Gildan Activewear Inc. (GIL: TSX and NYSE) (“Gildan” or “the

Company”) today provides details on the timeline of events leading

up to Glenn Chamandy’s removal as CEO.

For more than a month, Browning West and Glenn Chamandy have

claimed that the Board of Directors carried out a flawed CEO

succession process. The facts, backed by years of documentation and

Mr. Chamandy’s own words, tell a much different story.

In December 2021, the Board and Mr. Chamandy agreed to an

orderly three-year succession plan. Had Mr. Chamandy abided by his

agreement, rather than attempting to entrench himself as CEO, the

recent turmoil at Gildan would have been avoided.

We now know that Mr. Chamandy never intended to abide by the

agreed succession plan. He made that clear when he told the Globe

and Mail on December 16, 2023 “I had no intention of leaving. You

know, my view is that I would leave when I think the time is right

for the company.”

The Board, on the other hand, has consistently acted to carry

out its fiduciary duties to ensure management had a strategy for

the longer term, to prepare for the succession of the CEO and to

position Gildan for future success by recruiting and appointing a

highly qualified CEO.

A Timeline of Facts

2021

At the May 2021 Board meeting, Mr. Chamandy informed the Board

that he planned to retire within three to five years.

That was followed by a December 7, 2021 meeting where the Chair

Donald Berg and Mr. Chamandy agreed to a formal succession

process for Mr. Chamandy’s retirement which would have seen him

stepping down as CEO in December 2024 and leaving the Company

following a reasonable transition period with the new chief

executive. Mr. Chamandy agreed to that plan. Mr. Berg and

Mr. Chamandy then discussed the CEO succession plan in most of

their quarterly feedback meetings and communications over the next

two years.

2022

In January 2022, the Board hired a leading executive search firm

to advise the Board on Gildan’s CEO succession as well as to

conduct internal assessment and development work.

In March 2022, the Board, including Mr. Chamandy, discussed and

approved a CEO position description and profile. Over the next

year, that profile was used to evaluate internal candidates and to

narrow the external search from a universe of 515 profiles to a

list of 37 potential candidates.

2023

In May 2023, the executive search firm began the external phase

of the search, further refining the list of potential CEO

candidates.

At the August 2023 Board meetings, Mr. Chamandy demanded that he

be provided with a definitive and final timeline on the succession

process, which was considered by the independent Board members at a

special meeting of the Board on August 31, 2023.

Prior to this special meeting, Mr. Chamandy sent a memorandum

outlining his new proposal and thoughts regarding CEO succession

planning to Mr. Berg. Contrary to the plan agreed to in December

2021, this proposal contemplated yet another three-year timeline,

prolonging Mr. Chamandy’s tenure far beyond the original timeframe.

According to Mr. Chamandy, he needed to stay on for several more

years to oversee internal development and transition

thereafter.

The Board held its special meeting on August 31, 2023 to review

the succession plan, Mr. Chamandy’s proposal, and determine

the succession timeframe. At that meeting, the Board decided to

continue to evaluate both internal and external candidates for CEO

and rejected Mr. Chamandy’s proposal extending him as CEO for an

additional three years as it included no new facts to justify

delaying the plan originally agreed to. In particular, it was noted

that there was no new strategy being proposed that required Mr.

Chamandy’s ongoing oversight and that Mr. Chamandy’s recent actions

to terminate a senior executive in Manufacturing, within seven

months of his joining Gildan, indicated no willingness or ability

to develop internal successors. It was clear that Mr. Chamandy was

out of ideas to move Gildan forward.

By September, the CEO search had narrowed to a shortlist of 21

candidates.

On September 6, 2023, Mr. Berg and Director Luc Jobin met with

Mr. Chamandy in Montreal to inform him of the Board’s decisions and

answer his demand for a definitive timeline on the succession

process. A slide deck was provided to Mr. Chamandy indicating the

Board would continue to consider internal and external candidates,

with a tentative retirement date between July 31 and December 31,

2024, with a reasonable overlap period where Mr. Chamandy would

relinquish his CEO title but stay on through an orderly transition

until his retirement.

By early October, as the succession process advanced, Mr.

Chamandy contacted Mr. Berg to meet and discuss how his succession

was tied to the strategy he had for Gildan. Mr. Berg offered, and

Mr. Chamandy accepted, an opportunity to present his strategy

proposal and his related succession plan at the Board meeting on

October 30, 2023.

Mr. Chamandy’s October 30th presentation was not, as he now

claims, a routine annual strategy exercise. This was a formal

strategy proposal.

The idea that Mr. Chamandy put forward on October 30, 2023 was

for Gildan to embark on a risky and highly dilutive

multi-billion-dollar acquisition strategy predicated on him

remaining as CEO for several more years to oversee integration and

his eventual succession. As the Board has stated in earlier

communications, it was dubious about these high-risk acquisitions,

particularly in light of Mr. Chamandy’s inability to answer

even the most basic questions about his strategic proposal.

The Board was concerned that Mr. Chamandy appeared disinterested

in Gildan’s existing business and offered no new ideas about how to

advance that business. The Board asked Mr. Chamandy to provide a

more detailed analysis of his plan that addressed risks and

mitigation. Instead, Mr. Chamandy gave the Board an ultimatum:

Either approve his acquisition strategy and resulting succession

plan, or he would immediately leave and sell his stock.

The following week, on November 8, 2023, Mr. Chamandy welcomed

the founders of activist hedge fund Browning West, and a number of

Browning West investors, on an exclusive visit to the Gildan

manufacturing plant in Honduras.

On a phone call on November 24th, following a Board meeting to

consider Mr. Chamandy’s ultimatum, Mr. Berg informed Mr. Chamandy

that the Board planned to make a formal offer to an external CEO

candidate which would see an orderly transition at the end of Q1

2024. Other options were also discussed that would have seen Mr.

Chamandy stay on longer. Mr. Chamandy refused to engage in

succession at all and asserted that the Board had to commit to him

as the continuing CEO. He threatened to leave immediately if the

Board did not do so, said that he would speak to his lawyers and

would respond on Monday, November 27th. Mr. Chamandy recorded that

private and confidential phone call with the Chair without the

Chair’s knowledge.

Mr. Chamandy did not wait until Monday. Instead, on Saturday,

November 25, he sent the Board a letter reiterating his demands and

setting a deadline for Monday, November 27, 2023. On Sunday,

November 26, before the Board had even responded, Mr. Chamandy

began moving out of his office.

Throughout 2023, Mr. Chamandy repeatedly said that he would “go

gracefully” when the Board decided the time was right for Gildan.

But Mr. Chamandy could not let go, devising ill-considered

acquisitions that would have cost Gildan billions in an effort to

justify staying on as CEO.

By December, it was clear that Mr. Chamandy was disengaged and

had no new ideas about how to advance Gildan’s existing business

and was focused on his interests and not those of the Company. His

ultimatums, his decision to upend the carefully planned succession

plan, his disruptive behavior and his unwillingness to cooperate

and his concealed taping of a private and confidential conversation

led to an unreconcilable break in the relationship between the

Board and Mr. Chamandy and left the Board no choice but to

terminate him.

Moving Forward

It was Mr. Chamandy who had no credible long-term strategy or

vision for Gildan. It was Mr. Chamandy who proposed a risky,

multi-billion-dollar acquisitions strategy, backed by no serious

analysis. It was Mr. Chamandy who gave the Board ultimatums. It was

Mr. Chamandy who threatened to leave but in the end would not agree

to a negotiated retirement or resignation, forcing the Board to

terminate him. It was Mr. Chamandy who attempted to create chaos at

Gildan by misleading investors regarding both the timing and

reasons for his termination. It was Mr. Chamandy who failed to

disclose that he had invested in funds managed by a Gildan

shareholder who has now come out in support of reinstalling him as

CEO and that a senior executive of the same shareholder had

purchased a multi-million-dollar property at Mr. Chamandy’s luxury

golf resort in Barbados. And it was Mr. Chamandy who now admits

that he had no intention of leaving Gildan despite agreeing years

earlier to an orderly succession process, working through that

process and indicating he would go gracefully.

The Company has already detailed in earlier communications that

the Board had gradually lost trust and confidence in Mr. Chamandy.

Furthermore, it became clear that he increasingly disengaged as CEO

as he focused more on personal pursuits like developing his private

golf resort.

It was time for a change of leadership at Gildan, and the Board

made the right decision for the Company.

The Company is now focused on the future and the Board will

continue to act in Gildan’s best interests, including by engaging

with stakeholders.

Vince Tyra has joined the Board of Directors and is off to an

impressive start as CEO. He is meeting with employees, customers

and investors and will be visiting Gildan locations. Mr. Tyra is

bringing the stability and thoughtful leadership that Gildan and

investors demand as we move forward with confidence and

optimism.

Caution Concerning Forward-Looking

Statements

Certain statements included in this press release constitute

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities

legislation and regulations and are subject to important risks,

uncertainties, and assumptions. This forward-looking information

includes, amongst others, information with respect to our

objectives and strategies. Forward-looking statements generally can

be identified by the use of conditional or forward-looking

terminology such as “may”, “will”, “expect”, “intend”, “estimate”,

“project”, “assume”, “anticipate”, “plan”, “foresee”, “believe”, or

“continue”, or the negatives of these terms or variations of them

or similar terminology. We refer you to the Company’s filings with

the Canadian securities regulatory authorities and the U.S.

Securities and Exchange Commission, as well as the risks described

under the “Financial risk management”, “Critical accounting

estimates and judgments”, and “Risks and uncertainties” sections of

our most recent Management’s Discussion and Analysis for a

discussion of the various factors that may affect these

forward-looking statements. Material factors and assumptions that

were applied in drawing a conclusion or making a forecast or

projection are also set out throughout such document.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion or projection in such forward-looking

information, include, but are not limited to changes in general

economic and financial conditions globally or in one or more of the

markets we serve and our ability to implement our growth strategies

and plans. These factors may cause the Company’s actual performance

in future periods to differ materially from any estimates or

projections of future performance expressed or implied by the

forward-looking statements included in this press release.

There can be no assurance that the expectations represented by

our forward-looking statements will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management’s expectations regarding the

Company’s future financial performance and may not be appropriate

for other purposes. Furthermore, unless otherwise stated, the

forward-looking statements contained in this press release are made

as of the date hereof, and we do not undertake any obligation to

update publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events,

or otherwise unless required by applicable legislation or

regulation. The forward-looking statements contained in this press

release are expressly qualified by this cautionary statement.

About Gildan

Gildan is a leading manufacturer of everyday basic apparel. The

Company’s product offering includes activewear, underwear and

socks, sold to a broad range of customers, including wholesale

distributors, screenprinters or embellishers, as well as to

retailers that sell to consumers through their physical stores

and/or e-commerce platforms and to global lifestyle brand

companies. The Company markets its products in North America,

Europe, Asia Pacific, and Latin America, under a diversified

portfolio of Company-owned brands including Gildan®, American

Apparel®, Comfort Colors®, GOLDTOE®, Peds®, in addition to the

Under Armour® brand through a sock licensing agreement providing

exclusive distribution rights in the United States and Canada.

Gildan owns and operates vertically integrated, large-scale

manufacturing facilities which are primarily located in Central

America, the Caribbean, North America, and Bangladesh. Gildan

operates with a strong commitment to industry-leading labour,

environmental and governance practices throughout its supply chain

in accordance with its comprehensive ESG program embedded in the

Company's long-term business strategy. More information about the

Company and its ESG practices and initiatives can be found at

www.gildancorp.com.

Media inquiries:

Geneviève Gosselin

Director, Global Communications and Corporate Marketing

(514) 343-8814

ggosselin@gildan.com

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Nov 2024 to Dec 2024

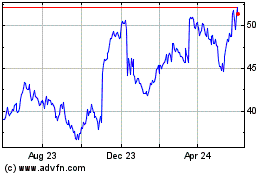

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Dec 2023 to Dec 2024