Globex Acquires Gold Silver Exploration Target in Nevada, USA

February 28 2024 - 9:00AM

GLOBEX MINING ENTERPRISES INC. (GMX – Toronto Stock

Exchange, G1MN – Frankfurt, Stuttgart, Berlin, Munich,

Tradegate, Lang & Schwarz, LS Exchange, TTMzero,

Düsseldorf and Quotrix Düsseldorf Stock

Exchanges and GLBXF – OTCQX

International in the US) is pleased to report to

shareholders that it has acquired by staking 8 unpatented lode

claims totaling 66.88 hectares (165.28 acres) in Clark County,

southern Nevada, USA.

The property herein called the

Red Star Project was staked to cover two

epithermal quartz vein systems, the over 2 km long Red Star vein

system and the western, 470m long segment, of the Double Standard

vein system. The Double Standard vein zone is located 2.5 km south

of the Red Star vein system. The project area is situated

at the north-western edge of the historic Crescent Mining district

at the western slope of the McCullough Mountain range.

Prospecting began in this district in about

1894, but no important discoveries were made. The period of

greatest activity was from 1905 to 1907, when at least 10

incorporated companies were working in this area. Late in 1936

metal mining was revived, stimulated by the increased price of

precious metals. Most of this work was carried out by small

companies or lessees until 1942. Most of the historic production

included turquoise (around the porphyry copper occurrence at

Crescent Peak), gold, silver, copper and lead. However, no complete

production data is available for the Crescent Mining district. In

the early 1980’s the Crescent Mining Ltd. exploited the Rest Mine

and extracted gold via a heap leach operation. However, no grade or

production data are available. Initial historic mining and

exploration at the Red Star vein system dates back to the period

1907-1914. At that time, it was staked by 5 unpatented lode claims

(Red Star Group) owned and operated by the Red Star Mines Company

(probably active from 1906 to 1910). In addition, this company also

had purchased the high-grade Ag-Au vein system at the Double

Standard mine (3 patented claims), located 2.5 km south of the Red

Star Group.

Globex has already carried out initial field

work including geological mapping and has collected a total of 65

rock samples (mostly grab samples and linear chip samples) from the

Red Star property and two samples from outside the property. These

include 60 samples from the Red Star vein, 3 samples from the

Double Standard veins, 1 sample from the Peak vein and 1 sample

from the Aurum vein (the two latter form part of the Red Star vein

system).

The Red Star vein system trends

about 100° and the principal Red Star vein dips in average about

55°N. Vein outcroppings of the Red Star system can be

followed over a lateral distance of 2000 m, but it is

likely that it continues under post-mineral sedimentary and

volcanic rock cover at least until the western limit of the Globex

claim block (resulting in about a 2240m strike length). Horizontal

vein widths of individual or composite quartz veins (including

quartz breccias and stockwork zones with > 30% quartz) vary

greatly from less than 1 m to 23 m (4 m to 23 m width in the 220 m

long Main-pocket). The average vein width is about 4

m.

The 1300 m long Double

Standard vein system strikes in average 105° and dips in

average 70° N. The western vein segment (staked by Globex) is

traceable over a length of 470 m. There is present

a principal vein and several vein splays, however detail geological

mapping has not yet been performed. Quartz veins are 0.2 to about

1.5 m thick.

Epithermal mineralization of low- and

intermediate sulfidation type (or

adularia-sericite type) took place in at least three

multi-quartz-generation pulses:

Pulse A1 has been observed only

in the Double Standard Vein system and in the Peak vein. Obtained

assay results are up to 9.6 g/t Au and up

to 70 g/t Ag. Pulse A1 is of the

intermediate sulfidation epithermal style.

Pulse A2 is volumetrically the

most important within the Red Star vein system, but is present also

in the Double Standard veins, the Aurum vein and possibly also in

the Peak vein. Pulse A2 is of the low sulfidation epithermal style.

Samples with significant elevated gold values collected exclusively

from A2 quartz along the Red Star vein are as follows: R-21 over 3

m width with 0.73 ppm Au and 4.1 ppm Ag; R-51 over

4.5 m width with 0.558 ppm Au and 3.8 ppm Ag, R-40

over 1.22 m width with 2.01 ppm Au and

46.2 ppm Ag.

Pulse B represents most likely

the latest multi-generation epithermal stage. It is present only in

the Red Star vein, especially in its hanging wall portion as

massive quartz bands from 1 to about 5 m wide. Chalcedony,

crustiform-colloform quartz banding, high-grade grey and black

ginguro quartz (these dark grey to black bands are referred to as

ginguro layers, which is the Japanese word for black silver) and

rarely quartz after platy calcite indicate precipitation from

boiling epithermal fluids. Pulse B appears to represent a low

sulfidation epithermal type with occasional injections of

intermediate sulfidation epithermal fluids (precipitating ginguro

quartz). So far only 5 samples have been collected from

ginguro-rich quartz vein material yielding gold equivalent

values of 5.67 g/t (sample C-3),

20.4 g/t (sample C-6), 4.83 g/t

(sample C-9), 20.1 g/t (sample R-9) and

11.42 g/t (sample R-10). Nevertheless, ginguro

quartz is present along the entire hanging wall portion of the

Main-pocket and in numerous isolated outcrops in the eastern vein

segment.

Selection of assay results from Red Star

epithermal Au-Ag project

The Red Star project offers exceptional

discovery potential for epithermal high-grade Ag-Au, polymetallic

Ag-Au and wide low-grade gold-silver mineralization.

Analytical Methods

Samples were placed in labelled plastic bags,

sealed with a plastic zip and shipped to American Assay

Laboratories (AAL) in Sparks, Nevada, USA for preparation and

geochemical analysis. AAL is an ISO 17025 certified laboratory.

Samples are crushed and a 300 g subsample pulverized to >85% -75

micron. All samples underwent ICP-OES analysis of a 0.5 g subsample

after 5-acid digestion (HNO3, HF, HClO4, HCl and H3BO3) for 11

elements including silver. 5-acid treatment results in near total

digest (resistant phases e.g. corundum, ilmenite, rutile are not

digested). Gold was analyzed via fire assay of a 30 g subsample and

analyzed with ICP-OES. Obtained gold values above 10 ppm and silver

above100 ppm were re-analyzed via fire assay of a 30 g subsample

and gravimetric determination. Typical internal standards and

checks were completed by AAL during analysis.

This press release was written by Matthias

Jurgeit, Eurogeologist under the supervision of Jack Stoch, Geo.,

President and CEO of Globex in his capacity as a Qualified Person

(Q.P.) under NI 43-101.

|

We Seek Safe Harbour. |

Foreign Private Issuer 12g3 – 2(b) |

|

|

CUSIP Number 379900 50 9LEI 529900XYUKGG3LF9PY95 |

|

For further information, contact: |

|

Jack Stoch, P.Geo., Acc.Dir.President & CEOGlobex Mining

Enterprises Inc.86, 14th StreetRouyn-Noranda, Quebec Canada J9X

2J1 |

Tel.: 819.797.5242Fax: 819.797.1470 info@globexmining.com

www.globexmining.com |

Forward Looking Statements:

Except for historical information, this news release may contain

certain “forward looking statements”. These statements may involve

a number of known and unknown risks and uncertainties and other

factors that may cause the actual results, level of activity and

performance to be materially different from the expectations and

projections of Globex Mining Enterprises Inc. (“Globex”). No

assurance can be given that any events anticipated by the

forward-looking information will transpire or occur, or if any of

them do so, what benefits Globex will derive therefrom. A more

detailed discussion of the risks is available in the “Annual

Information Form” filed by Globex on SEDAR at www.sedar.com.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1310ff3b-4685-4b80-a4d3-f4f6ea4f2199

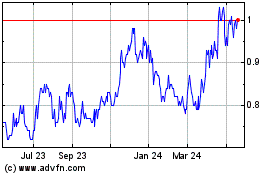

Globex Mining Enterprises (TSX:GMX)

Historical Stock Chart

From Nov 2024 to Dec 2024

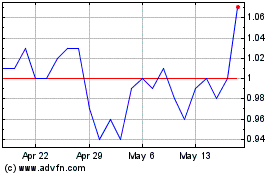

Globex Mining Enterprises (TSX:GMX)

Historical Stock Chart

From Dec 2023 to Dec 2024