Brompton Announces Special Meeting of Brompton Lifeco Split Corp.

August 09 2019 - 5:26PM

(TSX: LCS, LCS.PR.A) Brompton Funds Limited

(

“Brompton” or the

“Manager”),

announces that it will hold a special meeting (the

“

Meeting”) of holders of Class A Shares and

Preferred Shares (the “

Shareholders”) of Brompton

Lifeco Split Corp. (the

“Fund”). The purpose of

the Meeting is to consider and vote upon an extraordinary

resolution to implement amendments to update and modernize the

investment objectives, investment guidelines and investment

restrictions of the Fund (the

“Amendments”).

The Fund was launched in April 2007.

The Fund invests, on an approximately equal

weighted basis, in a portfolio consisting of common shares of

Canada’s four largest publicly traded life insurance

companies: Great-West Lifeco Inc., Industrial Alliance

Insurance and Financial Services Inc., Manulife Financial

Corporation and Sun Life Financial Inc. The Fund provides a

low cost, efficient way to gain exposure to Canadian life insurance

companies, with the added benefit of a proprietary covered call

option strategy employed by Brompton which can lower portfolio

volatility along with generating cash flows for distribution to

Shareholders.

The Manager believes that the financial sector

continues to be an attractive sector for investment and dividend

growth, however, in order to respond to the changing business

environment including the interest rate environment, regulation,

fintech and evolving asset and wealth management businesses

generally, the Manager believes that it would be advisable to make

certain changes to the Fund’s investment objectives, investment

guidelines, investment restrictions and distribution target.

These changes will allow the Fund to diversify its holdings and

expand its investment universe which the Manager believes will

enhance long-term returns and would be for the benefit of

Shareholders.

The proposed changes are primarily designed to

accomplish the following:

- expand investment holdings and diversify the portfolio by

changing the investment universe of the Fund from only four

Canadian life insurance companies to a portfolio of between 10 to

20 equity securities of primarily North American financial services

companies including insurance companies, banks, asset management

companies and diversified financials, selected by the Manager, in

its discretion. In addition, the Fund may hold up to 20% of

its total assets in financial services-related companies or global

financial services companies;

- the diversification of the Fund’s portfolio should provide

opportunities to increase the value of the Fund’s portfolio which

in turn would result in a higher net asset value of the Class A

Shares and as the net asset value of the Class A Shares

appreciates, the asset coverage for the Preferred Shares will also

improve;

- by increasing the number of securities held by the Fund, the

Manager will be provided with more opportunities to write covered

call options and potentially generate additional returns for the

Fund;

- the Manager will be permitted to rebalance and/or reconstitute

the Fund’s portfolio at its discretion so that the Fund may respond

to security or market developments on a more timely basis and

provide more active portfolio management;

- the Manager believes that amending the target rate for

distributions from $0.90 per Class A Share per annum to an amount

initially targeted to be approximately 10% per annum of the net

asset value per Class A Share is still a high distribution rate for

holders of Class A Shares; however, it is expected to be a more

sustainable distribution rate for the Fund. A lower Class A

Share distribution rate would also improve the Preferred Share

coverage.

In keeping with industry trends over the past several years to

lower investor costs and in connection with the proposed changes to

the Fund, the Manager will discontinue the service fee paid to

dealers based on the number of Class A Shares held by dealers’

clients of 0.40% per annum of the Class A Share net asset value

beginning January 1, 2020. In addition, the management fee

will not be increased for the Fund as a result of the additional

work associated with the aforementioned enhancements.

As a result of the changes described above, the

Manager is also proposing to change the name of the Fund to

“Brompton Financial Split Corp.” and the ticker symbols in respect

of the Fund’s Class A Shares and Preferred Shares to BFS and

BFS.PR.A, respectively.

A special meeting of Shareholders will be held

on September 26, 2019 to consider and vote on the proposed

Amendments. Shareholders of record at the close of business

on August 27, 2019 will be entitled to vote at the Meeting.

The Manager expects the effective date of the Amendments to take

place shortly after the Meeting. Details of the proposed

Amendments will be further outlined in the Fund’s notice of meeting

and management information circular that will be prepared and

delivered to Shareholders in connection with the Meeting and will

be available on www.sedar.com.

About Brompton FundsBrompton

Funds, a division of Brompton Group which was founded in 2000, is

an experienced investment fund manager with approximately $2

billion in assets under management. Brompton’s investment solutions

include TSX closed-end funds and exchange-traded funds. For

further information, please contact your investment advisor, call

Brompton’s investor relations line at 416-642-6000 (toll-free at

1-866-642-6001), email info@bromptongroup.com or visit our website

at www.bromptongroup.com.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of an investment fund on the

Toronto Stock Exchange or other alternative Canadian trading system

(an “exchange”). If the shares are purchased or sold on an

exchange, investors may pay more than the current net asset value

when buying shares of an investment fund and may receive less than

the current net asset value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund

must prepare disclosure documents that contain key information

about the Fund. You can find more detailed information about

the Fund in the public filings available at www.sedar.com.

Investment funds are not guaranteed, their values change frequently

and past performance may not be repeated.

Certain statements contained in this news

release constitute forward-looking information within the meaning

of Canadian securities laws. Forward-looking information may relate

to matters disclosed in this press release and to other matters

identified in public filings relating to the Fund, to the future

outlook of the Fund and anticipated events or results and may

include statements regarding the future financial performance of

the Fund. In some cases, forward-looking information can be

identified by terms such as “may”, “will”, “should”, “expect”,

“plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may

vary from such forward-looking information. Investors should not

place undue reliance on forward-looking statements. These

forward-looking statements are made as of the date hereof and we

assume no obligation to update or revise them to reflect new events

or circumstances.

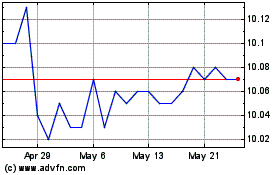

Brompton Lifeco Split (TSX:LCS.PR.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brompton Lifeco Split (TSX:LCS.PR.A)

Historical Stock Chart

From Nov 2023 to Nov 2024