Gildan Activewear Inc. (TSX: GIL)(NYSE: GIL) is pleased to announce

that its Board of Directors has approved the introduction of a

quarterly cash dividend. The initial quarterly dividend of U.S.

$0.075 per share will be paid on March 18, 2011, to shareholders of

record on February 23, 2011. The dividend policy will be reviewed

annually by the Board of Directors.

The Company continues to be committed to investing in capital

expenditures for capacity expansion and cost reductions, and will

also consider selective complementary acquisitions which, in the

opinion of management and the Board of Directors, will provide an

attractive return on capital. The Company believes that its strong

balance-sheet and strong free cash flow generation provide it with

significant financing capacity and flexibility to be able to

continue to pursue its growth strategy, at the same time as

introducing a dividend to provide yield and further enhance total

returns to its shareholders. The Company ended its 2010 fiscal year

with cash and cash equivalents amounting to U.S. $258.4 million. In

addition, the Company has no amounts outstanding under its U.S.

$400 million revolving bank credit facility and has significant

unused debt financing capacity even under conservative debt

leverage parameters.

In addition, the Company announced that it is reinstating a

normal course issuer bid to repurchase outstanding shares of the

Company in the open market. Gildan intends to purchase up to

1,000,000 common shares, representing approximately 0.8% of the

Company's issued and outstanding common shares, in accordance with

the requirements of the TSX. As of today's date, the Company has

121,357,204 shares issued and outstanding.

Gildan is authorized to make purchases under the bid during the

period from December 6, 2010 to December 5, 2011, or until such

time as the bid is completed or terminated at Gildan's option.

Purchases will be made on the open market on both the TSX and the

NYSE. Under the bid, Gildan may purchase up to a maximum of 105,782

shares daily which represents 25% of the average daily trading

volume on the TSX for the most recently completed six calendar

months. The price to be paid will be the market price of the shares

on the stock exchange on which such shares are purchased at the

time of acquisition. Shares purchased under the bid will be

cancelled.

At the date hereof, directors, senior officers and other

insiders of the Company have indicated that they may sell up to

approximately 400,000 shares of the Company during the course of

the bid in order to cover tax liabilities from the exercise of

certain stock option awards that are expiring, having reached their

maximum ten-year term, and certain restricted shares units that are

vesting. The benefits to any insider whose shares are purchased

would be the same as the benefits available to all other

shareholders whose shares are purchased.

The purchase of shares under the normal course issuer bid will,

in the Company's opinion, represent an appropriate use of funds in

the event that the shares trade at a price which does not

adequately reflect their value in relation to Gildan's assets,

business and future business prospects. The purchase of shares will

also offset the dilutive effect of the issuance of shares pursuant

to Gildan's compensation plans.

Forward-Looking Statements

Certain statements included in this press release constitute

"forward-looking statements" within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities

legislation and regulations, and are subject to important risks,

uncertainties and assumptions. This forward-looking information

includes, amongst others, information with respect to our

objectives and the strategies to achieve these objectives, as well

as information with respect to our beliefs, plans, expectations,

anticipations, estimates and intentions, including, without

limitation, our expectation with regards to unit volume growth,

sales revenue, cost reductions and efficiencies, gross margins,

selling, general and administrative expenses, capital expenditures

and the impact of non-recurring items. Forward-looking statements

generally can be identified by the use of conditional or

forward-looking terminology such as "may", "will", "expect",

"intend", "estimate", "project", "assume", "anticipate", "plan",

"foresee", "believe" or "continue" or the negatives of these terms

or variations of them or similar terminology. We refer you to the

Company's filings with the Canadian securities regulatory

authorities and the U.S. Securities and Exchange Commission, as

well as the "Risks and Uncertainties" section and the risks

described under the section "Financial Risk Management" in our more

recent Management's Discussion and Analysis for a discussion of the

various factors that may affect the Company's future results.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout this document.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion, forecast or projection in such forward-looking

information, include, but are not limited to:

-- our ability to implement our growth strategies and plans, including

achieving market share gains, implementing cost reduction initiatives

and completing and successfully integrating acquisitions;

-- the intensity of competitive activity and our ability to compete

effectively;

-- adverse changes in general economic and financial conditions globally

or in one or more of the markets we serve;

-- our reliance on a small number of significant customers;

-- the fact that our customers do not commit contractually to minimum

quantity purchases;

-- our ability to anticipate changes in consumer preferences and trends;

-- our ability to manage production and inventory levels effectively in

relation to changes in customer demand;

-- fluctuations and volatility in the price of raw materials used to

manufacture our products, such as cotton and polyester fibres;

-- our dependence on key suppliers and our ability to maintain an

uninterrupted supply of raw materials;

-- the impact of climate, political, social and economic risks in the

countries in which we operate;

-- disruption to manufacturing and distribution activities due to labour

disruptions, political instability, bad weather, natural disasters,

pandemics and other unforeseen adverse events;

-- changes to international trade legislation that the Company is

currently relying on in conducting its manufacturing operations or the

application of safeguards thereunder;

-- factors or circumstances that could increase our effective income tax

rate, including the outcome of any tax audits or changes to applicable

tax laws or treaties;

-- compliance with applicable environmental, tax, trade, employment,

health and safety, and other laws and regulations in the jurisdictions

in which we operate;

-- our significant reliance on computerized information systems for our

business operations;

-- changes in our relationship with our employees or changes to domestic

and foreign employment laws and regulations;

-- negative publicity as a result of violation of labour laws or

unethical labour or other business practices by the Company or one of

its third-party contractors;

-- our dependence on key management and our ability to attract and retain

key personnel;

-- changes to and failure to comply with consumer product safety laws and

regulations;

-- changes in accounting policies and estimates; and

-- exposure to risks arising from financial instruments, including credit

risk, liquidity risk, foreign currency risk and interest rate risk, as

well as risks arising from commodity prices.

These factors may cause the Company's actual performance and

financial results in future periods to differ materially from any

estimates or projections of future performance or results expressed

or implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made, may have on the Company's business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset write-downs or

other charges announced or occurring after forward-looking

statements are made. The financial impact of such transactions and

non-recurring and other special items can be complex and

necessarily depends on the facts particular to each of them.

We believe that the expectations represented by our

forward-looking statements are reasonable, yet there can be no

assurance that such expectations will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management's expectations regarding the

Company's fiscal 2011 financial performance and may not be

appropriate for other purposes. Furthermore, unless otherwise

stated, the forward-looking statements contained in this press

release are made as of the date of this press release, and we do

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, whether as a result of new

information, future events or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

Profile

Gildan is a vertically-integrated marketer and manufacturer of

quality branded basic apparel. The Company is the leading supplier

of activewear for the screenprint market in the U.S. and Canada. It

is also a leading supplier to this market in Europe, and is

establishing a growing presence in Mexico and the Asia-Pacific

region. The Company sells T-shirts, sport shirts and fleece in

large quantities to wholesale distributors as undecorated "blanks",

which are subsequently decorated by screenprinters with designs and

logos. Consumers ultimately purchase the Company's products, with

the Gildan label, in venues such as sports, entertainment and

corporate events, and travel and tourism destinations. The

Company's products are also utilized for work uniforms and other

end-uses to convey individual, group and team identity. The Company

is also a leading supplier of private label and Gildan branded

socks primarily sold to mass-market retailers. In addition, Gildan

has an objective to become a significant supplier of men's and

boys' underwear and undecorated activewear products to mass-market

retailers in North America.

Contacts: Investor Relations Laurence G. Sellyn Executive

Vice-President Chief Financial and Administrative Officer

514-343-8805 lsellyn@gildan.com Sophie Argiriou Director Investor

Communications 514-343-8815 sargiriou@gildan.com Media Relations

Genevieve Gosselin Director, Corporate Communications 514-343-8814

ggosselin@gildan.com

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Oct 2024 to Nov 2024

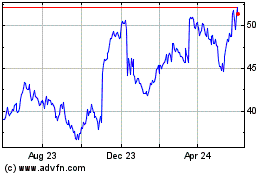

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Nov 2023 to Nov 2024