal net generating capacity. MAXIM will continue to execute on its

strategy as an independent power producer and is targeting significant growth

through acquisitions and development of power projects which utilize hydrocarbon

based fuels and renewables in the markets of Western Canada, United States and

France. MAXIM trades on the TSX under the symbol "MXG". For more information

about MAXIM, visit our website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

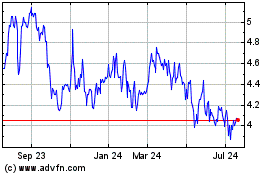

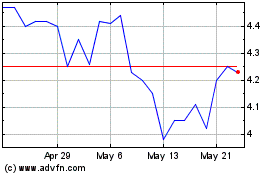

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024