INTERFOR CORPORATION (“Interfor” or the “Company”)

(TSX: IFP) announced today that it has reached an agreement with an

affiliate of Kelso & Company (“Kelso”) to acquire 100% of the

equity interests of EACOM Timber Corporation (“EACOM”).

Transaction Highlights

EACOM is a leading lumber producer in eastern Canada, with

operations across Ontario and Quebec, including:

- Seven sawmills with a combined

annual spruce-pine-fir (“SPF”) lumber production capacity of 985

million board feet;

- An I-Joist plant with annual

production capacity of 70 million linear feet;

- A value-added remanufacturing plant

with annual production capacity of 60 million board feet;

- Rights to access approximately 3.6

million cubic meters per year of responsibly managed and

internationally certified fibre supply; and

- An office in Montreal.

The purchase price is C$490 million, on a cash and debt free

basis, which includes C$120 million of net working capital. In

addition, Interfor will assume EACOM’s countervailing (“CV”) and

anti-dumping (“AD”) duty deposits at closing, for consideration

equal to 55% of the total deposits on an after-tax basis. As of

September 30, 2021, EACOM had paid cumulative CV and AD duties of

US$150 million.

“This transaction makes Interfor a truly North American lumber

producer, with operations in all the key fibre regions on the

continent, further diversifying and de-risking our operating

platform and enhancing our growth potential and opportunity set,”

said Ian Fillinger, President & Chief Executive

Officer. “This transformational growth secures a

desirable SPF product mix to meet the growing demand of our

customers, at a time when SPF fibre supply is under increasing

pressure in other jurisdictions in North America and around the

world. These are productive and well-managed mills, and we see

meaningful opportunities to further enhance their performance by

integrating them with our portfolio and applying our proven

operating expertise. We are excited for the opportunities that the

acquisition brings, and we look forward to welcoming the talented

EACOM team into our company and partnering with them to operate and

grow the business in the years ahead.”

Strategic Rationale

The acquisition is consistent with Interfor’s growth-focused

strategy as a pure-play lumber producer, increasing Interfor’s

total lumber production capacity by 25%. In addition, the

acquisition further builds upon Interfor’s already geographically

diverse operations, adding significant scale in a new region.

Eastern Canada is one of the major lumber producing regions in

North America, with highly competitive log costs, a desirable SPF

product mix and a supportive investment environment.

On a pro-forma basis, Interfor’s total annual lumber production

capacity will increase to 4.9 billion board feet, of which 46% will

be in the US South, 16% in the US Northwest, 20% in eastern Canada

and 18% in British Columbia.

The addition of the EACOM business will also provide an expanded

opportunity set for potential future lumber-focused growth in

eastern Canada, given its well-established systems, infrastructure

and team. The business will operate under the Interfor

banner, but Interfor will maintain all of EACOM’s key operating

leadership and employees as well as its office in Montreal, Quebec

to ensure continued regional support for the operations going

forward.

“This transaction will allow our team to write its next chapter

as part of one of North America’s best lumber companies,” said

Kevin Edgson, President & Chief Executive Officer of EACOM.

“Interfor’s operational excellence, financial strength, customer

relationships and North American-wide portfolio will provide

substantial opportunities to our people and our stakeholders. Our

companies have shared values, including a commitment to safety and

environmental responsibility and we are thrilled to be a part of

Interfor’s continuing growth ambitions.”

Enhanced Market Opportunities

From a market perspective, the acquisition extends and

complements Interfor’s geographic reach, enabling efficient supply

to key eastern markets, such as the Greater Toronto Area (the

fourth largest metropolitan area in North America) and throughout

the Great Lakes region. Approximately 40% of EACOM’s external

shipments remain in Canada and are not subject to CV & AD

duties. The acquisition also adds diversity to Interfor’s customer

mix by expanding exposure to key distribution segments, such as

home centres.

From a product perspective, the acquisition adds lumber-adjacent

offerings to Interfor’s portfolio of operations, with the addition

of an I-Joist plant and a value-added remanufacturing plant.

Consumption of I-Joists, like other engineered wood products

(“EWP”), is closely tied to new housing construction and demand

continues to be robust, while supply has been limited due to

constraints in the availability of suitable flange stock for its

manufacture. EACOM supplies the majority of the flange stock for

the I-Joist plant from its own operations, in the form of machine

stress rated lumber, enabling significant control over the key

inputs and a better ability to manage production levels. As a

result, EACOM’s I-Joist plant has sustainably increased production

by approximately 40% over the past three years and is well

positioned to take advantage of the positive market dynamics across

the EWP sector.

Immediately Accretive, Meaningful Synergies

The acquisition will be immediately accretive to Interfor’s

earnings and is expected to provide attractive returns in both the

near-term and over the long-term.

EACOM generated EBITDA1 of C$75 million, C$8 million, C$151

million and C$475 million in each of 2018, 2019, 2020 and the

twelve months ended September 30, 2021, respectively. Interfor

estimates EACOM’s mid-cycle EBITDA to be approximately C$90 million

per year pre-synergies, taking into account mid-cycle lumber

prices, normalization of operating schedules post-COVID and recent

ramp-ups in production and operating performance improvements at

both the sawmills and the I-Joist plant.

Interfor expects to achieve meaningful synergies of C$25 million

per year from reliability, productivity and quality control

improvements, shared purchasing programs, transportation

optimization, enhanced marketing opportunities and general and

administrative expense reductions. These synergies are expected to

be fully achieved within two years of closing, with no capital

requirements.

As a result, the purchase price of C$490 million represents a

pre-synergy mid-cycle EBITDA multiple of 5.4x, or 4.3x

post-synergies, and a lumber capacity multiple of C$497 (or US$398)

per thousand board feet, all of which compare very favourably to

recent precedent transactions in the industry.

Financing & Capital Structure

Interfor intends to finance the acquisition with a combination

of cash on hand and its existing credit facilities. Following the

completion of this acquisition Interfor will continue to have

significant financial flexibility to execute its strategic capital

investment plans and consider additional value-creating capital

deployment options. As of September 30, 2021 Interfor was in a net

cash position of approximately C$134 million. Proforma the

acquisition, Interfor’s Net Debt to Invested Capital ratio as of

September 30, 2021 would increase to 22%2. Similarly, proforma

liquidity as of September 30, 2021 would be approximately C$270

million, before consideration of significant additional borrowing

capacity available under existing credit limits and continued

strong near-term operating cash flows.

Closing Conditions & Timing

The completion of the acquisition is subject to customary

conditions and regulatory approvals for a transaction of this kind

and is expected to close in the first half of 2022.

Additional Information

Additional information has been posted on www.interfor.com under

the Investors section under News and under Presentations, including

French language versions of this release and an investor

presentation.

1 Reflects EBITDA as prepared in accordance with EACOM’s

financial practices, i.e. after deduction of cash CV & AD

duties expenses, but before one-time retroactive non-cash

adjustment in December 2020 for overpayments arising from duty rate

adjustments. 2 Proforma is based on C$490 million purchase price

and 55% of the tax-effected amount of EACOM’s September 30, 2021

countervailing (“CV”) and anti-dumping (“AD”) duties on deposit of

US$150 million, assuming an effective tax rate of approximately

26%.

FORWARD-LOOKING STATEMENTS

This release contains forward-looking information about the

Company’s business outlook, objectives, plans, strategic priorities

and other information that is not historical fact. A statement

contains forward-looking information when the Company uses what it

knows and expects today, to make a statement about the future.

Statements containing forward-looking information in this release,

include but are not limited to, statements regarding production

capacity, future growth, growing demand, synergies, pro-forma

capacity, expected earnings and returns, pro-forma debt ratios, pro

forma liquidity, borrowing capacity, regulatory approvals and the

expected closing date, and other relevant factors. Readers are

cautioned that actual results may vary from the forward-looking

information in this release, and undue reliance should not be

placed on such forward-looking information. Risk factors that could

cause actual results to differ materially from the forward-looking

information in this release are described in Interfor’s annual

Management’s Discussion & Analysis under the heading “Risks and

Uncertainties”, which is available on www.interfor.com and under

Interfor’s profile on www.sedar.com. Material factors and

assumptions used to develop the forward-looking information in this

report include volatility in the selling prices for lumber, logs

and wood chips; the Company’s ability to compete on a global basis;

the availability and cost of log supply; natural or man-made

disasters; currency exchange rates; changes in government

regulations; the availability of the Company’s allowable annual cut

(“AAC”); claims by and treaty settlements with Indigenous peoples;

the Company’s ability to export its products; the softwood lumber

trade dispute between Canada and the U.S.; stumpage fees payable to

the Province of British Columbia (“B.C.”); environmental impacts of

the Company’s operations; labour disruptions; information systems

security; and the existence of a public health crises (such as the

current COVID-19 pandemic). Unless otherwise indicated, the

forward-looking statements in this release are based on the

Company’s expectations at the date of this release. Interfor

undertakes no obligation to update such forward-looking information

or statements, except as required by law. The Company’s independent

auditor, KPMG LLP, has not audited, reviewed or performed any

procedures with respect to the interim financial results and other

data included in this release, and accordingly does not express an

opinion or any other form of assurance with respect thereto.

ABOUT INTERFOR

Interfor is a growth-oriented forest products company with

operations in Canada and the United States. The Company has annual

production capacity of approximately 3.9 billion board feet and

offers a diverse line of lumber products to customers around the

world. For more information about Interfor, visit our website at

www.interfor.com.

Investor Contacts:

Rick Pozzebon, Senior Vice President & Chief Financial

Officer(604) 689-6804

Mike Mackay, Vice President of Corporate Development &

Strategy (604) 689-6846

Media Contact:

Svetlana Kayumova, Corporate Communications(604)

422-7329svetlana.kayumova@interfor.com

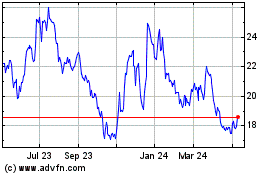

Interfor (TSX:IFP)

Historical Stock Chart

From Jan 2025 to Feb 2025

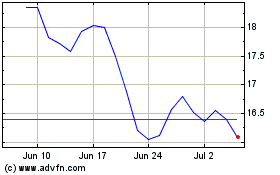

Interfor (TSX:IFP)

Historical Stock Chart

From Feb 2024 to Feb 2025