Fortuna Silver Mines, Inc. (NYSE: FSM)

(TSX: FVI) is pleased to report updated Mineral Reserve

and Mineral Resource estimates as of December 31, 2022 for its four

operating mines and its development Séguéla gold Project in the

Americas and West Africa, as well as the maiden Inferred Resource

for the Arizaro Project located at the Lindero Property in Salta,

Argentina.

Highlights of Mineral Reserve and

Mineral Resource Update

- Combined Proven and Probable

Mineral Reserves are reported containing 2.8 Moz Au and

20.1 Moz Ag, representing a year-over-year decrease of 14

percent and 22 percent, respectively

- Combined Measured and Indicated

Resources exclusive of Mineral Reserves are reported containing 1.1

Moz Au and 10.5 Moz Ag, representing a year-over-year increase of

32 percent in gold and no change in silver

- Combined Inferred Mineral Resources

are reported containing 1.4 Moz Au and 26.5 Moz Ag reflecting a

year-over-year increase of 39 percent and 1 percent,

respectively

- Maiden Inferred Mineral Resources

are reported for the Arizaro Project located 3.2 kilometers

southeast of the Lindero Mine containing 280 koz Au

2022 Mineral Reserves and Mineral

Resources

|

Mineral Reserves – Proven and Probable |

|

|

|

|

Contained Metal |

|

Property |

Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (Moz) |

Au (koz) |

|

Silver Mines |

Caylloma, Peru |

Proven |

43 |

213 |

0.78 |

2.62 |

2.30 |

0.3 |

1 |

|

Probable |

3,155 |

79 |

0.14 |

2.67 |

3.91 |

8.0 |

14 |

|

Proven + Probable |

3,198 |

81 |

0.15 |

2.66 |

3.88 |

8.3 |

15 |

|

San Jose, Mexico |

Proven |

184 |

208 |

1.45 |

N/A |

N/A |

1.2 |

9 |

|

Probable |

1,957 |

168 |

1.14 |

N/A |

N/A |

10.6 |

72 |

|

Proven + Probable |

2,140 |

172 |

1.16 |

N/A |

N/A |

11.8 |

80 |

|

Total |

Proven + Probable |

5,338 |

117 |

0.56 |

N/A |

N/A |

20.1 |

96 |

|

Gold Mines |

Lindero, Argentina |

Proven |

25,505 |

N/A |

0.61 |

N/A |

N/A |

0.0 |

504 |

|

Probable |

53,713 |

N/A |

0.54 |

N/A |

N/A |

0.0 |

937 |

|

Proven + Probable |

79,218 |

N/A |

0.57 |

N/A |

N/A |

0.0 |

1,441 |

|

Yaramoko, Burkina Faso |

Proven |

123 |

N/A |

3.42 |

N/A |

N/A |

0.0 |

13 |

|

Probable |

1,039 |

N/A |

6.19 |

N/A |

N/A |

0.0 |

207 |

|

Proven + Probable |

1,161 |

N/A |

5.89 |

N/A |

N/A |

0.0 |

220 |

|

Total |

Proven + Probable |

80,379 |

N/A |

0.64 |

N/A |

N/A |

0.0 |

1,661 |

|

Gold Project |

Séguéla, Côte d’Ivoire |

Probable |

12,100 |

N/A |

2.80 |

N/A |

N/A |

0.0 |

1,088 |

|

Proven + Probable |

12,100 |

N/A |

2.80 |

N/A |

N/A |

0.0 |

1,088 |

|

Total |

Proven + Probable |

20.1 |

2,844 |

|

Mineral Resources – Measured and

Indicated |

|

|

|

|

Contained Metal |

|

Property |

Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (Moz) |

Au (koz) |

|

Silver Mines |

Caylloma, Peru |

Measured |

669 |

83 |

0.31 |

1.82 |

3.23 |

1.8 |

7 |

|

Indicated |

2,170 |

79 |

0.21 |

1.58 |

3.04 |

5.5 |

15 |

|

Measured + Indicated |

2,839 |

80 |

0.24 |

1.64 |

3.08 |

7.3 |

22 |

|

San Jose, Mexico |

Measured |

72 |

135 |

0.98 |

N/A |

N/A |

0.3 |

2 |

|

Indicated |

839 |

107 |

0.70 |

N/A |

N/A |

2.9 |

19 |

|

Measured + Indicated |

911 |

109 |

0.72 |

N/A |

N/A |

3.2 |

21 |

|

Total |

Measured + Indicated |

3,750 |

87 |

0.35 |

N/A |

N/A |

10.5 |

43 |

|

Gold Mines |

Lindero, Argentina |

Measured |

1,855 |

N/A |

0.50 |

N/A |

N/A |

0.0 |

30 |

|

Indicated |

27,594 |

N/A |

0.42 |

N/A |

N/A |

0.0 |

369 |

|

Measured + Indicated |

29,448 |

N/A |

0.42 |

N/A |

N/A |

0.0 |

399 |

|

Yaramoko, Burkina Faso |

Measured |

86 |

N/A |

6.41 |

N/A |

N/A |

0.0 |

18 |

|

Indicated |

374 |

N/A |

5.97 |

N/A |

N/A |

0.0 |

71 |

|

Measured + Indicated |

460 |

N/A |

6.05 |

N/A |

N/A |

0.0 |

89 |

|

Total |

Measured + Indicated |

29,908 |

N/A |

0.51 |

N/A |

N/A |

0.0 |

488 |

|

Gold Project |

Séguéla, Côte d’Ivoire |

Indicated |

7,071 |

N/A |

2.30 |

N/A |

N/A |

0.0 |

523 |

|

Measured + Indicated |

7,071 |

N/A |

2.30 |

N/A |

N/A |

0.0 |

523 |

|

Total |

Measured + Indicated |

10.5 |

1,053 |

|

Mineral Resources – Inferred |

|

|

|

|

|

Contained Metal |

|

Property |

Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (Moz) |

Au(koz) |

|

SilverMines |

Caylloma, Peru |

Inferred |

5,003 |

105 |

0.45 |

2.23 |

3.42 |

16.9 |

72 |

|

San Jose, Mexico |

Inferred |

2,524 |

118 |

0.83 |

N/A |

N/A |

9.6 |

67 |

|

Total |

Inferred |

7,527 |

109 |

0.58 |

N/A |

N/A |

26.5 |

139 |

|

GoldMines |

Lindero, Argentina |

Inferred |

24,170 |

N/A |

0.47 |

N/A |

N/A |

0.0 |

365 |

|

Yaramoko, Burkina Faso |

Inferred |

141 |

N/A |

5.51 |

N/A |

N/A |

0.0 |

25 |

|

Total |

Inferred |

24,311 |

N/A |

0.50 |

N/A |

N/A |

0.0 |

390 |

|

Gold Projects |

Séguéla, Côte d’Ivoire |

Inferred |

5,708 |

N/A |

3.33 |

N/A |

N/A |

0.0 |

610 |

|

Arizaro, Argentina |

Inferred |

22,146 |

N/A |

0.39 |

N/A |

N/A |

0.0 |

280 |

|

|

Total |

Inferred |

27,854 |

N/A |

0.99 |

N/A |

N/A |

0.0 |

890 |

|

Total |

Inferred |

26.5 |

1,419 |

Notes:

- Mineral Reserves and Mineral

Resources are as defined by the 2014 CIM Definition Standards for

Mineral Resources and Mineral Reserves

- Mineral Resources are exclusive of

Mineral Reserves

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability

- Factors that could materially

affect the reported Mineral Resources or Mineral Reserves include

changes in metal price and exchange rate assumptions; changes in

local interpretations of mineralization; changes to assumed

metallurgical recoveries, mining dilution and recovery; and

assumptions as to the continued ability to access the site, retain

mineral and surface rights titles, maintain environmental and other

regulatory permits, and maintain the social license to operate

- Mineral Resources and Reserves are

estimated as of June 30, 2022 for the Caylloma and Yaramoko Mines,

as of July 31, 2022 for the San Jose Mine, as of August 31, 2022

for the Lindero Mine, as of December 31, 2022 for the Arizaro

Project, and as of March 31, 2021 for the Séguéla Project with the

exception of the Sunbird Deposit which is estimated and reported as

of November 21, 2022. Mineral Resources and Reserves for all mines

are reported as of December 31, 2022 taking into production related

depletion to this date

- Mineral Reserves for the San Jose

Mine are based on underground mining within optimized stope designs

using an estimated NSR break-even cut-off grade of US$68.7/t to

US$74.0/t equivalent to 119 -133 g/t Ag Eq based on assumed metal

prices of US$21/oz Ag and US$1,600/oz Au; estimated metallurgical

recovery rates of 91% for Ag and 90% for Au and mining costs of

US$35.37/t cut and fill (C&F) - US$30.00/t sub-level stoping

(SLS); processing costs of US$16.76/t; and other costs including

distribution, management, community support and general service

costs of US$21.91/t based on actual operating costs. Average mining

recovery is estimated to 92% (C&F) and 93% (SLS) and average

mining dilution 11% (C&F) and 17% (SLS). Mineral Resources are

reported at a 110 g/t Ag Eq cut-off grade based on the same

parameters used for Mineral Reserves and a 15% upside in metal

prices

- Mineral Reserves for the Caylloma

Mine are reported above NSR breakeven cut-off values based on

underground mining methods including; mechanized (breasting) at

US$86.60/t; mechanized (uppers) at US$77.33/t; semi-mechanized at

US$90.19/t; and a conventional method at US$155.09/t; using assumed

metal prices of US$21/oz Ag, US$1,600/oz Au, US$2,100/t Pb and

US$2,600/t Zn; metallurgical recovery rates of 82% for Ag, 45% for

Au, 88% for Pb and 89% for Zn . Mining, processing and

administrative costs used to determine NSR cut-off values were

estimated based on actual operating costs incurred from July 2021

through June 2022. Mining recovery is estimated to average 95% with

average mining dilution of 12% depending on the mining methodology.

Mineral Resources are reported at an NSR cut-off grade of US$65/t

for veins classified as wide (Animas, Animas NE, Nancy, San

Cristobal) and US$135/t for veins classified as narrow (all other

veins) based on the same parameters used for Mineral Reserves, and

a 15% upside in metal prices

- Mineral Reserves for the Lindero

Mine are reported based on open pit mining within a designed pit

shell based on variable gold cut-off grades and gold recoveries by

metallurgical type: Met type 1 cut-off 0.27 g/t Au, recovery 75.4%;

Met type 2 cut-off 0.26 g/t Au, recovery 78.2%; Met type 3 cut-off

0.26 g/t Au, recovery 78.5%; and Met type 4 cut-off 0.30 g/t Au,

recovery 68.5%. Mining recovery is estimated to average 100% and

mining dilution 0% having been accounted for during block

regularization to 10m x 10m x 8m size. The cut-off grades and pit

designs are considered appropriate for long term gold prices of

US$1,600/oz, estimated average mining costs of US$1.67/t of

material, total processing and G&A costs of US$10.32/t of ore,

and refinery costs net of pay factor of US$8.52/oz Au. Reported

Proven Reserves include 7.9 Mt averaging 0.48 g/t Au of stockpiled

material. Mineral Resources for Lindero are reported within a

conceptual pit shell above a 0.23 g/t Au cut-off grade based on the

same parameters used for Mineral Reserves and a 15% upside in metal

prices. Mineral Resources for Arizaro are reported within a

conceptual pit shell above a 0.25 g/t Au cut-off grade using the

same gold price and costs as Lindero with an additional US$0.52/t

of ore to account for haulage costs between the deposit and plant.

A slope angle of 47° was used for defining the pit

- Mineral Reserves for Yaramoko are

reported at a cut-off grade of 1.26 g/t Au for the 55 Zone open

pit, 0.73 g/t Au for the 109 Zone open pit, 4.1 g/t Au for 55

Zone and Bagassi South QV underground (SLS), 3.1 g/t Au for Bagassi

South QVP (Shrinkage) based on an assumed gold price of

US$1,600/oz, metallurgical recovery rates of 98.0%, 55 Zone and

Bagassi South (QV) underground mining costs of US$135/t, processing

cost of US$31/t and G&A costs of US$28/t, Bagassi South QVP

underground mining cost of US$115/t, and processing cost of

US$30/t, surface mining cost of US$3.49/t, processing cost of

US$27/t and G&A costs of US$25/t for the 55 Zone, surface

mining cost of US$3.66/t and processing cost of US$27/t for the 109

Zone. Underground average mining recovery is estimated at 86% (SLS)

and 90% (Shrinkage) for Bagassi South, 92% (SLS) for 55 Zone stopes

and 100% for sill drifts. A mining dilution factor of 10% has been

applied for sill drifts, 0.6m and 0.4m dilution skin has been

applied for SLS and shrinkage mining respectively. Surface mining

recovery is estimated to average 100% and mining dilution 0% having

been accounted for during block regularization to 5m x 5m x 5m size

within an optimized pit shell and only Proven and Probable

categories reported within the final pit designs. Yaramoko Mineral

Resources are reported in situ at a gold grade cut-off grade of

0.9 g/t Au for the 55 Zone open pit, 0.5 g/t Au for the

109 Zone open pit, and 2.9 g/t Au for underground (55 Zone and

Bagassi South), based on an assumed gold price of US$1,700/oz and

the same costs, metallurgical recovery and constrained within an

optimized pit shell. The Yaramoko Mine is subject to a 10% carried

interest held by the government of Burkina Faso

- Mineral Reserves for Séguéla are

reported constrained within optimized pit shells at an incremental

cut-off grade of 0.54 g/t Au for Antenna, 0.55 g/t Au for Agouti,

0.55 g/t Au for Boulder, 0.56 g/t Au for Koula and 0.56 g/t Au for

Ancien deposits based on an assumed gold price of US$1,500/oz,

metallurgical recovery rate of 94.5%, mining cost of US$2.87/t for

Antenna, US$2.74/t for Agouti, US$2.81/t for Boulder, US$2.85/t for

Koula and US$2.93/t for Ancien, processing and G&A costs of

US$14.51/t and US$7.13/t respectively, mining owner cost of

US$1.30/t, refining cost of US$2.60/oz and royalty rate of 6%. The

Mineral Reserves pit design were completed based on overall slope

angle recommendations of between 37° and 57° for Antenna, Koula and

Agouti deposits from oxide to fresh weathering profiles, between

34° and 56° for Ancien deposit from oxide to fresh weathering

profiles and 37° and 60° for Boulder deposit from oxide to fresh

weathering profiles. The Mineral Reserves are reported in situ with

modifying factors of 15% mining dilution and 90% mining recovery

applied. Mineral Resources for Séguéla are reported in situ at a

cut-off grade of 0.3 g/t Au for Antenna, 0.45 g/t Au for Sunbird

and 0.5 g/t Au for the other satellite deposits, based on an

assumed gold price of US$1,700/oz and constrained within

preliminary pit shells. The Séguéla gold Project is subject to a

10% carried interest held by the government of Cote d’Ivoire

- Eric Chapman is the Qualified

Person responsible for Mineral Resources reported for the Arizaro

Project, San Jose, Caylloma, and Lindero mines; Raul Espinoza is

the Qualified Person responsible for Mineral Reserves reported for

the San Jose, Caylloma, Lindero and Yaramoko mines; both being

employees of Fortuna Silver Mines Inc. Matt Cobb is the Qualified

Person responsible for Mineral Resources reported for the Yaramoko

Mine and Séguéla gold Project, being an employee of Roxgold Inc. (a

wholly-owned subsidiary of Fortuna). Shane McLeay (FAUSIMM #222752)

is the Qualified Person responsible for Mineral Reserves for the

Séguéla gold Project, being an employee of Entech Pty Ltd.

- N/A = Not applicable

- Totals may not add due to rounding

Lindero Mine, Argentina

As of December 31, 2022, the Lindero Mine has

Proven and Probable Mineral Reserves of 79.2 Mt containing 1.4 Moz

Au, in addition to Measured and Indicated Resources, exclusive of

Mineral Reserves, of 29.5 Mt containing 399 koz Au, and

Inferred Resources of 24.2 Mt containing 365 koz Au.

Since December 31, 2021, Mineral Reserve tonnes

decreased by 11 percent, while gold grade remained unchanged at

0.57 g/t Au. Changes are primarily due to mining related depletion

and sterilization of 6.0 Mt of material containing 158 koz Au

delivered to the heap leach pad in 2022 and an increase in the

reporting cut-off grade due to higher operating costs resulting in

a decrease of 3.4 Mt containing 30 koz Au.

Measured and Indicated Resource gold ounces,

exclusive of Mineral Reserves, decreased slightly by 16 koz Au

or 4 percent since December 31, 2021 to 400 koz Au year-over-year,

due to an increase in the cut-off grade used for reporting

resources as a result of increased operating costs.

Inferred Resources tonnes decreased by 2.9 Mt or

11 percent, to 24.2 Mt since December 31, 2021 with the gold grade

increasing 9 percent to 0.47 g/t. The decrease in Inferred

Resources is due to the aforementioned changes in cut-off grade

used for reporting resources.

Yaramoko Mine, Burkina Faso

As of December 31, 2022, the Yaramoko Mine has

Proven and Probable Mineral Reserves of 1.2 Mt containing 220 koz

Au, in addition to Measured and Indicated Resources, exclusive of

Mineral Reserves, of 0.5 Mt containing 89 koz Au, and Inferred

Resources of 0.14 Mt containing 25 koz Au.

There has been no material change to the

previously reported Mineral Reserves and Mineral Resources as of

June 30, 2022 (refer to Fortuna news release dated January 27,

2023) other than production related depletion to December 31,

2022.

San Jose Mine, Mexico

As of December 31, 2022, the San Jose Mine has

Proven and Probable Mineral Reserves of 2.1 Mt containing 11.8 Moz

Ag and 80 koz Au, in addition to Inferred Resources of 2.5 Mt

containing a further 9.6 Moz Ag and 67 koz Au.

Year-over-year, Mineral Reserves decreased 28

percent in terms of tonnes, while silver grade decreased 4 percent

and gold grade decreased 1 percent after net changes of minus

950,000 tonnes resulting from production-related depletion,

application of higher cut-off grades related to increases in

operational costs amounting to a decrease of 267,000 tonnes and the

upgrading and conversion of 370,000 tonnes of Inferred Resources to

Mineral Reserves due to infill and exploration drilling. Silver and

gold grades decreased slightly to 172 g/t and 1.16 g/t,

respectively due to upgraded grades having lower average grades

than those depleted in 2022.

Measured and Indicated Resource tonnes exclusive

of Mineral Reserves remained relatively unchanged year-over-year

with tonnes decreasing by 3 percent and silver and gold grades

increasing by 10 percent due to an increase in the cut-off grade

used for reporting resources because of increased operating

costs.

Year-over-year, Inferred Resources decreased 16

percent in terms of tonnes, with grades decreasing for silver and

gold by 6 percent and 11 percent, respectively. The net

variation is due primarily to reductions resulting from the

upgrading of Inferred Resources related to infill drilling and an

increase of 106,000 tonnes due to exploration drilling

activities.

The Brownfields exploration program budget for

2023 at the San Jose Mine is US$3.3 million, which includes 5,500

meters of diamond drilling, focused on extensions to the Magdalena,

Trinidad and Victoria systems, as well as work along the Taviche

corridor (refer to Fortuna news release dated January 17,

2023).

Caylloma Mine, Peru

As of December 31, 2022, the Caylloma Mine has

Proven and Probable Mineral Reserves of 3.2 Mt containing 8.3 Moz

Ag, 15 koz Au, 85 kt Pb, and 124 kt Zn in addition to Inferred

Resources of 5.0 Mt containing 16.9 Moz Ag, 72 koz Au, 112 kt

Pb, and 171 kt Zn.

Year-over-year, Mineral Reserve tonnes increased

by 1 percent, while silver grade decreased 4 percent to 81

g/t, lead grade increased 5 percent to 2.66 %, and zinc grade

increased 5 percent to 3.88 %. Changes are primarily due to mining

related depletion of 497,000 tonnes, upgrading and conversion of

548,000 tonnes of Inferred Resources to Mineral Reserves and

the addition of 594,000 tonnes due to successful infill drill and

exploration programs, respectively, focused on the Animas, Animas

NE, Nancy and associated splay veins counteracted by a decrease by

336,000 tonnes due to higher cut-off values related to increases in

operational costs and an additional decrease of 279,000 tonnes as a

result of changes in estimation parameters, geological

interpretation and commercial terms.

Measured and Indicated Resource tonnes,

exclusive of Mineral Reserves, increased slightly by 4 percent

year-over-year to 2.8 Mt with silver, lead and zinc grades

decreasing slightly by 7 percent, 1 percent and 2 percent,

respectively due to the same reasons as detailed for reserves.

Inferred Resources tonnes increased by 31

percent year-over-year. Silver and zinc grades decreased

9 percent and 2 percent, respectively whereas lead grades

increased by 10 percent. The increase in Inferred Mineral Resources

is primarily due to the inclusion of 1.9 Mt of new resources in

relation to exploration drilling expanding identified mineralized

material in the lower levels of the Animas and Animas NE veins

counteracted by the infill drill program of the Animas and Animas

NE veins resulting in the upgrading of Inferred Mineral Resources

to Mineral Reserves.

Management is in the process of conducting a

cost-benefit analysis to assess increasing plant throughput. This

is supported by the expanded mineralization which remains open at

depth in the Animas and Animas NE veins.

Séguéla gold Project, Côte

d’Ivoire

As of December 31, 2022, the Séguéla gold

Project has Proven and Probable Mineral Reserves of 12.1 Mt

containing 1.1 Moz Au, in addition to Indicated Resources of 7.1 Mt

containing 523 koz Au and Inferred Resources of 5.7 Mt containing

610 koz Au. There has been no material change to the previously

reported Mineral Reserves and Mineral Resources (refer to Fortuna

news release dated December 5, 2022).

Infill drilling at the Sunbird Deposit is

currently in progress with a 2023 program budget of US$1.7 million,

which includes 9,500 meters of diamond drilling, aimed at upgrading

Inferred to Indicated Resources with the ultimate intention of

conversion to Mineral Reserves once sufficient studies are complete

to determine modifying factors.

Arizaro Project, Lindero Property,

Argentina

The Lindero Property contains two known porphyry

gold-copper deposits. The Lindero Deposit, the focus of current

mining activities as described above in the Lindero Mine section

and the Arizaro Deposit which is located 3.2 km southeast of the

Lindero Deposit.

Gold-copper mineralization at Arizaro is

associated with two different mineralizing events. The strongest is

a non-outcropping intrusive which occurs in the north part of the

porphyry with an elongated shape trending northeast to southwest

for more than 400 meters with an estimated average width of 60

meters. The other mineralizing event is in the center of the system

and is related to breccias and micro-breccias which have a

semi-oval shape at surface. In the center, there is a higher-grade

core with a semi-ellipsoidal form, extending north-south for 480

meters with an estimated average width of 50 meters. The Arizaro

Deposit has mineralization styles with copper-gold grades that are

strongly correlated with different alteration assemblages.

Mineralization is mainly associated with potassic alteration. This

occurs generally in multi-directional veins, vein stockworks and

disseminations. In some areas, the vein density is high, forming

vein stockworks in the intrusive rocks. These vein stockworks are

limited to magnetite-biotite veinlets,

quartz-magnetite-chalcopyrite veinlets, late magnetite breccias and

in late-stage mineralization events, anhydrite-sulfide veinlets.

Chalcopyrite and bornite are the main copper minerals. Gold is

mainly associated with chalcopyrite, quartz, and anhydrite

veinlets.

A total of 65 surface diamond drill holes

totaling 16,166 meters were used in the modelling of the Inferred

Mineral Resource at Arizaro in conjunction with surface mapping to

construct three-dimensional wireframes to define individual

lithologic structures. Drill hole samples were selected inside

these wireframes, coded, composited and grade top cuts applied if

applicable. Boundaries were treated as hard with statistical and

geostatistical analysis conducted on composites identified in

individual lithologic units. Gold and copper grades were estimated

into a geological block model consisting of 10m x 10m x 8m

selective mining units. Grades were estimated by ordinary kriging

and constrained within an ultimate pit shell based on estimated

metal prices and actual costs experienced at the Lindero Mine,

along with estimated geotechnical constraints and metallurgical

recoveries to fulfill the reasonable prospects for eventual

economic extraction. Estimated grades were validated globally,

locally, and visually prior to tabulation of the Mineral

Resources.

As of December 31, 2022, the Arizaro Project has

Inferred Mineral Resources of 22.1 Mt averaging

0.39 g/t Au containing 280 koz Au. Mineralization

remains open at depth and along the trend of the northeast to

southwest striking porphyry.

Qualified Person

Eric Chapman, Fortuna´s Senior Vice President of

Technical Services, is a Professional Geoscientist of the Engineers

and Geoscientists of the Province of British Columbia (Registration

Number 36328) and a Qualified Person as defined by National

Instrument 43-101- Standards of Disclosure for Mineral Projects.

Mr. Chapman has reviewed and approved the scientific and technical

information contained in this news release and has verified the

underlying data.

About Fortuna Silver Mines

Inc.

Fortuna Silver Mines Inc. is a Canadian precious

metals mining company with four operating mines in Argentina,

Burkina Faso, Mexico and Peru, and a fifth mine under construction

in Côte d'Ivoire. Sustainability is integral to all our operations

and relationships. We produce gold and silver and generate shared

value over the long-term for our stakeholders through efficient

production, environmental protection, and social responsibility.

For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza President, CEO,

and DirectorFortuna Silver Mines Inc.

Investor Relations:

Carlos Baca |

info@fortunasilver.com | www.fortunasilver.com |

Twitter | LinkedIn |

YouTube

Forward looking Statements

This news release contains forward-looking

statements which constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995 (collectively, “Forward-looking Statements”). All

statements included herein, other than statements of historical

fact, are Forward-looking Statements and are subject to a variety

of known and unknown risks and uncertainties which could cause

actual events or results to differ materially from those reflected

in the Forward-looking Statements. The Forward-looking Statements

in this news release may include, without limitation, statements

about the Company’s plans for its mines and mineral properties; the

Company’s business strategy, plans and outlook; the merit of the

Company’s mines and mineral properties; mineral resource and

reserve estimates; the Company’s ability to convert inferred

mineral resources to indicated mineral resources and to convert

mineral resources to mineral reserves; timelines; production at the

mines; the future financial or operating performance of the

Company; the effects of laws, regulations and government policies

affecting our operations or potential future operations; future

successful development of our projects; the estimates of expected

or anticipated economic returns from the Company’s mining

operations including future sales of metals, doré and concentrate

or other products produced by the Company and the Company’s ability

to achieve its production and cost guidance; capital expenditures

at the Company’s operations; brownfields exploration programs for

2023 and estimated expenditures related to same; the success of the

Company’s exploration activities, including infill drill programs

at its mines and development projects; the duration and impacts of

COVID-19 on the Company’s production, workforce, business,

operations and financial condition; metal price estimates,

estimated metal grades in 2023; approvals and other matters. Often,

but not always, these Forward-looking Statements can be identified

by the use of words such as “estimated”, “potential”, “open”,

“future”, “assumed”, “projected”, “used”, “detailed”, “has been”,

“gain”, “planned”, “reflecting”, “will”, “anticipated”, “estimated”

“containing”, “remaining”, “to be”, or statements that events,

“could” or “should” occur or be achieved and similar expressions,

including negative variations.

Forward looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by the Forward looking Statements. Such

uncertainties and factors include, among others, changes in general

economic conditions and financial markets; the effects of inflation

on the costs of operations; the risks relating to a global

pandemic, including the COVID-19 pandemic, as well as risks

associated with war or other geo-political hostilities, such as the

Ukrainian – Russian conflict, any of which could continue to cause

a disruption in global economic activity; fluctuation in currencies

and foreign exchange rates; changes in prices for silver, gold and

other metals; technological and operational hazards in Fortuna’s

mining and mine development activities; risks inherent in mineral

exploration; fluctuations in prices for energy, labor, materials,

supplies and services; uncertainties inherent in the estimation of

mineral reserves, mineral resources, and metal recoveries; changes

to current estimates of mineral reserves and resources; changes to

production and cost estimates; our ability to obtain all necessary

permits, licenses and regulatory approvals in a timely manner; the

ability of Minera Cuzcatlan to successfully contest and revoke the

resolution issued by SEMARNAT; governmental and other approvals;

political unrest or instability in countries where Fortuna is

active; labor relations issues; as well as those factors discussed

under “Risk Factors” in the Company's Annual Information Form.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in Forward looking Statements,

there may be other factors that cause actions, events or results to

differ from those anticipated, estimated or intended.

Forward looking Statements contained herein are

based on the assumptions, beliefs, expectations and opinions of

management, including but not limited to the accuracy of the

Company’s current mineral resource and reserve estimates and the

assumptions upon which they are based; ore grades and recoveries;

prices for silver, gold and base metals remaining as estimated;

currency exchange rates remaining as estimated; capital,

decommissioning and reclamation estimates; prices for energy,

labour, materials and supplies, transport and services; the

duration and impacts of COVID-19 on the Company’s production,

workforce, business, operations and financial condition; that there

will be no material adverse change affecting the Company or its

properties; that all required approvals will be obtained; the

Company will be successful in revoking the resolution issued by

SEMARNAT; that there will be no significant disruptions affecting

operations and such other assumptions as set out herein. Forward

looking Statements are made as of the date hereof and the Company

disclaims any obligation to update any Forward looking Statements,

whether as a result of new information, future events or results or

otherwise, except as required by law. There can be no assurance

that Forward looking Statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, investors should not

place undue reliance on Forward looking Statements.

Cautionary Note to United States Investors

Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this

news release have been prepared in accordance with National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and the Canadian Institute of Mining, Metallurgy, and

Petroleum Definition Standards on Mineral Resources and Mineral

Reserves. NI 43-101 is a rule developed by the Canadian Securities

Administrators that establishes standards for public disclosure by

a Canadian company of scientific and technical information

concerning mineral projects. Unless otherwise indicated, all

mineral reserve and mineral resource estimates contained in the

technical disclosure have been prepared in accordance with NI

43-101 and the Canadian Institute of Mining, Metallurgy and

Petroleum Definition Standards on Mineral Resources and

Reserves.

Canadian standards, including NI 43-101, differ

significantly from the requirements of the Securities and Exchange

Commission, and mineral reserve and resource information included

in this news release may not be comparable to similar information

disclosed by U.S. companies.

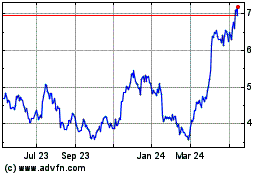

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Dec 2024 to Jan 2025

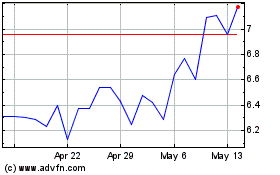

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Jan 2024 to Jan 2025